Short Items of Interest—U.S. Economy

Reaction From State and Local Level

It has taken a while, but the various stimulus efforts that had been undertaken at the start of the year have finally begun to pay off for the states and cities. They have seen some additional revenue coming in as result of the better business atmosphere and more consistent tax accumulation. The states and cities remain very dependent on sales tax and income tax. These both tend to fluctuate a lot through the course of a year. The new funding may be good news for those long-delayed infrastructure projects that everyone agrees the country needs. It has always seemed to be the case that something else took priority over these projects. It may happen that way again unless a concentrated effort is made to push these priorities.

Is the Fed Changing Its Mind?

There are many economic analysts who are trying to determine what is and what is not likely to shift the thinking of the Fed. To be honest, there has been nothing from the Fed itself that would suggest they are thinking any differently about rates than they did earlier this year, but they have acknowledged some changes in the factors they watch. The threat of inflation is far less robust than many thought it would be by now. There have been ongoing concerns regarding the strength of the dollar and some suggestion that headwinds might slow the economy in 2019. The Fed knows that it is a factor when it comes to interest rates and may want to be cautious if the housing sector looks even weaker next year.

Weather and Industrial Production

The level of industrial production does vary quite a bit with weather as the measure includes manufacturing as well as mining and utilities. It is the latter two that respond most to weather. The utilities generally like extremes of cold and heat. In the summer, they appreciate the use of air conditioning to lower temperatures and in the winter they like the opportunity to heat up all those homes. The mining category includes the oil and gas industry. These are fuels used more aggressively in the winter as well. The manufacturer doesn't generally care whether the weather outside is frightful or not.

Short Items of Interest—Global Economy

Xi Jinping Faces Criticism

The Chinese system confuses a lot of analysts. On the one hand, it is a very authoritarian system that has systematically concentrated power in the hands of Xi. It would seem that he would be quite immune to any critique, but the reality is his approach is being debated right now and there are more than a few serious critics. The objections are rooted in the way China has been handling some of the U.S. criticisms. It seems that many in the Chinese business community actually agree with the U.S. on many of these disputes and they want a more market-driven system. These ideas are being given a public airing. That suggests that Xi may even be open to some of them.

Russian Meddling

If there is one thing that has become abundantly clear from all the investigations taking place, it is that Russia very definitely tried to play a major role in the U.S. election of 2016 just as they tried to influence elections in France, the U.K. and Germany (among many others). This should be no shock to anyone given the hostile stance the Russians have taken. What is interesting is the choice of people to back. In most every case, they backed someone who would be a divisive candidate or leader—someone who would keep attention away from Russia.

Saudi Arabia Objects

The Saudi government is angry at the censure provided by the U.S. Senate and vowed to retaliate, but it is very hard to see what they can actually do given their dependence on U.S. aid. The only thing that protects them is their antagonism towards Iran given the U.S. is far angrier with that regime.

Can the U.S. Survive Without the Rest of the World?

The "America First" rhetoric is a bit disingenuous. In fact, every nation has always put its needs ahead of any other state. The domestic population is not all that interested in what happens outside their borders and will certainly punish any politician who forgets that fact for too long. The real question is which group of businesses and people will be getting that attention from the powers that be. There is a sense that somehow the U.S. can curl up with its own market and ignore the rest of the world, but that has not been the U.S. pattern for over a century. The export side of the U.S. economy accounts for over 15% of the total GDP. That is a higher percentage than is sported by Japan. The truth of the matter is that as the world goes so goes the U.S.

Analysis: There are worries enough as far as the domestic U.S. economy is concerned. These concerns are on top of the concerns that have been expressed over the state of the global economy. If the U.S. is to avoid a downturn of some kind in 2019, there will have to be some recovery in some of those global markets. The fear at the moment is that U.S. policy is making that recovery harder than it should be. The bottom line is that the U.S. needs healthy markets to both buy from and sell to. If the Europeans are moribund, Japan is in recession and China is being ostracized, the U.S. will suffer. The challenges for the U.S. extend broadly as there are strained relations with longtime allies such as Canada, Mexico and many nations in Europe. At the same time, there has been very little progress with the emerging market states that looked so promising just a few years ago.

Each of these regions has their own challenges—this is not yet a global recession that is affecting every country in a similar way. Europe has been contending with the perennial issue of what to do with the southern tier states, the so-called PIIGS (Portugal, Italy, Ireland, Greece, Spain). While there has been some progress, big financial issues remain in Portugal, Italy, Greece and Spain. For the time being, Ireland has escaped the classification, but the Brexit talks could yet cripple them. It is Brexit that has crippled the British economy and has taken a chunk out of the EU as well. Canada has been affected by the fluctuating price for oil and Mexico has been affected by the immigration crisis as well as U.S. antagonism towards NAFTA. Japan has been hurt by declining imports from the U.S., while China and the Chinese have likewise been affected by reduced demand from the U.S.

