By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—US Economy—

Consumer Confidence Watch

Tomorrow, the Conference Board will release its latest survey data on the mind of the consumer. As long-time readers know by this time, I am not a huge fan of these consumer surveys as the consumer is notoriously fickle and hard to read. One day they are asserting all is well and the next day they are slamming those wallets closed in response to some worrying trend. This survey will be examined closely to determine if the consumer is being affected by the disease predictions or the election nonsense. The betting is neither has yet to penetrate to any significant extent. Therefore, confidence levels should remain strong.

GDP Revision

This will be the week the Commerce Department releases the first revision of the Q4 GDP data. The expectation is it may trend just a little higher than originally thought. The first of the revised numbers will generally have a better handle on export and import data as well as consumer spending. The assertion is both of these numbers might have been somewhat undercounted at the start. The third revision will be out in a few more weeks. That will better reflect the level of business investment and spending, and therefore might recede a little.

Will Trump Bring a Deal Back from India?

The government of Prime Minister Narendra Modi needs this Trump visit as he has been losing support from his business supporters. The reforms he pushed at the start of his term have not panned out as hoped. He has had to rely more heavily on his Hindu nationalist allies to stay in power. This puts him at odds with the Muslim population while doing nothing for economic growth. Trump wants a deal to offset the Chinese influence over U.S. imports, but Trump has been critical of India as well. It is not clear the two nations will be willing to give the other what they want, but at least the two can play to the crowds for a day or two.

Short Items of Interest—Global Economy

French Right Exploits Crime and Economy as Key Issues

A few years ago, the traditional French center right fell apart as their candidates went to war against one another and then started to fall to corruption. The National Front under Marine Le Pen emerged as a likely beneficiary. That panicked the French into electing the unknown Emmanuel Macron. Now that Macron has been watching his popularity fade, the National Front is making a comeback on the back of two key issues—crime and the economy. It has even been enough to win support from the immigrant community that once saw Le Pen as their mortal enemy.

Changing Borders

There is nothing sacrosanct about borders. The majority of the world has witnessed massive changes in the makeup of their nation state over the years. Europe has been subject to many of these. They inevitably leave groups of people in the wrong place at the wrong time—or so they would assert. National boundary changes, however, do not mean the ethnicity and history of that region changes. At the moment, almost a third of the European population would like to be part of a different nation—one dominated by their own group. This also applies to nations such as the U.S. where people choose to voluntarily segregate themselves in order to live with their "own kind." It makes governing for the majority very hard indeed.

Central Bank Independence in Brazil?

Brazil is one of the few large economies without an independent central bank. That has been discouraging investors for years as they assume the bank will yield to the politics of the day. It now appears the Bolsonaro regime will spearhead a move to make the bank independent so these global investors will get interested again. This has been the plan from the U.S.-educated central bank head Roberto Campos Neto. The fact that Bolsonaro usually avoids ceding control is interesting as in this case he would be ceding a great deal of control over the economy.

Global Virus Threat Dominates G-20 Discussions

The financial leaders of the world met over the weekend as part of the G-20 meetings in Riyadh, Saudi Arabia. They had the usual agenda items to discuss—everything from interest rates to trade policies and currency values. Those in attendance included the various finance ministers and central bankers from the 20-largest economies in the world as well as the leaders of the big multinational organizations such as the International Monetary Fund (IMF), World Bank, Organization for Economic Cooperation and Development (OECD) and others. Generally speaking, these meetings are among the more productive as there is not the political gamesmanship that takes place when the national leaders get together. The attendees are generally focused on the same issues and seek more cooperation than their political counterparts. The new issue this time has been the impact of the coronavirus—now named COVID-19 to distinguish this strain from others that have been identified. There was universal consensus that the world economy was in stress due to the disease, but there was not as much unity when it came to what should be done to blunt the impact of the outbreak.

