By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Longer-Term Attitude Towards China

It has become increasingly obvious that there will be no "return to normal" with China regardless of what happens in next year's election. From the end of the Second World War until the early 2000s, there was no doubt where China stood. We were Cold War enemies. The opening of China was expected to usher in a period of reform that would make China more like the U.S. and Europe. It didn't. It now appears that the old patterns of hostility are returning to stay and the period between the 90s and the last few years will be seen as the aberration. The rivalry is not just over trade. It extends to military confrontation, foreign policy and ideology. The future of U.S. engagement in China is very much in doubt no matter who emerges victorious in the U.S. elections next year.

Case-Shiller Index Continues to Decline

The Case-Shiller index measures the rise and fall of home prices around the country. Over the last several years, it showed that home prices were rapidly rising. This created a concern that starter homes were getting priced too high for the beginning homeowner. In the last couple of months, the pace of home price growth has started to slow. This last month the rise was by only 3.1% as compared to the month before when the price hike was 3.3%. There is still a sense, however, that starter homes are too expensive in many of the major markets

Many Missed Out on Wealth Rebound

There has been a substantial recovery since the recession of 2008-2009, but it has not been shared by everyone. The bottom half of the population has just now returned to the wealth levels seen as the recession started and they have 32% less wealth than they did in 2003. The upper 1% of the population now has double what they had in 2003. This wide disparity in terms of economic recovery has been driving politics of late, making the issue of income distribution key to electoral strategy. The biggest concern among economists is that another recession would prove very damaging to those who just recovered what was lost—they are extremely vulnerable to even a mild downturn and would be in a crisis within weeks, much less months.

Short Items of Interest—Global Economy

Pushing for Trade Reform

The passage of the USMCA was thought to be an easy win for the Trump team. Many assumed it would be passed by the end of the year. It was a relatively modest reform of NAFTA, but seemed to have general support. It was passed quickly by Mexico, and Canada seems close. The problem is that unions in the U.S. are deeply opposed unless there are tighter labor standards and environmental protections. This has been the position of most Democrats as well. The unions had been supportive of the Trump plan, but have now turned against it. Passage is not guaranteed unless changes are made.

Major Crackdown Underway in Hong Kong

The Chinese government is arresting many of the activist leaders in Hong Kong. They have been detained by local authorities, but under the direction of Beijing. There is evidence that some are being held in China. The targets have included local politicians as well as student leaders and business people. Also, the police have become more and more aggressive. It is expected that a bloody final confrontation is only a matter of time. Members of organized crime gangs have been seen attacking the protestors viciously; these thugs have been ignored by the police.

New Coalition in Italy

The move by the leader of the right-wing League party has failed for the time being. Deputy Prime Minister of Italy Matteo Salvini hoped the collapse of his coalition with the Five Star Movement would trigger new elections, but Five Star is forming a new coalition with the center-left Democratic Party. These two have been intense rivals in the past and few expect this shotgun marriage to last very long. The two have little in common beyond opposition to the League.

Here Comes the Pain

There have been many predictions as far as the impact of tariffs on Chinese imports into the U.S. Most of them have not come to pass. The fact is that many of the threatened restrictions have been abandoned or delayed, but over the weekend, there will be another round of these import taxes (unless there is another last-minute delay). These are likely to get the attention of the U.S. consumer at last as many retailers indicate these will affect them. At this point, over 80% of U.S. companies importing from China have warned that their prices will go up, and often dramatically.

Analysis: There has also been more damage imposed by China's retaliatory tariffs. The farming community is taking it hard at this stage as they have been hit by bad weather as well as the Chinese tariffs. The timing of the Chinese moves couldn't really be worse and there is an expectation of some significant agricultural hardship. The long trail of threats and counterthreats may have finally reached a point of no return. The U.S. consumer is finally going to understand that these tariffs are essentially a tax on them. Perhaps it is worth it in the long run, but short-term pain is guaranteed at this point.

Is Africa Poised for a Breakthrough?

In many respects, the situation in Africa looks a lot like China at the end of the 1990s. Nobody really thought China was on the verge of dramatic expansion despite the fact it had rapidly urbanized and had started to attract significant levels of investment.

