Strategic Global Intelligence Brief for February 20, 2019

Short Items of Interest—U.S. Economy

Hawks Are Not Giving Up

The emerging consensus view of the Fed—it is not going to hike rates again this year. We will find out a bit more about their thinking as we peruse the Fed minutes, but the commentary from most of the members has been pretty dovish. The sense is the economy has slowed enough to create concern and it would be prudent to wait a while to see what the economy does later in the year. This may be the dominant view, but that hardly means the Fed hawks have abandoned their positions. Loretta Mester of the Cleveland Fed has stated she thinks rates will yet go up this year, but she is not a voting member of the Federal Open Market Committee (FOMC). Esther George of the Kansas City Fed is and she has not given up her desire to see rates rise either. Any hint of accelerating inflation and the hawks will be in full voice again.

Nothing Wrong With Deficits?

The shift within the ranks of the GOP has been startling. The Tea Party movement has all but vanished and been replaced by spenders as profligate as any from the opposition. The sense is that nobody in politics now sees huge deficits and debt as a problem any longer. The deficit hits $900 billion this year and will be well past a trillion dollar annually within a year or two. Public debt is $22 trillion. The GOP opposes reducing these as they think this is just a way to justify tax hikes and that Democrats will blame Trump. The Democrats have always been far more comfortable with debt and do think tax hikes are the solution.

Home Builder Confidence Rises

There are three prime motivators as far as the housing market is concerned. The most important of these is the employment situation. If people feel confident about their jobs, they worry less about taking on an obligation like a mortgage. The other two include the cost of that mortgage and the cost of the home they want to buy. The latter two factors had been trending in a negative direction over the last several months. That had affected confidence levels among buyers and builders alike. Now that mortgage rates have come down a little, there is renewed optimism as far as the builders are concerned.

Short Items of Interest—Global Economy

Venezuelan Military Warned

The only thing that keeps Nicolas Maduro in power is the support of the military. As soon as they elect to switch sides, his days are numbered. The opposition and those nations that want to see Maduro ousted are making offers to the military that will have very strict deadlines. In essence, the offer is—support Maduro's overthrow and all is forgiven. There will be no retribution or punishments for past crimes. Stay loyal to Maduro and when he is deposed, face prosecution and imprisonment for war crimes.

Does Pakistan Suffer Most From U.S. Withdrawal From Afghanistan?

The fear is that Afghan militants will be redirected to the contested Kashmir region if and when the long war in Afghanistan winds down. The sense is that the Taliban will agree to some form of ceasefire and will seek to reduce their engagement with the most violent of militants. At the same time, the Pakistani secret police will seek to deploy these groups to Kashmir to battle India. The massive car bomb that killed 50 paramilitary soldiers may just be the beginning.

More Brexit Defections

The group of Labor MPs that have broken with their party as a means to protest the Brexit policy has now been joined by three from the Tory party. The pro-Brexit forces are still dominant, but the cracks are significant. If many more join, they will have blocking power in Parliament and will change the conversation radically.

Trade Talks With China Unpredictable

During the course of the trade talks with China over the last few weeks, there have been assurances that additional tariffs would be imposed on March 1 and assurances that they would not be imposed—at least not yet. There have been utterly contradictory statements from within the White House with Trump saying one thing and negotiators saying the exact opposite. In the last few days, it looked certain that the tariffs would be expanded and it was certain that all efforts to reach a deal had failed—until yesterday anyway.

Analysis: Trump stated that March 1 is "not a magical date." In so doing, he threw doubt on what happens next. Does this mean March 1 is no longer the deadline? What is the deadline then? Is there a deadline at all? Did China agree to something? Did the U.S.? Has anybody told the negotiators? They seem to be under the impression that March 1 is still the date, so the business community has no choice but to assume that it still is. No definitive statement has been issued one way or the other, but the day is young and there is plenty of time to change positions.

Will Mexico's Drug War Ever Be Won?

The majority of those in Mexico who voted for Andrés Manuel López Obrador (AMLO) in the last presidential election cited three reasons for supporting the former leftist mayor of Mexico City and perennial candidate for the president's office. At the top of the list was the desire for a better economic future (more jobs, higher pay and the like), but right behind the economy was the desire for the government to do something about the drug war and the violence that has gripped the country for decades. The number three motivation was for Mexico to stand up to the bullying tactics of Donald Trump. That has played a role in the drug war strategy of AMLO.

Analysis: One of the flashpoints for the current drug war is the battle for supremacy between the Sinaloa cartel and the Jalisco cartel. This turf battle has all but turned Tijuana into a wasteland. The arrest and conviction of Joaquin "El Chapo" Guzman has exposed the depth of the crisis. He was once the all-powerful head of the Sinaloa gang. He was notorious for his ability to escape prison as he was able to bribe and intimidate any that would stand in his way. Now that he is guaranteed to serve time in a U.S. prison, there were those who thought the violence would subside. But these are the people who do not understand the nature of these cartels. His departure simply elevated another set of gang leaders; it has been business as usual. If anything, it made matters worse as rival gangs thought there might have been a weakness to exploit and they have been fighting with the Sinaloa cartel.

