By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Slight Hike in Consumer Inflation

The latest consumer price index has been released. It showed a 0.1% increase in consumer inflation. This is attributed to rising costs in sectors such as health care, food and housing. Even in these sectors, there was considerable variety. The rise in rents was a bigger factor than an increase in housing costs and the rise in food was more pronounced in the restaurant sector than at the grocery store. The part of the inflation data that was somewhat surprising is there was no pressure from the factors that used to drive these costs upward. The price of fuel has fallen as global demand has weakened. The costs of many consumer goods have either fallen or remained stable despite the fact that tariffs have added to the cost of imports in many cases.

Good Year to Have a Sweetheart

Last year, the U.S. consumer set a record as far as spending on Valentine's Day. The average spend was $161.96. This year the romantics among us are likely to break that record with some gusto. The estimate is that the average spend will be $196.31. That is a 21% increase. Some of this added spend is attributed to the higher costs of a restaurant meal, while the price of such staples as flowers, chocolate and greeting cards has remained stable. The difference this year seems to be there are more creative gifts factoring in. The fastest-growing romantic gesture appears to be a spa day or some other pampering. As with many other holidays, there has been more use of gift cards, but these come with a warning—they are not exactly the most intimate and thoughtful of gifts.

Death of the Newspaper

The newspaper, as we all know, has been in critical condition for years. Now, it has started to look like the entire industry is in hospice care. In a rare move, Berkshire Hathaway is selling off all of the 100 papers it owns. Charlie Munger has declared the entire industry dead. The predictions are dire as it is now assumed that virtually every local paper will be gone within the next few years. The fact is revenue has been destroyed as advertisers move away, but expenses remain high. The big national papers will survive, but the local news organizations are set to vanish; not good news at all.

Short Items of Interest—Global Economy

Oil Demand Shrinking Fast

For the first time in decades, the global demand for oil is set to shrink this year, and for a variety of reasons. The latest blow is the coronavirus as it has slowed the Chinese economy substantially. China has been responsible for the majority of global oil demand over the last few years. It may see a decline in growth of more than a percentage point, which will profoundly impact prices. Beyond the global price impact, there is the fact that China buys much of the Iranian output. If Iran loses that market, it will be in real economic crisis very quickly. It can't sell much to the rest of the world even if there was more demand as the U.S. sanctions make that activity very difficult.

Poland on the Way Out of the EU?

There is a showdown developing between Poland and the EU as the Law and Justice Party continues to dismantle all the democratic institutions the country developed after the fall of communism. The latest target has been the justice sector as laws have been passed that prohibit judges from criticizing the government. The Supreme Court has been emasculated and the lower courts have been packed with supporters of the ruling party. The business community is now shunning Poland as they do not believe the courts will protect them. The EU is demanding the attacks stop. Jarosław Kaczynski, head of the Party, is defying them.

China Reports Surge in Coronavirus Cases

It is not clear at this point whether there has been a real surge in the number of cases or if the issue is that local officials refused to release accurate numbers. Given that many of those local officials have just been sacked, the sense is it is the latter problem—people trying to dodge responsibility and accountability.

This Month's Report from the Front

As is our custom, we present excerpts of the report we do for a pair of manufacturing organizations. The Chemical Coaters Association International and the Industrial Heating Equipment Association are both made up of companies engaged with a wide variety of manufacturers—anybody who needs to treat metal with either chemicals or heat. They are especially engaged with the automotive sector as well as energy, construction, aerospace and agriculture. What follows is the executive summary and some of the sector breakdowns.

Analysis: The U.S. economy has started the year in better shape than expected. Now, the attention of the economist has been focused on two questions. The first is why the headwinds that were expected to slow things down haven't and the second is how long this situation can be expected to last. It is not as if the threats somehow vanished. To review, the threat at the start of the year was that consumers would start to run out of gas, business would start to engage in layoffs and the impact of the trade fights would be felt. The last few weeks of 2019 showed some weakness as far as consumer activity and it looked like the global slowdown was catching up. Then, some of the pressure was released with the "phase one" deal with China and the consumer just seemed to power through their concerns. The threats are still there, however, and they have been added to of late with the coronavirus situation. This illness is expected to take as much as a point off China's growth. That affects a lot of nations that do business with the U.S.

