Short Items of Interest—U.S. Economy

Consumer Debt

There are many aspects of the recent economic rebound that are positive and have contributed to optimism regarding the coming year, but there are also some potential land mine issues. One of the most threatening is debt. The level of consumer debt is back to where it once was—not a good thing. The consumer had been somewhat chastened by the recession. For a while, there was an attempt to deleverage so as not to be so vulnerable the next time. It seems those bad memories have faded and people are back at their borrowing best. Credit card levels are as high as they have been in 10 years. The good news for the moment is that most consumers are not having major issues as far as paying that debt, but a downturn in the economy that costs jobs will change that equation very swiftly.

Consumer Confidence Dips

It doesn't come as a great shock, but the levels of consumer confidence have fallen to lows not seen in a while. The rise in the confidence level has been attributed to some degree to the performance of the stock market. Now that the market has lost most of its gains and has become highly volatile, the confidence impact has been going in the other direction. There is also a general sense that economic progress next year will be slower than this year. Those on the margin economically are even more worried now than they had been. A downturn of any substance at all will place a lot of households in some jeopardy.

What Is on Investor Minds?

This is a very difficult question to answer with any degree of certainty given the variety of investors out there. Judging by the topics that have dominated investor meetings and calls, the majority of the business community seems to be focused on three key issues. These are different from what they have been. It used to be taxes, regulation and labor supply. Today, the big three seem to be tariffs, trade wars and global business in general. The tariff has become the major tax issue now. The higher these tariffs go, the more impact on the domestic economy. The trade wars are disrupting supply chains at a record clip. Few companies have been able to develop effective substitutes, although these will start to appear in the months ahead.

Short Items of Interest—Global Economy

Chinese Factory Orders Dip

The Chinese government has been engaged in some stimulus efforts, but there has been a reluctance to pull out all the stops as there remains a threat of inflation that this set of policies would only worsen. The factory sector has started to struggle. That may force the government to pursue more stimulus despite the threat to the economy down the road. The tariffs are having an impact on China, but it is reduced domestic consumption that is the problem. This has been due in part to the decision to reduce stimulus a few months ago. It was assumed the economy would be able to withstand that loss, but now many are not so sure. It is likely that another stimulus round is near as the Chinese really can't count on the export sector this time.

U.S. and China Competing in Africa

This time, the battleground is economic. It is unlikely the U.S. and China will fight proxy wars here—at least not yet. It has now become an economic game. The U.S. is shifting its approach from one of giving aid to promoting investment. The Chinese have preferred to stay close to the government-controlled businesses in these nations, but these are often the most woefully inefficient and badly run. The U.S. has an opportunity if it moves fast enough.

Changing of the Guard in Africa

The old men are dying and as these despots leave, they are being replaced by a young and more technocratic class that at least seems to be paying lip service to the ideas of democracy.

Why International Instability Matters

If one looks at the supposed trigger issues as far as the market is concerned, there are many that relate to what is taking place in other parts of the world. Why do these things matter as far as the U.S. markets are concerned? The short answer is that U.S. business is global and thus affected by global events, but it is often a deeper issue. Take the situation in Syria—why would that make the U.S. investment community uneasy?

Analysis: The logic is not all that straightforward. The U.S. engagement in Syria was minimal, so it was not as if U.S. troops were actively engaging with ISIS or any of the other combatants. It is a matter of influence. The U.S. had a voice in this shredded nation and could temper Russia, Iran and Turkey to some degree. Now that influence is gone. The Kurds were under pressure from Turkey and Syria already and are now that much more vulnerable and feeling betrayed by the U.S. The U.S. needs Kurdish support in Iraq to hold that nation together. Also, much of the oil is in Kurdish territory. The Syrian pullout ultimately jeopardizes the U.S. position in Iraq and the oil regions of the Middle East. That makes investors nervous.

Lots of Activity in the Middle East

To be honest, there is rarely a time when this is not the case, but as 2019 starts to get underway, there is more than a little to watch and to be concerned about. The fallout from the Khashoggi assassination is roiling Saudi Arabia and has forced a massive cabinet reshuffle by the king. The elections in Israel are getting nasty and intense and could signal a major change in the focus of the country's foreign policy should the Likud coalition fail to hang on to power. The U.S. withdrawal from Syria has opened the region to new influences and alliances. One of the surprise players is now France. The U.S. is looking increasingly isolated in terms of influence. Some of that isolation is by design, but there is also a lot of shifting that doesn't seem related to much more than neglect and confusion.

