By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

What Worries the Fed?

The commentary from some of the regional Fed officials would suggest the Fed has the same concerns as have been expressed in previous years despite the fact there is no imminent risk that would require immediate action. Eric Rosengren of the Boston Fed has pointed out the usual risks that follow a long period of low interest rates. There is a threat of inflation at some juncture and there has been reckless borrowing behavior prompted by these unusually low rates. The inflation threat has been subdued as there has been little wage inflation, but that could be changing soon. There has already been concern regarding corporate debt. This is not enough to suggest rates are going to climb, but it is worth thinking about.

Rejecting Inflation

One of the great challenges for economic policy is consumer expectations. The fact is that in the U.S. the vast majority of spending is to some degree discretionary. That means people have a choice as to whether they spend and what they spend on. This becomes problematic when there is inflation to deal with. After a long period of low or no inflation, the consumer decides that any inflation is unacceptable and resists price hikes even as these are natural reactions to changes in the economy. If there are no price hikes, there are no wage hikes and vice versa and that leads to stagnation. The Japanese have been dealing with this for years. The Fed is worried this may be an issue in the U.S.

Wage Growth Keeps Slipping

There is still no sign the Philips Curve will be kicking in any time soon. The assertion since the 1950s has been a low rate of unemployment will inevitably lead to wage inflation as the employer will have to pay more to get the workers needed when there is a shortage of them. This has not been the case. The latest jobs data shows there has been no rise in wages and even a decline. The major issue is retiring Boomers are being replaced by people paid less than they were and there has been more hiring of people with limited skills who don't command high wages.

Short Items of Interest—Global Economy

Twin Threats to Austria: Immigration and Climate Change—This has to rank as one of the oddest combinations in modern European politics. The right-wing populist Freedom Party has formed a coalition with the Greens—a left-leaning populist group. The platform emerging is far from normal with an emphasis on both the threat from immigrants and the threat of climate change. This is certainly a marriage of convenience for both parties and a repudiation of the center right and left as the voter now seems attracted to extremes from both sides.

Europe's Trade Commissioner Tries to Reduce Tensions

Now that the U.S. and China seem to have developed a path to some kind of trade truce, the Europeans are worried that the attention of the Trump team will shift to them. Phil Hogan is an Irish politician who has been critical of Trump and his policies in the past, but now seems to be seeking some kind of truce of his own. It may look a lot like the one with China as it would involve selling more food to Europe from the U.S. in exchange for tariff relief from the U.S.

Boosting the Birth Rate in Europe

The eurozone states have rapidly aging populations. This has reached a crisis level as far as workers are concerned. Europe has only two choices—increase immigration, which has become a political non-starter, or increase the birth rate and wait. Realistically, the only way to get more women to have children is to make having a family more economically feasible. That means more support from the private sector as well as government. As long as women are going to be a bigger and bigger share of the workforce, there will have to be radical changes in terms of how children are raised and with what resources.

Why Didn't Trade War Do More Damage

When the U.S. and China essentially launched a trade war with one another, there were all manner of dire predictions as far as the U.S. economy and the global economy. Most of these pessimistic assessments did not play out as expected—at least in terms of how the economic indicators are concerned. The question on many minds is why not. In some cases, the impact may show up later and there are certainly areas in the U.S. economy that have suffered profound losses. The hardest hit sector was farming as the U.S. lost a significant amount of export business due to the Chinese limitations on U.S. farm output. There have also been sectors dependent on imports from China. They have taken a major hit as they cope with the tariffs. The level of investment activity between the U.S. and China also fell sharply. It can be argued that many other global economies suffered more than either China or the U.S. and it seems that China was hurt more than the U.S.

Analysis: The short answer to the question is the U.S. consumer continued to drive the economy despite the threat of higher prices. Many producers in China opted to swallow the tariff cost and not pass it on to consumers. U.S. companies worked hard to find alternative sources and U.S. exports slowed a little, but remained strong. At the time the tariff war started, it was pointed out that finding new sources would be far easier than finding a new consumer as active as the ones in the U.S.

Return to Old System

The latest wrinkle as far as U.S.-China trade relations are concerned involves a system the U.S. had been attacking through the last couple of years. There used to be a system of bi-annual meetings between Chinese and American trade officials intended to be a way to settle disputes without the drama and distortion of tariffs and trade wars. This series of meetings came under attack by Trump and the system was abandoned.

Analysis: Part of the "Phase One" agreement is the resurrection of this meeting. The U.S. and China will now engage in bi-annual discussions just as they did in past years. The assertion is China will take the meetings more seriously this time as it knows what the alternative might look like. The sessions would be led by Treasury Secretary Mnuchin from the U.S. side and by Vice Premier Liu He from China's side.

