Strategic Global Intelligence Brief for February 3, 2020

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Watch the PMI Data

The manufacturing sector worldwide has been drifting deeper and deeper into recession territory. Today, the latest set of purchasing managers' data will be released for many of these countries. There is a universal expectation that the news will be bad, but the question now is how bad. The U.S. version of the Purchasing Managers' Index (PMI) is expected to be under the 50 line in contraction territory again, but perhaps not quite as deep as it was last month. If this is the case, the PMI will have been in contraction for six straight months. The news from Europe will be worse and China is likely to see a really profound plunge. For the last several months, the data has been under 50 for almost every global economy, while those in positive territory have been registering numbers just barely in the expansion zone.

Trade Data Expected to Provide Mixed Message

Last month, the trade deficit was smaller than it has been in years—since 2016 to be precise. The primary reason for the reduction was the fact that imports from China were down to levels not seen in years. The tariffs have been making it more costly to buy from China; other nations are just starting to fill the gap. This month, the deficit is expected to expand again, but not because the U.S. is importing more. This time the problem will be a reduction in the level of U.S. exports. The sagging global economy is taking its toll on demand for U.S. goods and the stronger dollar has not helped matters much. As long as the U.S. economy remains the healthiest in the world, the dollar will retain that position.

Not Much Variation Expected in Job Numbers

The jobs data issued this week will not shock many. The expectation is it will reflect the same patterns that have been in place most of the last year. There will be a modest increase in the numbers of jobs added and the overall rate of unemployment will remain at around 3.5%. Most important is that wages will not move much either. That continues to be a vexing issue. The expectation has always been that low levels of unemployment will lead to higher wages, but that has not been the case and nobody has a clue as to when that will change. As a result, there is not much concern about the arrival of wage inflation.

Short Items of Interest—Global Economy

Coronavirus and Oil

For those who still don't quite grasp why a virus outbreak in China matters to the global economy, consider the reaction of the world's oil producers. The OPEC nations and Russia are calling for an immediate and deep reduction in oil production as they are seeing a radical drop in Chinese demand for oil. The Chinese have all but shut down internal travel, while the Wuhan region has been more or less quarantined. This is factory territory, which means compromised production. The oil sector has been worried about reduced demand anyway. This just adds to their concerns.

Pushing China

The Chinese government has its hands full these days. That has allowed several nations to push an advantage over China—essentially taking the opportunity to pursue their own agenda while Beijing seems distracted by issues such as the coronavirus and the demonstrations in Hong Kong. This has been good and bad for the U.S. On the one hand, the Taiwanese have dispatched their vice president to meet with U.S. leaders—the highest-level delegation sent by the Republic of China (ROC) since 1979. China is not at all happy about this. On the other hand, the antics of the North Korean leader have accelerated with additional missile tests and bellicose threats. China is either not willing to curtail Kim or it is genuinely not concerned—everybody else in the area is, however.

Growth of the Rich in Venezuela

The facts are stark. Roughly 75% of the country now lives in poverty and Caracas is the most crime-ridden and violent city in Latin America. At the same time, the wealthy in the country are doing better than ever as the Maduro government has opted to support them in exchange for their backing. The only thing imported into the nation now is luxury goods for the elite.

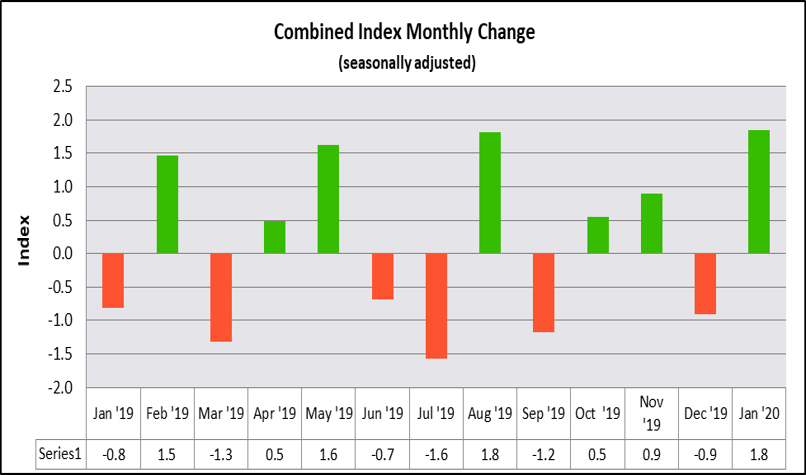

Nice Little Gain in the CMI Data

There has been some concern expressed over the performance of the Purchasing Managers' Index of late as it has been languishing in the contraction zone for the last five months. There has not been a total collapse as far as the numbers are concerned, but it has been a worry. There has long been a relationship between the Credit Managers' Index (CMI) and the PMI as these functions within a company are closely tied. Purchasing managers are not going to be able to do the buying they want to without credit. The CMI therefore often predicts the patterns that will show up in the PMI. Right now, that would certainly be a good thing. What follows is the executive summary for the CMI and the breakouts for manufacturing and the service sector.

