By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

No Shocks Expected in Today's Jobs Data—

By the time you read this, the jobs numbers will have been released and you will know whether the economists have any idea about what is going on in the economy. The expectation is there will have been some solid job gains and the overall rate of unemployment will remain at historic lows. This is the time of year that many in retail and transportation add jobs—boosting the numbers. Beyond that, the real issue in the job market is not a lack of jobs but a lack of people to fill the jobs that are available. It is estimated that there are close to two million more jobs available than there are people looking for work.

Trying to Calm the Repo Market

The Fed has been intervening to protect the liquidity of the money markets over the last few months as there have been consistent strains on the sector. The Treasury Department is now working with Fed officials to determine whether there are some structural reasons for this persistent issue. There has been some concern that new regulatory actions have contributed to the shortage of these short-term funds and there has been some suggestion that the timing of corporate tax payments serve to drain the system at the same time the Treasury debt auctions are being settled.

More Worker Shortage Worries

As the Trump trade policy has unfolded, it has been assumed that one of the goals was to bring back production to the U.S. from China and other locations. In fact, there has been evidence of substantial reshoring interest in sectors that had been losing to overseas competition for decades. There has been potential return activity in textiles, shoemaking, furniture making and a whole host of parts manufacturing. The problem is there is no labor force available for these companies to employ. The incentive to move back to the U.S. is there, but without people, there will be much less reshoring than might have been possible.

Short Items of Interest—Global Economy

Economic Crisis Drives Protests in Iran

Details have been very hard to obtain as the government in Iran has been clamping down hard on information regarding the protests and demonstrations. They have been so large that some information has been leaking out. The trigger for these near riots has been the decision to double the price of fuel. The country that once subsidized fuel consumption can no longer afford to do so, which has been the last straw for many in the country. The sanctions have been cutting deeply into the economy for years and this has unsettled the country to the breaking point.

Canadian Priorities

Prime Minister Justin Trudeau squeaked by with a victory in the last election, but it was very close. In the end, it was the traditional base for the Liberal Party that made the difference. His attempt to win support from the center was not successful. That has now informed the positions he takes in his second term. The three issues that dominated his recent speech are climate change, gun control and health care. There has been very little comment on economic issues or on national growth. Infrastructure has dropped off the agenda completely.

British Politics as Divisive as Ever

The polls suggest that many in Britain are perplexed regarding the behavior of the dominant parties. How could the Tories and Labor both manage to put such desperately unpopular men as Prime Minister Boris Johnson and Jeremy Corbyn in leadership roles. They are the two-most-unpopular politicians Britain has seen in years with Corbyn the most unpopular since the end of WWII. The fact is both parties are bitterly divided and unable to field a unity candidate. Former PM John Major has gone so far as to urge people to support alternatives to his own Tory party. He has not supported Labor, but seems to suggest a vote for the LibDems or Greens or Scottish Nationalists would be in order.

Imports from China are Down

This should come as little shock to anyone given the trade disputes and tariffs that have been imposed on China and on the U.S. from China. The real question is whether this is a trend that continues in the event of some kind of trade deal. It remains far from clear that such a deal will be developed as both the U.S. and China keep moving the criteria, but it is reasonable to expect some resolution someday. Will those imports resume and will the deficit worsen again?

Analysis: The reaction to the trade war by U.S. importers and by rival suppliers to China suggests that the old dependence on China will not reappear. U.S. companies are finding alternative suppliers all over the world and are starting to figure out how to approximate the efficiencies that had been developed with China. There has been some reshoring taking place as well. U.S. companies are using technology and robotics to compete and the trade wars have accelerated the process. This has been the challenge that China has faced from the start—they have to find a set of consumers as dedicated as those in the U.S., while the U.S. has to find new suppliers. While that brings challenges, it is an easier task than faces China. Thus far, the damage from the tariffs have been more profound in China than in the U.S.

Real Crisis for German Industrial Sector

The decline in the German industrial community is plunging the country into a reversal as bad as the recession of 10 years ago. Industrial output dropped by 5.3% in October from October of last year. There had been some faint hope that numbers would have shown the decline in the industrial sector had started to bottom out, but the sense now is that conditions will get even worse in the coming months. There is no end to the two-year decline in the industrial sector. That ensures Germany will enter an extended recessionary period. The impact on the overall economy has been significant with a sharp increase in the unemployment rate and some serious revenue implications for the government.

