By Chris Kuehl, NACM Economist—

Short Items of Interest—U.S. Economy—

Durable Goods Slide—

Most of the news from the consumer has been pretty solid of late. There have been good retail numbers and consumer confidence has remained strong. That hardly means there is nothing for the dismal scientists to worry about. The latest data on durable goods shows some weakness with a 2% drop rather than the 1.2% gain that had been expected. In some respects, this should have been expected given the four straight months of decline in the Purchasing Managers' Index. The majority of the decline was attributed to the 35% dip in purchases of military equipment. If this rather volatile category is eliminated, the sector actually gained by 0.8%. The most significant issue as far as civilian activity is concerned is in big ticket consumer buys such as recreational equipment and electronics.

Fudging the Car Loan Numbers

When one looks at the factors that led to the housing sector debacle a decade ago, there were several that stood out. Chief among these were moves by banks and other lenders to make applicants look richer than they really were so that they could qualify for bigger mortgages. That same pattern is now being observed with car loans. The prices of new vehicles have soared and consumers are struggling to afford them. This is creating pressure on lenders to make the consumer more palatable and has led to people getting car loans that are proving to be a burden. If there is a downturn any time in the near future, this will be a big problem and quickly.

Steel Plant Shut Down

Business is complicated—the understatement of the year. The Trump approach to assisting the steel industry was simplistic and, as it turns out, ineffective. The assertion was that tariff protection of U.S. steel production would be enough to bolster the sector. The 25% tariff on imported steel was uneven from the start—with a whole series of changed plans. The real problem is the Trump trade policy has been hard on export-oriented manufacturing and that has affected demand for steel. That sagging demand has meant steel prices have been falling. Now the steel operations are closing and laying people off anyway.

Short Items of Interest—Global Economy

Australian PM Faces Mounting Criticism

The last eight weeks in Australia have been the worst weeks for wildfire in recent history. The crisis has claimed thousands of acres of land, structures and lives. In the middle of the crisis, Australian Prime Minister Scott Morrison elected to take a vacation with his family in Hawaii. At the same time, he has declared there will be a change in the country's climate change policy despite the fact that he has acknowledged this change has had an impact on the wildfire threat. Morrison has been loyal supporter of the coal industry in the nation and will not accept further limitations.

British Pound Sinks Again

In the days after Prime Minister Boris Johnson won his election, the markets were excited in the U.K. and the pound rose in value. Now, the reality of what lies ahead has started to sink in. Brexit is going to be a mess and chaotic regardless of the Johnson win. The EU is not interested in compromise and a hard withdrawal is nearly certain. The expectation is GDP growth will fall as much as 3% and some have it down by 5%. This means the U.K. will head for a real and extended recession.

Japan Worries About Olympics

Over the decades, it has been made very clear that hosting the Olympic Games will be a monetary disaster. The only one to make money was the Salt Lake City Winter Games run by Mitt Romney. The Games in Greece and Brazil literally bankrupted the countries. Now Japan is starting to wonder whether it is too late to get out of this. There are ways to lower the costs, but that comes at the risk of making the nation seem less than prepared. Japan doesn't want unfavorable comparisons to either China or South Korea.

China Making the Right Moves

This is certainly the impression thus far. On January 1, the Chinese will be drastically reducing tariffs on a wide variety of goods. In some cases, the tariffs will be eliminated altogether. These cuts are not aimed at U.S. goods specifically, but there are many items the Uniform Data System (UDS) sells that will be affected. The tariff cuts will lower rates to below even those that have traditionally accompanied "most favored nation" status and will impact over 50 nations in the weeks to come. Some of the biggest cuts will be to farm goods. That will likely have the most important impact on the U.S. The Chinese now need to import a great deal more pork and food in general as they work to rebound from the swine flu outbreak. There is also a desire to bring in more tech and even some consumer goods. Just as the Western nations gear up for the holiday season and a strong retail reaction, there is a focus on New Year in Asia. China seems determined to provide the stuff that the Chinese want to buy as they make their annual trek back to their ancestral homes.

Analysis: There are two major questions hanging over this announcement and the deal that has supposedly been struck between the Chinese and the U.S. The first and most obvious is whether China will actually live up to its end of the bargain (and by the same token—the U.S.). It will be hard for China to back away from the tariff reductions, but there will always be other trade barriers that can be employed based on Chinese regulations and restrictions. In the past, the Chinese have rejected U.S. farm output over issues such as quality or the use of GMOs. The U.S. has agreed to limit tariffs and perhaps even to reduce them, but Trump has been very capricious regarding these tariffs and they could reappear with a tweet.