Analysis: The shakeup in Saudi Arabia doesn't appear to have fundamentally weakened the position of Crown Prince Muhammad bin-Salman, but there are some new players that are closer to his father than to him. These men will likely be playing a restraining role as much as advisory. The two most significant changes involve two longtime advisors to the king. The first is National Security Advisor Musaad al-Aiban as he revives that somewhat moribund post. He essentially takes control of the security apparatus that was ostensibly responsible for the killing of Khashoggi. The second key addition is new Foreign Secretary Ibrahim al-Assaf. His task will be to mend fences with the nations that turned on Saudi Arabia in the wake of the killing. It will be his task to show that there is a "house cleaning" underway. The actual powers of the crown prince remain intact, but this cabinet reshuffle is a way for the king to reinsert himself into the middle of the nation's affairs again.

The U.S. has been virtually alone in terms of its support for the crown prince. Trump has refused to acknowledge the conclusion of the intelligence community as it has asserted that Crown Prince Muhammad bin-Salman knew of the plan and approved the execution of the dissident writer. The assertion by the U.S. is that it wants nothing to interfere with the weapons sales planned and that Saudi Arabia would work to keep oil prices down. The fact is that Saudi Arabia led the OPEC charge to cut production in an attempt to get those prices back up. The Iranian influence in the region has been expanding as the Saudi influence has waned.

The nation that has started to see its influence expand is France. The U.S. withdrawal from Syria has been a devastating blow to the Kurds and seemed to leave them totally exposed to Turkish pressure. The U.S. was seen as a protector by the Kurds, but that is now a thing of the past. France has suddenly inserted itself into the equation with a declaration of support for the Kurds in Syria as well as in Turkey and Iraq. There has been a small contingent of French soldiers tasked with protecting Kurdish fighters, but they were supported in turn by the U.S. troops. Now that the U.S. is pulling out, the French seem willing to step up and expand their presence, but to what degree remains to be seen.

The issue in Israel is whether the Prime Minister Netanyahu will be indicted on corruption charges. If so, will he resign or force the issue to come before the Supreme Court? It is not clear whether an indictment automatically precludes Benyamin Netanyahu from running for a third term or from holding the position of PM. In every other such case, the accused politicians stepped down before it came to that—something that Netanyahu refuses to do. This places a cloud over the elections. Analysts assert the Likud organizers will be watching the polls carefully. If the voters are rejecting Likud because of Netanyahu's travails, there will be a strong desire to remove him from the leadership.

Race to Succeed Draghi Starts to Heat Up

Mario Draghi's term as head of the European Central Bank is up in 2019. The contest over who should replace him has started in earnest. Traditionally, the post is supposed to shift from France to Germany and back again, but that pattern was broken when Axel Weber unexpectedly turned the post down and Mario Draghi was chosen as something of a compromise candidate. Now it is more or less open, but Germany and France still have the dominant voice.

Analysis: At the moment, the leading candidate seems to be the former head of the Finnish central bank—Erkki Liikanen. He has been deeply engaged in the efforts to protect the euro. The knock on him is that he is not as forceful as Draghi. That is a quality that may be needed. Economists polled think that Benoît Coeuré—an executive board member—has the right personality for the job, but he may be too close to the French for the Germans to be comfortable.

Stock Market Volatility—Why and Will This Continue?

As the year ends, the big economic news has been the intense volatility of the stock market. The market has always been a poor representation of the overall economy despite the fact that many people look at it as if it is something of a proxy. The status of the economy is only one factor considered by investors and often it is not the most important. Many investors are engaged in the market for very short periods of time and are seeking very quick profits. They react to small changes every day and can be either spooked or encouraged by the smallest of motivations. The overall trend of the market for the past year or so has been very positive. There has been little mystery as to why this has been the case. The primary issue has been that this growth is not sustainable. The very fact that the market was growing as fast as it has been was the seed of its ultimate destruction.

Analysis: In the simplest of terms, the market surged because there was a significant stimulation undertaken by the government in the form of a big tax cut. There is nothing unusual about a tax cut to stimulate an economy—it is the tried and true technique that is employed every time there is a recession or downturn. What made this one unusual was that it came so late in the process. If there had been a desire to make a maximum impact on the economy, the tax cut would have come much sooner—2015 or even 2014. This would have meant that the fiscal side (Congress) and the monetary side (Federal Reserve) would have been working in tandem. As it stands, the Fed was doing all the heavy lifting for the bulk of the recession and Congress was almost an afterthought. The problem with this late response is that the economy was already doing pretty well with growth of around 3% a quarter through most of 2017. The surge in growth in 2018 from the tax cut was akin to a sugar rush.

The business community had several options as far as the tax cut was concerned. Had the break occurred a couple of years earlier, the majority of the corporate community would have been in some financial distress and the tax cut would have allowed them to ease a bit of that pain. There would have been fewer layoffs, fewer closures and fewer draconian cost-cutting moves. As the tax cuts came after growth had recovered, the majority of the money was used to buy back stock. This was certainly a good move from the internal corporate perspective, but it caused a surge in the markets that was fundamentally unsustainable. The Federal Reserve played a role in all this due to the low level of interest rates. There was indeed corporate borrowing taking place as intended, but the majority of the money was used to buy back even more stock—thus driving the markets even higher.

