By Chris Kuehl, Ph.D., NACM Economist

Short Items of Interest—U.S. Economy

Slower Start than Expected

There were some pretty high hopes for the retail season, but they seem to have been somewhat misplaced as the numbers are weaker than expected. The season started off pretty well with a good back-to-school period and a decent Halloween, but the big days were yet to come. Black Friday has morphed into "Black-vember," with the entire month becoming one of sales and discounts. The traffic was OK, but individual spending was less than expected because consumers have opted for a more frugal approach. There have been fewer big-ticket purchases and less use of credit. It now comes down to the last-minute shoppers, who will likely drop the ball again.

Some Clarity at Last?

Nothing is ever set in stone as far as the economy, but all of a sudden, it seems that some of the confusion was eliminated—at least for the moment. There is now a trade deal of sorts between the U.S. and China, but details are sketchy at this stage. There is a more or less clear path for Brexit with Boris Johnson's win, but again, details are not forthcoming as yet. There will not be another government shutdown, but budget wrangles are still underway. Perhaps the most secure position was taken by the Federal Reserve at their last meeting when they indicated rates will stay where they are for the foreseeable future. Who knows how long all this will last, but for now, there is a little more certainty than in the last several months.

All Important Consumer in 2020

It is possible the corporate community finds a way to shake off some of the gloom that has settled in over the last few months, but the assumption is the business community is going into 2020 with some trepidation and caution, verging on despair in some sectors. The hope for a good 2020 will rest squarely on consumers just as it has for the bulk of 2019. No matter what the economic report, the consumer remained confident and expressed satisfaction with their current financial position. The one concern is that retail activity is slower than expected and will likely carry over into next year. If there is a bad jobs report anytime in the next few months, the mood of the consumer will sour very quickly.

Short Items of Interest—Global Economy

Corbyn's End?

If there was ever a time for Labour to make gains in the U.K., it was now. Boris Johnson is an unpopular leader and even his Tory allies have grown tired of his bullying and bombastic ways. The Labour Party should have made a good showing, but in the end, the voters disliked Jeremy Corbyn even more than Johnson. Corbyn has long come across as a vain and intolerant ideologue and he turns off all but the most hard-core leftists in the country. He is very likely to face leadership challenges soon. It may also be a warning shot for Democrats in the U.S. who have candidates ardently supported by the core yet rejected by the majority of voters.

Return of Boeing's 737Max Still Very Distant

Boeing executives were asserting that the 737Max would be back by the end of this year and now, they are admitting this will not happen. It is now likely the plane will be out of service for the bulk of 2020 and perhaps longer. The issue of the plane's safety has become an issue of how the entire company is run, making the issue of the 737 Max almost irrelevant. This is now threatening to end Boeing itself or at least create grave financial issues.

Optimism in Japan

The latest surveys of Japanese business indicate confidence is growing at a rapid pace. It rose the last four months in a row, despite the troubles that affected exports from Japan. The trade war with South Korea has hurt along with the slowdown in the Chinese economy, but the Japanese consumer is finally starting to come back to life.

Do We Have a Deal? Really?

The headlines were certainly enthusiastic. It seemed that the whole tariff and trade war between the U.S. and China had finally come to an end, and the consumer would be spared high dollar tube socks while the business community in both nations could start to put all this wrangling behind them. That was when everybody took a breath and looked at the "deal." Today's headlines look a lot different. Despite the statements from Trump, the Chinese have not signed off on anything and seem to have the same issues they have had all along. Even if the arrangement is approved, the significance is weakened by the lack of any real assurance or enforcement. At the moment, it is a vague indication from China that it plans to buy more from the U.S.—mostly farm goods and some higher value manufactured goods. There have been no specifics mentioned as to how much or when. The U.S. has issued vague assurances that it will reduce or remove tariffs but has not indicated which ones or how many or when, and that is the main reason that China has not indicated formal agreement.

