Short Items of Interest—U.S. Economy

Arrival of Late Reports

This may have been the most colossal and serious impact of the government shutdown—at least as far as I was concerned. The many agencies that produce the reams of economic data used to assess the state of the economy were not grinding out this information for over a month. Now there will be some urgency in terms of getting that data out there. The retail numbers will be out this week; they are a month late. It is expected they fell a bit as consumer confidence has been down for three months, but the crucial question is by how much. The consumer drives the U.S. GDP and if there has been a real retreat, this will have implications for the remainder of the year. There will also be data on the rate of inflation. Again, most expect it to rise even as the price of oil has been dropping a little. The question is by how much and in what specific areas.

Economic Slowdown Anticipated

There has been a lot of hand wringing as regards the slowing of the economy. This has produced a lot of conjecture as to the likelihood of another recession. This chain of events has not been accepted by many—including several of the regional Fed chairs. The most recent statement to that effect has come from San Francisco Fed President Mary Daly. The gist of the argument is that the slowdown was inevitable as the U.S. economy can't really sustain growth over 3% for long without triggering a host of issues such as inflation, investment bubbles and the like. It the opinion of many that the U.S. is just drifting back to a normal state of growth between 2% and 2.5%. This has been the 20-year average.

Is There a Middle?

The race for the 2020 White House is still in its formative stage, but it is already a cause for despair among those who would count themselves as moderates or middle-of-the-road voters. The Republicans will stand behind the populist right that has constituted the Trump base, while it looks like the Democrats will swing to the far left as a counter to them. What remains interesting and somewhat baffling is that polls suggest the vast majority of Americans are in the middle with more liberal beliefs on social issues than the Trump base and more conservative views on economic issues than the progressive left of Elizabeth Warren (D-MA), Kamala Harris(D-CA) and Bernie Sanders (D-VT).

Short Items of Interest—Global Economy

U.K. Growth Is Tanking Badly

Ever since the issue of British withdrawal from the European Union was broached, there have been warnings that this move would have an adverse impact on the British economy, but there had been persistent hope that cooler heads would prevail and a deal would be struck. Over the past year, it has become more and more obvious that there will be a very bitter split, and the U.K. economy has been feeling it. The growth of the economy is now slower than it has been since 2004 and still tumbling as business has been forced to decide where it will focus—Europe or the U.K. Many are choosing Europe.

The Race Is On

The head of the European Central Bank—Mario Draghi—retires this year. The race to find a replacement is on. These are intensely critical times as the eurozone economy has been retreating due to a variety of factors ranging from the slowdown in China to Brexit to the protectionist mood in the U.S. The people that appear to be on the short list are very different from one another—critics of Draghi's policies like Germany's Jens Weidmann to close allies of Draghi's such as France's Benoît Coeuré. There are also at least five other names that have been thrown into contention.

China's Birth Rate Issue

China may be the most populous nation on the planet, but it is also one of the oldest. This has many in the government worried. The country already suffers from a lack of skills in critical areas. There is a real possibility that more will be retired than are working in the next decade.

IMF Supports Current Central Bank Mentality

There are always institutions and individuals who will weigh in on the decisions made by central banks like the Fed. These are not meant to be political pressure but only the "advice" of interested parties. The International Monetary Fund (IMF) has been sounding the warning about the state of the global economy and has been consistently downgrading the performance of the world economy as it is noted that Europe and China are struggling. The conclusion is that the U.S. Fed is correct in its assumption that no further rate hikes will be in order for the first half of the year.

Analysis: The Fed has not reversed its position, but is maintaining a cautious approach with its statements suggesting the economy looks a bit more fragile than it did a few months ago. There remains a strong desire to head off any inflation threat, but it is not seen as urgent.

The Attack of the 'Isms'

It is already easy to identify a theme for the political campaigns of the next two years. The perpetual electoral process will mean two solid years of positioning and arguing over a variety of themes as candidates seek out the issues that will motivate voters to support them or oppose their rivals. Economics becomes one of those issues to fight over. The accusations are flying with assertions that somebody is a raving socialist or another is a heartless capitalist. The fact is few of those seeking power are particularly connected to any of these ideologies and rather use them as some kind of shorthand to vilify their opponent or extol their own virtues.

Analysis: According to that well-known font of all wisdom—Wikipedia—here is a formal definition of socialism. "Socialism is a range of economic and social systems characterized by social ownership and workers' self-management of the means of production as well as the political theories and movements associated with them. Social ownership can be public, collective or cooperative, or citizen ownership of equity." There are some parts of this definition to pay close attention to. The first is there are many types of socialism practiced in many nations. It can range from the approach of social democrats in many European states all the way to the despotic systems employed by North Korea or China or Russia. There is an enormous difference between a system where ownership is public (China for the most part) and a system where the public owns the equity. In truth, the stock market is a form of socialism as the public owns the stock of the company. Granted, the majority of that ownership is concentrated in the hands of a minority, but it remains true that ordinary stockholders possess a portion of that equity.

