Strategic Global Intelligence Brief for February 8, 2019

Short Items of Interest—U.S. Economy

It's All About Communication

Several economists working in the private sector (as opposed to government or academe) were asked to grade the last few Fed chairmen. They turned out to be fairly tough graders. Current Chair Jerome Powell got a B-. The two prior to him (Ben Bernanke and Janet Yellen) received B+ grades. There was also a B- assigned to Alan Greenspan. The grading was not based on how well the economy fared under their leadership as there are far too many variables. It would be unfair to hold them accountable for something that involves Congress and the president as well as the entire business and consumer community. The assessment comes down to how well they communicated. Points were earned for clarity and focus. Greenspan enjoyed being obtuse and mysterious as he disliked signaling his intent. Both Bernanke and Yellen worked very hard at being transparent. Powell has sometimes seemed a little out of his depth as he is not an economist and has been hampered by a president who insists on meddling in the Fed far more often than previous chief executives.

Second Shutdown Would Be Worse than First One

This is from an economic standpoint. That is the conclusion reached by a panel of economists put together by The Wall Street Journal. Roughly 60% thought the impact would be significant and 16% thought the impact would be severe. The main issue is that another shutdown would erode business and consumer confidence enough to pull growth down further than had been forecasted earlier. The sense is many would assume the government is incapable of settling differences. This pattern would then dominate throughout the year and into next. It would make it unlikely that cooperation would occur in areas such as trade and economic development.

Trade Meeting Unlikely

There had been some hope that the president would decide to meet with China's Xi Jinping prior to the deadline for additional tariffs and that an extension of the trade war might be averted. Trump, however, has not indicated that such a meeting will take place. He may change his mind as this could be a strategy to make the Chinese ask for a meeting. It is now likely the tariffs will be imposed and the trade war will intensify as the two sides try to find some areas of common ground. The major issue is that China has become a symbol for all that ails the Trump base. It has become an enemy more than a rival. That makes any sort of collaboration very awkward.

Short Items of Interest—Global Economy

Eurozone Decline Is Precipitous

The latest assessment of the EU economy is grim. It details a whole host of threats that will likely pull growth back down to near recession levels. The three most damaging issues include a sharp reduction in demand from China as that nation struggles to avoid its own economic decline, the impact of a hard Brexit which cuts the U.K. off from European trade and the political ferment caused by the populist movements in Italy, Germany, France, Sweden and most of the other states. These political actors have been complicating any and all efforts to address the issue of growth and dealing with debt and deficit.

U.S. as Interventionist

The foreign policy of the U.S. has become very divided and confusing of late. It seems to demonstrate there is no clear policy in place. When it comes to trade and economic issues, the U.S. has become very insular and protectionist—signing no new deals and pulling out of many that had been in place for years. At the same time, those that identify as part of the neo-con sector of the GOP are on the rise and have advocated for direct engagement in Venezuela as well as continued engagement in Syria, Iraq and Afghanistan. Some even call for intervening in Iran.

Standoff in Venezuela

The issue that may allow the interventionists an opportunity to engage with the country is the threat by Maduro to block aid convoys to the desperate people on the Colombian border.

What Are the Indices Indicating This Month?

Each month we take a look at a series of indicators that provide insight for the manufacturing community and the business world as a whole. The two organizations we do this for are the Chemical Coaters Association International and the Industrial Heating Equipment Association. Both are very involved in everything from automotive to food service, health care and others. What follows is an executive summary and some of the specific assessments of the different index readings.

Analysis: This month the data was considerably more uplifting than it was the prior month. The focus of attention now is on determining if this is a kind of last spasm from the good 2018 numbers or if it is trend that signals that 2019 might not falter as many have predicted it would. Of the eleven indices we watch, all but two finished in positive territory as compared to last month. Of the two that trended downward, only one was a real fall. The report from the Credit Managers' Index was significantly worse than it had been, however. That is a concern we will come back to after we celebrate all that good data.

The New Home Starts numbers tracked strongly positive after having slumped towards the end of last year. It seems that many Millennials are still interested in those multi-family options, while the older members of that cohort are starting to get involved with the single-family home. Mortgage rates eased a little and there was a slowdown in the pace of increased housing prices—at least in some markets. The data on steel consumption was another positive. That seems attributable to more construction rather than increases in vehicle production. The data that was collected for the sales of new cars and trucks was flat, but the important thing for the steel sector was that bigger vehicles are popular. They involve more steel. The other metal prices have also started to rise in response to some limited production activity as well as some additional demand. There is not a lot of evidence that domestic steel and aluminum has been seeing big changes in demand, but the sales have been steady and there is some connection to the lack of overseas competition. It is useful to remember that foreign steel is still coming into the U.S. from countries that were given an exemption from the tariffs—notably Brazil and South Korea (No.2 and No. 3 exporters of steel to the U.S.).