The U.S. has been partly responsible for these economic reversals, but the problem is not solely that of the U.S. The point is this has long been an interconnected world and when these connections are altered, there will be a reaction, and not usually a pleasant one. To put it simply, the U.S. needs to buy from other nations so that they have the ability to buy from the U.S. It doesn't serve the U.S. to adopt an isolated stance. That is likely to become ever more obvious in the coming year.

The Brexit Disaster

The British supporters of a hard-line Brexit are living in a true fantasy world. This has colored their approach to the issue and to the leadership of Prime Minister Theresa May. There has been an undercurrent that has been more and more public as the Brexit hardliners talk. They are attacking Theresa May as much because she is a woman as for her stance. The assumption that has been made by the hardliners is that the EU can be forced to see things their way if only the British leader was "tougher." They assume the EU needs the U.K. and what is needed is for the U.K. to stand its ground and demand.

Analysis: The reality is that nothing could be further from the truth. The Brexit hardliners hear the comments from Jean-Claude Juncker, Chancellor Angela Merkel, President Emmanuel Macron and every other EU leader and pretend they don't really mean it. The fact is the EU has long ago moved on and couldn't care less what happens to the British from this point. The EU has made it extremely clear there will be no further deals and no shifts to accommodate the U.K. May brought back the only deal on offer and the British can take it or leave it. The bombast of the Brexit hardliners must be for domestic consumption only as it has no effect on Europe at all.

The British hardliners assume they have leverage, but they don't. The Europeans can and do function just fine without the U.K., but the same can't be said for the British. In the very near future, the impact of Brexit will be felt by the ordinary Brit as the U.K. economy sinks into an extended downturn. There is already "buyer's remorse" on the part of many who voted to leave the EU, but that flow will soon become a stampede as the economy falters. The assumption has been made that Europe would take the U.K. back if they asked, but the reality is that the EU wants little or nothing to do with the U.K.

Must What Goes Up Also Come Down?

The saying is certainly common enough and always seems to be uttered with a certain sense of resigned moral superiority. It is a warning not to expect the good times to last forever. In fact, there is no evidence that the laws of gravity apply to the world of economics. The pattern we see in this field is tied to the fact that every stimulus effort has a natural limit as far as effectiveness is concerned. It has been noted many times that most positive trends when carried to that natural limit contain the elements of their own destruction. As we start to turn our attention to 2019, we know one thing for sure. The last year (2018) has been one of the best that has been experienced by the U.S. economy in years. By some measures, the best that has been experienced in decades. What we do not know is whether this run is about to come to an end and whether that will be a sudden shock or a more gradual decline.

Analysis: First a quick review of what made the last year so positive—at least from a numbers perspective. The top of the list has been an unemployment rate that is the best seen in 49 years. It has been so low it has created problems with labor shortages. The expected surge in inflation has not taken place in part because the new hires are not commanding the higher wages one would expect in a jobless environment like this one. This has given the economy all the advantages of low unemployment without the downside of wage inflation. If one looks at economic growth, there was another quarter of 3% or above growth. That is only the third time since the recovery started that this took place. Inflation rates have been subdued but have at least reached the bottom of the Fed's preferred level. That keeps threats of deflation at bay. So, what about any of this would make people uneasy about what is to come in 2019?

It is important to point out that none of these threats are guaranteed to bring this period of expansion to a halt. They may not be powerful enough to do more than slow things a little. There are factors and trends that could still take the economy in a positive direction. Not that we are suggesting you go back and check on this, but we were among the many economists who thought that 2018 would show more signs of strain and end up weaker than 2017 had been.

In general, there are "natural" periods of growth and there are those periods that rely on various kinds of stimulus. This last year was one that relied pretty heavily on efforts by the government designed to boost the economy. Not that these are unusual efforts by any stretch—they are trotted out every time an economy gets into trouble. The basic plan is to spend money as aggressively as possible while cutting taxes. The result is greater levels of consumer spending that can be counted upon to boost growth. It can also be counted upon to blow deficits and debts out of the water. We know for a fact that both of these are at record levels. It will likely take generations to get them paid down. We also know they did the job they were supposed to as far as growth. The question is whether it was too delayed to do the most good—most economists had been advocating this strategy back in 2015 or 2016. The growth in 2018 can be attributed to big tax cuts and the additional spending that was done on behalf of the military. It was not just the military budget that swelled and all that cash had an impact on growth.