Analysis: It is hard to decide what the latest lesson from the Credit Managers' Index would be. Is it that 2019 ended on a more promising note than was expected or is it that 2020 is starting out to be a better year than had been anticipated? Given that credit managers tend to think in the future, this month's good data may be seen as a harbinger of things to come. Not that everything is likely to come up roses in the next several months, but for the time being the threats seem a little more distant than expected.

The numbers this month are up quite substantially. This tends to contrast with the numbers released by the Institute for Supply Management and Markit in their purchasing managers' indices. The overall score for the CMI moved up from 54.6 to 56.4, the highest reading seen in almost three years. The good news was reflected in both the favorable and unfavorable categories. The favorable readings returned to the 60s with a reading of 62.2 compared to last month's 59.3. The numbers for the favorables have not been this good since May of last year. The combined unfavorable numbers also jumped as they went from 51.5 to 52.6. This is another three-year high.

The details in the subcategories were also showing real progress. The sales numbers reached 63—nearly as high as the levels reached last August when the reading was 64.4. This is one of the real surprises given that the first of the year is not generally seen as an active time for consumers or business. The new credit applications reading is at 61.1 and last month it was at 59.4. This takes the category back to where it was in November when it hit 61.2. The dollar collections data also moved into the 60s with a reading of 61.7 compared to 57.9 in December. The amount of credit extended kept pace with a reading of 62.9, while last month it stood at 61.1. All four of the categories were in the 60s. This had not been the case since last August.

There was similar good news as far as the unfavorable categories are concerned. The data for rejections of credit applications stayed the same as the month prior, not a bad thing given that the numbers stand at 52. This is positive news as it comes at the same time that applications are up. This means there are good applications coming in. The accounts placed for collection improved a little as well. Most importantly, they stayed above the 50 line, indicating expansion, with a reading of 50.6 compared to 50.3 in December. The disputes number also jumped up by quite a bit as it went from 50.8 to 52.4. The data for dollar amount beyond terms made the biggest gain, however. It now stands at 54.2 after being at 51. This is perhaps the most significant reading of them all. There has been a desire on the part of many companies to go into 2020 with a reduced set of credit obligations in order to be better protected should there be some kind of slowdown. This is showing up in the credit data with reduced slow pays and improved dollar collections. There was also improvement as far as the category of dollar amount of customer deductions. It moved from 51.3 to 52.2, which took the reading back to what it was in September. There was a nice rise in the filings for bankruptcies data with a new reading of 54.4 compared to 53.4 in December. For the second month in a row the numbers for this index were all in the expansion zone and by a substantial margin. There has not been a two-month period like this in over three years.

It is the sworn duty of a dismal scientist to point out that good news months can easily be followed by bad news months—there have already been several of these shifts. May of last year was even stronger in some respects than this one; however, by mid-summer the numbers had fallen precipitously. For now, we can enjoy the data and hope for a third-straight month of these gains.

Manufacturing Sector

As for manufacturing, the sector was supposed to be in pretty bad shape by this point. There have been any number of headwinds to contend with over the last several months after all. There have been tariffs that made steel and aluminum more expensive to buy. Then, there were the tariffs that all but killed trade between the U.S. and China and reduced U.S. export activity as global trade in general faltered. Add in the GM strike, problems at Boeing and a sense that 2020 was likely to be a slower year and the manufacturing sector has been buckling down for a rocky 2020. Then we get these numbers in the latest CMI—some of the best we have seen in well over two years. Is this just a one-month anomaly or is the sector in better shape than many had expected?

The combined score for manufacturing is 56.5, substantially higher than readings collected over the last couple of years. In August it hit 55.7 and in May it was at 55.4, but this January takes the crown. The index of favorable factors moved into some rarified territory with a reading of 62—the first time the readings have been in the 60s since August and only the sixth time in the last 12 months. This is also the highest reading in close to three years. The index of unfavorable factors jumped a little from last month with a reading of 52.7 compared to 52 in December. The more interesting news is that this number is higher than it has been in a year.

The sales data surged back into the mid-60s with a reading of 63.8 after one of 57.9 last month. In August it hit 65.3, but this month's reading is the next highest. The new credit applications numbers slipped a bit but stayed in the 60s with a reading of 60.2 compared to the 61.2 in December. The data for dollar collections improved as well—going from 57.5 to 62.9. That tracks well with some of the data in the unfavorable categories. The amount of credit extended moved from 59.1 to 61.3, meaning all of this January's favorable readings entered the 60s for the first time since May of 2019.

The rejections of credit applications slipped a bit but stayed in the expansion zone with a reading of 52.5 compared to the 53 notched in December. The accounts placed for collection numbers improved slightly from 51.1 to 51.8, but the important factor is this category has been out of the contraction zone for the last two months after spending most of the last two years in the doldrums. The disputes category also improved a little—going from 51 to 52.5. There was a bigger improvement in the dollar amount beyond terms as it went from 52.4 to 54.3, while the dollar amount of customer deductions slipped a little from 52.6 to 51.1. The filings for bankruptcies improved quite a lot from 51.8 to 54.2. With that, the entire sector was above the 50 line and in expansion territory. This is the second month in a row for this kind of reading, which has not happened in well over three years.

