Strategic Global Intelligence Brief for August 5, 2019

Short Items of Interest—U.S. Economy

Communication Is Hard

The chairs of the Federal Reserve have had varied personalities. Each one has been a mystery to the investment community for a while. Some have actively cultivated that mystery and have reveled in their ability to keep the markets guessing (Alan Greenspan), others have almost been central bank bullies (Paul Volcker). Some have been essentially academics who liked to lecture (Ben Bernanke) and others have been Fed insiders and more bureaucratic in tone (Janet Yellen). Now we have Jerome Powell who has tried to adopt the more open and casual style, but has been trying to do this in very uncertain times. Nobody quite knows the plan as he has maintained a far more conversational tone, one where he seems to invite feedback and opinion. He is also fighting the most interventionist president in recent history.

PMI Numbers Shock

It was thought the latest Institute for Supply Management (ISM) readings from the service sector Purchasing Managers' Index (PMI) would be roughly as the month before. The actual numbers were a shock, as low as they have been since August of 2016. The numbers remain in expansion territory at 53.7, but in June the readings were at 55.1—a steep decline. This comes on top of a decline in the manufacturing PMI last week and some truly dramatic reductions in the PMI for most of the European states and the Asian nations measured by the Markit surveys. Given the importance of the service sector for the U.S. economy, it is not good news to see this level of decline.

The Rush to Bonds

The latest breakdown in the U.S.-China trade dispute has forced a lot of repositioning of investor assets as the markets are now worried about the future of many companies that are engaged in some aspect of global trade. The bond markets are surging as investors seek a haven from the turmoil in the equity markets. This is contributing to lower and lower yields as issuers do not need to provide much of an incentive to get people to buy. This makes it easier for governments to borrow. That is a good thing in the short term, but not so good long term as every nation now seems determined to go deeper and deeper in debt.

Short Items of Interest—Global Economy

Crisis Atmosphere in Kashmir

For decades, the region of India that borders Pakistan has been disputed territory. The Kashmir region is majority Muslim. Much of this population wanted to go with Pakistan when the division took place. It has held a special relationship status within India that protected the Islamic community, but the Hindu nationalist BJP has withdrawn that status and set off protests among Muslims who fear Hindu attacks. Pakistan has also objected and tensions have been ratcheted up. This is a region that has hosted a great deal of tension and terror attacks. Far more is now expected.

Hong Kong Nearly Shut Down

Protests and demonstrations in Hong Kong have led to a general strike that has all but shut the city down. This has become a showdown over the fate of the city. Most observers assume it will end with bloody violence. The protestors are demanding concessions that Beijing can't grant and China's government has been massing troops and police in a way that suggests a final confrontation.

Poland Needs What It Seems to Hate

The ruling Law and Justice Party has taken a very strong and hostile stance towards immigration as one would expect from a populist party. The problem is that Polish economic growth has been severely hampered by the lack of workers. The shortage has been acute and gets worse every day. The nation needs the very people it is currently shunning. This may be costing as much as a point of GDP growth.

What Happens Now?

There had been some assumptions made regarding the trade conflict between the U.S. and China, but by now, it should be obvious that assuming anything about the motivation of the Trump administration is pointless. The negotiators and advisors working on China had concluded that slow progress had been made and noted that China has been quietly complying with U.S. demands. Trump concluded that China was not meeting his demands and that it was time to increase pressure.

Analysis: China had been buying more U.S. farm output and was working on limiting technology theft. These accommodations have not been swift and there has been no progress on addressing the structural reforms (such as state subsidies and blocking U.S. engagement), but it seemed there were grounds for limited optimism. Now it is clear that China is giving up on Trump altogether and will wait to see if there is a new regime in place in the U.S. next year. China now seems bent on creating as much havoc as it can. The currency devaluation is an example as this will affect many other nations in the world. The plan is to get other nations to turn on the U.S. and blame Trump for their economic ills. That tactic seems to be working already. China's economy has taken the brunt of the conflict, but that may be about to change as the U.S. starts to see dwindling exports combine with inflated consumer prices. The tariffs planned for September impact consumer goods more than previous attempts.

What This Means for China?