Analysis: There are several reasons cited for the decline. Any one of the three would have caused the economy to stutter, but with all three taking place at the same time, the impact has been severe and there are no simple solutions on the horizon. Two of the three are well outside German control. That has made the situation much more frustrating. At the top of the list has been the slowdown in the global economy that has been triggered by the U.S.-China trade war. Thus far, the real damage from this confrontation has been sustained by nations other than China and the U.S.—the fable of the two elephants fighting comes to mind. It is the mice that suffer. Germany had invested a great deal in expanding its trade with China. China's slowdown has hit the export-centered German economy very hard. In addition, the Germans sold a great deal to other nations that sell to China. As these countries have seen a decline in exports to China, they buy less from Germany.

The second blow has been Brexit. No member of the EU has more investment and engagement with the U.K. than does Germany. The chaos of the Brexit process has slammed the German economy as much or more than it has affected the British. The rest of the EU has not been growing fast enough to make up for this loss. In fact, there has been a decline in exports to France, Italy, Spain and others as their economies have been having issues of their own. Germany's economy is 55% dependent on exports and the slump in trade has been devastating.

The last straw has been the decline in the auto sector. It is hard to overestimate the importance of that industry to the German economy. It accounts for the direct employment of over 830,000 jobs and another two million are indirectly dependent. There has been a nearly 15% decline in auto production in just the last year. Part of the issue is the weak economy in the rest of Europe as that has reduced demand and part of the problem has been a shift in consumer taste towards the electric vehicle—something the German carmakers have not embraced. German expansion into other markets has been largely unsuccessful as compared to their Japanese and South Korean rivals. There had been high hopes for the China market, but these have faded with the Chinese slowdown.

Chinese Bailouts Not Working Out as Planned

The Chinese government has always been very active in terms of managing the affairs of its "private" sector. Most of this engagement has taken the shape of bailouts, subsidies and other supports. This has been one of the issues at the heart of the trade talks with the U.S. On the one hand, it has given these companies an edge in competing with rivals in the U.S. and elsewhere, but it has come at a huge cost to the Chinese government. The support for these "private" operations amounted to $28 billion in the last year alone as 339 companies listed on the Chinese stock exchange got bailouts. It has now been revealed that 75 of these companies are behind in their debt payments despite the bailout and another 100 are close to default.

Analysis: The motivation for the Chinese government is easy enough to understand. The primary goal for the government is to keep people employed. If that means supporting companies, the government will do so. The issue gets even more complex when output is considered. These operations are failing for a reason. They are producing things that are not in demand—either domestically or globally. In a more market-driven economy, they would either have to produce something else that was in demand or they would have to go out of business altogether. China just dumps money on them and they continue to make things that nobody wants. That creates an incentive to dump these products on the world market. In many cases the unwanted inventory is sold at prices lower than the cost of production (the actual definition of dumping). This gets rid of the excess, but in the process, distorts the global market and makes it all but impossible for competitors to keep pace.

Taxation, Growth and Competitiveness

One would be hard pressed to identify anything more controversial about government and the economy than taxation. There is not even much agreement on what the purpose of taxation is, let alone how much a given tax should be. The most basic function of a tax is to finance the activity of government, thus creating debate over what that activity should be. If there is a desire to have government involved in a wide variety of activities, there will be a need for revenue to support that activity. In addition to simply financing government, there is the use of taxation to reward and punish. Don't want people to smoke cigarettes? Put a high tax on them. Want people to install solar panels on their house? Give them a tax break. It is also important to understand what tax money really is. This is money that has been worked for by people in some capacity or another—money that would be used by those who earned it except they have been obligated to pay a percentage of those earnings to the government. All taxpayers will benefit to some degree from what the government provides—military defense, infrastructure and a myriad of efforts to boost overall growth that provides jobs and opportunity. Other benefits are available to select populations—Medicare and Social Security for those who have reached 65 or support programs for people in financial distress.

Analysis: At the heart of the tax conversation is the notion of opportunity cost. Money that is provided to the government is money that is not available for the consumer or the business who worked to earn that money. How much should people expect to keep of the money they worked for? What value is provided by government with the money raised in taxes? No two people will have the same answer to that question. Other key issues will revolve around who gets taxed and by how much. This leads to debates over growth and expansion of an entire economy.