Many of the financial readings looked good this month. The rate of capacity utilization stayed high—just slightly higher than it was the month before. That is very close to the bottom end of the "preferable zone." There are some sectors that have exceeded the 85% capacity usage and are seeing the bottlenecks and shortages that come along with that number. The rate of capital investment also jumped. It seems related to the fact that companies are struggling to find workers and are opting to increase their acquisition of machines and robots. This increased investment in capital expenditure has not worsened the rate of capacity utilization—certainly a good sign.

There has also been good news as far as industrial production is concerned. The Purchasing Managers' Index (PMI) New Orders staged a nice recovery albeit not back to the days of readings over 60. The overall PMI also bounced back nicely as companies started to get engaged again. For the last few months, there have been political issues that have affected the decisions of businesses. The trade wars and tariffs announcements made companies consider acquiring and holding far more inventory than they would have previously. Then, there was all the uncertainty that accompanied the government shutdown. The future still looks murky to many. More radical shifts in the PMI numbers seem likely. There was a slight jump in durable goods numbers and appliances as well as factory orders. These were not dramatic changes, but the trend is certainly in the right direction. The one area that seems to be causing the most concern is the drop in the level of exports of machinery and high-value goods. The economic slowdown in Europe and China is hitting U.S. exports from both an indirect and direct point of view.

Transportation made a nice recovery, but that might be short-lived. The issue for the transportation sector is a capacity shortage, which will only get worse. The trucks, trains and ships are available, but there are no drivers, engineers, pilots and ship crews available to man the equipment. This will drive logistics costs up sharply—perhaps as soon as this year.

New Automobile/Light Truck Sales

The evidence is mounting. It now appears all the angst expressed for the last year has eventually been justified. Analysts have been baffled to some degree by the resilience of the automotive sector for the last couple of years. There was supposed to be a reduction in activity as consumers became a bit more cautious and concerned about issues such as inflation and job growth. Then, there is the expected impact of higher fuel prices and the fact that this market is already saturated. Each month seemed to defy the grim predictions, but over the last several months, there has been a plateau and growth no longer seems likely. The good news is sales are not declining, but they have flattened.

The dominant vehicles have been trucks, SUVs and CUVs with sales ramping up by around 15% per year. The sedan is seeing a drop-off in demand by a similar rate. Several of the sedan brands and models are being phased out completely. This has meant plant closures for GM, Ford and Fiat Chrysler. There will likely be more down the road. Another factor to watch has been the on-again and off-again threat to impose steep tariffs on European vehicles coming to the U.S. There will not be much change as far as auto production in North America as vehicles made in Canada and Mexico already comply with the new domestic content provisions.

New Home Starts

The housing sector is not the rip-roaring driver of growth that it was just a few years ago, but it has not collapsed as it was expected to either. There has been a definite slump, but there have been strong regional differences. There are still many hot markets that have offset the slower ones to some extent. There are a variety of factors that go into assessing the housing sector and they do not all move in lockstep. At the top of the list of determinants are mortgage rates and the cost of the new and existing homes. These were all trending in the wrong direction just a few months ago, but since then, there has been some positive movement. Mortgage rates have stabilized and fallen a bit and the price of homes started to stabilize in most markets. The major challenge now is labor. Most of the tight markets are facing severe shortages of workers, especially in the high-skill areas. This slows the building process.

The consumer is still feeling fairly confident as there has been solid employment data coming out for months. Wages had been slow to respond to the lower rates of unemployment, but there has been a little progress on this front as well. The expectation is that housing will continue to grow at about the current pace with multi-family units dominating and Millennial buyers still slow to get involved with single-family units. They are affected by everything from student loan debt to their decision to put off starting families until later in their 20s and 30s.

Steel Consumption

The level of steel consumption has been more consistent than many had expected. Several factors are at work here. The most important is that there has continued to be demand for steel from the automotive sector as well as from construction. The dominant vehicle sales have been larger trucks, SUVs and CUVs and they use more steel. Construction has not exactly been on a tear, but it has not collapsed either. There has been enough public sector activity as well as commercial development to drive some demand.

In addition to the demand side, there has been a supply side factor. The steel tariffs that have been somewhat on and off have been mostly on for the last few months. That has led to more domestic steel being purchased. One reaction to the tariff imposition has been predictable. There is now more in the way of finished goods from steel and aluminum coming to the U.S. as a way to beat the tariffs. There is now a demand for tariffs on these imports as well.

There is a glimmer of encouragement on the horizon as there has been serious talk about addressing the nation's infrastructure needs. Should that talk lead to action, there will be an increase in steel demand. The main challenge is that there is already a major deficit and expanded spending on roads and bridges just adds to it.

