Strategic Global Intelligence Brief for December 26, 2018

Short Items of Interest—U.S. Economy

Strong Retail Numbers

The expectations for this year's retail season were pretty high at the start. There had been a pattern set already with strong back-to-school numbers and then a strong Halloween. The November numbers looked good, but there was some concern retailers were limiting themselves with another year of light inventory. It seems there was still enough demand and opportunity to make the season a very solid one—best in over six years. The consumer was back to their old ways in many respects—heavy use of credit cards, lots of luxury purchases and more spending per person. Now the challenge will be to keep some of that momentum going into the new year.

Farm Country Fear

The single-most international sector of the U.S. economy is agriculture. This has been the case for many decades. The U.S. may well be one of the fattest nations on earth, but even we can't eat all the food the U.S. farmer produces. The export sector of the U.S. is heavily dependent on the sale of farm goods. Of late, the trade wars and tariffs have been hitting the U.S. farm sector hard. The loss of China due to tariff wars is well known, but now there is worry about what happens with Japan. The Japanese have been opening up their market to Europe and other Asian states. That has been limiting the amount of food the U.S. can expect to send. The fear is that farm exports are going to take the biggest hit in these trade wars.

Mexico Will Pay (Indirectly)

The campaign promise made by Trump was nonsense from the start. The U.S. has no ability to force another nation to pay for a wall or anything else. The promise has since been hung around the Trump White House like an albatross. The assertion now is that the wall will not be paid for directly by Mexico, but indirectly from the savings and revenue generated by the new version of NAFTA. Assuming the U.S., Canada and Mexico ratify the USMCA, the assertion is that the U.S. will save all the money it needs for the wall to be built. The problem thus far is that no independent economic analysis shows that there will be anything close to that much money saved or earned.

Short Items of Interest—Global Economy

Retail Slow in the U.K.

While the U.S. retailer is enjoying the best holiday spending it has seen in six years, the same can't be said for the U.K. The high point of the British retail calendar is Boxing Day—the day after Christmas. The data shows that sales have been slow and far below original projections. The consumer reports they are worried about the impact of Brexit. That has made them cautious about their money and taking on more debt.

Dramatic Slowdown in Factory Employment in China

There has already been a reaction from the Chinese when it comes to the trade fights with the U.S. Exports have been falling for the better part of a year as the tariffs come into effect. This has led to a slowdown in the manufacturing sector. This has, in turn, caused issues as far as employment is concerned. Many operations have stopped adding workers and others are laying people off. It has also been noted that China has been adopting the same kind of robotics and technology that led to job elimination in the U.S. and in Europe. The Chinese government has always worried intensely about jobs. This is a trend they do not want to see.

Nationalists in Italy Back Off

Now that the Northern League and the Five Star Movement are trying to actually govern Italy the rhetoric is changing and fast. The leader of the Northern League was deeply opposed to the euro, but that has now been dropped from the party platform. There has been a different attitude towards the EU as a whole and even some wiggle room on the issue of immigration as the two parties try to expand their coalition a little.

Critical Elections Around the World

There are several nations that will be going to the polls in the next few weeks. These elections will have a major impact on the future of these states and the countries with which they interact. In Israel, the coalition that has kept Benyamin Netanyahu in power has been fraying and finally declared an end to its unity. There will now be early elections in April. Most are looking at this contest as a referendum on Netanyahu himself. A big part of the issue is that he may be under indictment on at least three charges of corruption. If this takes place, he will not be legally allowed to hold the prime minister's position although he could continue to lead the coalition and his own party.

In Bangladesh, the voters will decide whether to extend the life of the current government which has been in power since 2008. Sheikh Hasina has led the Awami League for the entire period and has a lot of economic growth to show for this time in office. But to many, this progress as come at a steep price as she has become ever more autocratic and has been accused of eroding many of the nation's institutions.