In looking at the index readings this month, the news is pretty good. Of the 12, there are seven trending positive and five pointing in a more negative direction. The more important note is the good news readings are very strong and the negative readings are not so dramatic. The seven positives start with a dramatic rebound in new housing starts. The expectation was mortgage rates would be climbing and demand would be down, but the opposite has occurred. The housing sector is as strong as it has been in some time. There was also some significant gain in terms of steel consumption despite the lack of attention to public sector infrastructure. The automotive sector and the energy sector have helped boost demand. There was a very impressive rebound in the Purchasing Managers' Index (PMI). The overall index jumped back into expansion territory (over 50) with a reading of 50.9, but an even bigger leap was noted in the New Orders index as it went from 46.8 to 52. Given the future orientation of the new orders data, this is good news indeed. The jump in capital spending was equally impressive as it seems that business has been trying to make up for lost time in terms of new acquisitions. There is also some sense that companies are buying now in anticipation of harder times to come. There were nice gains in terms of durable goods and factory goods as well. The gains in the durable category were the most impressive and seemed to be led by sectors such as health care, energy and, to some degree, automotive. Factory activity has not yet kicked into high gear, but is currently affected by the trade wars as well as China's health issues. The data from the Credit Managers' Index followed the same pattern as the PMI with a nice gain this month—especially among the nonfavorable factors. That signals that some of the troubled companies are either gone entirely or have started to reverse their decline.

Of course, not everything is coming up roses this month, but the negative readings have not been too depressing. There was a slight reduction in terms of new automobile/light truck sales, but for the most part, these readings have been stable for the last several months and are expected to stay in that range as long as the consumer stays confident. Banks are getting a little pickier about car loans, but are still active. The prices for metal commodities have been falling as demand has slackened. This is likely to continue to be the case through the remainder of the year. The rate of capacity utilization has not deteriorated much. It had been starting to improve and has now reversed course again and is slipping. There was not really a decline as far as appliance activity is concerned—it has been more of a rebalancing of demand and supply. The transportation index is more of a concern as it is often a harbinger of things to come. The slip has been mostly in the rail and maritime sectors thus far as both have been affected by the trade wars and other interruptions in the global economy. The bottom line is the bad news data has not been all that serious. Most are likely to see some improvement in the future if the good news data keeps coming in.

The news this month is better than expected—it's both good and bad. The better performance is certainly welcome, but there is a sense of waiting for the other shoe to drop. The problems that worried people about the start of 2020 are still present. The question is when will they manifest—not if.

New Automobile/Light Truck Sales

It is nearly impossible to overstate the importance of the automotive sector to the overall manufacturing community in the U.S. There are literally thousands of companies producing parts for assembly by the myriad of automakers in the U.S. Millions of people are employed by these companies. Add in the other tens of millions that are indirectly employed in selling, advertising, servicing, financing, insuring, fueling and even washing these cars and you have the life blood of the economy itself. All of this is ultimately driven by the consumer's desire for a vehicle. For the last year, that demand has been fairly consistent, although there was a slight dip this last month. The crucial factors influencing demand have been fairly consistent as well—the rate of unemployment, inflation, interest rates on car loans, the price of fuel and overall consumer confidence. There has been no signal suggesting that demand is likely to dip dramatically, but nothing to provoke additional demand either. The boom in electric vehicle sales has been blunted by the decline in the price of gas. There is little to suggest, however, that these prices will be rising in the near future.