Today, there is a real problem in terms of corporate debt. All these years of cheap money led to excessive borrowing. That debt level is $9.1 trillion—up from $4.9 trillion in 2007. Very little of that money was used to improve the competitive position of the businesses that borrowed that money. Now, they are vulnerable to higher interest rates—even small ones. This is making investors nervous about the state of these companies, which helped trigger the market volatility.

The second issue that stems from the tax cuts is the fiscal position the U.S. is in as a result. It was acknowledged at the time of the cuts that this action would create a deficit problem—the report from the Congressional Budget Office was more than clear. One of the assumptions was that Congress would react to the revenue reduction with sufficient belt tightening to keep the deficit at levels that might be addressable through additional growth. That did not happen. There has been even more spending than before. Much of it has come from the new policies put in place through the year. Money has been poured into compensating farmers for trade losses, border security, additional military hardware and even a space war initiative. The fact is the government has been taking in far less and spending far more. That the U.S. is running a record deficit during times of economic expansion is staggering—the height of poor revenue management and a situation that leaves the U.S. very vulnerable in the event of a next recession.

Beyond all this, there are the "triggers" for market unease. These do not motivate everyone and there are varied reactions. The point is these are all factors that make investors uneasy. All can be traced back to decisions made by President Trump in the last few months: withdrawal of troops from Syria, resignation of Defense Secretary Mattis, government shutdown, attacks on global institutions such as NATO, trade war with China, attack on the Federal Reserve, Russia investigation and fears of an impending recession. None of these may have a serious impact on investors or all of them might. It is a matter of mood and confidence.

Time

It seems that a lot of people were doing the same thing I was doing this week. The period between Christmas and New Year is a time to catch up on all those duties there seems to be little time for during the rest of the year. A lot of people are taking breaks, on vacation or home from school. I was doing tasks such as getting an eye exam, repairing watches, exchanging gifts, etc. The lines were all far longer than would usually be the case and people were venting.

There was the inevitable complaint about doctors and their seeming lack of interest in anybody else's time. One older guy was ranting and raving about his last visit to the doctor and how he was kept waiting. In the middle of this diatribe his wife leaned over to two of us waiting to get our watch batteries installed. "Yeah—he complains about their timing, but who is it that jabbers away at the poor doctor for 20 minutes with his list of ailments? I would hate to be the person behind us." There is the crux of the issue—we all love that time and attention when it is focused on us, but hate it when somebody else is getting it and we have to wait.

We are now at the end of the season when we are reminded to be kind to one another. For many that seems to be the signal to revert back to our self-absorption. Too bad we can't carry some of that goodwill to the coming year. Patience has never been a virtue I can lay claim to, but this is the time of year for resolutions and attempts to alter one's patterns. I think my big goal this year is to find some of that missing patience—with people, with myself and in other manifestations.

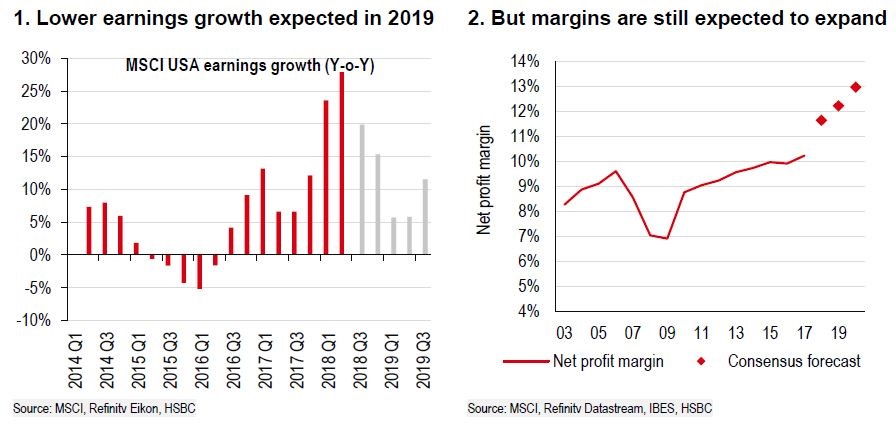

2019: Lower Earnings, Expanded Margins

According to the bulk of the stock analysts there are three factors that should be worrying the market bulls at this point. It is not that a total collapse is inevitable, but the warnings are more urgent. The first is that earnings growth has been more anemic than would have been expected at this point. The second is that the Fed still has plenty of reasons to continue hiking rates even as the market falters. The inflation signs are there and have started to accelerate. The third warning is that government gridlock looks certain for the next two years as Trump has adopted a very hostile stance towards the Democrats and vice versa. The chances for cooperation on any front are very slim.