Analysis: The trade battle continues and it remains a political one. Within hours of Trump's decision to approve the "phase one" deal, the White House was trumpeting the success of the talks and declaring the U.S. had clearly gotten the best end of the deal. The statements immediately became part of campaign efforts but thus far there have been no details other than an indication that China had signed a "pledge" to buy from the U.S. Chinese negotiators have claimed that no such pledge has been signed and continue to assert the U.S. has to make the first move with reduction of tariffs. Their position has been consistent over the last several months. They will not increase imports from the U.S. until tariffs are removed or reduced and how much they buy will depend on how much tariff reduction there is.

If the deal as it stands falls through, it will be presented as a political victory by both Trump and Xi. Trump will assert the Chinese were the ones that ruined the arrangement and that he is justified in taking an even harder line. The statements from Xi and the Chinese have been harsh and assert the U.S. can't be trusted and therefore China is entitled to hold out for actions that match the words.

Government Shutdown Averted?

The near constant budget battle that has dominated Congress for the last decade was heading for yet another crisis deadline. If there was no budget agreement by next week there was to be another government shutdown. Analysts have been pointing out there was absolutely no appetite for such a confrontation at this point—it is the holiday season and the eve of an election year. Nobody in Congress wanted the headlines that would come with such a development. The latest word is that a tentative deal has been struck, but the details have yet to be worked out.

Analysis: As in past confrontations, the primary sticking point was funding for the border wall as well as the disposition of $1.4 trillion in discretionary funding. The White House position has been $8.6 billion for the wall and the continued ability to transfer additional funds from other programs and the military. There has already been $3.6 billion in military construction diverted to the wall—a decision that had an impact on 27 military bases in the U.S. The Democrats want to limit funding to the current allocation—$1.38 billion—and want to limit the ability to transfer funds. The allocation of discretionary funding is always a debate over what programs should be funded and by how much—these are the funds that are not part of mandates such as Medicare, Medicaid, Social Security and the like. Hovering over the whole budget debate is the issue of debt service. The size of the U.S. debt means the government must pay $479 billion in interest on the $18.087 trillion debt. That is money that comes right off the top of the budget every year.

The Progressive Agenda—Thus Far

The real race for the Democratic nomination has only just started, and if the past is any indication, the majority of the voting public is not paying much attention yet. This has been a competition to rally the base, and candidates are focused on those issues that rally the primary voter. One of these issues is rooted in economics. What does a progressive economic agenda look like at this point?

Analysis: The answer to that question will become clearer as the first primaries are held in Iowa and New Hampshire, and the message is likely to be different on the other side of these polls. Right now, there are three planks. The first and most consistently touted has been much higher taxes on the wealthy. There are differences as far as how high the taxes should be and who is considered wealthy, but all of the Democratic candidates have this in their plan. The second plank is rooted in what should be provided free to all. There is more variety here with some advocating free health care, free education and free child care while others have restrictions on who gets what benefit. The third plank has been loosely described as anti-corruption, but the definition of that corruption has been loose. It is more a critique of big business and its influence than it is accusation of illegal activity. There is no real claim that most of the business community is breaking the law but there is support among some candidates for making current business practices illegal in the future—especially those that involved investment and decisions regarding mergers. As the field of candidates starts to narrow these positions will be sharpened—for now they are heavy on concept and light on specifics.

Johnson Crushes Corbyn—Now What for Brexit?

Throughout the British election, the polls reiterated this was a vote where the public was casting a ballot against someone rather than for someone. The two leaders of the dominant parties were among the least popular politicians in recent British history but in the end the most unpopular of all was Jeremy Corbyn of the Labor Party. He presided over a complete rejection of Labor by the public despite very deep suspicions regarding Boris Johnson and some of the key positions taken by the Conservatives. This was supposed to be essentially a referendum on Brexit and at the start of the campaign it seemed likely that voters would stand against the Tories as there has been a major change in attitude towards the Brexit plan for many in the U.K. The assumption was that Johnson's strong Brexit stance would cause voters to turn on him. Instead the election ended up turning on the intense dislike that many have for Corbyn. Even strong Labor regions turned on their leader. Does this mean that Johnson has a mandate to do as he likes? Probably not.

