Strategic Global Intelligence Brief for December 20, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—US Economy—

Even the Doves Are Satisfied—

It has been no shock that various hawks on the Fed's Open Market Committee have been calling for an end to the lowering of rates—Esther George and Eric Rosengren have dissented against the cuts three times in the last several months. There had been some dovish remarks made in those same months, but as the Fed looks towards 2020, even those doves are signaling that rates are where they should be and don't need to fall any further. It is not that anybody sees any new threats of inflation to worry about, but they simply don't see any benefit from taking rates down at this point. Business borrowing is down and the banks are making it clear this is not because the rates are too high—it is simply that these companies are not seeing demand.

Losing Two Key Advantages

The U.S. has long enjoyed a pair of advantages that other developed nations have not. The U.S. has had a far higher fertility rate than either Europe or Japan—since the end of the Second World War. The Baby Boom was a real thing and the other nations had lost millions of their men to war. That boom is over and the U.S. is now under replacement level. The U.S. also once had a welcoming attitude towards immigration. That has eroded to the point that migration of needed workers has slowed to a trickle. The worker shortage crisis is already acute and it is going to get worse.

Expansion Will Survive Through 2020

The U.S. is still enjoying the longest economic expansion it has seen in decades. This is the 11th year for this one and there will be at least another one to add to that track record. The expectation is there will be growth of between 1.7% and 2.1% next year—not great and not as fast as has been the case in the last few years but respectable. The expansion over the last decade has been subdued and simply has not carried the seeds of its own destruction—no burst of inflation sufficient to trigger an attempt to slow the economy.

Short Items of Interest—Global Economy

Australian Wildfire Crisis

The summer has been brutal in Australia. The heat has combined with years of persistent drought to create a major wildfire emergency. The fires have blanketed the country with dense smoke and affected major cities like Sydney. The population has been unable to get outdoors as is the custom this time of year. That has had an impact on retail and other businesses. Dozens of outdoor events have been canceled and power demands have surged as people rely on their A/C to fend off the bad air.

Ecuador Gets More IMF Help

The International Monetary Fund (IMF) has agreed to release another $500 million to Ecuador as part of a $4.2 trillion promise. The left-of-center government has continued to pursue the austerity budgets the IMF has required despite the mounting pressure from protestors. The government has been aided somewhat by the fact that there is no opposition calling for this plan to reverse. The left is in control and the right supports the austerity plan as well. The hope is this IMF aid allows for some short-term relief to current budget crises.

Shift in Alliances in North Africa

Libya has been in utter chaos since the deposing and death of Muammar Qaddafi. The tribal nature of Libyan society has been on full display and it is unclear what faction has control over what. The Egyptians have been trying to influence, but now they are watching Turkey get involved with support for the official Libyan military. This sets up some very tense relations between Turkey and Egypt, but this seems part of a bigger push by Erdogan to influence the region. He has been heavily engaged in Syria and has also meddled in Iraq while courting better relations with Russia. His relationship with the U.S. is in shambles and he is not all that popular in NATO or Europe either.

Does Impeachment Matter—Economically?

This issue is delicate to say the least. It is not as if I can ignore politics when discussing economic issues as there is always a political element to economic policy decisions and the state of the economy plays a major role in elections. On the other hand, I do try to stay out of the purely political and partisan realm. I bring up the question of the impeachment of Trump because I have been asked about this at every talk I have given of late.

Analysis: The short answer is the impeachment issue is unlikely to have any impact on economic growth in 2020. The bottom line is the outcome is a foregone conclusion and has been from the start. The Democrats in the House voted to impeach, but the GOP controls the Senate and they have all but declared they will not find Trump guilty. The behavior of the markets in the last few days signals that even nervous investors are paying absolutely no attention to this drama.

If there is an impact, it will come indirectly. The driver for the economy over the past year has been the consumer. If this trial makes that consumer nervous and concerned enough to slow down their spending, the economy will react unfavorably. The consumer has already started to show some strain and has begun to exhibit some caution, so it is not out of the realm of possibility that political division might add to that nervousness. In an election year, it is more likely that the actual campaigns will have a bigger impact—especially after the primaries are over and it becomes a two-person race.