Analysis: It offered what the developed world wanted—a manufacturing platform that would allow the lifestyle desired by the developed world consumer. It had quietly improved the health of its population, and there had been an expansion of education. The country had invested in infrastructure and was better able to feed its population. The rest, as they say, is history. Today, China has surpassed Japan, Germany, France and the U.K. as the second-largest economy in the world. Will that be Africa at the end of this decade?

The fastest-growing population in the world is now Africa. By the year 2050, the population will reach two billion and outnumber those in China. In past years, that would be seen as an enormous burden, but improvements in education and health have made that growth of a young population into an asset as compared to the rapidly aging populations of the developed world. By 2050, there will be only one working person for every retired person in the developed world of Europe, Japan and the U.S. In Africa, there will be five or six working people for every retired one.

One of the major reasons for all this recent growth has been China. In 2000, the trade between China and Africa amounted to about $10 billion. By 2015, the amount was $200 billion. During that same period, the Chinese government invested another $148 billion into various African states—mostly on development initiatives that looked a lot like the ones that China invested in 20 or 30 years ago.

Not everything has been smooth for the Chinese, however, as some African leaders have complained that China behaves like new colonialists. The Chinese mostly invest in the extraction of needed raw materials, but the bulk of the labor comes from China. The managers and technocrats are certainly Chinese. They have seen Africa as a source of raw materials and as a place to sell Chinese goods, but there has also been evidence China is investing in making Africa a place for production.

The trade wars that now mark the relationship between the U.S. and China have accelerated this process as Chinese companies can produce in Africa and escape the tariffs. In many cases, they can take advantage of special trade privileges that were designed to encourage exports from Africa into the U.S. and Europe.

Politics, war and corruption have long hampered the development of Africa, but that shows signs of change as well. In 1990, 12 of the African leaders held their position due to military coups, while only six had been elected. In 2019, there are 45 leaders that gained their position through a multi-party election of some kind. Institutions are still often weak and corruption remains a major problem, but many sectors are far less subject to that graft and abuse. There are certainly miserable war-torn nations such as Somalia, the Democratic Republic of the Congo (DRC) and Burundi. There are also nations that have been hamstrung by their own ineptitude such as Nigeria and South Africa. The six fastest-growing nations in the world are all in Africa. Many of them are unfamiliar to most people—Ghana, Ivory Coast, Tanzania, Ethiopia, Djibouti and Senegal.

The challenges faced by the 54 nations of the African continent are still daunting, but the same was believed of China in the 1990s. The growth of China has become a model for many of these states. They will be gaining in importance with every passing year.

Johnson Tries to Hold Off Tory Rebels

The move to push for a new election is designed to hold off what looks to be a certain defeat for the Brexiters. The Labor Party is now solidly in favor of avoiding a hard departure from the European Union (EU). It has been joined by a considerable number of Tory MPs who disagree strongly with Prime Minister Boris Johnson's position. He is now pushing talks very aggressively as he tries to pressure the EU leaders to agree to hammer out a new deal. He is betting the EU really does not want a hard exit and will buckle and start new talks.

Analysis: Thus far, there has been no hint of European panic or willingness to re-open talks. They have taken the position that Britain has far more to lose than does Europe, and that a hard exit will be disastrous for Johnson. The EU now seems to be holding out hope that a new leader emerges in the U.K. who agrees to all the EU demands. The analysts are siding with the EU as far as impact is concerned as they predict growth in Britain will stall and the country will end up in a deep recession. The notion that Johnson could work a quick deal with Trump has faded, although one never knows what can be declared at the last minute. Most assume that a deal with the U.S. would take months to develop and it would still not adequately replace the business lost from Europe.

What Does Slow Growth Mean?