Analysis: There will be important political repercussions from this election in the U.K. Labor will have to deal with the depths of Corbyn's lack of popularity if it ever wishes to hold power again but that is a conversation for later. The issue that most affects the world right now is how this election affects the issue of Brexit. The immediate reaction from Europe was favorable as the Tory win seems to signal the end of gridlock on how to proceed. Johnson declared that he will take the U.K. out of the EU and he has the votes he needs in parliament to proceed. The problem is that he still faces the same internal opposition that existed before with some in the Conservative ranks insisting on a full break and others demanding some form of compromise. This is also the opinion of the voter.

Johnson is asserting that he will pursue a relationship that preserves the U.K.'s trade position and is demanding full market access and duty-free trade. The EU is not necessarily opposed to this but quickly reiterated the demand the U.K. adhere to all of the EU regulations and rules as regards labor, environment and financial issues. This is the crux of the issue and has been from the start. The reason the U.K. business community wanted to pull out of the EU was to escape the welter of regulations and rules that came from Brussels. If the EU is demanding these be adhered to whether the U.K. is a member or not, there will be some very tense negotiations. The public wanted the split due to concerns over immigration but that is not at the top of the list of priorities as far as the U.K. economy is concerned. A break with the EU without trade protections will result in a significant drop in the British GDP—clearly into recession territory and perhaps into depression.

EU Prepares for Weakened WTO

It appears certain the World Trade Organization will be rendered impotent in a few days. The Trump administration has refused to allow new judges to serve on the WTO appeals court and that removes the WTO's ability to arbitrate disputes. This means that countries which are ruled against by the WTO in future cases can simply demand the dispute be sent to the non-existent appeals process and thus stall and delay any WTO decision into perpetuity. It renders the WTO useless as a trade arbiter. The EU has now started to alter its regulatory system to allow for the imposition of tariffs and restrictions regardless of what the WTO has decided.

Analysis: These alterations would preclude countries from exploiting the crippled nature of the WTO but it also threatens to put a nail in the WTO coffin. Once these rules and regulations are put in place it means the EU can ignore the WTO—now and in the event that judges are finally appointed to that tribunal. Should there be a change in policy in the U.S. and appointments made, the EU and any other nation that follows their example would still have the right and ability to ignore any rulings. These nations would have to go back to the old system and change their new regulations.

This seems like somewhat arcane stuff given that the WTO has never had particularly strong enforcement powers. Even if the appeals process rule against a given nation there was not a lot the WTO could do other than call attention to the transgression. Their decisions allowed countries to impose tariffs and other penalties without violating WTO rules. The whole idea of a WTO appeals process was to reduce the kind of political gamesmanship that often drives trade disputes. The current trade war between the U.S. and China is a good example of a dispute that has very little to do with business and the economy and much to do with politics. The WTO system was an attempt to reduce that political motivation.

One Really Has to Make the Effort

This is a tough time of year, and that is weird. The reason for all the holiday hoopla is simple enough—it is supposedly a celebration of various religious moments. The birth of Christ, the rising of the Maccabeans as celebrated by Hanukkah, Boxing Day, Omisoka in Japan, the birth of the Prophet Muhammad, Bodhi Day for Buddhists and that is just a few of the observances that take place in December. All of these urge people to do much the same thing—be kind to one another, be generous, be faithful. Why does it seem so hard to get in the spirit of the season? The press is full of stories of stress and dysfunctional families. Police report higher levels of road rage and more crime and family violence.

The bottom line is that holidays are what we make of them. This can be a period of stress and chaos, but it can just as easily be a period of peace and kindness. It becomes a choice. I find myself getting caught up in the chaos and have to consciously take a step back. As I write this, my lovely wife is baking Neiman Marcus cookies, and the whole house smells absolutely delicious. In a little less than two weeks I will get to see my granddaughter and her family. My grandson and his new (very pregnant) wife will be here and so will my stepson and his wife. I will have my whole family together for the first time in years.