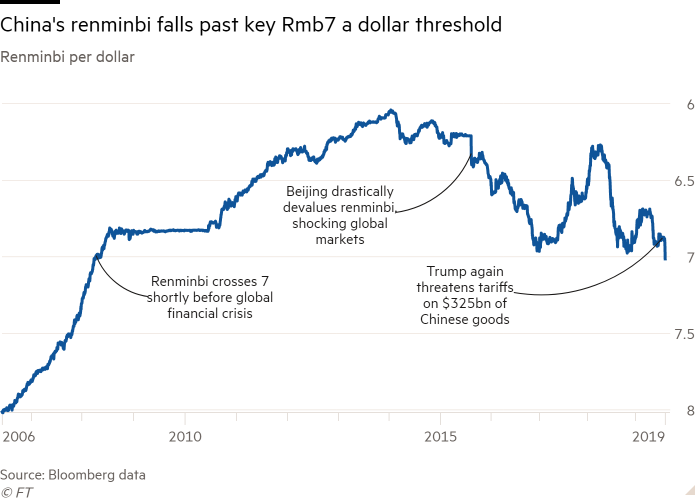

The decision to stop protecting the value of the renmninbi has major implications for China and the global economy. Getting to the level of 7 rmb to the dollar is a major step and has taken he value of the Chinese currency to a point not seen since the recession of 2008-2009. The major motivation for this move was the sudden decision by Trump to impose new tariffs. Lowering the value of the currency will go some way towards off-setting the impact of the tariffs, but this move will likely provoke more reactions from the U.S. as well as the rest of the world. It can be seen as something of a shot across the bow of the Trump administration as this kind of currency manipulation is precisely what the Chinese have been accused of in the past. Why now and what happens from here?

Analysis: The assumption had been that China was going to resist the temptation to pull out this tactic for fear of jeopardizing the trade talks. Now it appears the Chinese have lost all faith in these negotiations and are prepared to start a protracted struggle. There is really nothing left for the Chinese to sanction as they simply do not do enough purchasing from the U.S. The big move was to reduce purchases of U.S. farm goods, but they had already done about as much damage here as they could. The days of a surgical strike are over. Now the Chinese are opting for a broader attack, one that will affect a lot more than just the U.S. The whole attitude of the Chinese has now shifted. There are preparations for an intensified and lengthy fight.

There have been some immediate reactions in other nations. The Japanese yen gained in value right away as there is a persistent belief that the yen is the most appropriate of haven currencies when there is global uncertainty. This doesn't please the Japanese at all as this will hit their export market hard. This was already an area that has been compromising Japanese economic progress. Now the stronger yen makes all this worse. Japan has been warning the U.S. that trade wars with the Chinese will hurt other nations more than they will hurt the Chinese and it will be making that case again. Not that this argument will sway Trump as he has been almost as critical of the Japanese as he has been of the Chinese. Other Asian states have been similarly affected as the Korean won has fallen. The presumption is that emerging markets in Asia are all going to be negatively challenged by the accelerating trade war. They all sell to China and have been hurt by the slowdown in the Chinese economy—it is down to 6.2% growth—as slow as it has been in almost 20 years. The lack of business between the U.S. and China will also damage a lot of the connected intermediate markets.

It is not clear what China can do from here. The drop to 7 rmb to the dollar was a significant threshold and sent a very strong signal. The next step for China is to see how the rest of the world reacts. The best-case scenario for the Chinese and global investors would be for Trump to respond to pressure from his own advisors and from allies in Asia that have been hurt by this conflict. What this would look like is anybody's guess. It would mean resumption of the talks, but for China to get engaged again would require a major concession from Trump and that is not likely. The position taken by Trump has very little to do with economics and everything to do with politics. It is a strength to confront China as far as Trump's base is concerned, but at this stage, the tariffs have not had a huge impact on the U.S. consumer. As that changes, the attitude towards the trade war could change.

Brazil Worries About Deforestation

It would likely be more accurate to assert that some in Brazil are worried about losing the Amazon. The rate of deforestation has accelerated sharply since the arrival of the Bolsonaro regime. An area the size of Luxembourg has been razed in the year since his election and his decision to open up the region more aggressively to logging and farming. The whole world takes an interest in the fate of the Amazon as it plays a major role in trapping carbon dioxide, not to mention the whole conversation around biodiversity. The issue has always been one of future development. Bolsonaro has essentially told the world that if it is so concerned about the preservation of the rain forest, it can pay for it.

Analysis: There have been attempts to preserve the Amazon, but the space involved is vast and there is no amount of private funding that can protect the land. The Brazilian economy has been struggling and the farm sector exports have played a huge role in the future of the national economy. That importance has been ratcheted up with the trade war that has shifted Chinese import priorities. The Brazilians are getting the majority of the market share the U.S. soybean producer has lost. This has encouraged a great deal more investment in the farm expansion into the Amazon. The future is not very encouraging for those who seek to limit the exploitation of the rain forest.

Some Interesting Data Points Ahead This Week

This week there will be quite a lot of data coming from the Labor Department as well as from private sources like the Institute for Supply Management. The Trump decision to boost tariffs on more goods from China has contributed to another round of unease in the markets, especially since the revelation that Trump's own advisors argued against the move. Trump's attitude towards the Chinese has ceased being a tactical response to Chinese negotiating tactics and now seems to be motivated by petulance and personal animosity. That makes the acts far less predictable; investors tend to get very nervous when there is little predictability for them to count on. This latest act has increased focus on some of the underlying economic motivators as the investor and the overall business community tried to assess what is going on now and what can be expected down the road.