The data that has been released of late tells a pretty confusing story. Most people can be forgiven for not being able to keep up with what all this really means. If you are told that corporate profits are up, that retail sales and consumer confidence is up, that rates of unemployment are at 50-year lows and that there was really no sign of inflation on the horizon, what would your conclusion be as regards the health of the economy? If you were told that there was an inverted yield curve, that global growth had fallen to 20-year lows, that the debt and deficit were reaching yet another record level, that the industrial production numbers and the Purchasing Managers' Index were as low as they have been since the recession, what would your conclusion be regarding the health of the economy? Confused, are we? Is there one of these indicators that is more salient than the other? Can it be that there is both growth and no growth? The answer to that question is yes.

Analysis: You are not alone in your perplexed attitude. It is possible to be seeing signs of both growth and decline at the same time. Remember this is an economy with a $20 trillion GDP—the largest in the world, and by a wide margin. Every single state in the U.S. has a GDP to match that of a country. California has a GDP comparable to the U.K. or France. Texas compares to Canada or Brazil. Kansas compares to Kazakhstan, and that certainly makes sense. Therefore, it is entirely possible for there to be boom and bust taking place in the U.S. at the same time.

In the first quarter of the year, the U.S. economy grew at a more than respectable pace of 3.1% but started to tail off in the second quarter with growth of 2%. This is certainly respectable and consistent with the growth over the last 20 to 30 years. The pace of growth last year was 2.9%; most expect that pace to slow to perhaps 2.1% or lower this year. At the same time, corporate profits were up in Q2 by 4.8% as opposed to declines in the first quarter of this year and the last quarter of 2018. These profit numbers can be volatile and there is an expectation of more decline in Q3 and Q4.

The factors that worry the business community have not changed over the course of the year. It is the opinion of most analysts that these issues will worsen as the year progresses. The three that get the most attention include the rising cost and shortage of labor, the low level of inflation and the decline in export activity. The Philips Curve has not been as reliable an indicator of wage inflation as it has been in the past, but there are some extenuating circumstances. There are fewer qualified workers available so those that do have the required skills are getting good money. On the other hand, the companies have been forced to hire less qualified people and then train them. This affects productivity. At some point, the newly trained will be able to command higher salaries. Part of the reason that jobless rates are as low as they are is the retirement of some 10,000 Boomers every day. If they are replaced, it is generally with lower-paid employees.

The low inflation rate is now considered an issue—part of what has been termed the Japanification of the U.S. or secular stagnation. The low rate has been so persistent and resistant to all efforts to push it up through Fed actions that it has severely limited the ability of producers to hike prices—even a little. The only way for companies to push much in the way of revenue gain or profit has been through cost cutting. At some point, that will involve cutting the size of the workforce. The fact is that a little inflation is a good thing, otherwise there are extended periods of deflation as Japan has been going through for the last decade and longer.

Finally, there are the issues that have surrounded trade. By now, we are all pretty familiar with these. The trade war has been utterly disjointed and capricious. There have been threats to cut off trade with Canada, Mexico, Argentina, Europe, China, Japan, India and pretty much every other nation on earth. The vast majority of these threats have been completely empty and policies change by the hour. Companies have no idea what to expect tomorrow much less in weeks or months. The thing that has not changed has been the strength of the dollar, which has not done the U.S. exporter any favors at all.

Any one of these could drag the U.S. economy down. If all three persist and worsen, the result could be recession or at least a significant downturn. There is not much that can be done about the first two issues, but the trade war is entirely man-made at this point.

Never Pay Attention to One's Neighbors

This particular lesson cost me $130. There has been a road closure in my neighborhood for what seems like the last 25 years. Getting around this blockade adds a good 10 minutes to any trip to places like local stores and complicates visits to the doctor. Recently, the local internet news blog for my neighborhood was alive with the "news" that at last the construction was over and the road opened. I had a meeting that gave me the opportunity to take the old route, so I did. The barricades were still there, but moved to the side. The new paving was not all in place, but all the equipment was gone and so were the workers. Getting through was simple enough—no barriers in place. Alas, this was all a mirage.

As I followed the car ahead of me down the road, there were suddenly flashing lights. We both got pulled over and issued a ticket for $130 for driving in a construction zone and apparently endangering the very fabric of modern civilization. Really? No barriers in place, no construction taking place and I get this? Slow day in the criminal world? The moral of the story is that listening to what neighbors say in a social media blog is among the dumbest things one can possibly do. I deleted that app as soon as I returned home and have resumed my old habits of utterly ignoring anything said by those living around me.

