Short Items of Interest—U.S. Economy

Position Unchanged on China?

It has been more than a little challenging to determine just where the talks with China might be. Both nations have adopted a fairly hard-line approach to the negotiations, but that is not unusual given what is at stake. The question is whether any part of this deal is set in stone or if everything on the table is open for debate. The pattern for both President Trump and Xi Jinping has been to keep everything in play until the very last minute. Both men have very hard-line advisors who are more than willing to suffer the consequences in order to fight for principle. In the U.S., that is White House National Trade Council Director Peter Navarro and in China it is Premier Li Keqiang. Neither President Trump nor XI has been willing to commit to a set policy at this stage. That leaves the door open for now.

Closer to Real Limits of Employment

The behavior of the job market has been unpredictable and has defied many of the old assumptions. That pattern may have started to dissipate. It has long been assumed that when the jobless rate fell to levels seen the past few years that certain changes would follow. There would be higher wages due to the low rate of joblessness, leading to wage inflation. This time around, the predictable didn't happen—there was little in the way of a wage hike. That has started to change as Dec. 7's employment data showed. The rate of wage hikes stepped up. Now, there is reason to believe the inflation issue will have an opportunity to manifest.

Different Approach to Illegal Immigration

There have been a variety of approaches used to deal with illegal immigration. Nearly all of them place the responsibility on the migrants themselves—trying to discourage them through threats of arrest and deportation or long-term incarceration, family separation and the like. Many are now suggesting the real target should be employers of illegal workers. They think the punishment should be severe—heavy fines and imprisonment. The thinking is that drying up the job opportunities will serve as a real impediment for those considering the risk of illegally crossing the border. Right now, employers are not getting hit that hard when they ignore the immigration rules.

Short Items of Interest—Global Economy

Anti-Semitism in Europe

Recent polls and surveys show that some 40% of the Jewish population in Europe has considered moving to another country to escape the growing problem of anti-Semitism in many European nations. In the last few years, there have been repeated attacks on Jewish institutions as well as people who have been labeled Jewish. The attacks have been coming from a variety of places—Islamic radicals, right-wing populists and from various nationalist groups. The attacks have become so common that some 90% of those surveyed indicated they have been personally affected. Most indicate they would move to Israel or the U.S.

Russia Backs Away From Venezuela

It was not quite a year ago that Russia solemnly promised solidarity with the Maduro government in Venezuela and indicated it would provide some $6 billion in aid. That money has not yet made an appearance. Now, it looks like it never will as Putin has denied that any sort of promise was ever made. This is despite the official statements that said exactly that.

German CDU Picks AKK

In a very close election, the ruling Christian Democratic Union (CDU) selected Angela Merkel's chosen successor. Annegret Kramp-Karrenbauer (AKK) won by 35 votes over two more conservative candidates. She now has to find a way to unite the two factions. She is a supporter of Merkel's more cautious approach, but has indicated a difference of opinion over issues like immigration and even the position on Brexit that Merkel has taken. Her opponents have grudgingly agreed to support her, but they will remain critics.

How Worried Should We Be About Global Recession?

The last few weeks have been unsettling to the global investment community. This has been reflected in all the volatility on display in global markets. These have fallen short of actual correction status, but there has been a loss of all the gains made thus far this year in the U.S. market as well as most of the other major global systems. The worry has been over issues such as trade and geopolitics. There is an expectation that fights between the U.S. and China will get more intense and will drag other nations into the fray. There is ongoing concern over the impact of higher interest rates at the Fed and whether that will be copied by any of the other major central banks. There are concerns over the price of oil and there is still instability over the price of metals due to the steel and aluminum tariffs. Throw in worry about the politics of upheaval in France, Italy, Brazil and Mexico as well as the ongoing worries about terrorism and there seems good reason to think that a major global recession is imminent. The counter argument is that few of the usual indicators of a major recession are in evidence at this point. Not that this situation can't change at a moment's notice, but for now, the situation doesn't look as bleak as some would assert.