Industrial Capacity Utilization

There has been a steady rise in capacity utilization over the last month or so. This is good news for the most part. The numbers are still a little short of the ideal range between 80% and 85%, but at almost 79%, it is awfully close. Many sectors of the industrial community are already in that ideal zone. Some are even starting to press against the upper limits—the point at which there will be shortages and bottlenecks as demand exceeds supply. There are two means by which the capacity numbers improve. One is more welcome than the other. The best reason is that demand has pushed companies to add capacity, which provokes the acquisition of new machinery and expansion in general. The not-so-good reason is that machinery acquisition has halted to allow the existing consumer demand to catch up with capacity that exists. This seems to be the dominant reason for the current data on capacity usage. There have been ample signs that industrial activity has slowed a little—nothing drastic yet. It can be seen as just cautious reaction to some of the unsettled conditions in the economy right now.

Metal Pricing

For most of the last year, the prices of industrial metals have been coming down. That has been perplexing given the fact that tariffs have been imposed on imported steel and aluminum and the fact that industrial activity has been fairly strong. There has been something out of sync. It appears that most of that imbalance has been on the supply side. There has been too much expansion in metal output and demand has generally not been able to keep up. That situation may have started to alter as production has been more limited of late and prices are reacting accordingly. It remains surprising that aluminum prices have not risen given the impact of the tariffs, but the reality is these prices have been falling in every nation other than the U.S. That has been the prime complaint of aluminum users in the U.S. Their rivals in other nations are paying a far lower price for that metal than are users in the U.S.

My 'Favorite' City

By now, alert readers of this newsletter know there are some destinations that I care for less than others. There are also those I always look forward to visiting. At the top of my list are Louisville, Milwaukee, Portland (Maine and Oregon), Austin and a few others. Most of the places I go are delightful in their own way. Even with my limited time, I enjoy them. I can't say many nice things about Las Vegas, although there are certainly lots of sights. There are basically two things that turn me off when in Vegas.

The first is the distinct feeling that the people running Vegas don't care much for those that visit. I am always astonished at the petty inconveniences—elevators that demand a code to get to one's floor and a room without the amenities that are provided routinely by a regular chain hotel. There is a sense that everyone is expected to be a cheat of one kind or another. Perhaps this is true, but I tire of the suspicion.

My second issue is that few seem to be having any fun—ashen faces pushing slot machine buttons endlessly, poker players daring not to crack a smile, bored couples staring into space. If anything, people appear sullen and put upon. I assume those attending the shows are having a good time, but even the folks in the restaurants look miserable.

I have never had the opportunity to explore much of Vegas beyond the strip. I am told this is the real Vegas and well worth the effort. I will have to give that a try before passing judgment.

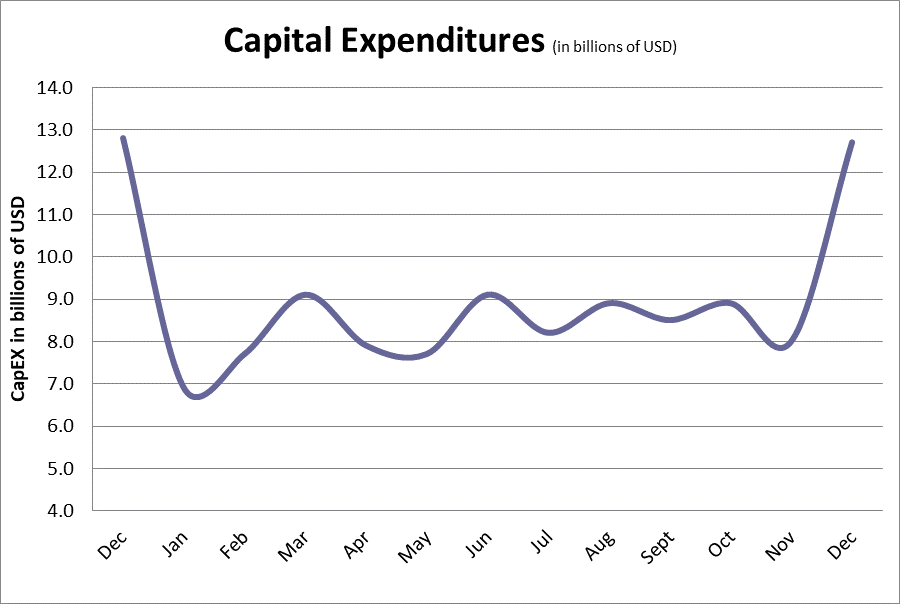

Capital Expenditures

The surge in capital expenditure (capex) was not expected as this took the numbers back to where they were almost a year ago. The motivations for capex can be complex, but there are usually three that dominate. The first, and most common, is often related to some kind of tax break or other incentive program provided by the government. There has been nothing new added to the governmental offering of late although there have been no significant reductions in assistance either. This doesn't explain the spike. The second motivation is often a surge in anticipated business as companies usually make these acquisitions well in advance so they are prepared to handle the orders when they come. There has not been evidence of that kind of demand surge, although there has not been evidence of a decline in demand either. The third motivator may be the most plausible. The sectors doing the most in terms of capital expenditure are the same ones struggling to find qualified workers. It seems many companies are essentially giving up and choosing to purchase machines and robots instead.