By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Where Was the Good and Bad News in the Employment Numbers?

The number of jobs added was more than had been predicted—225,000 as opposed to the expected 160,000. The breakdown of where jobs were gained and lost was of the most interest and significance. The big gains were in construction as many projects have been off to an earlier start than usual. These are jobs that would ordinarily have started to show up in a month or two. There were also gains in hiring for education, health care and the entertainment/hospitality sector. The losses continued in manufacturing as the export sector continues to shrink. There were gains in jobs connected to warehousing and transportation, but losses in retail connected to the actual brick-and-mortar stores—the online world continues to dominate consumer spending growth.

Possible Trade Pact with Kenya?

The U.S. has not been that engaged with Africa over the last several decades. There had been some expectation of additional engagement when Obama took office, but little developed. The announcement that the U.S. is looking at a trade deal with Kenya surprised many. The Chinese have been extremely active in Africa, but results have been mixed. The Chinese are interested in selling to Africa and are interested in extracting resources, but that has earned them the reputation as the "new colonialists." Kenya wants development help and access to the U.S. market—it is not clear the U.S. wants to grant this without something substantial in return.

What Does Slight Rise in Jobless Rate Mean?

In truth, it means next to nothing as the unemployment rate has barely moved from 3.5% to 3.6%. The significance is that there was any movement at all given the addition of 225,000 jobs. The only way the jobless rate moves up these days is when people who have been off the job search come back in. The number of people on the sidelines is then reduced a bit. The reason is that people who had opted out are being lured back in. These are not the hopelessly unskilled that could not find a job—these are people who had decided to stay at home raising kids or caring for elderly relatives or had elected to stay in school. They are now being drawn back to gainful employment.

Short Items of Interest—Global Economy

New Vacancy at IMF

David Lipton is resigning as Deputy Managing Director for the International Monetary Fund (IMF) after nine years. That opens the door for Trump to appoint his replacement. Traditionally, the U.S. picks the holder of this No. 2 position as the head of the IMF is a European. The new head of the IMF is Kristalina Georgieva—she replaced Cristine Lagarde who left to head the European Central Bank. Trump has been critical of the IMF as he has been critical of every other international organization, so it is unclear who he would select to take this job.

U.K. Rejects the U.S. Position on Huawei

The U.S. has been trying to get other nations to follow the U.S. lead as far as rejecting Huawei. This is the largest telecoms and tech company in China and arguably the world as it supplies systems globally. There is concern in the U.S. that China could use its influence over the company to conduct espionage and cyber-attacks. Doing business with Huawei has become all but illegal. The U.K. has rejected this approach although it is not using Huawei gear for its most sensitive uses. This has still infuriated Trump, which has provoked threats against the U.K.

Chinese Doctor Becomes Martyr

The doctor who exposed the threat of the coronavirus has died from the disease and the population has rapidly reacted to this death. He is being hailed as a hero and a martyr as he was the man who exposed the attempt to cover up the spread and the threat. The Chinese government is not happy with this attention, but is at a loss to know what to do about it.

Impatience in Ireland

Ireland's Prime Minister Leo Varadkar is in trouble electorally. He won the position a few years ago with his combination of liberal social positions and a promise to turn the Irish economy around. There has indeed been a boom in the economy and Ireland has left behind its position as one of the PIIGS (Portugal, Italy, Ireland, Greece, Spain), but this has not impressed the voters. So, Varadkar faces possible defeat in the coming election. His challenges are those of many leaders right now—the challenges fueling populism.

Analysis: The bottom line is economic progress has not been shared across the board in Ireland; a similar situation to that in many other nations. The very rich have been getting much richer. That continues to be a major frustration, but just as concerning is the fact that nations have been pouring their money into helping those at the very bottom of the economic ladder. It is not that these populations do not need the help, but for those in the middle, there is a sense of being abandoned. They make too much money to get assistance, but they make too little to adequately advance. Many in middle class Ireland complain they can't afford to buy a house or car or even take holidays. The cost of living rises and their wages do not. This has become the lament of the middle class universally as they grow to resent both the rich and the poor.

There are not a lot of options available. Much is made of taxing the wealthy, but most find ways to avoid it, while the money raised by the government seems to go exclusively to the poor. Those in the middle feel a lot of added pressure. The squeeze is real even if the conclusions reached by the middle class tend to be overblown. That feeds political ferment.

Tweaking One's Way Out of Paying Tariffs

The aim of the tariff policy deployed against China was ostensibly to encourage more production within the U.S., but that has not been the result for the most part. The reality is companies shifted their production away from the U.S. for a reason and tariffs have not altered the situation that much.

