Strategic Global Intelligence Brief for December 9, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

A Giant Has Passed—

The news started off with a depressing note. Paul Volcker has passed away at the tender age of 92. It is hard to argue that there has been a more influential Fed chairman in modern times and very few economists with the reach he had. As recently as a year ago, he was working on bank reform efforts through the promulgation of the Volcker Rule. His stands were principled and unbiased. He took his assignments very seriously and never wavered despite severe criticism. His contributions rank as the most important in modern economic history. The power of his mind and attitude will be sorely missed.

Crime and GDP

This subject comes up from time to time, but it never leads to any definitive answer to the question. How much does illegal activity add to a nation's GDP? There is abundant anecdotal evidence and lots of indirect analysis. One can look at a given area and estimate economic activity based on legitimate work and quickly notice there is far more activity than this work would justify. Something else has to be generating income for there to be that much activity. That something is generally illegal. It is the drug trade, gambling, prostitution and even the spoils from theft and burglary. The best that can be done is to guess what amount of economic growth stems from all this. Estimates run as high as 1% of the U.S. GDP ($20 billion)—a lot of money by any definition.

Equity Market Impact

It comes as no shock, but the majority of Americans have not seen much benefit from the surging stock market for the very simple reason they are largely uninvested in it. The surge in the markets has been a big factor in overall business confidence and has been of some interest as far as the consumer, but the polls suggest that most do not equate the markets with their individual economic position. This is important at this point as it means that a high-performing stock market may not be all that significant to voters next November. To the average voter, the only economic data that really matters is the unemployment rate and the rate of inflation.

Short Items of Interest—Global Economy

Technology Wars

The U.S. has been trying to limit the use of technology from Huawei and some other Chinese companies. Now, Beijing is striking back with bans of its own. The edict has been issued by the government that all foreign-made computer equipment in Chinese state offices will be replaced by Chinese-made gear. This will hammer the likes of IBM, HP and Dell—among other U.S. hardware makers. The Chinese are using the same argument the U.S. has used against Huawei—national security. The continued battle between the U.S. and China has accelerated the move to isolate the two business communities.

Russia Hit with Harsh Sanctions

Throughout the Cold War, the arena of sports was just another ideological battleground. There was widespread cheating and manipulation—especially by the USSR and the Iron Curtain states. The habits have remained and Russia has been assessed a major ban due to their doping activity. It will be banned from the Olympics and World Cup for four years as a result of the investigation and more sanctions are likely.

Finland Gets a New Prime Minister

Sanna Marin will become the youngest PM in the history of Finland at age 34. She is the leader of a four-party coalition of center-left and left-wing parties (all led by women). The previous PM was forced to resign over his response to a postal strike. That meant he was in office for just six months. The left coalition still remains in power, but the polls show that the right-wing populists have more voter support and would win control of parliament if the election were held today. Marin will have to galvanize young voter support and find ways to blunt the xenophobia of the right-wing parties.

Success Imminent for USMCA?

The long-awaited replacement for NAFTA may soon get its moment in the sun. The negotiators from the White House and Congress seem to have worked through some of the biggest hurdles and there has been immense pressure from the business community to get this done. There is still a lot to work through and there is no guarantee the pact will pass through the House even if the deal comes to a vote. The major sticking point is the enforcement of labor rules in Mexico. The Democrats are demanding tighter standards in Mexico, higher wages and more protection for unions. There are many in the GOP with similar interests as they have opposed U.S. companies moving operations to Mexico due to lower labor costs and reduced cost of production in general. Mexico has balked at letting U.S. do inspections, but the government under Mexican President Lopez Obrador (AMLO) has been pushing for many of these same labor standards.

Analysis: Politics continues to play a major role in the timing of this deal. If the agreement makes it to the House and passes, it will be a victory for the Trump team as its passage has been a priority all year. Many of the more centrist Democrats want the deal as well as it suggests they can work with the Republicans when it makes sense. They do not want to be pigeon-holed as the "party of no." The U.S. business community just wants to know what the rules are. The biggest trade partners for the U.S. are Mexico and Canada and the tension that has surrounded trade over the last two years has been damaging—more so than the U.S.-China trade dispute. The recent collapse of the Mexican economy has not helped matters. Under AMLO, the economy has gone from nearly 3% growth to recession and ferment in the country has escalated dramatically. Fights over the influence of the drug gangs and Trump's border wall have added more tension yet.

