Short Items of Interest—U.S. Economy

Job Numbers About as Expected

The latest employment data was not much of a shock, which is just fine for this time of year. The level of unemployment has remained where it was at 3.7%, although there were slightly fewer jobs added than had been expected. The assessment prior to this report was that some 200,000 would be added to the rolls, but the actual number was 155,000—not all that bad, but certainly a slowdown. The wage increase was substantial though and has implications. If the wage hikes continue at this pace, there will be an additional inflation threat. The Fed has not had to worry much about the wage inflation side of things, but that seems to have changed. This will figure prominently into their rate decisions next year.

Fed Chief Gets Support

It is unusual for a president to attack the positions taken by the Federal Reserve. The reason the central banks of the world are independent is so that they can go about the business of limiting the impact of inflation. The politician is always in favor of low rates and the business stimulus they lead to, but there is such a thing as too much stimulus. Trump has been increasingly vocal in his critique of the Fed and its policy of rate hikes, but his comments have been ignored by the Fed. Now, there are voices from Congress that have supported the Fed and have been pointing out the kind of damage inflation can do to an economy. With the latest news on wage hikes, it will be much easier for the Fed to keep to the plan of hiking rates.

Tariff Costs Mount Fast

There seem to be many misnomers about tariffs. The majority of the population seems to think that somehow these are fees paid by other governments. A tariff on goods from China will cost that government. That is not how it works. The tariff is a tax. It is one that falls on U.S. companies that buy from these other nations. The tariff is imposed on a good sold by China so as to make that good less appealing to an American buyer. Presumably that means the U.S. buyer will choose a domestically made version, but that only works if there actually is a domestically made version. In many cases there isn't. So, the American buyer has to buy from another country anyway—but at a higher price. The U.S. company and the U.S. consumer will end up paying that tax until and unless there is an alternative.

Short Items of Interest—Global Economy

German Succession

The race to replace Angela Merkel as leader of the Christian Democratic Union (CDU) has split the party into mutually hostile camps. It will be the task of the new leader to find some way to unite the group after the choice is made. It appeared that the more conservative wing was in the lead with Friedrich Merz, but in the last month, the Merkel side has been gaining in the polls. Some now have Annegret Kramp-Karrenbauer in the lead. The party has been roiled by the immigration issue and the rise of the populist right-wing Alternative for Deutschland (AfD). How to address that issue is at the core of the difference between the two factions.

U.S. Attack on Multilateralism

The Trump approach has been self-described as "America First." It purports to place American interests above all else. This is supposed to be different than what the U.S. has pursued in the past, but since the days of Henry Kissinger, the U.S. has been a devotee of its own self-interest against overtly nationalistic regimes in China, USSR/Russia and others. The U.S. created the institutions that Trump now vilifies as a way to control these regimes and their nationalistic impulses. Now, it seems the U.S. wants to abandon that strategy in favor of going it alone.

Global Bankers Look Away From Paris

The Brexit decision by the U.K. was felt immediately by the global banking community. It was obvious that London would soon lose its position as the host of that community. Now, it was a race between Paris and Frankfurt. The riots and demonstrations in France have tilted the bankers towards Germany as the new host.

Geopolitical Tensions Mount

The last few weeks have not been encouraging as far as the global economy is concerned. There has been more volatility in the global markets than had been expected given the run of decent economic data from the U.S. It has become something of a tug-of-war between those reacting to perceived future threats and those looking at the current data and expecting these trends to continue. On the plus side, we have a better reading from the Purchasing Managers' Index. That comes with some caveats, however, as there is abundant evidence companies are doing a lot of advance buying and selling in anticipation of the tariffs and other trade restrictions. The employment data still looks good and there has been evidence of a solid retail year thus far. The level of consumer confidence has dipped a little, but has not dampened enthusiasm for holiday shopping. These will be the critical weeks for retail as there is always a slump between Thanksgiving weekend and the days right before Christmas.

Analysis: In the last 24 hours, there has been a great deal of uncertainty within the global investing community and among business leaders in general. This may well be the theme for the next year. Right now, 2019 is shaping up to be a year of turmoil and reaction. The markets have been tumbling for a few days now. Over the last few weeks, the markets have managed to lose almost all the gains made from the start of the year. There are many reasons for investors to get nervous or exuberant on any given day, but there seem to be some bigger themes at work right now.

At the top of the list is the U.S. relationship with China. Every statement and every gesture is parsed to the extremes as people attempt to work out what is in store. Not much can be said with great assurance. Trump seems to actively dislike China and is motivated as much by this personal animus as anything to do with the U.S. economy. At the same time, he remains a dealmaker and continues to hold out the possibility of agreements that ratchet down the tension. He left the G-20 meeting with a vague promise on China's part to address some core concerns, but no definitive moves have been made. The U.S. agreed to hold off on tariffs for a while, but then turned around and arrested a top executive from Huawei—one of China's tech giants. This is a company with very close ties to the leaders in China and especially to Xi Jinping. The chill over the talks with the U.S. were felt immediately. Whatever slim hope seemed to come from the G-20 statement vanished. Now the assumption is that China and the U.S. will resume their collision course. Not only does a trade war stand to damage the two largest economies in the world, but it will quite obviously affect many other nations that do business with the U.S. and China.