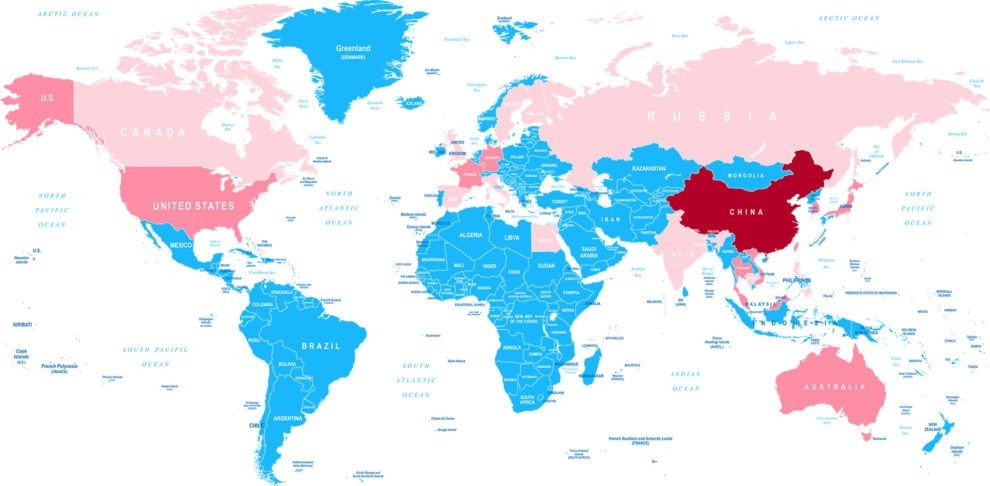

Analysis: The assessment holds there will be three areas of most immediate impact. The most obvious is the actual cost of treating the disease and of trying to contain its spread. Hospitals in the most affected areas have been overwhelmed and there is a desperate need for more medical supplies and more personnel. The second major impact will be the costs of the precautionary measures as there have been extensive quarantines that have prohibited people from working and traveling. The public has been growing more and more alarmed by the threat. That has been affecting their willingness to travel—a trend that has already affected the airlines, cruise ships, hotels and entertainment venues. In the most affected areas of China, the cities look almost abandoned as people try to avoid contact with one another. The third area and potentially the most threatening from an economic point of view is the shift taking place in the global supply chain. Business had been getting nervous about dependence on China already as the various trade issues have affected business supply chains. Now comes the biggest threat yet to China as the world's supplier. Almost every business that has dealings with China now has to think in terms of their options. At some point, these back-up supply chains become the dominant ones and China will struggle to regain their market share. The estimate at this point is that global growth will falter by as much as half a percent, but some pessimistic assessments have that growth falling by as much as a full percent.

What can be done at this point? Very little. In the short term, all that is available is containment and identification. There are efforts under way to develop a vaccine, but that is at least months away and maybe years. The spread has not been contained and more Asian states have declared a state of emergency. It is not a matter of if it spreads to other parts of the world—it is only a matter of when and to what degree.

Europe Confronts Covid-19

Over the weekend, the global markets started to plunge. The more pessimistic assessments assert that this is the beginning of a very serious global market correction. The investors are starting to yank their money out of any sector that might be at risk as the disease spreads. Without knowing a lot about the threat, that can include just about anything. The outbreak seems to have hit Italy very hard and quickly. That has affected the overall mood in Europe. What would it be in Italy that would have made them vulnerable? It is not as if there are more Italians doing business in China than there are Germans or British or any other nationality. This is not a nation with inadequate medical talent. The Italians are moving fast, but there are far more questions than answers. Thus far, the EU has not elected to alter the Schengen agreement which allows for free movement within Europe, but restricting travel is one of the first suggestions made to control the virus.

Analysis: Beyond the public health crisis and beyond the economic implications, there is another deeply worrying development that threatens to exacerbate another issue. In a region that has already been roiled by anti-immigrant fervor, there is yet another factor to feed that paranoia. This has been taking place in the U.S. and other nations as well. Asian people have reported being shunned and denied entry into public places. There has been discrimination against Asian people when they try to rent apartments or attend school or even report to work. Thus far, the disease has not spread to the populations that have been under attack from anti-immigrant groups, but health officials are convinced these vulnerable populations will be next to encounter the pandemic. That means those migrants from the Middle East and North Africa will be under even greater scrutiny in Europe. The U.S. will become ever more hostile to the migrants coming from Mexico and other parts of Latin America.

The entire issue has been made far more complicated by the surge of conspiracy theory and outright lies. The social media claims are vicious and completely fabricated, but have found a willing audience of wholly ignorant and ill-informed people. Claims have been made that China weaponized this virus and there are claims the U.S. weaponized it. Assertions have been made that it can be transmitted from hundreds of miles away and that it is 100% fatal. It is essentially the cold virus or a close cousin and is transmitted the same way—touch and close proximity to the infection. The death rate is above 14% for those over 80 and 0.2% for those under the age of 40. It is more harmful to those with a compromised respiratory system—just as the cold and flu are.