The second major question for the U.S. is whether the reduction in tariffs will position China better in the global market than the U.S. is right now. The Trump trade policy is clearly protectionist and confrontational and not just towards China. Threats have been made and carried out against Europe, Japan, South Korea, Brazil, Canada, Mexico and many others. There is not a nation in the world that has escaped the trade wrath of the Trump approach. Does China's move to lower tariffs this dramatically signal they intend to replace the U.S. as the favored trading nation? They lack the consumer base to replace the U.S., but they still have 300 million to 400 million people who would be classified as middle class with all the middle-class desires that come with that title.

Brazil Resurgent?

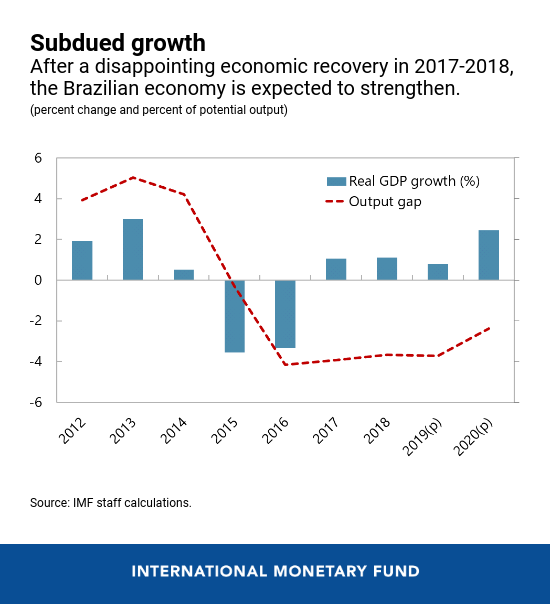

The economic news from Brazil has suddenly started to reverse. For the last several years, the story has been a bleak one with a long and grinding recession that sapped the consumer of confidence. The U.S. may be the most consumer-centric of nations (roughly 80% dependent on that activity), but Brazil is not far off with an economy that relies on domestic consumption for at least two-thirds of GDP. The policies pursued under previous leaders led to a triple crisis for Brazilians—high rates of unemployment, high rates of inflation and a subsequent loss of optimism regarding the future. Many still point to the twin debacle of the Olympics and the World Cup as triggers for the malaise. The grand gestures fell flat as the country spent 10 to 15 times as much as it made. Taxes were hiked to pay for it and billions of dollars were diverted. There has also been criticism of the policies that favored government workers and imposed regulations on every aspect of commercial life.

Analysis: Much has been made of the controversial outbursts from the "Tropical Trump"—President Jair Bolsonaro. His statements and antics have done their share of damage to the country's reputation, but the economic leadership has been left to Finance Minister Paulo Guedes. His ambitious reform effort has centered on a combination of fiscal rectitude, deregulation, privatization and close cooperation with the central bank. The government had been spending more and more money each year under the center-left regimes of Inazio "Lula" da Silva and Dilma Rousseff and had been hiking taxes to pay for this. At the same time, the regulatory system had grown exponentially with measures designed to address everything from climate change to indigenous people's rights to urban poverty and crime. Not that these issues are not important, but the regulatory environment had become suffocating. The state-run or managed operations became centers for graft and corruption, and productivity slumped. Under Guedes there have been austerity budgets, a significant reduction in regulation and some major efforts at privatization. The result thus far has been a higher level of employment, higher wages and improved levels of consumer confidence.

This has not been without controversy. The budget cuts have fallen on social programs primarily. The deregulation has led to extensive burning of the Amazon and there have been strenuous objections from the unions and others over new work rules. Productivity is up and that has meant more consumption. As people give credit to Guedes, there is also the fact that Brazil has benefited from global situations. The demand for soybeans has been on the increase as the Chinese raised tariffs on U.S. output and the Boeing mess has been good news for Embraer in many markets. Even the lurch back to the left in Argentina has been a boon to investment in Brazil.

Modi Doubles Down

The protests and demonstrations in India have not subsided despite the aggressive response of the police and elements of the military. These now constitute the most intense challenge Narendra Modi has encountered since taking office. The center of the controversy is a new citizenship law that discriminates against Muslims in India. Modi's political organization is the Bharatiya Janata Party. It has long been an overtly Hindu nationalist group. As Modi has seen the economy stutter in the last year, he has started to lose support from the business community and has been required to turn back to his base. That is a core of supporters who place antagonism towards the Islamic population at the top of their list of priorities.