According to the Organization for Economic Cooperation and Development (OECD), the U.S. is now one of the nations with the lowest tax burdens in the organization. Only three member nations have a lower obligation (Mexico, Ireland and Chile). The U.S. marks tax revenue for 24.3% of Gross Domestic Product. The average for OECD members is 34.3%. That puts the U.S. about 10 points below the norm. France, Denmark, Belgium and Sweden are all between 42% and 45%. If one looks at economic growth over the last couple of years, the U.S., Ireland, Mexico and Chile have sported better rates than France, Denmark, Belgium and Sweden, but only by the narrowest of margins. There is, however, more to the impact of taxation than the rate—there is the matter of how that tax revenue is spent.

Service Sector Still Growing at Comfortable Pace

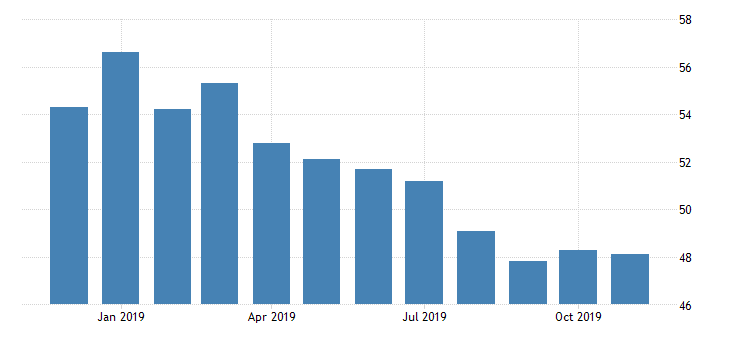

The latest iteration of the Purchasing Managers' Index (PMI) on services is still solidly in expansion territory (a reading above 50). That is in marked contrast with the data coming from the manufacturing index. The service index fell a little from where it had been in October (54.7) and now sits at 53.9. Given the decline of the manufacturing index (below the 50 line for the last three months), it is encouraging to see that services have not followed suit. The sectors that dominate the index include health care, finance, agriculture and construction, but there are also significant contributions from transportation and retail. The services sector is still responsible for roughly 80% of the U.S. economy, but it is important to recognize that these services are in support of other sectors. The work of many people in finance, accounting or law is in support of manufacturing or some other segment of the economy.

Analysis: The challenge involved in interpreting the service sector data is that it is essentially divided into high-level work and low-level work. Most of the job gains over the past year have been in lower-paid sectors, while the higher-paying positions go unfilled for the lack of qualified people. The impact of the trade wars around the world have been taking their toll on both manufacturing and services. It is not just the confrontation between the U.S. and China, it is the impact of Brexit, the trade spat between Japan and South Korea and the one between Brazil and most of Latin America.

Nearing a Temporary Reprieve

Happily, there is one more speaking engagement out of town this year. I will not be treated to the joys of flight for a few weeks. This will leave some time for the scars to heal. Given the amount of time spent in airports and airplanes, I have become quite the critic and commentator (usually under my breath) and have reached a few conclusions. The first is that my airline of choice (Southwest) does a remarkably good job coping with the vagaries of travel. This has been a stress-filled year for the industry with the 737 Max mess, an early and nasty winter and so on. I, however, have not experienced a single cancellation. In the last month, I have not encountered a single delay of more than 30 minutes (that is 16 flights on time or early). I have also noted that many airports have become accommodative as well—business centers in Tulsa and Portland, fairly decent food options and ample places to plug in one's laptop.

The part of flying that has not improved is the behavior of my fellow passengers. Granted, the majority of those I am sharing the plane with are well-behaved enough, but it only takes a few to turn a given trip into a nightmare. On a recent flight, I narrowly missed some real disasters, but the same could not be said for others on that flight. The first sign of trouble was the impatient lout trying to cram his bag in a space too small. His efforts dislodged another bag which almost clobbered a guy. Moments later, a woman came tottering down the aisle with her coffee precariously balanced against her shoulder. It didn't make it and spilled all over the place. Finally, there was the kid with the book bag swinging freely as he made his way. He practically took out four aisle sitters before the rest of us started to dodge it by becoming well acquainted with our center-seat companion. One would think that close quarters would cause people to be a little more careful and considerate, but it appears that it is just the opposite reaction. Needless to say, I am looking forward to my break!

Purchasing Managers' Index Declines

The decline in the Purchasing Managers' Index continues for the fourth month in a row. The bad news is that these are numbers signaling contraction, but the good news is that the numbers have remained within striking distance of expansion and seem to have stabilized a little in the last two months.