Strategic Global Intelligence Brief for August 7, 2019

Short Items of Interest—U.S. Economy

Currency Trigger Pulled

For the better part of the last decade, the U.S. has threatened to label the Chinese as currency manipulators. This is a formal designation by the Treasury department. It is based on a set of formal rules that supposedly separate the deliberate adjustment of a national currency from the normal variation currencies are subject to. It is perfectly acceptable to adjust a nation's interest rate to reflect the status of the economy even though this action will have an impact on the value of the currency, but it is considered manipulation if the currency value is lowered simply to bolster exports. The U.S. has now determined China is doing exactly this, but the gesture is really more symbolic than tactical. The designation means the U.S. can take actions to counter the move, but the U.S. was already doing all it could to pressure China, so this designation will add nothing to the strategy already in place.

Farm Sector Hammered

China really had only one major move left and they have now elected to make it. For some months, the Chinese have been asserting they would reduce their imports of U.S. farm output, but they always relented and continued to buy. Now, they have decided to halt all imports of U.S. agricultural output. This cuts the U.S. farmer off from their largest market, and in a year when weather and other factors have been damaging in the extreme. The expectation now is U.S. farmers will be facing a recession environment this year and next. The Chinese will suffer as well, but they have alternative sources for the food they want to import.

Trade and the Fed

When the Federal Reserve stated it was going to reduce the Federal Funds rate by a quarter point, the assertion was issues of global trade had made that move necessary. Now the trade crisis has intensified and the commentary from the Fed has been focused on the global economy as the rationale for further action. There is no promise that rates will be cut again, but if they are, the motivation will be the state of the world economy, and that is not expected to improve much this year.

Short Items of Interest—Global Economy

Surprise Global Rate Cuts

The U.S. Fed is certainly not the only central bank concerned about the state of the global economy and the trade war. Overnight, the central banks in Thailand, India and New Zealand all cut their rates and cited the trade war as the motivation. These are nations that depend on business with China. All think slow growth in China will affect their economies sooner than later. It is very likely that other central banks will be following suit soon. This has provoked a major bond rally and a collapse in bond yields.

Trade War Intensifies Between Japan and South Korea

There has always been a good deal of animosity between Japan and Korea. The years during which Japan controlled Korea as a colonial possession left bitter memories. This was compounded by the experiences of WWII. The issue that has brought the two nations to the brink of an all-out trade war has been the demand by some in Korea for war reparations from Japanese companies. Japan asserts that a treaty signed a few decades ago settled that issue and the conflict shows no signs of settlement. Korean consumers are shunning Japanese imports, while pressure builds on the Korean government to get aggressive with Japan.

Honduran Crisis

No nation has contributed more to the current immigration crisis than Honduras. The majority of those fleeing to the U.S. come from this wretched nation. The corruption at the top is immense and the power lies in the hands of the drug lords. People are killed daily. The stream of people escaping this nation has overwhelmed the U.S., Mexico and neighboring states.

Fears of a Global Recession Mount

The arrival of a recession is generally not swift. It tends to build over time and there are generally plenty of warning signs. Not that these warnings always provide an opportunity to do much about the trend, but recessions move slowly enough that people and businesses can react accordingly. The irony is that those reactions hasten the arrival of the recession. If one expects a major slowdown, there will be predictable and natural reactions. Business will be reluctant to expand as they don't want to be saddled with unused capacity or debt in the event of a slowdown. Consumers get cautious as they start to worry about their jobs and don't want to handle larger debt loads. They stop buying homes and cars or going on big vacations. Thus far, the U.S. business community and the U.S. consumer have not started to react to an impending recession—spending is still strong, jobless rates are low, capacity utilization shows some slack and measures like the Purchasing Managers' Index (PMI) and the Credit Managers' Index are still sitting in positive territory. But that is not something the rest of the world can assert.

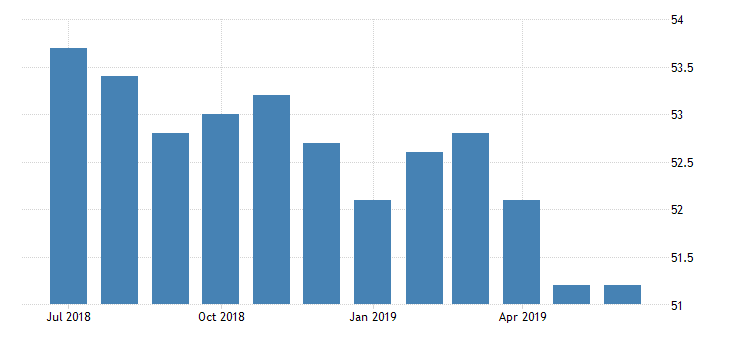

Analysis: One of the more reliable ways to examine the state of the global economy is to look at the Purchasing Managers' Index as prepared by groups like the Institute for Supply Management, Markit and others. All use the same diffusion index and ask the same questions in the same format. It is comparing apples to apples and is easy to understand. When readings are above 50, there is expansion; readings under 50 indicate contraction. It was not long ago that PMI readings around the world were in positive territory. Many were even in the 60s (including the U.S. PMI). This is no longer the case.