New Head of the Bank of England

The debate over who should replace the retiring Mark Carney has been dragging on for nearly two years. The choice is always an important one and there have always been many candidates, but this time the whole process has been affected by the Brexit issue. The next head of the Bank of England (BoE) is going to have to steer the U.K. through a very rocky economic transition. There had been a desire to put off the final decision until there was some certainty regarding Brexit. Some concluded that Prime Minister Boris Johnson's big win was sufficient to ensure some version of Brexit. The next head will be Andrew Bailey. He has been with the BoE for most of his career and currently holds the position of chief of Financial Conduct Authority. He has held a number of positions at the BoE, all of them have been engaged in various aspects of regulatory activity. He has been described as a "safe pair of hands."

Analysis: When Mark Carney was picked to head the BoE eight years ago, there were some gasps of surprise as he became the first head who was not British. He had been the head of the Bank of Canada and was selected in part because he had managed to keep Canada from sliding into the recessionary mess that had been gripping the world. He was also seen as somewhat high profile. Bailey is not high profile and has a long reputation for being careful and almost taciturn. He will continue to work with the other Board members. The BoE remains a consensus-based organization, but he will be the face of the institution and the man who will work with the other major central bank heads. His style will definitely be in contrast to the European Central Bank's Cristine Lagarde and more similar to that of Chief Jerome Powell at the Federal Reserve.

The first challenge will be over how much stimulus the economy will require once Brexit is implemented. The reports from the BoE thus far have been bleak as they assert a decline into recession in 2020, likely a deep one with growth rates down by as much as three-to-five percentage points. There is not much room to lower already low rates. That would mean more creative responses—everything from bond buys to incentive programs. It is also expected that many banks will get in trouble with a sharp increase in nonperforming loans.

Do These Trade Deals Change Much?

There have been two significant developments as far as the U.S. and global trade patterns are concerned. After almost two years of wrangling, the House of Representatives has passed the USMCA and after almost a solid year of often hostile negotiations the U.S. and China have declared a truce in the trade war. Does this mean that the U.S. is back to what used to be considered normal as far as its role in the global trade community? Unfortunately, that does not seem to be the case. Neither of these deals has impressed the investment or business communities although it is a possible step in the right direction.

Analysis: The shakiest deal is with China as there have been very few details revealed thus far. China has supposedly agreed to buy considerably more farm output from the U.S., but even in the statement of intent, there were qualifiers. The imports will have to meet their quality standards and there has been no indication as to timing. The U.S. has agreed to hold off on additional tariffs and will consider reducing some, but none of these moves are off the table and Trump has a record of arbitrary action. The Chinese are well aware he can impose them again anytime he feels inclined to do so. There is no trust between the two nations. The fact remains that both Trump and President Xi benefit from this tariff war when it comes to politics. Trump gets points from a base that despises China and Xi gets support from nationalists that dislike the U.S. and its influence.

The USMCA is not quite as vulnerable, but it is no sure thing. In order to bring the Democrats on board, the pact was changed to include stronger labor protections in Mexico. This was not something motivated by deep concern for Mexican workers, but by the desire to keep U.S. companies from moving to Mexico to take advantage of cheap labor and lax environmental laws. Right now, labor costs in Mexico are lower than they are in China. That has made shifting business south of the border more and more appealing. Demanding better labor conditions in Mexico will drive up their cost of labor. The Mexican government is not opposed to workers getting paid more, but they do not like the fact that inspectors from the U.S. will be all over Mexico checking on these rules and regulations. The Canadians are still on board, but not with the same enthusiasm as was evident before. The pact will likely get approval, but in the end the differences between the USMCA and NAFTA are still very minor.

What Is the Future of the Gig Economy?

To begin with, there is a great deal of opinion regarding what exactly the gig economy actually consists of and these opinions vary widely. In some respects, there has been a gig economy for decades, but in the past, this was referred to as consulting or simply part-time work. The consultant sells their services to a variety of clients and is never considered to be an employee with all this would imply in the way of benefits and perks. The part-time employee rarely received the kind of benefits the full-time workers received, and, in many cases, people would hold more than one part-time job. The gig economy reference started to show up when technology allowed the development of businesses such as Uber and Lyft. What is under discussion in California is how people in this kind of business should be treated. To note that it is a highly controversial conversation is an understatement as decisions made to address the life of an Uber driver can and will affect the consultant and others that could now be classified as an employee—whether they want to be or not.

