Strategic Global Intelligence Brief for January 10, 2020

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Women in Ascendance

For the first time in a decade, women make up the majority of the workforce. This is not the first time that women have held this position, but the situation is far different from the last time this was the case. In the past, it was due to the fact men were getting laid off in large numbers as they were in sectors such as manufacturing and construction. Today, the female rate of engagement has gone up mostly because of the rise of the service economy. There are more service sector jobs than ever and services generally attract women more than men. The downside to this expansion is that most of these new service jobs are in low-wage categories such as food service, retail and support jobs. The male-dominated sectors like manufacturing have seen more in the way of declines.

Support for Current Economic Policies

The latest polls suggest most Americans are pretty happy with the current state of the economy. The attitude remains close with 51% believing there has been an improvement and the rest unsure or unhappy. The motivation for this optimism seems to be both the performance of the stock market and the state of employment. This is good news for the incumbents in Congress and Trump, but it also exposes the vulnerability of consumer attitude. Should there be either a market correction of some seriousness or a jump in the level of unemployment, there will likely be a shift in voter/consumer confidence.

Business Groups Express Concerns

The U.S. Chamber of Commerce, the Business Roundtable and others have been sharp critics of many of Trump's policies on issues such as trade and tariffs as well as his attitude towards international organizations such as the World Trade Organization (WTO), International Monetary Fund (IMF) and others. This has not meant support has shifted to Trump's opposition. There has been a sharp rebuke of many of the policy positions adopted by Democrats running for their nomination—especially the demand for much higher taxation on corporations, expanded social programs, free public education, Medicare for all and the like. The assertion is these moves would limit economic growth and do more damage than good.

Short Items of Interest—Global Economy

Guaido Regains Influence

Less than a week ago, the police in Venezuela physically prevented the current head of the National Assembly from taking his seat. Juan Guaido tried to scale the walls of the compound and was assaulted as a flunky picked by Maduro took the seat. Guaido has since rallied the opposition and reestablished himself as the key opposition leader—exposing the National Assembly as a farce. The question now is what he can do with this shift in popular momentum as Maduro still holds the support of the police and military.

New Sanctions on Iran

After several days of what would best be described as idle threats and tantrums, the U.S. and Iran are back to their old ways. The U.S. has imposed new sanctions rather than launch new strikes despite the fact there is very little left to sanction. Iran is back to loud and boisterous denunciations, but no further action. The real losers in this will be the opposition forces in Iran. Just a few months ago there were anti-regime demonstrations larger than the state-organized protest over the killing of Soleimani. The fear is that any sort of opposition to the current regime will be treated as treason and even more detentions and killings will take place.

Taiwan's President Heading for Win

The vote will be close, but the polls suggest that Tsai Ing-wen will win a second term as the president of the Republic of China. If she does succeed, it will be seen as a rebuke to mainland China as it has lobbied hard for her opposition. She is a nationalist and has opposed the Chinese moves to bring Taiwan under Chinese control. Her popularity is high among young voters, but they are hard to motivate to actually vote.

Iran Crisis—Diminishing?

It had all the makings of a global cataclysm, but in the days after the U.S. assassination of Major General Soleimani, it seems that cooler heads have prevailed—in the U.S. and Iran. This could well be a temporary situation as the downing of the Ukrainian airliner suggests. The watchword for the moment is chaos. The threats that were pouring from both Trump and Iran's military have suddenly toned down. The threat by Trump to attack cultural sites and civilians directly was rejected by U.S. military leaders unwilling to be labeled as war criminals. Now, the threats against Iran's military have been toned down as well. The latest statements from Iran suggest it has finished with a direct response and will not be targeting U.S. positions. This doesn't mean Iran-backed militias will be quiet, however. The U.S. has made it clear that any attacks from these groups will be considered an attack from Iran itself.

Analysis: The aircraft that was apparently shot down by the Iranians was from Ukraine and carried citizens of Iran, Ukraine and Canada as well as some other nations not involved in this confrontation. It seems to have been the trigger-happy Iranian air defense system at fault, which may have given everybody pause. This was clearly a mistake and one that cost over 170 lives. This is the classic "fog of war." Once the tension reaches a certain level, it is hard to predict what happens next. At the end of the day, the desire for an all-out war is very limited. Iran can't afford it and neither can the U.S.

The actions thus far suggest both sides are wary but exercising caution. The Iranians will take their revenge through "traditional" terrorism. This gives them a modicum of deniability as they can claim they lack control over these groups. The U.S. will not accept that excuse, but at the same time it will likely focus its retaliation on these groups or on parts of the Iranian military that supports them. It is also likely the U.S. will ask its allies to engage on behalf of the U.S.