Analysis: The three most common reactions to the tariff policy have included setting up a new supply chain in another nation such as Vietnam, Sri Lanka or Mexico. The second-most common has been to alter the supply chain out of China so that the bulk of the production stays in China, but enough is outside the country to avoid the tariffs. The third strategy has been to substitute products for the ones subject to the tariffs.

Why Economists Are Not More Enthusiastic About 2020

It is important to reiterate some of the commentary that often surrounds the economist. We are not called the dismal science for nothing. In the final analysis, it is our job to find the dark cloud behind every silver lining. As 2020 has gotten underway, there has been a good bit of enthusiasm about the state of the 2020 economy, but that excitement is coming from the investors and the politicians as opposed to the analysts and economists. The investors have been encouraged by the progress on ending the trade war between the U.S. and China. The supporters of the GOP have been trumpeting everything from the jobs report to the latest trade deficit reduction. What is making the economic analysts less enthusiastic?

Analysis: The basic assertion is there are some major issues set to boil up in the next year. Any one of them could take the wind out of the economy. The other basic point is growth has been sustained by some very fickle motivators—namely consumer mood and confidence. This is notoriously changeable. In an election year. the consumer will often become more distressed and therefore cautious.

There are three concerns that have the ability to tip the economy of the world and the U.S. into something resembling recession. The first is the ongoing trade war. The pact with China is very fragile and neither nation has yet to live up to the agreement made. China has taken a first step by lowering tariffs, but they have not yet started the big purchases that had been promised. The U.S. has done nothing at all—no reduction of tariffs and no relaxation of pressure. Trump continues to threaten trade wars with Europe, Canada, Mexico, Japan, India, Turkey, Brazil and pretty much everybody else. Thus far, these have all been somewhat idle threats, but at any moment they can heat up.

Concern No. 2 is the coronavirus. In many ways this crisis is overblown—the flu has already killed thousands more than this new scourge. The problem is there is so little known about the coronavirus and there is no vaccine as yet. It could be something China can contain or it could become a pandemic that infects millions. It is that uncertainty that is affecting the global economy with everything from travel bans to altered supply chains.

The third major worry is a faltering consumer. The U.S. has been relying on its consumer to drive growth. There are now signs of some significant consumer fatigue. The willingness to spend on big ticket items has faded somewhat although there has been continued demand for homes. The vehicle sector has been slowing as well. Thus far, the consumer is still upbeat in the U.S., but that is not the case in Europe, Japan or China. That is a big factor in the global slowdown. The bottom line is that a reduced level of consumer activity is more likely than an increased one.

Will Latest Jobs Report Meet Expectations?

At the time of this writing the job numbers have not yet been released, but by the time you read this, they will have been. This is your opportunity to either laugh at how bad the economists are at assessing the data or be impressed with how prescient we are. I am betting that we are close, but may end up missing by a little (as it turned out the predictions of 160,000 added jobs was a little low as there were 226,000 added). The pre-Friday reports that come from the likes of the ADP survey and some other economic think tanks suggest this will be a somewhat less exciting report, but not a bad one. There will be some job creation, but the numbers are likely to be less impressive than they have been. There will likely be little change in the overall unemployment rate. It is also likely that wage growth will remain anemic. There has been little to suggest either a burst of good employment news or bad employment news.

Analysis: What makes the job numbers so important as far as assessing the economy? It seems a little overblown to obsess over a change of a few percentage points in the rate of joblessness. If 97% of the population is working, is that really that different from 95% or 93% working? The numbers would indicate that the vast majority of eligible workers are gainfully employed. The main reason that 3.5% unemployment is far better than 4.5% or 5% is primarily psychological at this point. Look back at your old economics textbook and see what the normal rate of unemployment used to be. The standard for years was that 6% was considered full employment, but today a 6% rate would be seen as tantamount to recession. Even a rate of 4.5% would create consternation. The key is that trend matters.

We all spend a little of our emotional energy wondering about our job future. We pay attention to how well the company we work for is doing. We worry about what our bosses think of us. We watch the others in the office. We know that employee X over there in the corner is not the brightest bulb in the lamp and if he still manages to keep his job, we feel pretty safe in our ability to keep ours. On the other hand, there is employee Y. He has been employed a long time, is more experienced and more familiar with the whole process. If he gets laid off, there will be panic as everybody thinks they will be next. The average person feels pretty good about their future until they get wind of big layoffs.

The one part of the labor situation that has been baffling to the analysts is that wages have not gone up despite these very low levels of unemployment. The Phillips Curve says this should not be the case as when there are fewer available workers it stands to reason that employers will have to offer more to get the people they need and hang on to the people they already have. This time around, there have been factors that have weakened the Phillips Curve. The Boomers are retiring and taking their higher salaries with them. The business community is hiring people who lack the needed skills and training them. During that training period they will not be paying them what they might earn once they have the right skills. In general, the majority of the new jobs added have been low-paying jobs in the service sector. That drags down the rate of wage improvement.