One of the most common misconceptions is that socialism is synonymous with welfare. There is nothing that mandates a socialist system to provide any of the welfare and assistance programs that people have developed over the years. The system places the power to direct the economic system in the hands of the workers to a significant degree. It can be assumed that workers will want different policies than would be favored by private owners. But in the many cases where workers actually run a company, it is common for many of these welfare offerings to be cut so employees can take home more of the revenue and profits. It is also very common for those who do not work to be excluded from the benefits of ownership. Many of those who are being accused of being socialist or self-identify as socialist are more accurately described as advocates for some variation of a welfare state.

Just as socialism is dimly understood, capitalism suffers from the same levels of ignorance. Again, with the help of Wikipedia we have this definition. "Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Characteristics central to capitalism include private property, capital accumulation, wage labor, voluntary exchange, a price system and competitive markets." The vast majority of people really have few objections to the existence of private property, the ability to accumulate capital or the ability to get paid for the work that is done. In the majority of cases, the critics of the current system have issues with the functioning of the systems of voluntary exchange, the price system and most common of all—the system of competition.

All three of these characteristics are rooted to a significant degree in fairness. The consumer should be able to count on competition to keep prices low, but if there are monopolies and oligopolies, there will likely be abuse. Lack of information allows collusion and that further erodes competition. Capitalism is designed to work in conjunction with government—not against it. A system that protects that voluntary exchange of services for remuneration, a fair and transparent pricing system and competition requires an authority that can crack down on those that would abuse the system. A regulatory system is required to control collusion and corruption and distortion of these private markets. Those who seem to oppose capitalism are really objecting to the fact that necessary boundaries and controls have not been implemented or are being ignored.

As people try to sift through the semantics of the next two years, it is important to keep perspective and avoid falling into semantic traps where we vilify people without understanding what they are really suggesting and espousing and to what purpose.

Latest Inflation Threat Looming

It has been noted that inflation is like being cut by a thousand knives. The impact of inflation is not as sudden and universal as a recession, but rather accumulates more slowly as more and more product categories see higher prices. The latest evidence of price creep is showing up in a wide variety of consumer and household goods. Some of the biggest companies that provide everything from toilet paper to kitty litter to laundry soap are hiking prices again—only a few months after they hiked them in 2018. The rationale is simple enough. They have seen their commodity prices rise and there has been a steady increase in labor cost as they have been required to pay new hires more while paying existing workers enough to keep them from being poached.

Analysis: The consumer is now starting to feel the impact, which will accelerate through the year. There have been substantial price hikes on most staples, restaurant meals, entertainment, travel and so on. Each item may only be going up by a few cents, but cumulatively, the budget soon gets strained and decisions have to be made. Some activities will be curtailed and the product mix will likely change. Thus far, there has not been a wage hike commensurate with the higher costs. When there is, it will be highly uneven. Some people will get a raise that allows them to keep pace but most will not.

State of the Economy

Most of the artificial moments for marking the progress of the economy suffer from the same challenge—they are arbitrary. The assessment of a given policy could well be extremely inaccurate as the impact may have been designed to manifest months or even years in the future. Each year, we get excited about the passing of the old calendar and the arrival of the new one. We make statements about what will be different when the passing of December to January really doesn't mean much. So it is with the State of the Union address. Some of that speech is directed at the economy, but most of it is just political positioning. This year was no exception and economists have been assessing the policy statements that were made. The overall conclusion was that the economy is currently earning an A-, but that several of Trump's policies are getting far lower grades than this.

Analysis: That A- grade is well deserved with the majority of indicators pointing in a very positive direction—everything from very low levels of unemployment to solid performance in the Purchasing Managers' Index to good reports on durable goods and factory goods. The stock market has surged all year despite its various periods of trepidation. Consumer confidence has been good, but has fallen back the last few months. The major concern has been that much of that growth seemed related to temporary boosts such as the tax cut and most of this growth was taking place before the global economy started to stutter.

The one area where Trump's policies get a very low ranking is trade. There is little doubt that nations like China fail to play by the rules of global trade. There are many nations that have sought ways to bring the Chinese into some semblance of compliance, but it is very hard to use tactics such as tariffs and trade wars without doing a lot of damage to the country that is imposing the restrictions. The U.S. has transitioned from being a champion of free trade to a nation committed to protectionism and it has been hurting the U.S. economy. There are manufacturers paying far more for steel (prices up by 40% on average), farmers unable to sell to China and other nations as they impose counter tariffs. It can be argued that these steps have damaged China's economy more than the U.S., but that is cold comfort for those in the U.S. that have been affected by the trade and tariff war. The problem is that this protectionism is not limited to China—it has affected relations with key trading partners such as Europe, Canada and Mexico. Of the 50+ economists polled, the consensus is that Trump gets a low grade for trade policy.