The markets are looking at all this as reassuring. The oil prices rose for a few days and then started to stabilize with some reduction in the offing. Trump declared the U.S. independent of Middle Eastern oil, but that is not quite accurate. The U.S. has indeed become the largest producer of oil again—thanks to the development of shale oil. That doesn't translate into independence, however. The U.S. produces light and sweet crude, but many of the refineries are designed to handle heavier oil which is obtained from Middle Eastern sources. There are refineries on the East Coast that can't get access to the U.S. oil for lack of a pipeline and they rely on imports. Then, there is the whole issue of global pricing—everybody's oil sector is affected by everybody else.

Immigration and the Demography of Europe

The fact is Europe's population is shrinking and aging—fast. The latest study shows there are 10 members of the EU that now have shrinking populations. These nations are losing people at a very rapid pace and the overall age of that population is climbing fast. Many of these are in East Europe—Latvia, Lithuania, Romania, Bulgaria, Croatia, Poland and Hungary lead the list. But Portugal, Italy and Greece are also losing population faster than it can be replaced. Some of this is due to the departure of people who are seeking better economic opportunities, but there is a bigger issue of low birth rates. The young people are simply uneasy about bringing new lives into an uncertain future.

Analysis: The low rate of births combines with a rapidly aging population to create a real future crisis. There are only two ways for a nation to build its population and only immigration can accomplish this quickly. There are efforts underway in many of these nations to boost their populations—subsidies for parents, fertility clinics, assistance with childcare and so on. The problem is this is a slow process—even if it works. The reliable means by which to grow population is via immigration, but nothing has been more controversial in the states that are facing the biggest issue of population growth.

The decline of the native population is a concern that gets amplified with the arrival of migrants. The threat is seen as economic and cultural. Will the new arrivals take all the jobs? Will they alter the culture of the country? The fact that many of the migrants come from Africa, the Middle East and South Asia only complicates the matter. They are of differing races, ethnic backgrounds and religion and all of that feels threatening to some.

If there is no response to the demographic challenge, these nations will be in real trouble and soon. The lack of manpower compromises business expansion and creates even more incentive for the remaining workers to seek opportunities in other nations. The hostility towards immigrants has to be dealt with, but this will be a very difficult task.

Ex-Im Bank Is Back from the Dead

Over the last few years, the future of the U.S. Export-Import Bank (Ex-IM) was in real jeopardy. It had become a symbol for elements of the GOP and was considered a waste of government money, a handout to select major companies and a sop to foreign governments. The opposition in Congress had meant it was starved of money and there was a refusal to even appoint new leadership. In the last weeks, the Ex-Im Bank gained a very unexpected ally. After being on the verge of extinction, it has now received a new lease on life with a new appropriation and a new leader—Kimberly Reed. She is an attorney from the D.C. area who had served under Treasury Secretary Hank Paulson. She has been in place since May of 2019, but had not been approved by the Senate. There has not been a quorum for the past year and there has been little money. The Ex-Im Bank had been attacked by Trump on many occasions, but somewhere along the way he was convinced that this institution was important to the U.S. export sector and a way with which to compete with other nations, so he has been lobbying for its approval.

Analysis: Every nation on the planet engages in some kind of export promotion. Many of these schemes are pretty blunt—everything from direct subsidy to overt trade deals that persuade other nations to permit a given nation to sell their output in some new market. In order to bring some order to this chaotic global competition, there have been many attempts to limit this kind of promotion by institutions such as the World Trade Organization. The U.S. engages in far less direct subsidy than its rivals—partly in response to these limitations and partly due to reluctance to use federal money to support select industries. Obviously, the U.S. engages in some of this activity, but many other nations do far more.

The Export-Import Bank has been a means by which the U.S. can promote exports without this kind of costly and controversial subsidization. The basic premise is the U.S. backs very low interest loans to foreign entities so they can make big purchases (and small) from U.S. companies. These loans are paid back by the borrowers at a very high rate and the U.S. is rarely called upon to commit any funds to the effort—it simply guarantees the loan. This process has been key for companies such as Boeing or Caterpillar as they sell very expensive goods to countries that do not have large budgets as a rule. The Ex-Im money is not limited to big companies and there have been thousands of small businesses that have been able to sell overseas with the help of this institution. The export sector in the U.S. has been deeply concerned about the loss of this player and are now heaving a real sigh of relief.

Jobs Report Due Today

The Labor Department has just released the last jobs report for the decade. The estimate was there had been another 160,000 jobs created and the overall rate of unemployment would remain at 3.5%. In fact, the real number was less than expected at 145,000 and there was a downward revision of the data reported in November and October. The real issues as far as employment is concerned will be wage inflation and the continued challenge of labor shortage.