Some Global Data Releases

The U.S. is not the only nation tracking its inflation threats and the news will not likely be as positive. China is running into higher inflation numbers. This is complicating their efforts to bolster their economy. The trade war with the U.S. as well as overall economic slumps in other key markets have caused the Chinese pace of economic growth to fall to 6% (and some analysts assert that it is really even lower than this). The government has been trying various stimulation efforts, but with inflation now running at around 4.5%, there are limits to what the stimulus can be. The country is now teetering on the edge of stagflation with the Producer Price Index down at the same time that consumer prices are rising.

Analysis: The Fed is also not the only central bank meeting this week and not the only one that is standing pat. The European Central Bank (ECB) has been signaling stability for the time being despite the challenges that have been facing Germany. This will be the first meeting where ECB President Cristine Lagarde will preside. That is the focus for analysts. The expectation is she will start to outline her assessment of the coming year, but nobody expects her to telegraph much about what she has planned. The comments she has made thus far suggest she will take a more active role in overall EU policy than was the habit of the previous head of the ECB, Mario Draghi. She has suggested that ECB decisions will be made with some attention to the issue of climate change, but no details have emerged as yet.

The ECB is stuck in some ways. There is clearly a need to bolster growth in the EU as the German economy continues to flounder in recession; but at the same time, there are threats of inflation showing up. That mitigates any more dramatic interest rate reductions. To be honest, the ECB faces the same issues that face the Fed and many other central banks. They really can't cut much more than they have; it is doubtful that yet another rate drop will do much to stimulate in any case. The burden of boosting the EU economy will fall on the fiscal authorities. Lagarde is expected to apply a lot more pressure on these leaders than Draghi did. This will put her at odds with the Germans and other fiscal hawks as they continue to be more worried about inflation and expanding debt. Lagarde is no stranger to intense scrutiny of her every word, however. This will make parsing her statements all the more popular with analysts seeking some clues as to 2020 policy.

Some Significant Data Releases This Week

There will be quite a bit of information released this week (Dec. 9-13) that will pertain to central bank policy as well as inflation. The data will not necessarily answer all the relevant questions that start appearing as the new year dawns, but it will provide some solid insights into the status of the global economy right now.

Analysis: The Fed meets this week. There is no expectation of any sort of change in policy—not after last week's better than expected employment news. The Fed will leave rates just as they are and analysts will be far more interested in what the chairman has to say about the future. The real analysis will have to wait until the minutes are released, but the expectation is that the hawks on the Federal Open Market Committee (FOMC) will be issuing a warning or two about inflation next year as their terms will expire in January. The balance of hawks versus doves will not change much next year as Esther George (hawk), Eric Rosengren (hawkish), James Bullard (dove) and Charles Evans (dove) will be replaced by Loretta Mester (hawk), Robert Kaplan (hawkish), Patrick Harker (hawkish) and Neel Kashkari (dovish).

The inflation picture will be a little clearer with the release of the Consumer Price Index (CPI) on Wednesday. This is no longer the favored measure for the Fed as it prefers the data from the Personal Consumption Expenditure index. The CPI has been struggling to create that "typical" basket of consumer goods to track as there are five generations engaged in the U.S. economy for the first time (Greatest Generation, Boomers, Gen-X, Millennials and Gen-Z) and they all spend differently. The CPI rose by an annual rate of 1.8% last month. The expectation is that it is now rising at a 2% rate. Nothing to suggest an inflationary outbreak, but reassurance that deflation is not set to be an issue.

On Friday, the retail numbers will be released and the expectation is they will be positive. The consensus view is there will be growth of around 0.5%, better than many had assumed at the start of the retail season. The better than expected jobs numbers will encourage the consumer and reassure them they will be gainfully employed next year and able to pay for all those gifts they purchased.

A Few Things the Job Report Tells Us

Last Friday (Dec. 6), the jobs report released by the Labor Department was better than had been expected. Granted, all of the estimates had been calling for a good month with at least an additional 180,000 jobs created, but few anticipated the addition of 266,000—a number just short of the 312,000-record set in January of this year. There have now been 110 straight months of job gains and the unemployment rate has dropped to 3.5%—the lowest level since 1963. There has even been an increase in wages—a gain of 3.1% over what it was last year at this point. This is still not suggesting imminent wage inflation, but it is promising given the very slow pace of wage gains that have been the norm up to this point. Is there any reason for anything but unbridled joy at this latest release of data? Of course there is—we are not referred to as the dismal science for nothing.

Analysis: Perhaps the most important factor to consider is demographics. The fact is that 10,000 Boomers reach the age of retirement every day. This is the fastest pace the economy has ever had to contend with and it is utterly unavoidable. The largest age cohort in the U.S. has been moving through the economy like a slow wave for the better part of seven decades. The school age population in the 1950s and 60s caused classrooms to nearly burst, that wave then flooded the job market and caused a couple of decades of job shortages. Now, that same wave is exiting the workforce—roughly 300,000 a month. If the economy is adding 266,000 jobs that still means that there are 40,000 fewer people working.