Of the top 15 U.S. trade partners in July, only three are in expansion territory (Canada at 50.2, India at 52.5 and the Netherlands at 50.7). In June, there were just four above 50 (Brazil was at 51, India was at 52.1, France was at 51.9 and the Netherlands was at 50.7). The 15 top U.S. trade partners (in rank order) are China, Canada, Mexico, Japan, Germany, South Korea, U.K., France, India, Italy, Taiwan, Brazil, Netherlands, Ireland and Switzerland. The lowest PMI number is Germany at 43.2. That is a real problem given that Germany is supposed to be the economic engine for the whole of the EU.

The problem is that slowdown has been global and there are no nations pulling in the opposite direction. In past years, there have been economies that served as engines of growth for the world. They had the ability to pull the rest of the world out of decline through trade. In the past, there was growth in countries such as Japan, Germany and certainly China. The rapid growth of the Chinese economy was enough to boost the fortunes of dozens of other nations who were able to sell to them. The system seemed to work pretty well with nations selling to China so China could sell to the U.S. When all was said and done, it was the U.S. consumer at the heart of it all. Today, that pattern has been broken. The U.S. is not supporting trade as it has in the past. The breakdown in trade relations with China is only the most prominent change. The U.S. has been hostile towards Europe, Canada, Mexico, India, South Korea, Japan and essentially every other nation. The U.S. still imports a lot, but the pace has slowed enough that every nation has been affected. That has meant U.S. exports have declined as well.

Germany Headed for Recession

The latest industrial numbers for Germany were considerably worse than had been expected. The decline in the industrial readings was 1.5%; the expectation had been this decline would be around 0.4%. This means industrial output is a whopping 5.2% lower than it was a year ago. It is abundantly clear that Germany is no longer serving as an engine of growth for the whole of Europe and has become a drag on that growth instead.

Analysis: There have been three factors that reduced the German economy to this level. The most important has been the impact of the trade war between the U.S. and China. China's economic issues have meant a dramatic reduction in German imports and that has upset years of German strategy. Many companies had invested heavily in that Chinese expansion. Now that seems to be for naught. The second issue has been the decline in the auto sector. German carmakers staked everything on the diesel car. Now that has fallen out of favor as electrics have boomed. Finally, the German consumer is slowing down and seems headed for one of the weakest holiday spending seasons in years. Rounding off this list of woes would be the issue of Brexit as Germany was a major trade partner for the U.K.—another market that is compromised by politics.

Musings from the Armada Guys

As one might assume, the two of us at Armada spend a significant amount of time mulling over the "what ifs" of global economics and politics. The latest escalation of the trade war between the U.S. and China got Keith (my co-partner at Armada) and I talking. The basic question is motivation—for Presidents Trump and Xi Jinping. What do these men gain from expanding this conflict and what do they stand to lose? Has this issue transcended geostrategic goals and become a simple matter of personal animosity?

The sense in the markets was made abundantly clear by yesterday's global crash—the worst day for the markets in years. The initial assumption is that the gloves are off and the two nations will devote themselves to hurting the other regardless of what that means for their own domestic economies and also the rest of the world. But is that really what is going on?

Here is a theory to consider. Trump knows full well that when it comes to the 2020 election, the only thing that will matter will be the situation that exists a few weeks before the November vote. The pro and anti-Trump voters made up their mind years ago. Nothing will alter their opinion going forward. The contest will come down to motivating the largely apathetic voter who will either not vote at all or will react to what is happening at that precise moment. Most of these voters are motivated by the economy.

Trump could confront China for the next several months and then broker a deal next summer (or maybe sooner). The sudden end to the confrontation would excite the markets and cause a major sigh of relief among all of the U.S. trade partners. The economy would have the shackles thrown off and would boom—just as people are making up their minds on Trump and a second term. Of course, there has to be a willing partner in China. Here things get stickier.