Analysis: It is estimated that around 15% of the California workforce is considered part of the gig economy, but that percentage could rise sharply depending on how the proposed law is interpreted. Is a freelance writer a gig worker? How about an entertainer performing in a bar on weekends? The kid that mows your lawn? Conceivably, they can all claim employee status and with that they can demand minimum wages, overtime pay, paid sick days, worker's compensation, set schedules and a host of other employee perks. At the moment only California is looking at this law, but similar bills are advancing in other states such as New York and New Jersey.

For every gig worker who seems to favor the change in status, there is one that detests the idea as they will lose the flexibility that came with the gig in the first place. The new system would require set schedules and no longer allow people to opt in and out as they desired. There would no longer be an option to refuse a passenger and prices would go up. This would very likely reduce or eliminate tips as has happened in other types of service work. People assume the employee is getting paid enough and no longer feel compelled to tip.

Regardless of what happens with this law there will be discussions regarding the intersection of technology and work for many years to come. The process is going to be very chaotic and messy for a very long time.

Home Sales Start to Recover

This sector is hard to overestimate. It is safe to assert that as housing goes so goes the overall economy. In the first half of this year that was a bit of a problem. The market had slowed even as the usual support for a robust sector was in place. Mortgage rates have been low, home prices have been stabilizing and even declining in some areas and the consumer seemed secure in their employment. As the data has come in for the second half of the year, there has been a nice little rebound. Now, the housing market is showing some new growth.

Analysis: The key to the difference in the two parts of 2019 seems to be the attitude of the new home buyer. There has been more interest in home buying from the Millennial generation and that seems to be related to the higher costs of renting. The reluctance on the part of the Millennial increased demand for rental units. That has strained supply—resulting in higher rental costs. Sooner or later people do the math and discover it would be cheaper in the long run to buy. The other driver of late has been severe housing shortages in fast-growing cities such as Nashville, Austin, Seattle and others. The next big concern for the housing sector will be the exit of the Boomer and their desire to sell off their existing homes—many of which are in the wrong place and without the amenities.

Season of Contrasts

This is a very weird time of year as far as messaging is concerned. In the space of a day, one will hear stories of kindness and generosity and people will be urged to be full of holiday spirit and joy. There will be toy drives, secret Santas and good will. In the next breath, there will be stories of how stressful the holidays are and how many people are lonely and abandoned. There are stories of all the new and creative holiday rip-offs to be wary of. I am getting at least a dozen scam messages a day by email and we now worry about "porch pirates" and hackers getting into our security cameras.

The retail community is in a frenzy as it tries to pry the last dollar from the consumer at the same time that people are being urged to remember the reason for the season (and it isn't supposed to be consumption). It is very hard to sort out the appropriate responses—party with colleagues one minute and argue with relatives the next. I have to confess this all does get to me. I want the peace and quiet and have been binging on Hallmark movies so as to hide from the news at the end of the day.

All we can do is focus on the good stuff, but that is a habit that should transcend the holidays. Soon enough we will go through the ritual of making resolutions for the New Year. I am going to try an early one. I am going to learn to disengage and leave the stress behind at some point in the day or week or month. I can't make all that craziness stop, but I can tune it out and appreciate the other stuff more—hugging my sweetie, cats on my lap, music, the beauty around me and the return of Dr. Who in January.

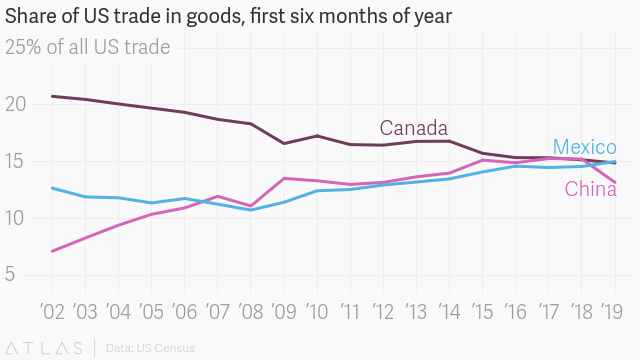

U.S. Trade in Goods

There is a lot of interest in this chart. It certainly shows that overall trade with the U.S. has been in decline as all these trade wars make an impact. It also shows that China trade has taken the biggest hit of late. China was a distant third in the early years of last decade and moved up fast. Canada saw a big drop and Mexico grew. Today, Mexico is on top and shows some signs of an increase into next year and after.