Fiscal policy is another area where the grade is not very good but, in all fairness, this has been a policy area that most of the politicians have been failing for years. The ideal situation calls for the government to spend less and not reduce taxes when economic times are booming. This allows the build-up of a surplus that can be used when times are not so good. The $1.5 trillion tax cut was ill-timed as it came after the economy had been growing at over 3% for several quarters. It boosted that already decent growth, but it was more of a sugar rush than anything else and the impact had faded by the end of 2018. The administration and Congress have both been complicit in this fiscal nonsense. This has set the economy up for hard times when and if there is another recession. The consensus grade has been D-.

The third area is monetary policy. This is generally a simple issue for the president as his powers here are limited to picking who sits on the Fed's Board of Governors. Trump has earned fairly high marks for the people he has appointed as they have been earning either A or B grades. He loses points, however, for his constant attempts to influence and threaten the Board of Governors. The usual role of the Fed is to maintain independence from either Congress or the president. That usually means far more subtle attempts to influence their assessments. Trump gets a C for this, although an A for the selections he has made thus far.

Mr. Rogers

I missed the Mr. Rogers era. I was a teenager by the time the show started so it was not something I saw for myself nor did I have kids that compelled me to watch. I was a Captain Kangaroo and Rocky and Bullwinkle kid (with a little Romper Room thrown in). I really remember the parodies more than the show, but over the weekend I watched the Mr. Rogers documentary and must admit it moved me to tears more than once.

The message was simple enough, but presented with complexity and nuance. The notion of being good, kind, generous and accepting is more important and more absent now than it has been in a while. I say that, but the documentary reminded me of the extremes and tumult of his times. The assassinations of 1968, the Vietnam War, overt racism on a grand scale, hatred of any group or person who differed from the norm, these and many more crisis situations existed. He quietly waged a constant battle to find the good and the decent within.

I have written about this more than once and will doubtless do so many more times in the future. I am baffled by hate. I simply do not understand those who hate a group of people for their skin color, their ethnic background, their sexual preference and so on. I certainly understand disliking people for specific reasons and motivations, but even these are not people I hate. I would like to think I can strive for a Mr. Rogers attitude and approach to life although I know I will likely still fall short too many times.

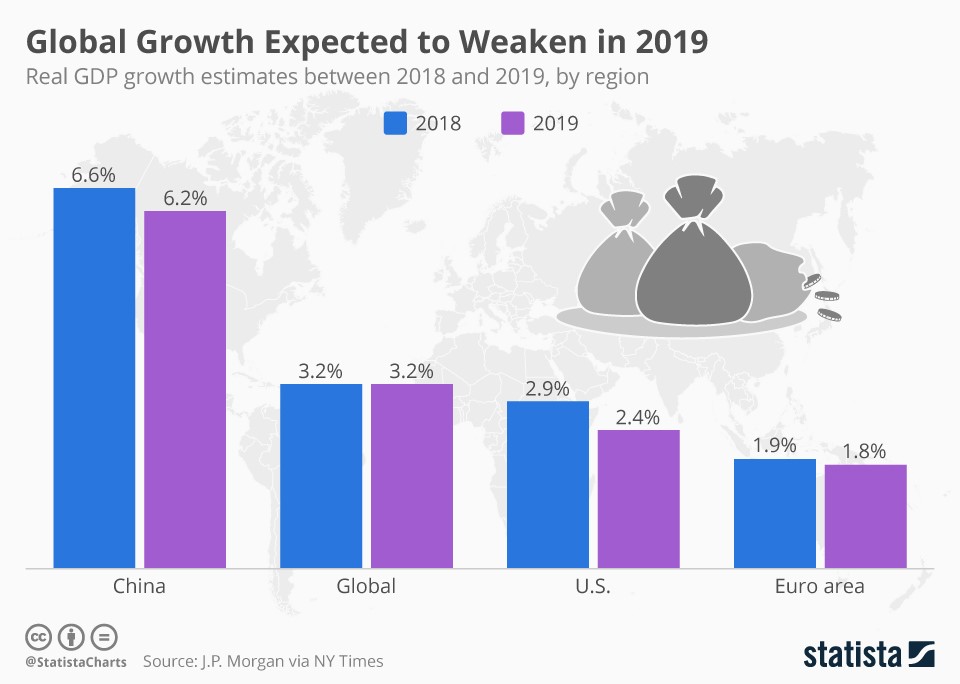

Global Growth in 2019

The consensus view is that global growth will stall to some degree in the coming year. The major drivers of the world economy are all struggling to some extent. That leaves the rest of the global economy in the lurch. The Chinese are already down from last year and so are the Europeans. The U.S. is not moving at the same pace as in 2018 and there is no other major economy capable of pulling the others along with it.