There are other things to be grateful for—the new kitten doesn't climb Christmas trees, Sven is still with us at nearly 20 years of age, My business partner Keith and our associate Karen are enjoying their families as well. I will be seeing old friends and attending holiday performances. I only have one more trip to do this year. Two years ago, I was heading for cancer surgery immediately after the holidays—this year everybody is hale and hearty. There is a lot to be happy about, and it is up to me to remember that when the temptation to grouse comes.

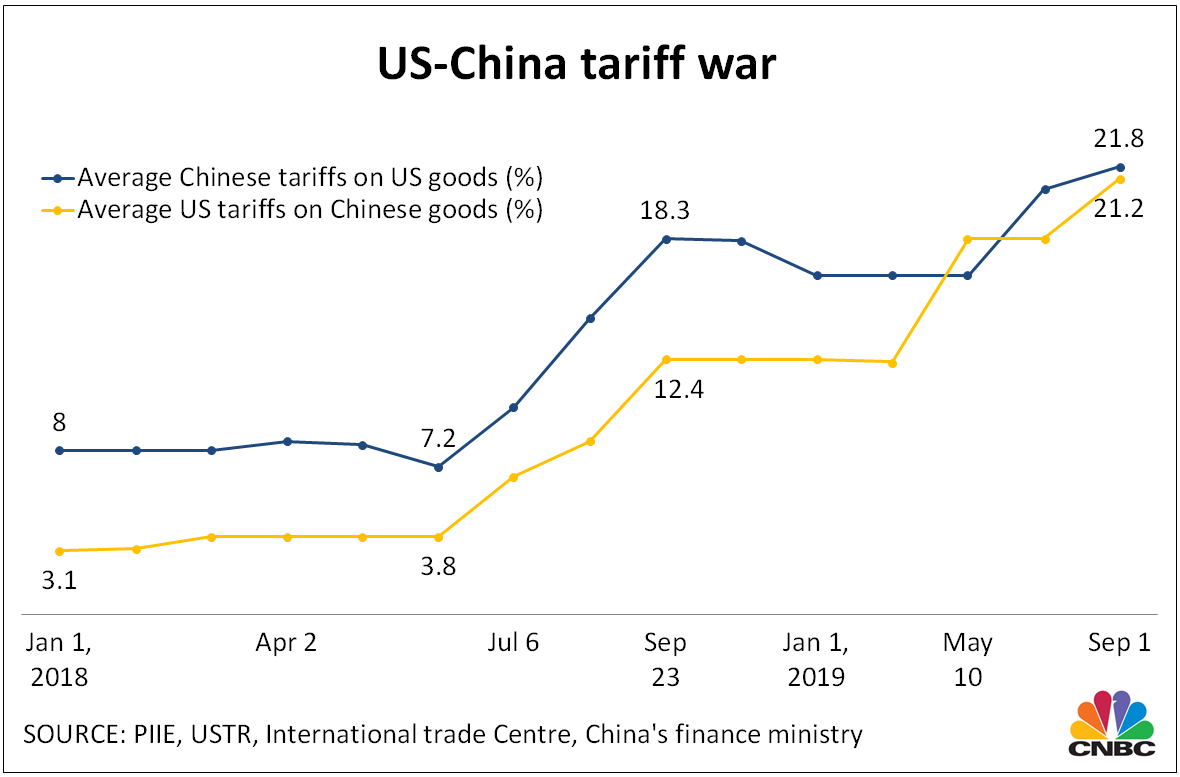

U.S.-China Tariff War

The chart shows the advance of tariffs over the last year. What is interesting is that Chinese tariffs on U.S. goods have been consistently higher than those imposed by the U.S. on China until very recently. Even now the tariffs are essentially equal. One would get the impression that the U.S. was imposing far higher levels of taxation on China, but it has been the opposite for many years. Not that seeing both sets of tariffs rising has done the global economy any favors.