Strategic Global Intelligence Brief for February 6, 2019

Short Items of Interest—U.S. Economy

Productivity Levels Rose at End of 2018

One of the major concerns for the economy has been the level of worker productivity as the unemployment rate fell to record lows. This has been especially worrisome as employers started hiring people who would require a lot of training before being truly productive. The data for the end of 2018 was more than encouraging as there was a gain of 1.3% after a third quarter gain of 1.1%. The data is a little incomplete due to the shutdown and will doubtless be revised in the weeks to come, but there is some confidence that productivity has been improving—at least to this point. The expectation is there will be a dip while these new hires get acclimated to the jobs they now hold, but that will likely not emerge until second quarter numbers are examined.

Trade Deficit Surprises With Big Decline

Over the last year or so, the trade deficit has worsened each month as the majority of companies that do business in China have tried to beat the impact of the tariffs by buying or selling ahead of the deadline. That led to wider and wide deficits, but suddenly, this seems to have reversed as imports from China are finally starting to decline. The panic buying is basically over and companies are wondering what they are going to do with this inventory now that the economy has started to slow.

Calls to Expand Range of Steel Tariffs

As expected, the countries that exported steel and aluminum to the U.S. have gotten around some of these restrictions by sending more finished products made of that steel and aluminum. The steel and aluminum producers in the U.S. as well as some of the manufacturers are now asking the U.S. to impose tariffs on these finished goods as well. This makes a certain amount of sense, but it is hard to determine where this pattern ends. The producers will continue to seek opportunities to ship in assembles and products that are not covered by the tariff law. It becomes a chasing game of sorts.

Short Items of Interest—Global Economy

A European Army?

There have been rumblings about this for some time, but the voices that urge fiscal caution have always prevailed. It has been assumed the Europeans would be able to count on the U.S. and NATO should the situation call for it. That is no longer an assumption that Europe wants to make. The new head of the German CDU (Annegret Kramp-Karrenbauer) has become a leading advocate for its creation. This is critical as Germany would end up shouldering the majority of the financial burden and would contribute the bulk of the soldiers. There are many issues that will have to be dealt with, but Europe is now accepting the fact that the U.S. is no longer an ally that can be trusted.

Venezuela and Aid

At this moment, there are several aid convoys on their way to Venezuela from Europe and the U.K. The U.S. has yet to mount one of its own, but it is supporting the overall effort. The Maduro regime sees these aid convoys as invaders and states they will be attacked if they try to enter the country. This could immediately create a diplomatic and military crisis as these convoys are full of people from Europe and the U.S. They would likely be injured or killed in such an attack. This would provide all the rationale needed for direct intervention.

Chinese Steel Industry Under Assault

In past years, the Chinese government has done what it could to prop up the steel sector as these operations are generally in the rural areas and provide a lot of jobs. The sense is there is less interest in the steel sector this time and the stimulus money is not heading that way. There will doubtless be shutdowns. With that, China may stop overproducing—a development that would be accepted favorably in the global economy.

New Oil Alliance?

Over the last few years, there has been more and more cooperation between the members of OPEC and Russia, but there has been no desire on the part of the Russians to subsume themselves to the control of OPEC. That several other oil states have had the same attitude as OPEC is generally seen as a proxy for the Saudi oil ministry. It has not been all that sensitive to the needs of oil states not in the Middle East and North Africa. There has also long been tension between the biggest members of the group—Saudi Arabia and Iran. Russia has created something of an alternative to OPEC—a 10-nation alliance with far looser ties and requirements. It includes some of the former Soviet republics and some small producers in Africa, but the primary members are Russia, Kazakhstan and Mexico. These nations have been working with the OPEC states on a year-to-year basis, but OPEC has wanted a longer-term agreement that would tie the two groups together for as long as 10 to 20 years.

Analysis: The aim of OPEC and the Russian 10 has been the same for the last year or two—restrict output enough to get oil prices back up. Right now, the Brent crude prices are in the low 60s and West Texas Intermediate (WTI) is in the 50s. These prices have been even lower at times. The preferred price for OPEC and Russia would be closer to $80 or $90. It is not clear that even this grouping would have enough clout to drive prices that high if the U.S. and Canadian oil producers elected to step up their output. It is useful to remember that an ideal price for oil from North Dakota is about $70. These producers are not all that happy with the current price of WTI.