The third election may never happen and has been delayed several times already. The Democratic Republic of the Congo (DRC) was supposed to have gone to the polls last year, but current President Joseph Kabila has found many reasons to stay in power. He was slated to leave in 2016, but has declared one crisis after another and stays on. The latest excuse was provided by a fire of mysterious origin that ostensibly destroyed the majority of the nation's voting equipment and ballots.

Analysis: In every case, these elections could bring new leadership to some troubled nations, but in all three countries, the problems go far beyond the political. Israel has been intensely divided over the way to respond to the Palestinian issue. It is not that the Labor Party opposition is pro-Palestinian, but they assert that Israel needs to find ways to work with people from the other side and assert that some Palestinians are more amenable to that cooperation than others. The Likud approach has been rooted in total rejection regardless of faction. This has seemed to only escalate the tensions. Netanyahu has seen his popularity decline in all but his core supporters, so the issue is whether the centrist voters can be brought back to the Likud fold. Should he lose and Labor win, the equation shifts in the region. That will alter a whole slew of relationships involving Iran, Turkey, Saudi Arabia, Jordan and Syria.

Bangladesh is at a potential crossroads as the tariff and trade war between the U.S. and China gets more intense. The U.S. business community is already frantically searching for alternative sources for the products it imports from China now. In past years, the U.S. did a lot more business with Bangladesh, and that could happen again. The Awami League has been good for business, but has been criticized for being too harsh and unwilling to take stands against the businesses that want to set up operations in the country. Right now, it looks favorable for Hasina to stay in power, but the opposition was making strides in the last few weeks.

Kabila doesn't really have any intention of moving from office in the DRC. He was forced to call these elections by the international community. He can't survive without aid and support from the rest of the world so he caved and declared he would step down in 2016. That did not happen and he remains in power. The nation is one of the poorest in Africa, but it also has a great store of raw materials that consistently attract the attention of the world. These business interests would love to see stability in the country so that these riches might be exploited, but that doesn't look likely anytime soon.

Japan to Resume Commercial Whaling

The Japanese decision to pull out of the International Whaling Commission (IWC) ends any shred of effectiveness the IWC had. The major whaling nations are all outside the IWC now. Norway and Iceland pulled out years ago and formed their own group. The only members of the IWC are those states that gave up whaling altogether. The Japanese asserted the IWC was only interested in a ban on whaling rather than on management.

Analysis: The demand for whale meat in Japan is now non-existent and the majority of what is taken ends up in storage. The issue is a hot button for Japanese nationalists who resent the idea of being controlled by some foreign body. The whaling industry is very small and contributes little to the economy. It has become a symbolic issue rather than a business or an economic one. Now, Japan has to decide if the decision is worth the criticism it has been receiving.

Picking Fights and the 2019 Economy

As the dust was settling from the 2018 election, there was considerable speculation regarding what would change politically that would be relevant to the performance of the economy in 2019. In many ways, the change in the status of Congress would be irrelevant. Consumers would still likely spend, business would still grow and hire, investors would still buy stocks and bonds, people would still buy homes and life would go as before. But a change in the national political conversation would have an impact—both short and long term. Laws would be introduced and changed, there would be budget battles at various intervals and there would be actions taken that would affect trade. One of the big questions concerned the reaction of the White House. Would President Trump shift gears and try to work with the Democrats on issues where there might be common ground or would he adopt an even more confrontational posture and retreat to his base of support. Based on the weeks since the election, it would appear that his strategy has been to intensify the confrontation. This is not the path that many in the business and investment community had hoped for.