The second issue that seems to be roiling the markets is oil. It has been a very awkward moment as it appears these may be the waning days of OPEC influence. As frustrating as dealing with OPEC has been for the last several decades, it has been forgotten how chaotic the sector once was. There was no price stability of any kind. That created a miserable situation for those in the oil business. It was never clear whether a given investment would be lucrative as a sharp drop in price was always around the corner. That situation now seems to have reemerged. At the very moment OPEC members are discussing production cuts, the price per barrel of oil has been falling. This should be the other way around, but the markets are not convinced that OPEC members will agree to the cuts. There is also concern that non-OPEC players will subvert the effort even if they do. Unless Russia decides to back the OPEC play, there will be no significant reduction of oil output. Beyond this immediate discussion, there is the fact that cheaper oil has altered expectations on a whole host of energy and transportation issues. GM is being assailed for their decision to close plants and lay off people, but the shutdowns are of operations that produce smaller cars. With the price of a gallon of gas down to less than $2 in many U.S. markets, there is no demand for these fuel sippers. No car company wants to make cars so they can sit in a giant parking lot. Will efforts be undertaken to hike the price of fuel so that smaller cars become popular again? Ask the French president how that effort has been working out for him?

Is the GM Decision Justifiable?

The confrontation between General Motors (GM) and the U.S. government will have some very long-lasting implications. If GM doesn't back down and reverse its decision regarding plant closures and layoffs, it will likely face punishment from an angry Congress as well as President Trump. There could be restrictions affecting its business in China or exports in general. There could be legislative demands to return some of the billions in bailout money GM received. If GM does back down, it will have committed itself to a business strategy that is doomed and will drain the company for years.

Analysis: There are always many factors that go into decisions this big, but three stand out at this point. All three have their roots in other governmental decisions. The first is that Americans are not interested in small cars. It is the factories making these cars that will be shuttered. The U.S. government has pushed for cheaper oil for decades and continues to do so. The fastest way to bolster demand for fuel efficiency would be to put high gas taxes in place. The second factor is the cost of steel. The tariffs imposed on imported steel added over $1 billion to GM's cost. The margins for small cars will not cover that hike. The steel sector may be delighted that imports are down by close to 15% this year, but steel prices are up by close to 40%—that hurts carmakers. The last of the factors is internal and has been on display since GM CEO Mary Barra took over. The stated goal was to build a company that was far smaller than the old GM and far more profitable. She was warned never to look to Congress for another bailout. That was a strong signal to GM.

Why Can't OPEC and Other Producers Agree?

The price per barrel of oil has been tumbling again. The assessment of just a few months ago now seems utterly foolish. Remember that argument—demand was coming back strong and it would spike oil prices back to the $100 a barrel level? The assumption was that OPEC and the other oil producers would do what they have done many times in the past when oil prices have been judged to have fallen too far. Today, the per barrel price is down to $58 and still falling. It was at $86 only a few weeks ago. That is a 30% decline in a very short period of time. Why is this happening? What does this say about the future of oil production and pricing?

Analysis: The fact is that oil is an inelastic good. It may not seem like it is given the assertion that people's consumption varies with the price at the pump. The reality is people do not vary their consumption much. They still have to get to work and other destinations and simply have to pay what is required. In the long run, they can adjust the level of consumption by buying a more fuel-efficient car or moving closer to their place of employment, but those are not short-term reactions. The inelastic nature of oil means that prices can go up without appreciably affecting demand. That has been the pattern with oil producers in the past. The power of OPEC was always rooted in their ability to reduce output to the point that an artificial scarcity could be created and prices would rise accordingly. That tactic is not working as it once did. There are three reasons why.

The first is that OPEC has lost the control it once had over global oil production. In its prime, the organization effectively controlled close to 70% of global oil production, but today that percentage has fallen as low as 35%. Any decisions limiting output as a means to boost oil prices will have to include non-OPEC members such as Russia. It is very unlikely OPEC will get any help from the Canadians, Mexicans, Norwegians, British or Americans. Right now, the Saudi Arabians are struggling to get the other OPEC members to reduce their output. Members don't think this action will get the prices to rise and all they will be doing is limiting their market share.

The second issue is that many producers are now ready and willing to fill any gaps that appear should the OPEC states elect to cut production. The U.S. alone can ramp up production at will very quickly. Every time the price goes up past the $70 or $80 level, there are producers willing to jump quickly into the fray. That immediately takes the prices back down as the flow of oil accelerates.