Threats to 2020 Growth

The statements from Trump in the last couple of weeks have been full of confidence regarding the 2020 economy, but this sentiment is not shared by members of his own team. Over the last few years, it has been clear that most of the Trump economic strategy has come from Treasury Secretary Steve Mnuchin. This is not unique to the Trump presidency as traditionally the power of the executive branch lies in the hands of Treasury as far as the economy is concerned. The three pillars of economic policy have long been the Federal Reserve (monetary policy), Congress (fiscal policy) and Treasury when it comes to executive strategy.

Analysis: Mnuchin is now making it clear the U.S. has some issues to contend with in 2020; rapid growth will be more difficult to sustain. He remains relatively optimistic, but has started to warn against assumptions and complacency. He has cited issues such as the Boeing 737 Max mess as it has all but shut down growth in the aerospace sector. He has pointed out that a spread of the coronavirus could be very bad for the U.S. and global economy and he is worried that consumer enthusiasm might fade and leave the U.S. with a weaker growth engine. He has also pointed out that investors and businesses may start to become very worried should it appear that someone like Sanders or Warren begins to show signs of winning the upcoming election.

Gestures

Every now and again, there is an action that helps restore my faith in humanity. In the wake of the Super Bowl loss by the 49ers to my hometown Chiefs, there was a traditional gesture made by San Francisco running back Raheem Mostert. As with soccer games, there is sometimes an exchange of jerseys between adversaries. Mostert gave his jersey to Chiefs running back Damien Williams and vice versa. A few days later Mostert elected to return the jersey to Williams with the statement that he knew that Williams would want to treasure that game jersey forever and should have it back. This interaction was the more poignant when one understands that both of these players had overcome some very long odds to be where they are today—both were undrafted backs who had to prove themselves every day. Williams had bounced around the league before joining the Chiefs as an emergency signing when Kareem Hunt was booted off the team.

That these two can compete as hard as they did against one another and still consider the feelings and memories of the other is an example of people keeping what is important in its proper place. I know that every day people do the right thing for others and rarely ever get noticed for it. That is not why they do it. We simply have to remember that we are all capable of doing the right thing for one another and shouldn't let our differences matter so much.

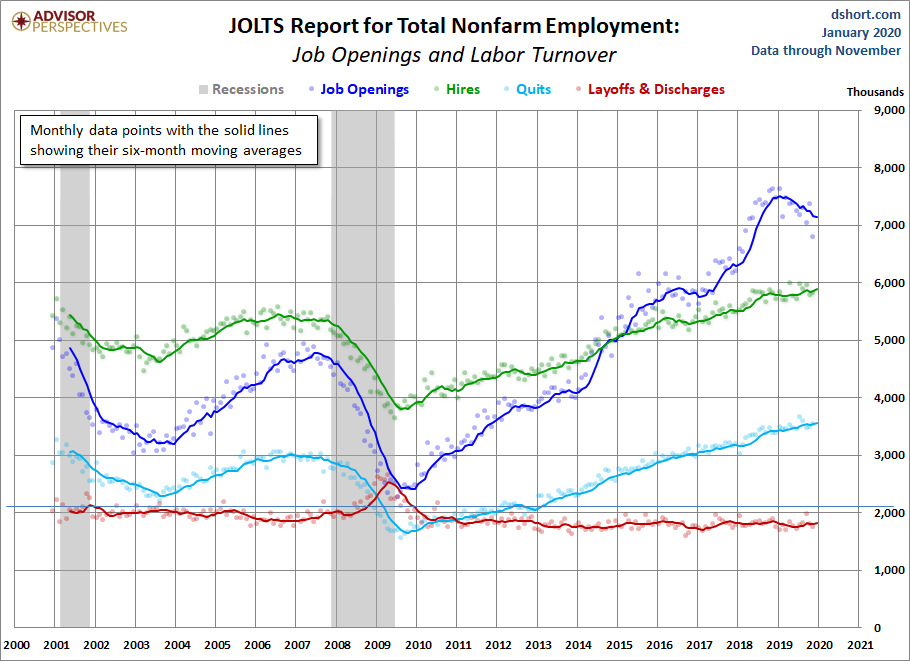

JOLTS Report for Total Nonfarm Employment

The assessment of the labor force is never easy. The data on job creation this month was better than expected, but it takes looking at the employment situation from a lot of angles to understand what is really going on. The JOLTS (Job Openings and Labor Turnover Survey) report is another excellent tool. It shows two interesting trends—the number of quits has been rising, which signals confidence in the labor market. There has also been a decline in job openings, although the number of postings still exceeds the available labor pool.