By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Disaster Relief

It would not seem that providing assistance to those who have been affected by natural disasters would be controversial, but in nearly every case the process is fraught with controversy. The most common issue is the ability of the recipients to handle the influx of money and help. Very few governments are designed to address major disasters such as hurricanes, floods, fires and the like. There are bottlenecks and delays, and there is inevitably waste. There are also those predators who swoop in to get hold of that money, and too many succeed. Then, there are the political decisions that can hamper the efforts. The Trump administration has been upset with the process in Puerto Rico and has now elected to divert $270 million in aid money to bolster border enforcement—just as the island is about to be hit again by another hurricane.

Fed Getting It from Both Sides

That Trump has been upset with the actions of the Federal Reserve is no secret. Despite the fact that nearly all of the members of the Board of Governors have been appointed by him (Lael Brainard was the only holdover), he has been critical of their reluctance to further cut rates. Now, there is a statement from former New York Fed Chief William Dudley calling on the Fed to resist the temptation to reduce rates as this would benefit Trump. The response from the Fed has been to utterly reject the notion that they will react in any way to political pressure. The decisions on rates and other moves will be determined by economic need.

Moving Beyond Income Tax

Many economists and analysts have become increasingly critical of the income tax as the chief source of revenue for government. It tends to be punitive as it goes after what people make and creates a disincentive to make more. It has also been manipulated and adjusted to the point that over 50% of the population pays no income tax at all. The Democrats are looking at taxes that hit the wealthy—inheritance taxes, capital gains taxes and mechanisms that reduce opportunities to shelter money. The Republicans are more interested in user fees and taxes that depend on what people actually consume. This debate will likely be a large part of the upcoming campaign season.

Short Items of Interest—Global Economy

Johnson Attempts to Accelerate Brexit Decision

British Prime Minister Boris Johnson has asked Queen Elizabeth to suspend parliament for several weeks so there will be less time for the members to debate the U.K. exit from the EU. The deadline for the decision is October 31. It has become clear that Johnson and the Brexiters want a hard exit. They believe that when it comes down to it, the Europeans will cave and agree to open talks again. There has been no signal that Europeans will want to do this, but Johnson now seems to be trying to force their hand.

Will the U.S. Bail Out the U.K.?

A big part of Johnson's strategy as far as Brexit is concerned is a trade deal with the U.S. that would essentially replace Europe. This has been promised by Trump, but as the deadline for British exit from Europe looms, it is becoming obvious that such a deal is going to be hard to pull off. The two economies are very similar and there is lots of competition already. Is the U.S. really interested in a flood of U.K. manufactured goods? Is the U.K. really interested in U.S. companies buying much of the British retail and service sector?

Chinese Pressure

While the world has been watching the demonstrations in Hong Kong with increasing unease, there are other issues that may prove to be more threatening. Cathay Pacific, one of the largest airlines in the world, is headquartered in Hong Kong. It attempted to stay out of the fray and stated it would not intrude on the decisions of its employees, but China put a stop to this. The crews are now subject to investigation and detention if they show any connection to the protests. China has ordered the firing of senior leaders—essentially dictating policy.

Japanification Is a Thing

For the last three decades, the third-largest economy in the world has been clanking along in a frustrating pattern of low growth and acute deflation. Japanese leaders have tried to shake out of this malaise, but nothing tried so far has worked as it was supposed to. The many stimulus efforts have been woefully ineffective. Bond yields have remained low even as debt burdens have risen. While the U.S. has been deeply concerned at various points that its national debt was out of control at 110% of its GDP, Japan has been sporting a debt that is 240% of its GDP. There have been tax cuts and the Japanese government has tried to dump cash into the hands of the population, but to no avail. This process has now been dubbed "Japanification" by many economists. The worry is that this problem is showing up elsewhere. It can be argued that Europe has now fallen into the same trap and there are signs it could be happening in the U.S. The most worrying part of this issue is that nothing the government or the central bank can do seems to work at all, which leaves the economy adrift.

Analysis: The primary indicator of Japanification globally is the rise of negative yielding debt. Right now, 30% of that debt is carrying sub-zero yields. That is $16 trillion worth of bonds for those who are counting. At the moment, the U.S. accounts for 95% of the world's available investment grade yield. The bottom line is that the world is one U.S. recession away from falling into an extended period of stagnation, and that without effective tools. Some have referred to the situation in Japan, and now Europe, as "black hole economics," the prospect of a generation of low interest rates that can't climb out of the basement.

As with most things in finance and economics, there are those who will benefit from this state of affairs and those who will not. The balance will be key to the future of economic growth. The most obvious beneficiaries will be those who want access to cheap money. Low interest rates mean borrowing will be cheap and governments can issue loads of debt without worrying much about yield. The expectation is that these lower rates will stimulate business growth, but that has not been the case with Japan. It is not happening in Europe either. Even the U.S. has not seen the bang for the buck that was expected from lower interest rates and tax cuts. The impact was less than anticipated and was short-lived—described by many as a "sugar rush."

It turns out there are motivations for business expansion other than low interest rates. The inhibitions that have had the most profound impact have included hesitant consumers, worker shortages and the drastic interruption of global trade. Look at Japan to see how these have combined to negate the impact of 30 years of low rates. The Japanese consumer has been frugal throughout and has been unwilling to spend regardless of the incentives piled on by the government. In addition, the aging population has robbed the country of the workforce it needs to keep pace. That has forced many companies to leave Japan to produce elsewhere. The majority of "Japanese" cars are now made outside Japan. The Japanese have survived on the back of global trade, but the trade wars instigated by the Trump administration have battered Japan directly and indirectly. The export patterns aimed at the U.S. have been hampered and the slowdown in the Chinese economy has dealt a severe blow to the Japanese economy.

