Strategic Global Intelligence Brief for February 13, 2019

Short Items of Interest—U.S. Economy

Over a Million Job Openings

It has been a very long time since there was such a distinct surplus of jobs in the U.S. economy—7.34 million of them. If every single person who is unemployed were to take a job, there would still be a million jobs unfilled. There are many reasons these jobs are going unfilled and addressing the issue is complex. Roughly two-thirds of these jobs demand a set of skills that the current pool of unemployed lack. Of the remaining third, the issue may be that they are in areas where there are few unemployed or the people seeking work can't get to the place that offers that job. Then there are the jobs that anyone could take, but within the pool of unemployed are those who simply refuse to work. They are content with whatever public assistance they are entitled to. The one sector hardest to measure is that of the grey economy worker—the ones who are paid off the books.

More Consumer Confidence Surveys Sag

In the last few months, there have been declines in several of the national and regional consumer confidence surveys. The ones put out by the University of Michigan and the Conference Board have both been down for the last three months. There have also been regional surveys that cover the southern states, New England, the West and the Southwest. All are indicating consumers are far more concerned about the future of the economy than was the case at the end of last year. The factors that seem to have had the most impact on that confidence include the government shutdown, trade wars and the mercurial stock market.

What Happened to Those Expected Rate Hikes?

Only a few weeks ago, it was deemed appropriate for the majority of the world's central banks to start the process of raising rates. It seemed logical enough given that real signs of inflation were showing up and there was growth in many of the world's largest markets. How quickly moods can change. None of those major banks are talking about rate hikes now—not even the Fed. The concerns now include slowing global growth, the impact of Brexit, the uncertainty regarding the U.S. government's ability to function and the ongoing trade deal crisis. Now, even the International Monetary Fund (IMF) is calling for the central banks, and especially the Fed, to halt the process of hiking rates for the time being.

Short Items of Interest—Global Economy

Guaido Issues Order

As the stand-off continues in Venezuela, the opposition leader, Juan Guaido, is trying to exert very real pressure on Maduro and get at least some of the military to break from the old regime. He has ordered the military not to interfere with the delivery of aid to the desperate people of the country, while Maduro has ordered them to halt the shipments. The soldiers are being told by Maduro to ignore the fact that fellow citizens are starving and to attack these desperate people. Guaido is asking them not to attack their own countrymen. That may be enough to break the military's unity. Such a break would end Maduro.

Will Malpass Succeed?

Trump's choice to head the World Bank is really more Larry Kudlow's choice as the current White House economist has been behind many of the positions that David Malpass has held—including that of chief economist at Bear Stearns prior to the debacle that led to the collapse of that firm. Malpass badly misjudged the impact of the mortgage crisis, but he was hardly alone. He is seen as a supply side economist who favors more private sector efforts on global development.

British Options

One of the key spokesmen for PM Theresa May has let it slip that the British Parliament will essentially be handed a choice of two things it would rather not see. The choice will be to agree to the current deal that May worked out with the EU or face an extension of the Rule 50 process—a very long and drawn out extension that essentially keeps the U.K. in the EU, but with maximum uncertainty.

Uneven Economic Expansion

In most every respect, some uneven economic performance is inevitable. It is not realistic to assume that every segment of a given economy will be performing at the same level—regardless of what efforts are made to assist or influence. This is a $20 trillion economy—larger than the next four-largest economies in the world combined (China, Germany, Japan and the U.K.). The U.S. is even bigger than the entire eurozone (19 countries including Germany and the U.K.). At any given time, there will be parts of the U.S. that will be growing and prospering and parts that will not. The real question is whether any of this can be affected, ameliorated by policy decisions made by the likes of the Federal Reserve, Congress, the executive or any of the myriad of state and local governmental entities.

Analysis: The message presented by Fed Chair Jerome Powell at a speech in Mississippi was similar to the speeches that have been made by many others. It acknowledged that the robust economy the U.S. has sported for the last few years has not been experienced in the same way by everybody. The growth in cities that are on the cutting-edge of technology has not been matched in rural areas that have been hit by everything from bad weather to slumping commodity prices and now steep tariffs as the U.S. and China engage in their tit-for-tat trade war. The surging growth in the suburbs doesn't help struggling inner cities. Industries that are on the ascent—such as health care and those based in technology—are not doing much for the regions dependent on declining industries. Factories in the "Rust Belt" falter as factories in the Southeast and Southwest thrive. The examples are plentiful. What can be done about this?

Very broadly speaking, there are two schools of thought on how to deal with this issue. The first essentially places the burden on the people and companies that have been negatively affected. If the industry that one is in has been in decline, it is the responsibility of the affected people and businesses to relocate to where there are better opportunities. This has been a common reaction in the U.S. for decades and has been responsible for the great migrations to the West and Southwest. There is also no escaping the fact that making this adjustment is wrenching and not always possible. People don't have the resources to pick up and move, they can't leave elderly relatives behind, they don't qualify for the new opportunities and so on. Even those who can afford the move will take a huge financial and emotional hit.