Analysis: The most significant economic development thus far has been the collapse of the stock market in the days prior to Christmas. The 3% fall on Christmas Eve was the worst one-day drop in history and the markets are heading for Great Depression territory at this rate. The sense at this stage is that a rally is likely this week, but it will not provide a full recovery. It is also likely there will be more days in the future when the markets fall. There is no one thing that is causing panic. The decline is taking place despite the fact there has been good economic news of late. The jobless rate remains low, the retail sales numbers have been the best seen in years, and there have been decent indicator numbers in everything from capacity utilization to the PMI and CMI indices. What has triggered the market meltdown? It seems to be an anticipation of confrontations to come—arguments over trade and tariffs that will launch a real trade war with China, an extended shutdown of the government over a border wall dispute, an attempt to bully the Federal Reserve and so on.

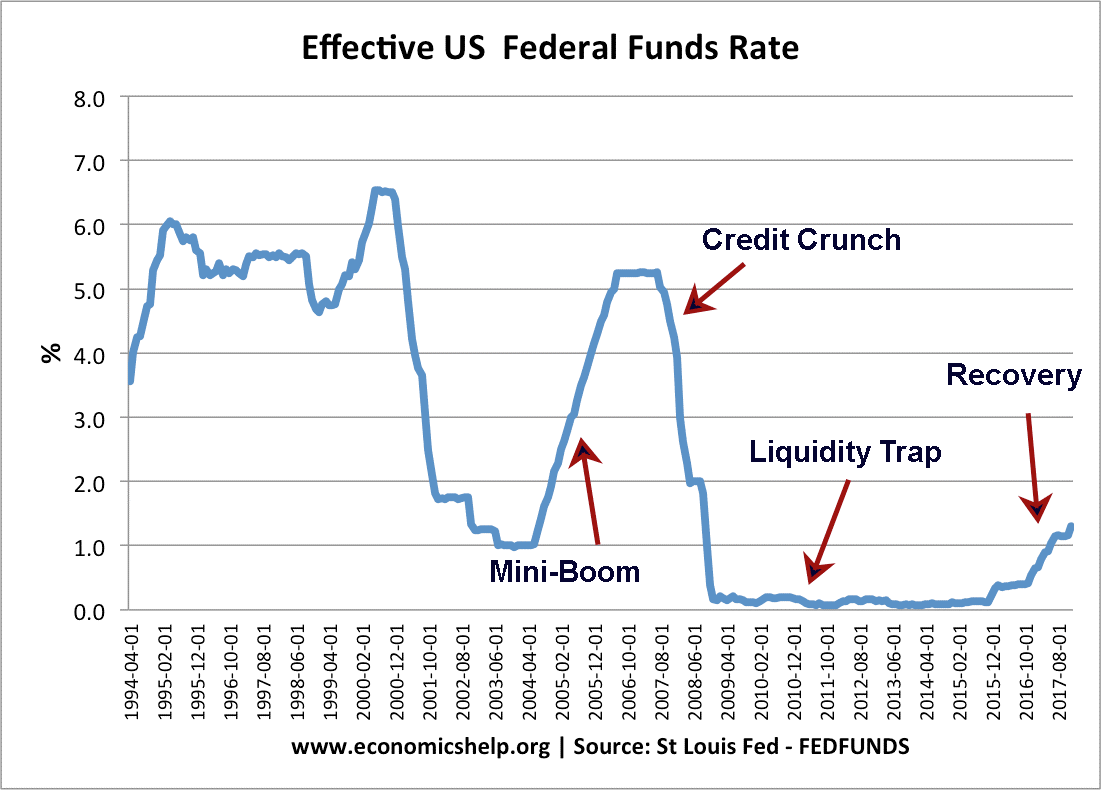

The assault on the Federal Reserve is one of the most distressing of these confrontations. Trump has threatened to fire Fed Chairman Jerome Powell. This is not something that President Trump can do, but he might be able to demote Powell and elevate the Vice Chair to the post (although this is not certain). His position is that the Fed has hiked interest rates too high and too fast. This position is not shared by the vast majority of economists as the rate policy that has been developing has been very conservative. Picking a public fight with the Fed is destabilizing regardless of what policy changes are made as it throws Fed actions into doubt. If rates are raised is it the Fed telling Trump to back off? If rates do not rise is it the Fed yielding to pressure? The independent activity of the central bank gets called into question.