Xi Jinping knows full well that a second-term Trump would have no limitations and would be able to attack China without inhibition. It stands to reason that China would rather not see Trump win and would take steps to thwart any ambition Trump had as regards a breakthrough with China. The Chinese would likely demand more than Trump would be willing to give.

Given these conflicting strategies it will come down to which leader feels the most pressure. If the U.S. economy starts to seriously falter by the start of next year, Trump will have to do something to shore up his support, but China could well be in worse shape. That would put pressure on Xi to do something to relieve that pressure. In the end, the Chinese leader has more power to protect his position than Trump, but it is not unlimited. He has rivals in the Politburo who would be willing to challenge him if the economy is truly faltering.

The two are engaged in what amounts to a giant game of chicken. If we had to bet, it would be on China. Things could get very ugly for Xi, but removing him from power is far more difficult than seeing Trump defeated in the election.

Analysis: This theory assumes that both men are engaged in some pretty high-level strategic thinking and have been spending a lot of time and effort attempting to outwit the other. It is reasonable to assume that advisors for both are actually thinking and gaming this way, but there is also a simpler rationale to consider; a much more personal one. Trump dislikes the Chinese leaders and it is pretty apparent that Xi cares little for Trump. Neither man tolerates dissent and neither man is used to being told they can't have what they want. Both have the capacity to be vindictive and ruthless. This trade war may be as simple as a contest between two men antagonistic towards one another. In our opinion, there is an element of this, but we also assert that bigger strategic goals are involved as both men have advisors who will be pushing them to look at the bigger picture.

Why There Will Be No Swift End to This Conflict

As expected, the markets recovered a good bit of ground yesterday after collapsing over the latest escalation of the U.S.-China trade rift. In fact, both reactions are fundamentally unrealistic. The imposition of a new set of tariffs on Chinese goods was not going to radically alter trade and China's decision to reduce the value of the renminbi was not going to remake global business overnight. By the same token, the rebound is overly optimistic as there has been a fundamental shift in how the global trade patterns will play out.

Analysis: Neither Trump nor Xi can afford to give in on this issue—not at the moment anyway. The Chinese have a major issue in Hong Kong. This will soon force a violent reaction, one that will cripple Hong Kong for an extended period. China is also preparing to celebrate the 70th anniversary of the Chinese Communist Party. Xi has no desire to appear weak in any respect. In the U.S., Trump is focused on the 2020 election, and it will be a tough one. He can't afford to lose any members of his base—the 30% of voters that back his positions on issues such as immigration, China and tariffs. It has always been hard to determine if Trump is really leading these supporters or is being led by them, but an election year is not a time to test the theory. At the same time, Trump will need to bring some of the uncommitted voters to his side to win. That means keeping the U.S. economy healthy.

Both sides are digging in for an extended conflict and will be putting pressure on their allies. The U.S. will want Europe to help push China, while the Chinese will push the other Asian economies to side with them. There will also be more interaction between China and Russia as the two nations work to counter the actions of the U.S. In this contest, the Chinese may have the upper hand as they have done a better job of cultivating their alliances than has the U.S. There is no desire on the part of the Europeans to back a Trump play and Putin has clearly allied with Xi.

A Note on the Art of Networking

Make no mistake—it is an art. It is common knowledge that networking is key to business success, every seminar reiterates this. Every textbook says so and there are probably thousands of articles and commentaries published every day extolling the virtue of networking. As important as this is, it remains a difficult skill to master. When people are being honest, they generally admit their networking efforts rarely yield much and they are not confident in their ability to make the whole process productive. I am not convinced that I am any good at this, but I have had the good luck to be exposed to some really masterful networkers. They seem to have two things in common.

They think long term. They adopt the same strategy that advertisers employ. The company running an ad on TV or on your webpage is not really expecting you to drop everything to rush out to buy their product or service. They know you are not sitting around thinking about plumbing or what cereal to buy. They also know that when the sink backs up, you will be intensely interested in the plumber. The idea is to be top of mind when the right opportunity comes around. The good networker stays top of mind.

The second trait is they seem far more interested in helping you than in you helping them. The ones that expect something from the people they meet are not much more than salespeople and we react accordingly. We get defensive and instinctively want to say no. The person who starts off doing you a favor builds trust and is likely to get far more cooperation from you in the future. The good salesperson plays that role very well—offering their help and expertise as opposed to pushing for the sale immediately.

Purchasing Managers' Index Readings for the U.S.

The Purchasing Managers' Index for the bulk of the world has been weakening. The composite index is as low as it has been in several years and the decline has been swift. Last year, the index was comfortably in the middle range and now it has fallen to near contraction territory despite the fact the U.S. remains in expansion mode (but just barely).