The death rate from the flu remains far higher than COVID-19. In 2019, there were between 300,000 and 600,000 deaths attributed to the flu. Thus far, the COVID-19 death toll in 2020 is just over 2,000. The worry with the new virus is that it remains largely unknown. It is possible that many more people have it than now assumed.

Johnson Draws Line in the Sand

At this point, Prime Minister Boris Johnson is talking very tough and seems to be playing to his own gallery. The statement on the upcoming Brexit negotiation is full of bravado and threat. According to him, the U.K. is prepared to walk away from the talks and let the chips fall where they may rather than yield anything as far as "British sovereignty." To begin with, nobody really knows what that means as there is nothing in the EU demands that would impinge on the U.K.'s right to govern itself. The EU has made its position clear from the start—if the U.K. wants access to the EU for trade purposes it will have to abide by European rules and regulations. These are the same rules that every other nation in the world is expected to adhere to—everything from food quality to consumer safety and so on. There is no doubt some of these regulations are protectionist, but they apply to everyone.

Analysis: If the U.K. is denied access to the European market, the impact on British business will be severe. That sets up a real confrontation within Britain. The business community backed the Tories in the last election, but not with boundless enthusiasm as their alternative was the Labor Party of Jeremy Corbyn. They believed Johnson would temper some of the Brexiter rhetoric to reach a deal they could live with. He may yet deliver on that assumption.

Johnson has a history of talking tough and then taking a different position when forced to—all the while asserting he was doing so against his will. The business community in the U.K. (and Europe for that matter) are hoping this pattern continues and both sides will find a way to salvage some kind of trade deal between the U.K. and the European Union. It may all depend on how secure Johnson feels and whether he can risk alienating any of his base.

Move Hard and Fast

This is the basic advice central banks are getting from various economists looking at the current state of the global economy and the effectiveness of the tools at the disposal of the central banks. There have been a couple of developments in the last 10 to 20 years that have radically altered the role of the central bank. The first is that interest rates have fallen to what would have been seen as record lows and have stayed there for an extensive period. Many are wondering if they will ever be back to what was once considered normal. At the same time, the fiscal players have essentially abdicated their role in terms of stimulating an economy (or controlling inflation). They have no room for radical spending as the legislatures have all run up huge debts. This leaves fewer options for the central banks.

Analysis: The suggestion now is that central banks will need to aggressively deploy the other tools they have been forced to develop—everything from intervention in bond markets to manipulating bank interest rates and continued use of tactics connected to quantitative easing. In the past, these have been seen as actions of last resort. Now, they might start becoming the very first steps taken by the central banks when a crisis starts to emerge.

Housing Sales Slump

The rate of home sales fell last month, but for somewhat unusual reasons. In past years, this kind of slump would be a signal of distress as far as consumer spending was concerned. It would have meant buyers were being scared off by high prices or high mortgage rates or fear of being unemployed. None of these have been a factor this time around. The issue is an acute shortage of housing stock.

Analysis: There are obviously still many parts of the country with ample supply, but the places where people are moving to have acute shortages of everything from multi-family units to single-family homes. The reasons for the shortage are many and varied—shortage of construction workers, people living in their existing homes longer, zoning laws that inhibit new construction, resistance on the part of buyers to move to where the housing stock is. There is a real division showing up in the national housing market with some cities facing very high prices and shortages and others struggling with abandoned housing stock.

History

I take a great deal of solace in history. Every time I look at current affairs and feel as if I am descending into a nightmare of stupidity and greed, I can read some history and remember there has been stupidity and greed forever and we managed to survive. I just watched a little mini-series on George Washington and was reminded that humans are universally flawed and always have been. He had his moments although these flaws were outweighed by his contributions to the founding of this nation. The account of his defeats and victories were instructive as were the examinations of others in his orbit—Benedict Arnold, Alexander Hamilton, Horatio Gates and so on.

The lesson is nobody is immune to criticism and nobody gets through life unsullied. Backstabbing, incompetence, deceit and betrayal are constants. Washington resisted the majority of these foibles and was most definitely the right man for the time. Others around him—not so much. We survived. As the history of the next 250 years showed—we survived a lot more. I am saddened by much of what I see in the world today, but I can keep from falling into despair by remembering there has always been much to despair, but somehow, we endure.

COVID-19 Virus

The spread of the COVID-19 virus is still heavily concentrated in Asia, but is obviously spreading to those nations that have extensive contact with Asia. That includes the U.S. and Europe. The disease has not yet appeared in most of the developing world, but that may only be due to the lack of reporting or identification.