The other alternative is to find a way to bring prosperity back to a region. This may involve finding an alternative for economic development as Pittsburgh did when it transitioned from its steel town origins to a regional health center. This is far easier said than done however. It usually takes copious amounts of government investment, concentrated private sector support and a population willing to make dramatic changes in their way of life. Even as the community prospers, there will be many who do not fit into the new system and will be left behind.

The bottom line is there are no easy solutions to uneven economic growth. Every scheme will have strengths and weaknesses; there will be winners and losers. As individuals and business people, the onus is on us to think ahead and have contingency plans. Not that this is very easy, but it means staying current and educated so new techniques and technologies can be adapted to and used. It means knowing when to shut down an operation and move, or shifting the product mix.

One tactic that never works but is tried over and over again is to somehow stop the advance of the global economy. It is some form of isolation or protectionism. Prohibit the development of new products or techniques so that the old systems can remain intact. Keep products from other countries from competing. The consumer loses out, but so does the protected business at some point. They can no longer sell to other populations because their product is antiquated and obsolete. Profits and revenue decline and they hire fewer people and pay those they have less. With less money and fewer consumers, they eventually fall into financial ruin anyway—but have taken the whole economy with them.

What Will Trump Do?

It is certainly not unusual for the world to be waiting with bated breath to see what the president of the United States does or doesn't do. The U.S. has had periods of waxing influence and waning influence, but there has never been a time when the actions (or inactions) of the U.S. have not been important and serve as a prelude for what other nations do (or don't do). Right now, there are several major issues that await a decision by Trump. Very few people can pretend to know exactly how these decisions will go. There is no doubt Trump has been unpredictable as his decisions can shift radically from one day to the next. Sometimes these changes have been due to the advice he has been given and other times it seems to be a matter of keeping his base loyal. Still other times, it seems that changes are just because he wants to change for personal reasons. Four major decisions are to be made in the next few weeks. There will be far reaching consequences no matter how he ultimately decides.

Analysis: Perhaps the most immediate is whether he will support the compromise on border security that was agreed to by the bi-partisan group from Congress assigned to work something out within three weeks. They did and they agreed that it was bi-partisan. Details are still a little sketchy at this point, but it clearly does not include anything close to $500 billion for a wall, although there is over a billion for "barriers and fences." Other aspects of the agreement deal with more electronic surveillance and manpower (the two things the Border Patrol has been asking for all along). If the deal is signed by Trump, there will be no government shutdown, but he has not yet indicated what he will decide. This will affect the U.S., but it also has a profound impact on Mexico and the U.S. relationship with their new president.

Decision number two is whether there will be further interaction with North Korea. President Trump has suggested that another summit be held, but the Kim regime has not lived up to a single one of the promises made at the first such meeting. Trump advisors are asking him to demand more from Kim before granting this special privilege as the North Korean despot has certainly not earned a speck of trust based on his actions.

Decision number three is whether to continue trade talks with China and holding off on expanding the third round of tariffs. Thus far, the tariffs imposed on China have involved technology and manufactured goods as well as some specific farm-related products. The third round starts to affect the consumer goods the U.S. traditionally imports from China. If these are hit with 25% tariffs, the U.S. consumer will feel it, and quickly. The last word was that Trump was inclined to keep talking and meeting and may be willing to push those additional tariffs off another month or two. The U.S. is now feeling the impact of that trade war in a negative way. That will show up in higher inflation numbers.

Decision number four concerns the U.S. engagement in Syria, Iraq and Afghanistan. An announcement was made just weeks ago that U.S. troops would leave Syria and many would also leave both Afghanistan and Iraq. His advisors immediately warned against the move and his Defense Secretary resigned over the issue. The withdrawal was delayed, but there has not yet been a reversal of Trump's position. Many advisors are pushing hard for that reversal.

These are just some of the major issues facing the White House. There is the matter of what to do with Venezuela and whether to impose more sanctions on Russia. There are domestic issues surrounding the debt and deficit as well as the chronic issues of labor shortage and poorly maintained national infrastructure.

Saudi Arabia on Defensive and Offensive

It is hard to believe how quickly Saudi Crown Prince Mohammad bin Salman has fallen. He has gone from being the leading voice for Saudi and Arab reform to being perceived as an arrogant and bloodthirsty tyrant. The catalyst for that fall from the pedestal was the murder of Jamal Khashoggi, but cracks in the façade had appeared earlier. The Saudi government gives money to different governments, but always with lots of strings. It has tested the friendship of allies like the U.S. by aggressively trying to hike oil prices. The issue that dragged the kingdom down most recently was the proxy war in Yemen, which has only intensified.

Analysis: The plan seems to be based on lavishing money on any nation that can be lined up to support the kingdom and the crown prince specifically. The Saudi oil company is buying capacity all over the world at high prices. It promises to buy from the U.S. too.