Analysis: If one looks at past recessions and downturns, there are patterns that emerge prior to the development of the decline. They are not manifesting at this point. This may be an example of an end to a long, positive business cycle, but not the start of an actual recession. Many economists are now expecting more of a period of stall as opposed to outright decline. One of the keys to whether the U.S. economy grows or shrinks is consumer activity. It can be argued this is the most important factor given the role the consumer plays in the U.S. The data here has been good and seems to have improved of late. In October of this year, the rate of spending was up by 2.9% year-over-year, better than the 2.4% annual gain that had been in evidence for the last four years. The boost this year may be partially attributed to the impact of the tax cuts, but frankly that was a bigger factor earlier in the year. What appears to be stimulating the consumer now is the fact that jobs are secure and personal wealth has improved as people are watching the value of their homes increase. Others are benefiting from the growth of the stock market. The cautionary note is these circumstances can change very quickly. The job market may not stay as tight as it is right now. There could well be a decline in the value of homes as the housing market cools down. The jittery stock market has already had an impact on consumer confidence. That could become a bigger deal in the future.

A second set of numbers showing recession is not imminent revolve around productivity. Generally speaking, a recession is presaged by a retreat in terms of worker productivity. There are several reasons for this. One is that during periods of growth many companies hire many more people. They are gearing up for more business. They think they will need more people or they are concerned about overworking their existing staff. They are also starting to train people to take positions they think will be open in the years to come. There are all sorts of rationales which inevitably lead to less output per person—at least for a while. This time around, most business did not engage in that kind of hiring and there has not been a huge loss in productivity. There has also been more investment in machines and technology. It has contributed to productivity gains as well.

Not all is sweetness and light, however. The U.S. is likely more insulated from a recession than most other nations—especially those in Europe and developed Asia. If these states suffer from decline, the impact will eventually be felt in the U.S. as the economy depends on global business for about 15% of the total GDP. Great Britain is still the fifth-largest economy in the world with a GDP of over $2 trillion. It is behind only the U.S., China, Japan and Germany. The Brexit fight will cost the British economy dearly and could plunge the country into a recession of its own. France is the seventh-largest economy. It now seems to be locked in a fight to the death between the government and a significant chunk of the population. Germany is in the throes of a leadership crisis as the country tries to figure out what a post-Merkel regime will look like. Italy is a mess again and is already skidding into a full-blown decline. There are still major issues in Spain, Portugal and Greece as well. The EU is not in decline as a whole—not yet. It is far from healthy, however.

China is sitting very close to what is considered recession in that country—6% growth. This is a nation that has to generate 1.3 million jobs every year just to keep pace with the population. That can't be done without growth at 6%. Japan has been flirting with growth from one quarter to the next, but then will stumble and sink into recession again. These are the two engines of Asian growth. If both are hurting, the whole region slows down.

Production Cuts Spike Oil Prices

The fall in the price of oil has slowed and probably will continue that pattern for the next few months. After what seemed like weeks of hard-fought negotiations, there has been an agreement between OPEC and some of its non-OPEC allies to cut production of oil for the next six months before a review of what this has meant to pricing.

Analysis: The pattern that has emerged in the past will likely set up again. The U.S. producers can easily make up the difference, but they will wait until prices are at least at the $70 level, and perhaps more. At that price, they can make money and will start to produce. This really suits the other oil producers just fine as they can be happy at between $70 and $80 a barrel as well. The question is how long the other producers will cede the market to the U.S. In the past, the nations that elected to cut production start gearing back up as soon as they see the U.S. erode their markets. Then, the prices start to fall again.

Can France Reform?

The latest round of protests in France is following a familiar and depressing pattern. Over the years, there has been near universal acceptance of the fact that reform is badly needed in the French economy. It is a system that consistently pits the French against themselves and reduces the nation's competitiveness. It is far too hard to hire people and even harder to fire them. Working hours are unconnected to the needs of business. Employees have the upper hand in situations that compromise the ability of even small companies to compete. The business community is very slow to invest in measures that improve productivity. In addition, the vast majority of workers are trained by the companies themselves rather than by formal schooling. This is somewhat workable for the largest companies, but is not at all doable for the small- and medium-sized companies that can't risk hiring someone who lacks the right skills and then fails to acquire them once on the job.

Analysis: The French place an immense burden on the government and expect it to solve all problems, but as soon as the political leaders try, there will be movements springing up to oppose the effort. The trigger for the latest protests is a case in point. According to every poll of the population, there are few issues that matter more than that of climate change. The population wants the government to act decisively. The response from the Macron government was a logical one if this really is as important to the population as they assert. The culprit as far as greenhouse gas is auto exhaust (and the output of power plants). To address climate change is to limit driving. The best way to do that is to tax fuel so that driving is more expensive. When asked in the abstract whether they would support higher fuel taxes to combat climate change, the polls said yes. Then the tax was actually introduced and the population rebelled in massive numbers. A gas tax was thought to be a good plan. Now, the Macron government has been forced to scrap the idea in the face of massive and violent protests, and the opposition has not stopped there. Every aspect of the Macron reform effort is now under attack from both the right and left. The support he received when he won the presidency in 2017 has evaporated. It is now more obvious than ever that most voters in France were casting ballots against somebody rather than for anybody.