New Home Starts

It was only a few months ago that most were predicting a drop in demand for new housing as there were expectations that mortgage rates were going to rise along with the price of homes. It was also assumed consumers would be getting more cautious and worried about unemployment and inflation. So much for expectations. The mortgage rates fell and so did the rate of unemployment, while consumer confidence continued to rise. All of that seems to have offset any trepidation regarding the rise in the price of homes. Earlier in the year, the more expensive homes were the only ones that were selling, but now there has been movement in the starter home category as well as in the intermediate range. One of the new developments has been the willingness on the part of the millennial to buy single-family homes. Those in their 30s are now getting around to starting families. That propels them out of the multi-family category. There has been a surge in availability of existing homes as well, but that has not stopped people from buying the new homes.

Steel Consumption

The level of steel consumption had been slumping for much of the last several months—it reached a peak in March of last year and has been dropping since. The latest numbers do not take consumption back to that peak period, but they are better than they have been. The demand for steel has been more or less steady, but it has not been at a point that drives the sector. That has been a big factor in the reduced price of steel despite the tariffs that were supposed to boost the domestic steel sector. The two biggest markets for steel are construction and the assembly of vehicles. The vehicle sector has been expanding. With that, has come demand for steel, but the construction sector is the biggest user and it has not been growing at the pace needed. The bulk of steel use is in the public sector. That has been stunted by the lack of infrastructure spend. This situation is more than a little baffling as it was always the case that politicians could agree on this kind of spending. Despite all the hand wringing regarding the need to address the crumbling U.S. infrastructure, there has been very little money allocated. The latest budget from the White House has additional funds for the military, veterans and the border wall, but almost nothing for roads, bridges, seaports, airports or any other kind of infrastructure project. If there is genuine interest in assisting the steel industry, it would be far more useful to expand infrastructure build rather than focusing on the tariff game.

Industrial Capacity Utilization

The utilization numbers have been fairly stable as they have been drifting just under the rate usually considered "normal." The latest data has the rate falling again after a brief rise, but there has been no precipitous decline as there was on the eve of the recession a decade ago. The assertion that normal is a rate between 80% and 85% is based on the behavior exhibited in the manufacturing sector as a whole. When there is utilization under 80% there is slack capacity. In these conditions, there is little incentive to add more machinery or hire more people. When the utilization numbers are over 85%, there will start to be issues around meeting demand. This is when there is an incentive to add capacity—buy new machines and hire new people. The latest GDP numbers for the fourth quarter of last year were better than had been expected, but the weakness was still there in terms of business investment. The growth was all coming from the consumer. That will be the case until there is a need to boost capacity.

PMI New Orders

The PMI data has turned a corner, or at least we hope that is the case. After five consecutive months of decline and readings in the contraction zone, the index has turned around with a reading back in the expansion zone. This is not a huge leap as far as the overall PMI was concerned as it is now resting at 50.9, but the important thing is that it has returned to positive territory. The same pattern has been revealed with the new orders index as it is now at 52 after a reading of 46.8 in January. This marks the first time the index has been in the expansion zone since August of last year. The new orders data is important as it is the most predictive of the ISM sub-indices. The sense is that some of the drags on manufacturing have been eliminated, or at least subdued. The tariff and trade war between the U.S. and China seems to have entered a truce phase, but the coronavirus is hampering Chinese production far more than the trade war has. The Trump threats have now shifted toward Europe, but nobody has started the battle in earnest, while the Boeing mess remains a big drag on aerospace.

Durable Goods Shipments

Given all the positive activity noted in everything from the PMI to capital spending to commodity pricing, it would have been unexpected to see little reaction in terms of durable goods activity. The recovery was impressive. That bodes well for the manufacturing sector as a whole. The gains were most apparent in technology sectors and in the energy and health care fields, but still weak in the aerospace and agriculture communities. The consumer has been driving demand with their appliance purchases as well as their interest in new vehicles. There has also been some additional activity in terms of defense goods and in construction-related goods. Business investment is still running slower than in previous years, but it has been showing more signs of recovery

Maybe There Is No Longer a Middle

I labor under a host of misapprehensions and assumptions based on how I view the world. This inevitably means that I fail to understand much of the world around me. I try but I am a product of my age, my Midwest origins, my education and other character-forming events and people. Usually, these are relatively minor issues—I don't get much of the music listened to these days, don't like man buns, have no desire to wear a tattoo and so on. One area where my failure to keep pace matters more is politics. I have always assumed most people occupied the middle of the political spectrum—not quite liberal and not quite conservative. The middle was full of the pragmatists and realists (as I would define it). I assumed that voters en masse would drift to the center at some point. I no longer assume this to be the case.