Analysis: These protests have already started to morph into riots and the violence has been spreading. The fear is that these will become the kind of tit-for-tat attacks that have marked relations between the Hindu and Muslim populations in the past. Modi's rise to power was marked by these nationalistic attacks during which thousands of people were driven from their homes. Gangs of Hindu nationalists attacked Islamic communities and there were counterattacks on Hindu communities.

There will also be issues between Pakistan and India as a result of these incidents., Kashmir has been flashpoint for many years and never really settles down. It has been a major center for these riots and protests and can easily drag the two nations into a more open conflict. The whole region has been unsettled as major powers exert their influence. The U.S. is trying to extricate itself from Afghanistan and India fears the resurgence of the Taliban there. China is also locked in a trade war with India and Russia has inserted itself into the mess as a hedge against growth of Islamic influence in Central Asian states that are still nominally allies to the Russians. The ferment shows no signs of abating.

"Growing Your Own"—Response to Lack of Workers

Throughout the conversation regarding the shortage of workers, there have been those who have asserted there were two easy solutions to the dilemma. All a company had to do was pay prospective employees much higher wages and agree to take people on who will need to be trained. This is a very naïve suggestion as it assumes that every company has an unlimited ability to pay people—even those that are not productive. It doesn't seem to occur to these critics that a company that plans to pay an untrained person a high wage is going to have to pay the experienced existing staff far more as well. The average company does not have a profit margin to sustain that strategy.

Analysis: There has been a rekindling of the training approach. There are many companies now starting up their own schools and training programs with an eye to developing a reliable future workforce. They are not being paid what the existing staff is paid, but they have the ability to move up over time. The trainee usually has to make a commitment to the company for a set period of time (but that requirement has been challenged in some states already). The biggest problem thus far is that there are few Millennial-age takers and even fewer from Gen-Z. The majority of those involved are in their 50s and even 60s as they seek to start new careers. The companies are worried they will lose these new employees to retirement too soon, but given the pattern of the Millennial worker, these older employees may end up staying longer than the younger workers.

Consumers Still on a Roll

The latest numbers for Personal Consumption Expenditures (PCE) shows that consumers are not slowing down much as the year ends. The PCE rose by 0.4%, more than had been expected. The rise was partly due to the rise in personal income—up 0.5%. Compared to last year, spending is up by 2.4%. The retail community would be far happier about this if they had not made the decisions they did earlier in the season.

Analysis: As the retail season was developing—back last summer—there was an expectation that growth would be slow this year. Thus, there was a decision to go into the season with an "inventory light" approach. That was combined with a decision to offer very deep discounts as a way to capture the early shoppers. It worked, but the early shoppers are the ones that react to the sales and rarely buy anything else. The result has been good news from a revenue point of view, but not such good news when it comes to profits. There will be a lot of retailers that will come out of this season with great sales numbers, but without the real income they needed. The fact that many goods have been more expensive due to the tariffs has been a factor as well. Many companies are choosing to absorb the tariff hike so they can avoid loss of market share and that will come back to bite them.

Random Christmas Thoughts

The general population tends to fall into two very broad categories this time of year. I choose to call these two categories Hallmark movie people and curmudgeons. On the one hand, you have the Hallmark movie person who has been binging on stories that invariably involve ice skating, snowball fights, hot chocolate and impossibly lovely people. On the other, you have the people who walk around muttering about crass commercialism, dysfunctional families and the pure stress of making merry. In the interests of full disclosure, I am in the former category and have watched about 300 of these movies (or maybe it was 10—they kind of run together).

Yesterday at the grocery store, both varieties were in evidence. There was the woman with a giant sugar cane in her basket. I asked what it was used for. Seems it is part of a Mexican holiday punch. We chatted about the fun and challenge of holiday meals. I assured her I had little or nothing to do with this preparation—that falls to my chef/wife. I am just the errand boy. Next up was a frail little man struggling to get to the upper shelves. I helped and asked what he was planning. Seems he is still the cook of the family at 92. "I have tried to let kids and grandchildren handle this, but people that live on microwave pizza and fast-food burgers can't cook worth spit. I am the only one who knows the Hanukkah dishes, so here I am." I helped him gather stuff and wished him good luck.

The curmudgeon showed up as I was leaving. He ran over an elf in his truck and never even slowed down. Two young lads righted the slightly dented elf, but he seemed able to carry on after his unfortunate encounter with Scrooge McTruck.

Subdued Growth in Brazil

The economic slump in Brazil may be finally coming to an end, but there is no sense that a major surge is imminent. There are just too many issues and problems to suggest another boom. The good news is that an end to the slide will allow the country to catch its breath. That will be good for the other nations in Latin America as well that depend on the Brazilian market for either imports or exports.