There are many motivations for the creation of an alliance like this one—not the least of which is the opportunity for OPEC to regain some control over the price per barrel. Another factor that has allowed this alliance to move towards completion is politics. Russia had been pushing for this closer relationship, but Saudi Arabia was a little reluctant to get closer to Russia given their long alliance with the U.S. Since the Khashoggi murder has strained relations between the U.S. and Saudi Arabia, the Crown Prince is suddenly far less concerned about what the U.S. thinks. There is something similar taking place as far as Mexico is concerned. They have not wanted to join OPEC but they also took an arm's length stand on the Russian alliance—until the election of Andrés Manuel López Obrador. He has been far more interested in relations with Russia and far less concerned about what the U.S. thinks and wants.

It is a long way from forming an alliance to restrict oil output and drive prices up and getting that desired outcome, but the U.S. is now facing a more concentrated set of opponents. The chances are good that price hikes will be taking place, and perhaps as soon as the summer driving season. Worries about inflation have been somewhat subdued over the last year because the price of gasoline at the pump has been down; even hitting 10-year lows. If that trend reverses, it can be expected that inflation will jump quickly. This is the kind of surge that provokes quick Fed action in terms of hiking rates.

A Critic as Head of the World Bank

The U.S. has traditionally had the upper hand in selecting the person who will run the World Bank as the Europeans have held sway in picking the head of the International Monetary Fund. To note that the U.S. has had a complex relationship with the institution would be an understatement. Previous heads have included Robert McNamara who pushed the U.S. global agenda during the Cold War, Barber Conable who advocated the "greening of the bank," and Paul Wolfowitz who was one of George Bush's team of neo-cons alongside Dick Cheney and Donald Rumsfeld. Then there was the controversial selection of Jim Yong Kim by Obama. He had no banking or financial background and was committed to shifting the focus of the bank to global health. This was not popular with the staff and neither was he. Ultimately, he decided to bail three years early.

Analysis: David Malpass from the Treasury Department seems to be Trump's choice. He has been a consistent critic of the World Bank and global institutions in general. Not that the World Bank and others don't deserve the criticism. There have been corruption scandals and boondoggles galore. It has often been hard to determine what the mission of the World Bank really is. The aim is development in the developing world, but what does that mean? Is it big public works projects like dams and roads? Is it trying to stimulate local entrepreneurs? Is it addressing education or health? Is it pushing state-sponsored development projects or pushing a private-sector response? What should the role of the developed world be? The recipient states want to control that money and involve the local business community, but the World Bank contributors want to keep control of their money as they don't trust these governments.

Who Can You Trust?

In a conference call the other day, I once again heard one of the common complaints lodged against the economist. "You guys just contradict one another and change your minds every other day." I can't really disagree, but there are reasons this is so often true. The economist is essentially driven by data. When there are differences in the various economic assessments, it is usually because there is different data under examination. Then, there is the fact that economics is as much philosophy as science in that economists differ as to who should be getting the benefits and who should be paying. The more liberal economist will lean towards higher taxes on the wealthy and more pressure on the business community. The more conservative economist will lean the other way. As for changing our minds, that is the result of the changes in the data. To do otherwise would be akin to the weatherman predicting a sunny day on Thursday and ignoring the arrival of a storm—insisting it was still sunny in the midst of a rain. With all this fluctuation, what can be trusted or at least relied upon?

Analysis: One of the challenges presented by data is age-old—you can have the data fast or you can have it accurate, but it is hard to have both. Much of the best information takes a while to gather. By the time it is available, it is months or even years old. That limits its effectiveness as a strategic tool. The more current data is usually based on some sort of survey technique, but these can be woefully inaccurate as people lie or they just don't know enough to answer accurately. Consumer confidence surveys are notorious for being skewed by non-economic factors. Good or bad weather affect responses and so do factors like the price of gas at the pump. Take heart though—there are surveys that can be trusted and have been exceedingly accurate estimators of the economy now and down the road.

The Purchasing Managers' Index and the Credit Managers' Index are structured very similarly and take advantage of the characteristics of both purchasing managers and credit managers. The basic concept is simple. Purchasing managers are asked if they are buying more or less of a given commodity or item, or if they are buying the same as they did the previous month. The purchasing manager is not the one that made the decision as to what to buy or how much—they are reacting to the orders and requests from their company. Therefore, the data is fundamentally unbiased. They are tasked with buying what is needed at the best price they can obtain, but are not trying to manipulate the system to make a point—the orders are simply what they are. If many purchasing managers in the automotive sector are buying less steel, this will show up in the data immediately.