There were several areas that drove consumer activity. Part of the reason for that robust activity was the availability of these additional funds. The housing sector was one of the more important areas. The fact that it is slowing down now is what has given people pause regarding 2019. Prices are up, mortgage rates are up and as a result demand is down. There are still markets that are alive and well in the U.S., but fewer than has been the case in the immediate past. The consumer was in a good mood generally, but there was not quite the aggressive activity expected—car sales did not rise through the year and generally speaking, there was not a lot of big ticket spending. Both of these issues will be more important in 2019.

One of the most complex issues stems from the trade and tariff wars. Part of the problem with assessment at the moment is that many of the provisions are just now coming into play. There has not been time to evaluate them. What is known thus far is that prices have gone up as a result of the trade and tariff efforts. The 40% average hike in the price of steel has been filtering through every product made of steel (and aluminum). The trade barriers that have been erected against China have started to show up in the consumer's wallet and the retaliatory measures taken by China have definitely had an impact on the farm sector. Trade wars will be very closely watched in 2019—they constitute the biggest risk.

Retailers to the Rescue

The holiday season carries the weight of the overall economy (as well as that of dysfunctional families everywhere). They don't call it Black Friday for nothing—this is supposedly the weekend that retailers finally start to make some money. Generally, there are three phases as far as holiday spending is concerned. The first is the mad rush in November as everybody tries to get the deals on offer. Then there is a fairly quiet period. That is followed by the male rush to get those gifts at the last minute. The first and third periods are generally strong, but if the middle one is also healthy, the retail community is in good shape.

Analysis: The data from the retailers shows that sales have been brisk throughout the period between Thanksgiving and the week before Christmas. That is consistent with some of the data showing up earlier in the year. Most consumers indicated they planned to spend more this year than in previous years. More of that spending would be concentrated on traditional gifts. Not as many of those practical gifts that would have been purchased anyway. There has also been a lot more travel and entertainment than had been the case in past years.

Winter Wind Down

The next two weeks will be about the least productive of the year. We may not have visions of sugar plums dancing, but we are certainly not spending a great deal of mental energy on our work at hand. There are too many parties to react to, too many plates of cookies and too much shopping. There are the 987 new Hallmark Christmas movies to catch up on. You can put on 20 pounds just by playing the Hallmark game—eat a sugar cookie every time you see the same main street or lodge setting.

I have noted a variety of reactions to the holiday—categories of people if you will. There are the adrenalin junkies hyped up on peppermint lattes. They have decorated every inanimate object within their reach as well as a few slow-moving pets and relatives. The holidays are just an excuse to overwhelm good taste with glitter. There are the holiday deniers that try to keep their head down as they cringe at every new rendition of Jingle Bells. The next group has to be the ones living vicariously through their kids. These are especially obvious when they acquire a model train for the nine-month-old. You have the stressed out crowd expecting the worst from relatives they moved 16 states away from in the hopes they would not make the holiday trek. This only works when one moves to someplace like Fargo. To each their own! Soon enough eggnog will be relegated to the back of the dairy case and sugar cookies will no longer suffice as a complete meal. Then we are all back to work with little to look forward to other than St. Elmo's Fire Dance Tuesday.

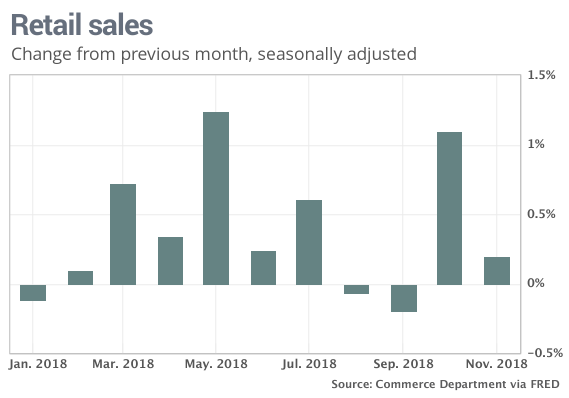

Retail Sales Assessment

The retail numbers have been somewhat unpredictable given the impact of the tax cuts and the other inducements to get the consumer engaged. There are not often numbers that rival the end of the year taking place in May. The summer was more typical and then we have had the holiday season. This year that season jumped off to a good start with the performance in October and carried through from there. The last month will be the critical one and will determine the question of how good the year really was—tax breaks and all.