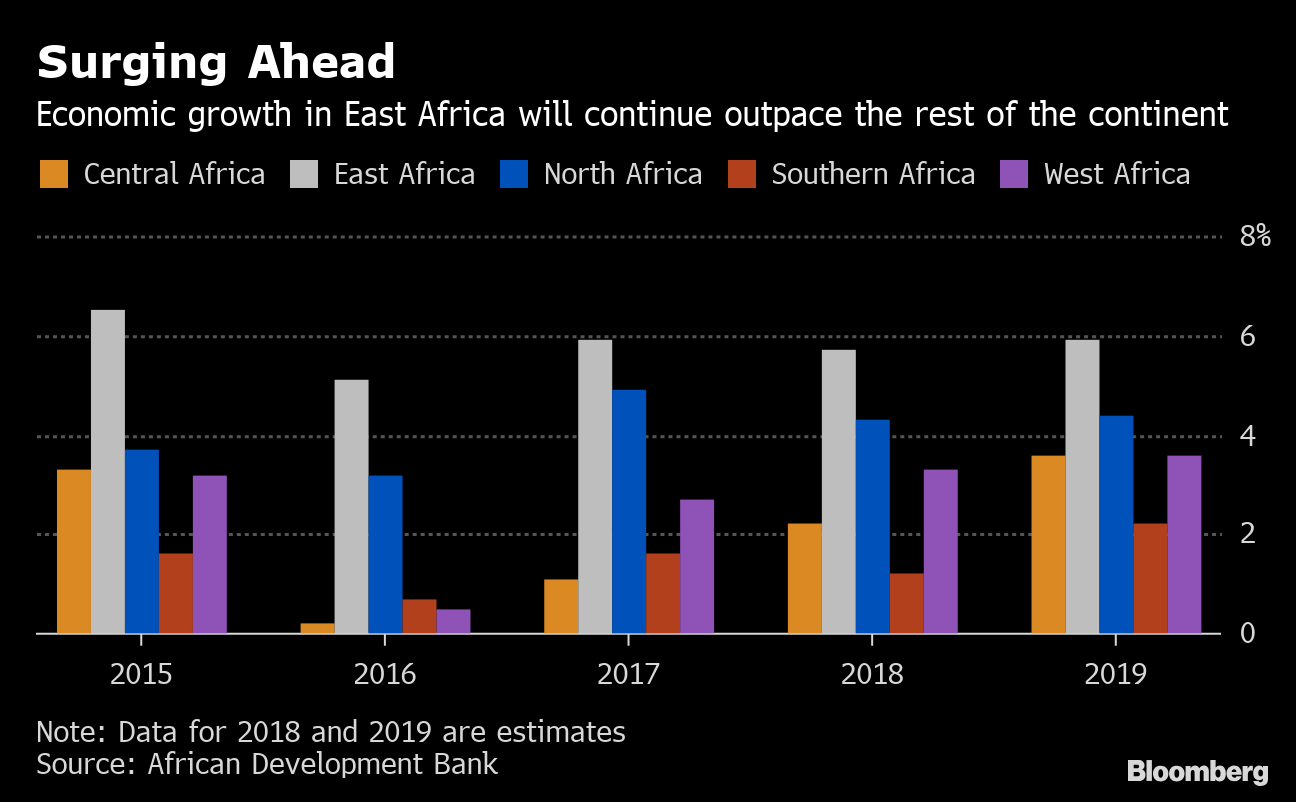

Economic Growth in East Africa

The economic future of Africa will likely be in the hands of the nations in East Africa. Three of the six fastest-growing economies in the world and Africa are in this region (Tanzania, Ethiopia, Djibouti). Add in others that are also doing well—Kenya, Eritrea, Rwanda—and it is apparent these are taking the place of Nigeria and South Africa as the engines of continental growth. Not everything is rosy, however, as this region also includes Somalia, Sudan and South Sudan.