AMLO promised an end to this scourge, but was vague during the campaign. His strategy now appears to be three pronged. The first is the same as was tried by his predecessors. He has deployed over a thousand troops to the Tijuana area to try to control the wars that have broken out between the rival gangs. As with the previous administration, the trust is in the military as the local police have largely been compromised. The limitation is as it has always been. There are not enough members of the trusted elite units to go around. Everywhere they are not active becomes a new hot spot for the drug cartels. The second part of his effort is to push a variety of social and education projects designed to keep teens and young adults out of the gangs. This has been tried before as well. Its main limitation is that far more money and personnel are needed to put a dent in the ability of the cartels to recruit.

The third plank is not completely new, but it is being pursued with renewed vigor. The crux of the issue from AMLO's perspective is that this is really not a Mexican issue—it is a U.S. issue. The drug cartels are not selling the drugs to people in Mexico. They make their billions by selling to the U.S. As long as there is an immense market for the drugs, there will be suppliers. The U.S. seems insatiable when it comes to an appetite for these drugs. The demand is for the U.S. to engage with this issue directly—everything from stepped-up law enforcement to increased attention on breaking the drug habit of millions of Americans. This has become intertwined with the border issue in the U.S.

The assertion by Mexico is that the U.S. becomes preoccupied with keeping Mexican laborers and workers out of the U.S. and fails to focus on the criminals. The Mexican government wants a priority placed on drug gangs rather than the economic migrants. That has to be addressed through means other than the construction of fences and walls. Theoretically, the drug cartels and terrorists are supposed to be the priority for the Border Patrol as well, but that is hard to accomplish when the bulk of the activity is focused on halting migration by workers and others not involved in drugs.

Japan Affected by China Slowdown

There are several reasons the Chinese economy has slowed in the past year. The trade war with the U.S. is not the only factor, but it is a major one. Part of the issue has been the attempt by China to shift towards a more consumer-centric economy less dependent on its export community, but the fact that much of the access to the U.S. economy has been cut off has had an impact. The slowdown in China has affected many other nations in the Asia-Pacific as China once imported a great deal from them in order to meet demand for China's own exporters. The Japanese have been among the hardest hit.

Analysis: Exports from Japan fell by 8.4% in the last month, the most significant dip in two years. Other nations that have felt the loss of the Chinese market include South Korea, Taiwan and Australia. Even rival states like India and Vietnam have been affected by the China slowdown. This is one key reason these states have been far less enthusiastic about the U.S. trade war on China. They would like China to play by the rules, but they don't want to see them shunned in the process.

Endless Spending

Once upon a time, there were at least a few political leaders that seemed to understand that there is a limit to how much spending a nation can engage in without making drastic changes to everything from tax policy to budgeting. It seems these voices have been stilled, or at least are no longer being listened to. There are dozens of spending efforts planned and underway right now and dozens more on the horizon. The source of all that money is the same—debt. The once frugal Republicans now talk of spending $500 billion on a border wall as if it were petty cash and add billions more for a space war program and a huge variety of other pet projects. The Democrats propose massive expansion of Medicare to the entire population and now have the "Green New Deal" which is estimated to cost $200 billion a year for over 10 years. These are on top of all the other programs the government currently runs. This is to be accomplished without a tax hike. Granted, the Democrats have a wealth tax in mind to fund some of their programs. Many nations have tried a similar tactic; however, they have learned that the wealthy can be very good at keeping their money in places the government can't touch, so it is unsure exactly what might be obtained in additional revenue. When asked how the Green New Deal would be financed, the advocates stated directly that it would be from issuing bonds through the Federal Reserve.

Analysis: It is very unlikely that any Fed would engage in an effort this large through the purchase of federally issued bonds. This is obviously something the Fed has done many times in the past—most recently as part of the effort to get out of the recession and to keep the banking system intact. The Fed bought $4 trillion of Treasury bonds and nearly $3 trillion in mortgage-backed securities to get them off the bank's books. The crucial difference between what the Fed is being asked to do with the Green bonds and what they have done in the past is intent. The mission of the Fed is to manage the monetary policy of the U.S. That means trying to control the eruption of economic threats from recession and inflation. The moves made in reaction to the recession were intended to bolster the ability of the economy to bounce back. The mission of the Fed is not to enable the government to borrow for some project or purpose that Congress is unwilling to raise or allocate money toward. If the U.S. wants a Green New Deal, it should spend the money it has or raise more through taxation, not expect the Fed to weaken its ability to manage monetary policy.