Analysis: The first order of business is reacting to the Chinese response to the Trump move. As expected, the Chinese launched counter measures designed to apply their own pressure—the most notable of which was allowing the yuan to fall to levels not seen in over a decade and at the same time ordering importers in China to avoid purchasing agricultural output from the U.S. Both of these moves have been taken to deliberately antagonize Trump. He has been asserting that China is a currency manipulator for years and now China has engaged in very deliberate manipulation. Trump has also demanded that China buy more from the U.S. farmers. That had been taking place over the last several months. Now China is refusing to continue that purchasing behavior. Observers have also noted that China is taking several other steps that are now directly related to trade—stepping up confrontational tactics in the South China Sea and further backing the North Koreans while also increasing aid to nations the U.S. is at odds with (such as Venezuela). It appears that President Xi Jinping and others in the Chinese leadership have started to see this trade conflict in personal terms as well and are focusing their reactions on whatever is most likely to alienate President Trump.

The first set of numbers will have been released by the time you read this. The Purchasing Managers' Index for manufacturing was released last week. It remained low but still not in contraction territory (a score below 50). The service sector reading comes out today and is expected to be in the middle 50s (consensus view has been that it would hit 55.7—slightly up from last month). The service sector is by far the largest sector in the U.S. economy, but it is also a somewhat dependent sector as many of the service sector companies and jobs are closely connected to the manufacturers. The numbers have been respectable for many months and this reading is not expected to be significantly different. The biggest categories are generally health care, construction, retail and transportation. There is considerable divergence between these sectors with health care very strong and transportation feeling weaker.

The more anticipated numbers will be coming from the Labor Department towards the end of the week. The Job Openings and Labor Turnover Survey (JOLTS) report will be issued. This has been an interesting data point of late. It measures the number of jobs going unfilled as well as the number of people who have been willing to simply quit their jobs in search of something new. The quit rate is expected to have risen again. That is a sign of a healthy economy as people rarely decide to just quit unless they feel they can get another job right away. The low point for the quit rate was in the middle of the last recession. The number of unfilled jobs will also be noted. There are estimates as high as 1.4 million jobs unfilled—more jobs than there are conceivably people able to fill them. Granted, a certain percentage of these jobs require rare skills, but even if every single person able to hold any kind of job at all was employed, there would still be over a million jobs unfilled.

The Labor Department will also release the Producer Price Index, but not much is expected from the gauge this month. There has been a slight increase in producer prices, but there have been no sharp spikes thus far—especially as far as oil is concerned. The lack of wage inflation has also figured in the reduced level of inflation affecting business. If there is a spike, it will signal there has been some reaction to the trade and tariff wars as these have been the only factors driving up prices in most sectors.

What Will It Take?

The incidents are starting to become almost routine and the reactions to them have certainly taken on a pattern of futility. A gunman opens fire in a place which should not a war zone—a garlic festival, a bar, a Wal-Mart, a school. There is immediate sadness and outrage. Prayers are offered, people decry the state of the world, calls are renewed for gun control, but everybody knows that it is just a matter of time before the next tragedy. What can really be done?

In some respects, there is nothing that can be done. There are 325 million of us in the U.S. Within that population will be people unbalanced and angry enough to commit atrocities. The more tragic news is that every single day there are approximately 310 people shot in the U.S. and 100 of them die. Many suggest gun control, but the reality is that there are 300 million guns in the U.S. so access is not a problem that can be solved with gun control at this point. The issue runs deeper than this and will demand a change that will be immensely challenging.

We have become a society that knows nothing about itself. We live highly isolated lives with almost no social interaction. We do not know our neighbors, much less people that live across town or the country. Not to overly romanticize the "good old days," but back in my tender youth there was a great deal of common experience as we all watched the same TV news and read the same local paper. There was an expectation that everything that happened in the neighborhood was everybody's responsibility. I was yelled at and disciplined by the neighborhood ladies far more than my own parents. Isolated people were rare and intervention was expected. I remember the kid who was caught torturing a stray dog. Within hours, he was being descended upon by police, but also by three local clergy people. I still remember seeing him sitting on his front porch talking to a rabbi. The family was Baptist (their preacher called his Jewish counterpart) and the kid also got a visit from the Catholic priest. The assumption was that something was wrong and needed to be fixed. I have no idea what they said or what the issue was, but that kid was far less isolated and stopped being a bully after that. It is no panacea, but we need to know one another a whole lot better.

China's Renminbi Falls

It has been a long time since the Chinese lowered the value of the renminbi to this level. This time, the decline was more deliberate as opposed to the demands made by the global economy. This is pretty clearly a case of currency manipulation, but it is also a justified reaction to intervention in the form of punitive tariffs. The classic definition of a manipulation is an unprovoked attempt to boost exports by artificially lowering the value of a national currency. The Chinese reaction is more along the lines of countermeasures.