Ferment in Iran

Trying to determine what is going on in Iran is an extremely difficult task given the almost total lack of access to the country by foreign press and the totalitarian control exerted by the regime. Despite the difficulties, there have been leaks and suggestions that all is not well for the government. There were indeed massive demonstrations over the death of General Soleimani, but it was apparent to observers that many had been ordered to appear by their employers and the police. The numbers—even with this encouragement and coercion—were less than those that turned out in protest of regime policies just a few months ago. Participating in those protests could cost one their life as it was reported that several hundred people had been killed and perhaps thousands detained.

Analysis: This week, the Revolutionary Guard has admitted it was responsible for shooting a civilian aircraft down. The vast majority of the passengers were of Iranian descent—even though many were Canadian citizens or lived in other nations. The several days of denial followed by an admission has shaken many in the country. Nobody is quite sure what the impact of this "mistake" will be.

There has long been an odd relationship between the general public in Iran and its leaders. There is near universal belief and acceptance that the regime is authoritarian. For many that is acceptable as this level of control is justified on religious grounds. The belief is people are sinners and in need of strict leaders to keep them on the right path. There are many who rebel against this control as well, but especially in the rural areas, the regime has massive support. The belief that goes along with this acceptance of the theocracy is these leaders will never lie to the people. It is accepted on faith that everything that comes from the clerics is true—especially the parts that blame all Iran's problems on the machinations of the western world. Now the regime has been caught in lie—a massive one and a lie that exposes the Revolutionary Guard as incompetent and dishonorable. The protests against the regime have been growing in intensity. This time, the usual rural support for the government is not in evidence.

China Slapped in the Face by Taiwan

The Chinese government under President Xi Jinping has renewed efforts to exert control over the Republic of China (ROC), but there are limits to what it can do. The most obvious means of intimidation are really not on the table as China can't pursue a military attack strategy unless there was some drastic change that it would be able to exploit. The strategy that had been in place in past years was to try to work out some kind of political deal along the lines of the Hong Kong arrangement, but recent events have revealed the limitations of such an approach. The desire for independence is far stronger in Taiwan than in Hong Kong as it has been a nation for all intents and purposes for decades. This leaves the Chinese with more subtle weapons such as co-opting local leaders and using economic pressure. Even the latter has been less than effective given the fact China depends on much of that Taiwanese business acumen.

Analysis: China tried very hard to influence the recent elections in Taiwan. Current President Tsai Ing-wen was an ardent foe of the mainland and made no secret of her desire to push the issue even further. The Chinese poured money into supporting her opposition and seemed to be making headway in the effort—especially among the older population with ties to the mainland and in the rural areas where there is less support generally for the politicians associated with the urban areas. The support for Tsai Ing-wen was very strong among the young population and the business community, but there was a concern that young people would not show up at the polls. That fear was not borne out by the behavior on election day. The young did show up and voted Tsai Ing-wen back to power in a landslide.

This is a serious black eye for the Chinese and for Xi. It fuels the protests in Hong Kong and makes it clear that Xi has no real options remaining for Taiwan. The military option remains very unlikely, but manipulating the domestic politics of the Republic of China is not working either. The Chinese economy needs Taiwan more than ever at this stage as it provides a way for some Chinese companies to subvert the restrictions and tariffs that have been imposed by the U.S. The biggest challenge that Tsai Ing-wen faces is remaining connected to other Asian economies as Beijing has been working hard to get other nations to isolate the ROC. This has had limited impact as Taiwan remains close to nations such as the U.S., Japan, U.K. and Australia. Even Vietnam has been expanding ties with the ROC given their long-time animosity towards China.

China bases its political influence on its ability to finance and encourage business relationships. Chinese economic slowdown has limited their ability to influence the region with its usual tools. That is part of the reason that China is turning to the military option more often.

Enthusiasm for the Coming Year

If one listens to the comments from the investment community as well as from the corporate community, the prospects for 2020 look pretty good. There is enthusiasm regarding the "Phase One" deal with China that seems to have ended the tit-for-tat trade war for the time being. There is a sense of relief over the U.S.-Iran confrontation as it doesn't appear to be escalating as feared. The consumer ended the year with demonstrated willingness to buy, while the job numbers are still solid despite some slowdowns in sectors such as manufacturing and construction. The Fed (and the other central banks) worked to lower interest rates and removed the majority of the inhibitions to lending and borrowing. It would be safe to assert that everything will be coming up roses for 2020, but economists are not supposed to do that—we are the "dismal science" after all. There must be something we can worry and fret over.

Analysis: Those concerns fall into three buckets. The first is the one that has been concerning economists for several years now. The global growth situation has been demonstrably poor—many of the major economies are in recession and several others are close. Germany was in recession most of the last year and France has been slowing dramatically as the protests and demonstrations accelerate. Most of the rest of the eurozone has slumped and they have been joined by Japan, India, China and several of the Latin nations. There is some hope that a more settled trade relationship between the U.S. and China will help pull some of these nations out of that slump, but nobody is under the impression the U.S. and China will return to old trade patterns. The expectation is that growth in the global economy will be as slow as it has been in many years—perhaps down to levels last seen at the recession.