The critical issue for the Fed is inflation. If the Fed were to agree to buy that $2 trillion worth of Green bonds it would mean that there would be $2 trillion less spent on Treasuries—regardless of the needs of the economy at any given time. If the Fed was buying these bonds in a depressed economy, interest rates would already be near zero. Practically speaking, the Green bonds could be sold to private investors rather than to the Fed. If, as is more likely, the Fed buys these bonds at a more normal time, the Fed will be paying interest on the reserves that it is issuing to banks. That erodes any profit made from the bonds. The ability of the Fed to control inflation with interest rates is compromised in the process.

Advocates for the plan assert that inflation concerns are overblown. They state that current economic reality proves their point. The standard assumption has been that deficits and debt trigger inflation pressures as the economy essentially grows too fast to sustain itself. This is the assumption of the Philips curve—stating that very low unemployment creates wage inflation. Of late, that connection has been weakened, but it would be foolish to assume that there has been a complete change in this pattern. As a matter of fact, the situation is reverting to normal as we speak. The wage hikes did not take place as early as predicted as the new hires have not been paid as much as had been assumed. Many of the new jobs were low-paid jobs. Companies also hired a lot of people that needed extensive training before they would be productive. There is now evidence that those hired a couple of years ago are now competing for higher wages. They are ripe targets for being poached by other companies. Thus, they are getting higher wages one way or the other. Either they get better wages by jumping to another employer or their current employer pays them more to stay.

The bottom line is that inflation has not magically ended in the last few years. It can and will be triggered, and by the same factors that always do so. Assuming that immense deficits and debt burdens can always be handled with no difficulty is foolish in the extreme. Whatever the merits of a Green New Deal may be, the proposed means by which to finance it is destructive and will simply not be tolerated by the Fed.

Why Such Distrust? Part Deux

My rant the other day was on the lack of respect offered those with expertise and knowledge. As fate would have it, there was a similar discussion on the radio. The subject was the distrust people have for the media. There was an assertion that the news is no longer the news as it has become loaded with opinion masquerading as news. The points made by the panelists were very good ones, I thought.

It came down to three issues. The first is that too many in the media have indeed crossed the line between reporting the news and offering an opinion without making it clear that this is what they are doing. There has always been tension over the fact that news is as much business as anything else—papers need readers and TV needs watchers. That means pandering to some degree or other. The second issue is that "new" media outlets have proliferated and are the furthest thing from "news" that one can get. The social media-driven nonsense competes with the traditional outlets. They have no qualms whatsoever when it comes to passing off opinion and outright fabrication as news.

The one important point made above all else was that consumers have to stop being so gullible and malleable. I am reminded of the poster that simply states, "Ignorance is a choice" There is nothing wrong with being ignorant, as we all are. We cannot possibly know everything about everything, but it is our choice as to what we are ignorant of. We can fix this at any time. I do not know how to fix a car or get my laptop to stop doing weird things. I know nothing of cricket and don't have a real grasp on the skills needed to fix plumbing, but I am confident I could learn. In the meantime, I keep my mouth shut and offer no opinions whatsoever. I choose to be ignorant of those things so that I can concentrate on the things I want to know about. Would that others had the same motivation.

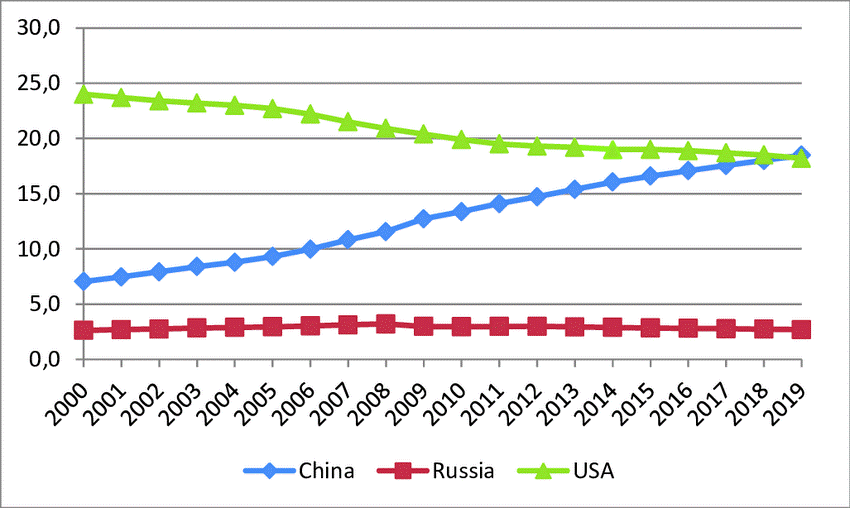

Global Economy Percentages

There has been a good bit of hand wringing as regards the Chinese slowdown. Of course, there has been a good bit of celebration among those that have resented the rise of China and the way that they do business. The recent issues have not really blunted the rise of China among the ranks of the world economies. In 2019, the Chinese and the U.S. will have roughly equal shares of the global economy (just shy of 20% each). The important point is that the U.S. once accounted for almost 25% when the Chinese held a little over 7%. The isolationism that has been in place with Trump has been accelerating the decline of the U.S. share and has done little to blunt China.