The third issue is demand. It isn't as reliable as it once was. The U.S. and Europe still dominate consumption, but there has been decline in how much oil is needed. China was adding to that demand side at a pretty rapid clip, but this has slowed down as their economy has struggled. All the rest of the nations in the world combined do not equal what these three big consumers require.

The bottom line is that a cartel like OPEC only works when it has control over the bulk of the assets. The production of oil is now far too spread out to control when most of the major players are not part of that cartel. The consumers of oil now have a better position than the producers do.

Migration Myths

The issue of immigration is always emotional and rooted in culture. It generally deteriorates into a set of "us versus them" arguments. There are many on both sides of the discussion that attempt to bring up other aspects of the issue as justification for their position, but more often than not these arguments are spurious. For example, it has been asserted by those opposed to migrants that they place a huge and expensive burden on health care systems because they have more babies than the other residents or that they are unhealthy to begin with and carry more disease.

Analysis: An exhaustive examination of over 300 studies carried out on the subject yielded a somewhat startling conclusion. The study was in The Lancet—a peer-reviewed journal that began publication in 1823. It stated that immigrants do not add anything of substance to the cost of health care in the U.S., Europe or anywhere else. Their rate of disease is no different than any other population. Because the vast majority of migrants are young, they present far less of a burden on health care. The most expensive cohort is older people. The vast majority of them are native born. The study also reiterated what many others have found. Immigration is a net benefit as far as economic growth is concerned as the migrants are not only working in the system in greater numbers, they are also consumers. Most migrants are employed—a much higher percentage than among native-born people.

Gifting

At a certain point, gift giving becomes more difficult than it once was. I never know what to give my darling wife these days and she struggles with me. We have been together now for 40 years. By this time in our lives we have just about everything we could ever desire. Granted, we don't have that luxury cabin cruiser or our own helicopter, but we certainly don't lack for anything of a more reasonable price. We are long past the point of buying practical things disguised as Christmas presents. If we need a new vacuum or a snow shovel, we just buy it. We also have no room for another piece of household decoration. We have all the tools we could ever need (kitchen tools for her and garage gadgets for me).

Of late, we have been opting for experiences rather than things—concerts, good meals at a new restaurant, maybe some travel. Those are hard to wrap and put under the tree. We still find an assortment of goofy things that provide a few minutes of mirth (I still have my Freudian slippers). What seems to matter most now is time spent together. We have always tried to do as much together as possible given that travel takes me away through the year, but of late, we want to try harder to make the most of time spent. This year, I think the main gift we will give one another is a commitment to getting back in shape. That means spending time in the workout room and on those long walks we used to take. I still plan to buy something dumb as a way to show my true personality.

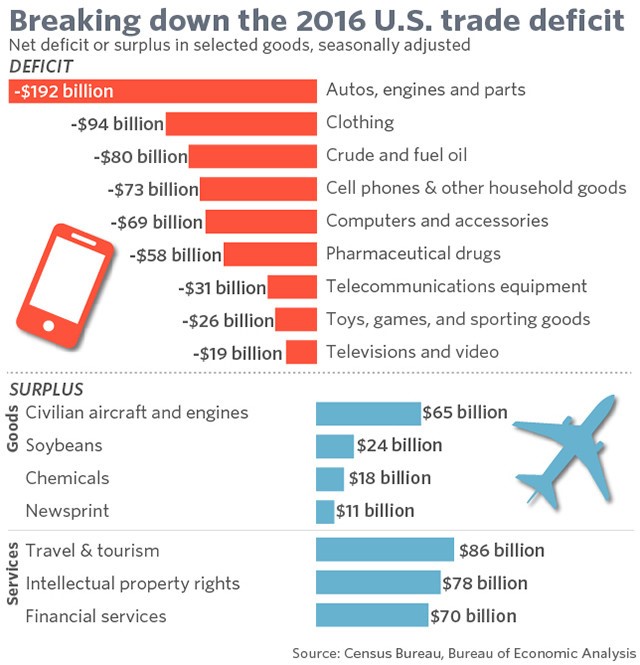

U.S. Trade Deficit

The chart below is from 2016, but the categories are about the same today as they were a couple of years ago. The point is the same—the U.S. runs a trade deficit with the world and with China in particular because we import a lot of things that are purchased by the consumer. The trade deficit has been worsening of late despite efforts of the White House to reduce it through the imposition of tariffs and other trade barriers. It can be asserted that the mounting deficit has been because of these efforts by President Trump. Three things have made the deficit worse. The first is that consumers have had more to spend since the tax cuts. The second is that companies are trying to beat the tariff deadlines by importing as much as they can before they have to start paying those taxes. Third, the dollar has become far stronger in the last year—making imports cheaper and exports harder to sell. This latter issue is due to the actions of the Federal Reserve more than to anything that has come from the Trump team.