Observation number two is that this is the time of year for the temporary job—mostly in retail and in transportation, but lately there has been growth in the hospitality and entertainment sectors as well. These are not your classic part-time jobs, but full-time jobs that will generally last only the season. It is definitely good news for the economy as a whole as there are two important characteristics of these jobs. The first is that these workers spend nearly all the money they make and spend it right away. The second important aspect of these jobs is that many are being held by people who already have a full-time job. They take advantage of these temporary positions to get some extra money. This practice has become more common as people take regular jobs with highly flexible schedules.

What Happens in the Event of Another Recession?

The Federal Reserve is making a point of noting its limitations of late. This is not a new issue as it has been pointing out for years that it is limited in terms of what it can do in the event of a recession. It has described as "pushing a string" as it involves trying to encourage expansion with low interest rates. The fiscal side of the equation is charged with doing the most to escape a recession. Thus far, Congress has dropped the ball more often than not.

Analysis: The fiscal response is limited to spending and lowering taxes. The goal is to get money in the hands of the consumers so they can stimulate the economy. The tax cut of a year ago was somewhat helpful, but relatively little of the tax relief was aimed at the consumer. Given that 50% of the population pays no income taxes at all, the efficacy of a tax cut is limited in any case. The usual response to a downturn is aggressive government spending on projects that drive employment, but with jobless rates at 3.5%, it is doubtful that people can even be found to take these jobs. That leaves spending on transfer payments—just taking government revenue and putting in the hands of select groups. If the goal is getting out of recession, that money should go to those most likely to spend it, but most of the transfer systems are geared towards some kind of income equality.

Unsung Heroes

I complain enough about poor service. Probably too much, but it has always bugged me that one rarely seems to encounter people who understand the concept. It is time to acknowledge those that provide service and rarely get any attention for it. Last week, I was out in the yard when the trash haulers came by. I grabbed the opportunity to hand them some cold drinks and thank them. We generate a great deal of yard waste despite composting and the like—it comes with the territory when a Master Gardener (my wife) is at work. Lots of trees, lots of trimming and I deeply appreciate the guys picking that all up.

Southwest hands little coupons to some of its A-list flyers that are meant to be handed to employees one wants to reward and acknowledge. It enters them in a lottery that has cash awards and it figures into their pay and promotions. The vast majority of these get handed to flight attendants and a few go to gate agents and desk agents. Those who work behind the scenes have little or no contact with passengers, so they rarely see them. I make a point of noticing these people when they venture into the airport and always get very surprised reactions. I am happy to see hard working flight attendants, but I am REALLY impressed with the guys that are keeping that airplane airworthy and are making sure that luggage goes the same place I am.

I have long made a point of thanking the maintenance people at airports and other locations. I really am astonished that these public places are as clean as they are given the behavior of the people that use them. These are people that rarely get noticed, but they have more to do with my total experience than many.

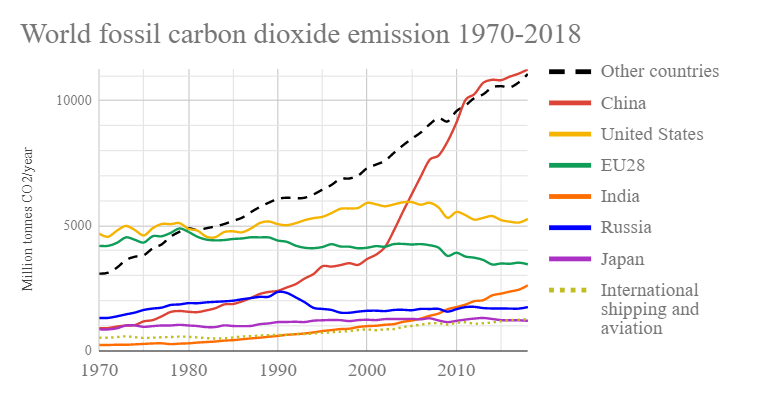

World Fossil Carbon Dioxide Emissions

The climate change debate has been raging for some years now, but the challenge is that it is a truly global problem that is not engaging all the nations involved. The Chinese share of the problem has been ramping up steadily as their industry has developed and the expansion of emissions worldwide have to do with China as well. The Chinese have been exporting coal-fired power plants throughout Africa and Asia. Now, these regions are major problems as well. This global issue is why the Paris Accords were started and how the U.S. refusal to engage has been reducing pressure on China and other states.

(source: en.Wikipedia.org)