Analysis: For decades, there has been an assumption that very low rates of unemployment will create wage inflation challenges. This is logical enough—fewer available workers will inevitably mean employers will be required to pay people more as they compete to get the best employees available. The problem is there has been very little of that wage inflation this time (although there are some signs it has started to kick in over the last few months). The most important reason for the lack of wage growth has been that higher-paid Boomers are retiring at a rate of 10,000 a day. They are being replaced by younger and less well-paid people. The other factor is business has struggled to find skilled people and been forced to hire people with less experience and who need training. They are also making less money than would otherwise be the case. The labor shortage is acute in several key sectors—everything from construction to manufacturing to transportation and even health care.

Even the Doves Are Satisfied

The debate over where interest rates should be seems to be over for the moment. Most of last year there was some spirited conversation among the members of the Open Market Committee (FOMC) as to where rates should be as hawks wanted them to remain higher and doves wanted them lower. Esther George and Eric Rosengren advocated for higher rates and James Bullard pushed for them to be lower. As the new members of the FOMC take their positions, there is consensus.

Analysis: Loretta Mester and Patrick Harker have been hawks who had been pushing for rates to go up, but both are now satisfied with where the rates are. They hasten to add that their opinions will change when and if there is a real threat of inflation on the horizon. The doves are happy with the status quo as well. Bullard is shifting off the FOMC, but endorses the current policy. Neel Kashkari from the Minneapolis Fed is a dove, but his comments of late have supported current policy. This meeting of the minds has not extended to the White House or Congress at this juncture as there are still calls for rates to come down. The view of the Fed is clear at this point—no need to boost the economy with a cut. Many doubt that a cut at this point would have an impact in any case. This consensus will likely survive until the arrival of an inflation threat.

Winter Travel

I have always been something of a weather wonk. It stems in part from being a child of the Midwest as I was born in Kansas City and have lived in tornado alley my whole life. In this part of the country we know that when the sirens sound it is not really a warning to take shelter—it is just to give one time to find one's camcorder. I have always liked the arrival of a nice spring storm and can even enjoy those winter blasts when I have the option of watching it from inside my cozy home.

Unfortunately, this is the time of year I am required to be on the road (or more specifically—in the air). Now I watch the local weather and the weather at my destination obsessively. At best, I expect delays and interruptions, but at worst, there are cancelled flights and suddenly my best laid plans are in shambles. This weekend, I am supposed to be in Las Vegas and had planned to fly out on Saturday afternoon. Now we seem to be expecting 36 feet of snow, an ice storm and winds of 187 mph (or something like that). Good old Southwest allowed me to change flights at no charge. Now I am trying an early Sunday morning departure with hopes that conditions improve.

Over the many years of traipsing all over the country to flap my lip, I have encountered about every kind of weather delay one can imagine—thunderstorms, blizzards, winds and even a flight to Phoenix that was called off because the runway was melting from too much sunshine. With any luck, I will spend Sunday getting to Vegas, talking for an hour and then returning home.

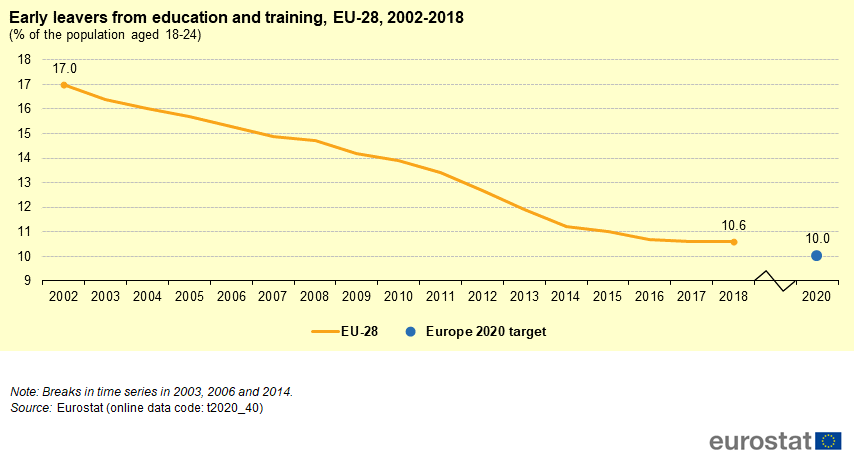

Education Crisis in Europe

Not only is Europe facing an older population, low rates of fertility and other demographic challenges, there is a crisis in terms of basic education and training. More and more people in their 20s are leaving school early. They are not getting trained for anything and are not receiving education of any kind. Those who are leaving are disproportionately from poorer communities. Many are destined to stay on the government dole for the bulk of their lives.