The second set of concerns revolves around the behavior of the consumer. Last holiday season was strong enough, but there were some reservations. It was a good year as far as revenue and traffic was concerned, but many retailers failed to see the profits they needed. Most went into the season with a heavy discount approach. It worked in terms of getting people into the store, but once there, they bought nothing but the sale items. Consumers have been showing a little less confidence and have expressed more worries about the coming year, but as long as there are good jobs numbers, the consumer will remain relatively confident. Given the importance of the consumer, there will be a great deal of attention focused on their mood throughout the year.

The third set of concerns will revolve around politics. The campaigns right now focus almost exclusively on the base for the two parties. Over the years, the base for both Democrats and Republicans have become more extreme. Early in the year, the positions taken will be extreme, but as the general election nears, the trend is for both parties to drift towards the center. That may not be the case this time as Trump has never strayed far from that base and neither have some of the Democrats still in the running. These positions could spook both the business community and the consumer.

Observations

This was a weird travel day—in and out of Las Vegas in a single day. The original idea was to fly in on Saturday and back home on Sunday, but the threat of a major snowstorm convinced me to leave KC very early on Sunday and return very late that same day. To be honest, the less time I spend in Lost Wages the better—Vegas is not my favorite place. It is, however, a marvelous place for people-watching. This trip was no exception.

As I arrived in Vegas very early in the morning on Sunday, I was struck by the fact that there were not many people in the casino. The early risers are few and far between, but there was one woman who had positioned herself to be able to play about five slot machines at once. She was dumping coins in at a furious pace. It appeared she had been there all night given the number of food and beverage containers surrounding her.

Later in the day, there was the parade of young women bent on some kind of adventure. They had stiletto heels on, but this was clearly not their usual foot gear. I have spent a good bit of time in Eastern Europe where the stiletto is more than a little common and those wearing them are skilled. Not so much this group. Alcohol had not made their movements any simpler. At one point, one went down and took some of her compatriots with her—a domino effect featuring mini-skirts and a tangle of glitter.

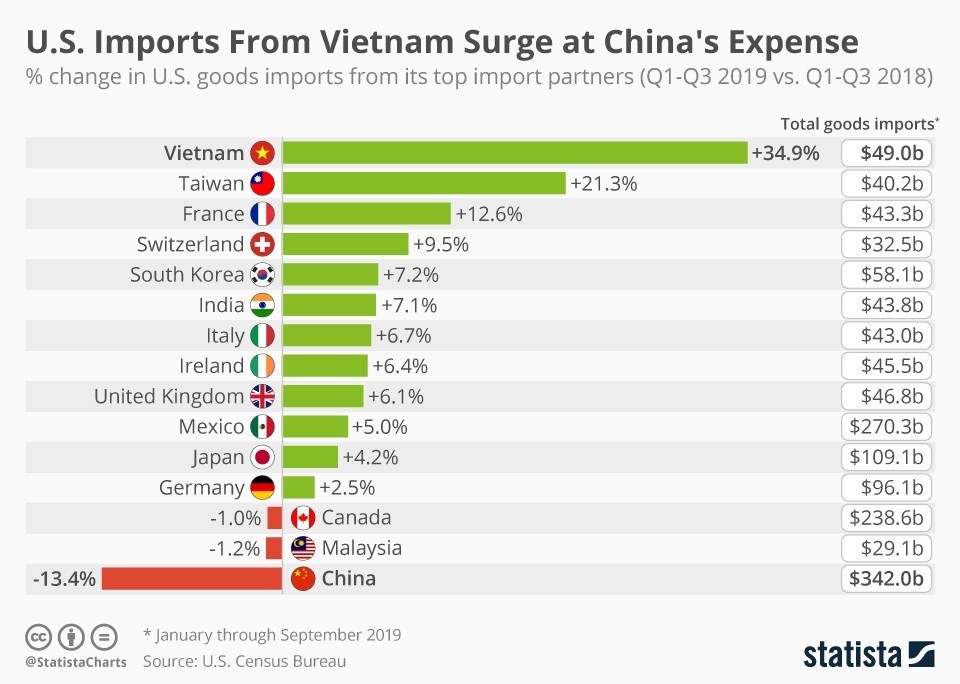

Percent of Change for U.S. Imports

There has been much made of the expansion of business between the U.S. and Vietnam in the wake of the tariff war with the Chinese, but it is evident there has been a great deal more activity involving Taiwan as well with a 21% increase in imports from the ROC. Some of that involves Chinese companies that are using ties to Taiwan to escape the U.S. restrictions.