These readings are not necessarily spectacular, although there have been a few months in the last couple of years that have been better. The important aspect of these readings is nothing like this kind of performance had been expected given all the gloom and doom surrounding the manufacturing sector. This can all change in a heartbeat and there have been times in the last year when there has been such a flip, but for now the news is quite encouraging.

Service Sector

There is often a bit of a mixed message sent by the service sector at this time of year. In the economy and with the Credit Managers' Index, there are dominant subsectors that will affect the overall performance of the category. This time of year, those dominant sectors are retail, entertainment and travel. Later in the year, the construction sector plays a bigger role. Then, there is the constant of health care. At the end of the year, one has the spending season aftermath to consider. In January, there is a process of "taking stock." This year, there have been some worries about retail. While traffic numbers were good and revenue was up, many reported lower profits as consumers tended to stick to discounted goods; there is just not enough margin in these.

The combined score for services was solid but not spectacular. It went from 54.4 to 56.4, but that just took the reading back to where it was in November when it stood at 56.5. The index for the favorable factors did a nice jump, but again the numbers in November (63.4) were better. It had been at 59.7 in December and now sits at 62.3. The index of unfavorable factors improved from 50.9 to 52.5, even better than the data in November when it stood at 51.8.

The sales numbers returned to previous highs with a reading of 62.2 compared to December's 59.7. In November, it stood at 62.5. The new credit applications data made a similar move as it went from 57.6 to 62 along with dollar collections which jumped from 58.3 to 60.5. The pattern continues with amount of credit extended. In November, it stood at a level of 66.9—higher than it was in May. In December, it fell to 63 and now is back to 64.5. All these gyrations mean these four categories are now back in the 60s as they were in November and previously in August.

The data for the unfavorables showed some of that same behavior. The rejections of credit applications shifted up slightly from a reading of 50.9 to one of 51.5, very close to the 51 in November. Accounts placed for collection slipped a bit and that is a concern. It was at 49.5 and in November it stood at 50.1. Now it has fallen to 49.3. This is not deep into contraction, but it confirms that many in the retail community are not in the best of shape after the holiday rush. The reading for disputes improved a little from 50.6 to 52.3. The data for dollar amount beyond terms made a nice recovery with a reading of 54.2 after a December reading of 49.7. This tends to reinforce the notion that companies are trying to get their debts and other financial issues in order for the new year. The dollar amount of customer deductions improved a bit as well as it went from 50 to 53.3, even better than November's data. The filings for bankruptcies slipped a bit as it went from 54.9 to 54.6—consistent with the data from November as well.

For the most part retail did well this year, but the big shifts in the sector were even more obvious. It was a good year for the online merchants and a bad-to-mediocre one for the brick-and-mortar versions; a pattern likely to intensify.

January 2020 versus January 2019

Whether this was an indication of a strong finish to 2019 or a good start to 2020 the data is encouraging. Now, all eyes will be on next month to determine which month was the anomaly—the shrinking December or the booming January.

Why Is Manufacturing in a Recession?

The growth that has been noted in the U.S. economy has been fairly subdued at just over 2%, but it has been growth. The problem is that too much of that growth has been due to the consumer and the service sector. There is nothing wrong with being dependent on that sector, but it would be nice to have manufacturing doing more. Why isn't it?

Analysis: The two most important factors have been the trade wars and the travails at Boeing.

I Have to Do This—Please Indulge Me

My hometown Chiefs won the Super Bowl. I am still in a state of some disbelief. Not because I doubted the abilities of this team and its coaching. By now, the whole nation is well aware of Mahomes, Kelce, Hill, Jones, Mathieu and so on. By now, everybody also knows Andy Reid. The thing is—this is Kansas City and we have a tendency to expect the worst while hoping for the best. Maybe this is because we live in tornado alley and are well acquainted with the unpredictable and capricious.

Our sports teams always seem poised to snatch defeat from the jaws of victory and we always seem to enter these championship periods with fingers crossed and squinting. During the Royal's run for the World Series we approached each set of games with the same mantra—"just don't be embarrassed—make it a good game." Then we won and we started the chant for the next series. So it was with the Chiefs. We were on the precipice of elimination in all three games and we all just hoped we could make a decent game of it. Then we win and the fans can start the process all over again.

We do not expect good fortune as some kind of birthright. As a rule, we are not given to hyperbole and overconfidence. We are disappointed when we lose, but it never shocks us. In a way, the life of the farmer still dominates our collective psyche. Each spring the crops get planted and we wait to see what the world will throw at us—and it is usually not all that good. Still we persevere as every so often it all works out and the harvest is bountiful—and our team can be crowned the champions.

January's Credit Managers' Index

The data from the Credit Managers' Index has been better than many had expected for the last few months. There have been some weaker months, but most have been securely in the expansion zone. That has been especially true as far as the favorable factors have been concerned. The weakness has been primarily in the manufacturing sector, but even here the damage has been confined to select areas such as aerospace and those businesses dependent on global trade.