It has also been noted that French politicians have a problem shared with many in other democracies. Macron stated in his campaign that nobody would be hurt by his reforms—a message that almost every politician delivers so they can win. The messages are always the same—we will provide you citizens with all you desire and without making you pay anything for it. All manner of programs are promised and all with no taxes (or at least no new ones). It is absurd, but the voter buys the myth. That lasts until an attempt to actually make good on the promise. The government either reneges on all the help promised or it raises revenue. Those are the only options. Both will provoke protests from a population that can't seem to manage simple logic. At the heart of the issue is selfish motivation—everybody wants all the assistance they can get and everybody wants someone else to pay for it.

British Government on the Brink

The expected crisis is putting the government of Prime Minister Theresa May on the brink. A vote on the Brexit plan negotiated between May and the EU leaders was planned for this week, but she has now postponed it as she was certain to have lost, and by a wide margin. She has not been able to garner any significant support from any faction in parliament. The hard-core Brexit fans were never going to support the plan as they are still insisting on a complete break. There was some hope that moderates in the Conservative Party would combine with some like-minded parliamentarians in the Labor Party, but it is now apparent that even the moderates are unhappy with the plan.

Analysis: The fact is nearly everybody agrees that the plan is not a good one for the U.K., but the reality is the U.K. will never get a good deal from the EU. The vote to leave the EU robbed Britain of any leverage it ever had. If it had stayed in, it could have used the threat to pull out to win concessions from Europe, but the decision to leave has the Europeans muttering "don't let the door hit you on the way out." The EU is angry and unwilling to give ground on much of anything. It is prepared to function just fine without the U.K. and has no plans to give on any crucial issue.

It looks very likely there will be a hard exit from the EU and that the U.K. will essentially lose its greatest trade partner and market. It will have to seek an alternative. That means looking to the U.S., China, Japan or India. These may become better markets in the future, but for the moment, the U.K. is looking at an imminent recession. It could be one that lasts quite a while.

Getting Into the Holiday Spirit

At last, it has started. My annual attempt to lower the property values of my neighborhood is underway. The yard is now festooned with all manner of Christmas frivolity—polar bears skiing, penguins building an igloo, elephants bearing gifts (National Geographic is not amused). I am not in the same league as the Griswold family or those people featured on TV, but as compared to the tasteful outlines of neighboring homes, I am definitely over the top. I would like to say that I do this all for my grandkids or great grandkids, but the grandkids are past 30 now and the great grandkids live in Florida. I have to confess I do this for me—I am about 11 when one looks at my real mental state.

The interior will start its makeover soon as well—lots of displays, two trees and endless supplies of holiday frivolity. It's the same rationale as with the outside. I just like it. On occasion, we are even organized enough to show it off to friends. It is a goofy obsession to be sure. I think what it comes down to is my desire to get out of my own head from time to time. The world is not that happy a place; really hasn't been for years. There is always pain, suffering and turmoil. I take a silly break from time to time—just to wallow in the season even as I know it can be forced and insincere more often than not. Just for the record when I wish somebody Happy Holidays, Merry Christmas or Happy Hanukah, I really mean it!

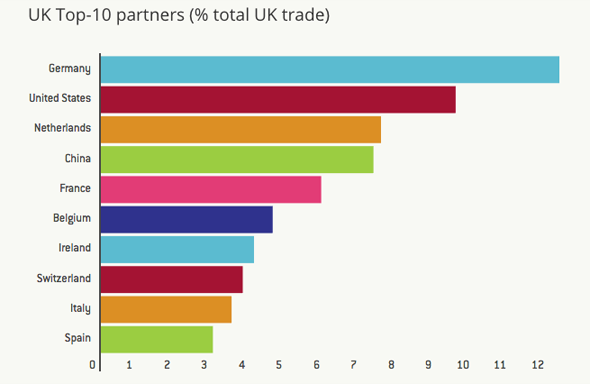

U.K. Top-10 Partners

The chart below is a graphic look at just how vulnerable the U.K. is to a bad Brexit deal. Of their top-10 trade partners, it will be losing access to seven of them—including Germany, the most important partner. The future of British trade will revolve around the U.S., China and perhaps India at some point. These nations will be hard pressed to make up the losses that have been incurred due to the Brexit debacle.