The Credit Managers' Index is a tool modeled on the PMI. It polls credit managers to see if they are seeing more or less of a certain activity—accounts out for collection, disputes, bankruptcies, dollar collections, sales and the like. Over the years, it has been noted that the CMI frequently predicts the behavior of the PMI as generally the credit managers will be doing their jobs before the purchasing managers do theirs. The credit manager will be determining what a given company will offer its customers in the way of credit. That determines how much that company is going to be selling.

Over the years the, PMI has spread to more than 30 nations around the world. The CMI has started to see some growth globally as well. These tools have been very good at advance warning. If customers are not getting access to credit, it is because their financials are not looking good and the credit manager is not willing to take the risk. In the last several months, the CMI has been showing significant weakness in what are referred to as the non-favorable factors. As with the PMI, the readings below 50 indicate economic contraction. Most of these non-favorables are now in the mid-40s. This includes accounts out for collection, disputes, slow pays and credit rejections. The favorables are still strong but weaker than they were. The sales, dollar collections, new applications and amount of credit extended are still in the high 50s, but they were in the mid 60s only a few months ago.

Meanwhile the PMI has been steadily dropping from an exalted height. The readings were in the 60s only a few months ago and are now wallowing in the mid to lower 50s—still in expansion territory but weaker. The PMI looks at data from industry sector to industry sector. There are now sectors that are in the 40s, not the case even six months ago. The bottom line from all this data is that the canary in the coal mine is starting to cough!

How Good Is the Economy?

As expected, the state of the economy was a big part of the State of the Union address by President Trump. There is no doubt that economic numbers looked very good in 2018 and some crowing was in order. The jobless rate is as low as it has been in decades, growth has been slightly above the 10-year norm, the markets have been volatile, but continue to perform well and the evils of inflation have only just started to manifest. The question now is whether 2018 will be the peak followed by a decline in 2019.

Analysis: This is obviously a topic that will be revisited often in the months ahead and we will really not know the answer until this time in 2020. What is evident thus far is that 2019 will be without some of the advantages of 2018. There will be no tax cut to provide an economic "sugar rush." The Fed has hiked interest rates a little, but inflation still looms and is accelerating. Confidence levels remain high with consumers, investors and the business community, but there is more caution and trepidation showing up. Trade wars and tariff battles have damaged manufacturing and agriculture. Few expect anything other than intense acrimony from the political leadership going forward.

Reverse Redlining

I have long been familiar with the practice of redlining and its destructive tendencies. Certain neighborhoods were marked as unacceptable risks by banks and other institutions. The people living in these regions were cut off from lending and other financial activity regardless of their personal situation. It doomed many neighborhoods and people to poverty no matter what they did. I only became aware of reverse redlining with my local newspaper. This publication has been dwindling drastically over the years—hundreds of employees laid off, coverage reduced and at the same time the subscription price ballooned to close to $1300 a year. Now I learn that if I was living in a different neighborhood, my subscription price would be lower. I have been deemed to live in a high-income neighborhood and have been a long-time subscriber (over 30 years). This apparently led them to conclude that I would not notice a price this high. They were wrong. I noticed and I am no longer a subscriber.

This behavior is not unique as I have learned over the last decade. We lived in a modest, rented duplex for over 20 years and finally had the wherewithal to build the house of our dreams. It is big and in a pretty nice neighborhood, but not the most prestigious in town. All of a sudden, every service offering was five to 10 times higher than it had been when I was in the rented duplex. I have been quoted a price of $300 to mow my yard (the reason I have my own riding mower), $200 to shovel a driveway and so on. It seems that it is assumed I am wealthy beyond the dreams of avarice and therefore a mark. I'm not and find that I deeply resent the exploitation. There may well be those who delight in overpaying as some sort of status symbol, but I am not among them.

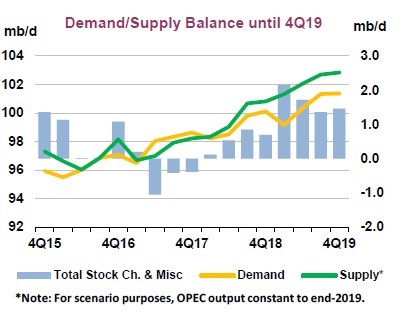

Oil Supply and Demand

As Russia and Saudi Arabia try to find ways to cooperate, the factor that drives the effort is clear enough. According to the majority of the studies of oil output, the rate of supply will outpace demand through 2019 and well into 2020 unless something dramatic were to change. This is a clear recipe for falling oil prices as the supply continues to chase a declining demand. This demand expectation is also based on reasonably good growth in the U.S., Europe and China. This is not an assumption that can be made given the most recent economic data. China is slumping fast and so is Europe. The U.S. is still growing, but not as fast as it was in 2018.