Missing the Point

The surge in interest in various "soak the rich" plans is understandable given the increased concentration of wealth in the U.S., but there are many statistical games that can and will be played with that data. It is pointed out that 1% of the U.S. population holds around 37% of the privately held wealth. This means that 3.2 million people hold that 37%. That is certainly a smaller number than the total population of 325 million, but it is not an insignificant number. The real issue is that with wealth comes options and mobility that others do not have.

Analysis: The vast majority of the wealthiest 1% do not get that wealth from income per se. Increasing taxes on income will have very little impact on the wealthy as they make their money from investments of varying kinds—stocks, bonds, real estate, businesses, art and many other stores of value. This kind of wealth is very easy to shift around and it is highly portable. If you are dependent on the income you earn, you are dependent on a job of some kind and are limited to where you can live. Investment income follows you where you go. If you elect to move somewhere, your wealth is taxed less—it is an easy solution. Just ask the states that have tried to tax their wealthy only to see them relocate to Texas or some other low-tax jurisdiction.

Many other nations have sought to get more from the wealthy and have found that taxing what they buy is generally the only reliable option. The expensive car, wristwatch, boat or home is more a symbol of wealth than a necessity. People will make these purchases regardless of the extra luxury tax—they will complain, but they still buy and pay the taxes.

The Life and Times of Seamus

As alert readers know, we acquired a new kitten a few weeks ago. We lost Miss Snip last Fall. I had wanted to bring our crowd back to the feline five, but my wife needed some time to mourn her cat. Seamus was a kitten with a face that would melt the hardest heart and we swooned. He was described as a very shy little boy—part of a feral litter that had been put in a foster home. We were grilled by his foster mom to make certain we were the appropriate home for him. We passed muster and brought him home.

Shy? Can't imagine where that came from. He immediately tried to attach himself to the elder statesman (19-year-old Sven), but soon he had the dominant male wrapped around his paw. Smoky is especially enamored of the babies. Now he and Seamus can be found snuggling all the time. The biggest revelation was yet to come. Scoot is Daddy's cat and has never interacted much with the other cats. She is not a cat at all—at least not in her mind. She doesn't play with them, rarely shares space with them and mostly tosses a hiss or growl at them as they pass. Until Seamus! Suddenly, we are seeing Scoot wrestling and playing with him all afternoon. No hissing, no growling. Not even when Seamus decides to sit in my lap. Any other interloper would have been driven from that prized location, but she just watches him and lays on my feet instead.

Seamus is not just a cat's cat—he sleeps next to me one night and my wife the next. He perches next to my desk when I am working. Scoot never allowed the others to do that. He is one that purrs the second you touch him and sleeps so soundly he rolls off chairs and couches. Amazing what having a baby in the house does to everyone's routine.

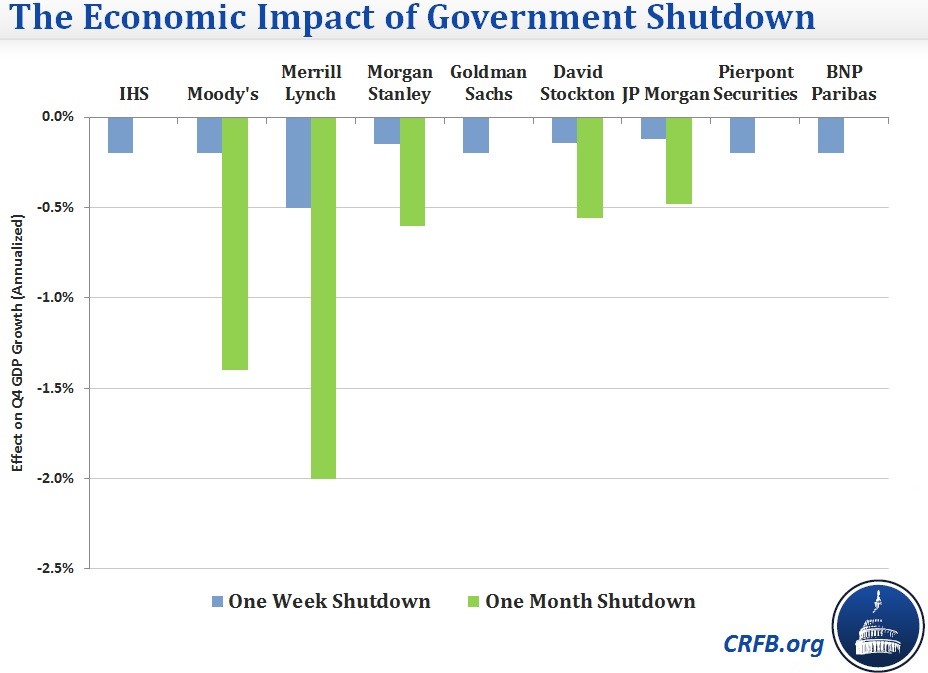

Impact of Shutdown

There has been a lot of variability as far as the impact of the government shutdown on the U.S. economy, but there is consensus that there was and will be an impact. The most aggressive assessment came from Merrill Lynch which predicted a full point of GDP decline. Most of the others assume a half-point decline. These are losses in the hundreds of millions at a time when the economy is showing some signs of weakness already.