It seems to me that there is a massive divide now. It's one that leaves little room for compromise and no room for the middle. People I thought I knew as essentially centrist reveal themselves as passionately pro-Trump or passionately pro-Bernie Sanders. They utterly reject anyone who would question anything either man says. I find fewer and fewer people who can exhibit tolerance of any kind. People I meet for the first time put me through what amounts to an inquisition so as to place me in a category. Two individuals were in a heated argument—one was wearing his Maga (Make America Great Again) hat proudly and the other his "Feel the Bern" T-shirt. They decided to drag me into it. I guess I should take some pride in the fact that I managed to create unity between them. By not siding completely with either of them, I managed to get both of them to curse at me and condemn me as a traitor.

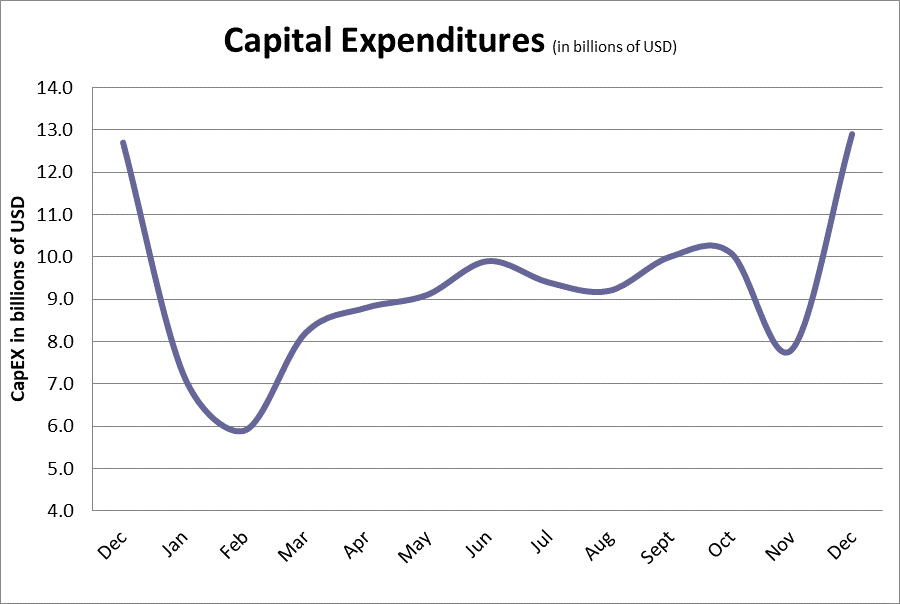

Capital Expenditures

There has been a very dramatic improvement as far as capital expenditures are concerned. This has taken place right after a rather pronounced slump. The factors that led to this jump are somewhat expected, but few anticipated the extent of these gains. The two biggest factors include an improved lending and credit environment and a better than expected start to the year's economy. The banks and other issuers of credit are not worried at all about inflation. That differs from their attitude of just a few months ago. All the indicators suggest a very low inflation environment for the coming year, which reduces inhibitions when it comes to lending. The other positive development is the performance of the economy. There are certainly pockets of strain, however. The manufacturing sector as a whole is in a recession, but generally speaking, the economy is on solid footing with predictions of growth at around 2%. This is enough to warrant some investment in everything from machinery and technology to expansion of markets and even hiring. There is also that element of uncertainty regarding the election. Some are hedging their bets in case there are dramatic changes in economic policy.