The fight over the border wall is another area of concern down the road. The issue of border security has become a litmus test politically and has lost much of its relevance to actual security. Analysts from the law enforcement community have indicated that a wall is perhaps the least cost-effective solution. They emphasize everything from electronic surveillance to increased patrols and actively working with Mexican authorities as opposed to a structure that is expensive to build and can easily be scaled, broken or tunneled under. The Trump position on the wall had started to soften, but then that position was attacked by the rabidly anti-migrant social media outlets and Trump reverted to his defense of the wall. It worries many that President Trump has vested too much in that core base. It limits what policy positions he can take.

Finally, there is the issue of trade. The business community worries that these spats will become a full-on trade war that isolates the U.S. from trading partners in Europe and Asia. China is not the only country that has been affected by the war over tariffs and trade. The U.S. is at odds with ally and enemy alike. It has been manifested in reduced levels of exports. It doesn't help that the dollar has been gaining strength against the currencies of these trading partners, but the U.S. has been hostile to nations that were once significant economic partners.

What Does President Trump Think the Fed Doesn't Understand?

The attacks on the Fed coming from President Trump have not been all that detailed. The tweets have suggested the Fed isn't "feeling" the market and is relying on numbers. The criticism from Trump is a little odd as he has appointed nearly the entire Board of Governors—including the chair. Shortly after he took office, he had six vacancies to fill on a seven-person board. Not all of them have been confirmed as yet, but besides Powell, the list includes Randy Quarles, Michelle Bowman and Richard Clarida. Lael Brainard was the only holdover and Marvin Goodfriend and Nellie Liang are waiting for confirmation. All of them support the current interest rate policy.

Analysis: President Trump's assertion is that Fed policy is the only challenge the economy faces. This is not, however, an opinion shared by investors or the business community as a whole. They would cite trade wars, tariffs, labor shortages, threats of inflation, debt and deficit, poor infrastructure and regulatory pressure as far more important. The plain fact is that interest rates are still historically low and there has been no sense that banks are pulling back on loans or that companies are avoiding debt because interest rates are too high. If the rates were really a major factor, there would be a stampede of companies seeking loans now before the rates rose further. That has not been the case.

Cats and Christmas

Every year about this time, there will be a flood of cat videos that show the desperate conflict between the feline and the Christmas tree. It usually shows the arboreal slaughter. I have had eight cats over the years sharing space with the tree and not one of them has been a climber nor do they take to attacking the ornaments. Getting under it is big fun, but that is so they ambush each other. Each year we wonder how they will react to the arrival of friends and family and each year we are surprised to some degree. The most social has been the eldest—Sven. He was the cat we inherited at 16 when my mother died. His transformation has been astonishing as he went from a surly and grumbling cat to the life of the party. This year he was joined by Scoot. She has been on the periphery before, but this year she was determined to be the center of attention. The other two stayed true to form and hid all night.

With the passing of Snip a few months ago, we have been a four-cat family, but that may be about to change as we spotted a truly adorable little guy on the website of our favorite shelter. He is a Maine Coon mix and reputed to be very shy. He will need a patient person, but seems to get along with other cats. We aren't sure we will get him as we put in a request on Christmas Eve and have not heard back yet. I shall keep you posted as to whether we will be back to the feline five soon.

Federal Funds Rate Remains Low

It should be pretty clear by this time that the Federal Funds Rate remains historically low. This chart shows the rates since 1994; however they have not been as low as they have been for the last several years. The fact is that even with some of the proposed rate hikes for next year the Fed will have kept them lower than has historically been the norm. If one goes back even another decade or two, the rates will be even higher. There is little to suggest that rates of around 3% is a problem for the economy as long as there is the rate of growth the U.S. has been enjoying of late.