Meanwhile, in the U.S., low interest rates are making life very difficult for small banks as they make their living through deposits; there is very little incentive to put one's money in a bank these days. The pension funds are already facing a crisis. They depend on calculations of their long-term liabilities using high-grade average bond yields. When these yields fall, their expected returns are reduced. This deteriorates their funding status and they have to set aside more money. The pension deficit for the S&P 1500 index rose by $14 billion in July due to lowered bond yields.

The message from the Jackson Hole G-7 meetings is clear enough. There is not much chance that things will go back to what was once seen as normal. The economy of the world has changed and the banks are struggling to keep pace. The trade wars and attempts at isolationism are only making matters worse. That has elevated the chances for a global recession, and sooner than many had expected.

What to Make of the G-7 Meetings

In past years, the meeting of the G-7 nations could be something of a yawner. The goal was usually to coordinate the policies of the nations that dominate the industrial economies of the world; the controversies were dealt with privately. The meetings generally focused on creating some kind of bland memoranda of intent that sounded great but contained very little specificity and buried most of the controversy in mounds of verbiage. This was not the case with this meeting and it was not all due to the mercurial nature of the U.S. president. The French leader, Emmanuel Macron, decided to discard the idea of that memoranda from the start and orchestrated a meeting that forced some interactions. As is often the case, there is a great deal of declaring of victory, but these declarations are usually disputed by others.

Analysis: As the meetings began, there were several items on the agenda. The trade war that had heated up between the U.S. and China lurched to the top of the list along with what to do about Brazil and the burning of the Amazon. There was discussion of what to do about the threat of recession and the turmoil in the bond market. As the meetings got under way, there were some unexpected issues that arose and most of those came from Trump. There was his insistence that Russia be allowed back into the fold. It was once the G-8, but Russia was booted over their blatant invasion of Ukraine. Trump lobbied hard, and often at inappropriate times. He tried to claim that others supported the idea. This was emphatically denied by everybody except the outgoing Italian prime minister. Russia will not be welcome any time soon.

France also shocked the attendees with the invitation extended to the Iranian foreign minister. There were no meetings between the Iranians and anybody from the U.S. delegation, but Trump made a vague assertion that he would welcome an opportunity to meet with President Hassan Rouhani under the right conditions. The Rouhani response was swift. He demanded that the U.S. lift all the sanctions and that Trump would bow down to the Iranian leaders. It is not likely that a meeting will take place, but then there were few who thought a meeting with Kim Jong-un of North Korea would happen either.

The meetings were clearly tense as the majority of these nations have been hurt by the U.S.-China trade war. There is deep concern that these battles will get worse. By the end of the meeting, there were slightly more conciliatory statements coming from Trump, but by this time nobody really knows what to believe. Trump clearly played this event to domestic political advantage. His audience was not the other leaders, it was the political base he carefully cultivates in the U.S. They want to see Trump scowling at these other leaders and sounding tough on China and everybody else. Trump is in full campaign mode and knows that confronting foreigners will not cost him votes. The Democrats can hardly exploit this meeting without appearing to care more about the opinions of foreigners than their constituents.

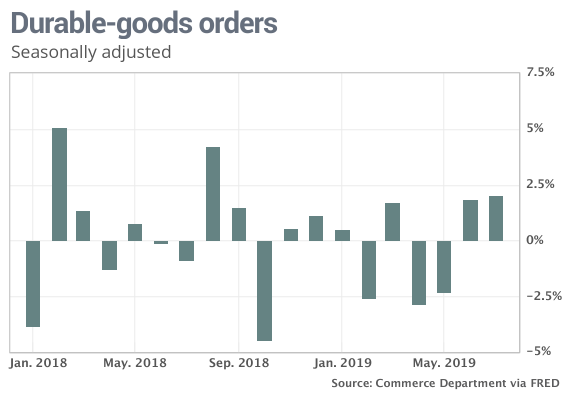

Durable Goods Orders Not Impressive

There was a little boost in durable goods numbers, but it was due primarily to an increase in aerospace activity. The travails that have beset Boeing are far from over, but there has still been activity as the airlines have been trying to react to their demand factors. The more disturbing data comes from the non-defense capital goods numbers. They are generally way down from a year ago as the watchword in business these days has been caution. It is simply not clear where the economy is headed although few are expecting an imminent or deep recession.

Analysis: The markets are getting whiplash from the ever-changing announcements from the White House on everything from trade to Iran to how to deal with hurricanes. The overall business community is not as reactive and tends to focus more on longer-term patterns. The challenge is that it has become harder to predict what the consumer is thinking. The confidence surveys are still pretty positive and retail sales have been solid, but at the same time, there is evidence that confidence in the future is at a low ebb. The sense is many are waiting for the bad news and are ready to react quickly if they see it. There is confidence in the economy, but fewer are expressing confidence in the security of their jobs. There are sectors where this unease is acute and others seem immune to the threats. Manufacturers are starting to feel the pinch of the global slowdown, but high tech and health care look as confident as ever. These are both areas generally unaffected by trade disputes.

Abdicating Responsibility

There has been a fairly radical shift as far as corporate attitude of late—at least in terms of what is being said publicly. At this juncture, it is hard to tell if this is just an attempt at public relations or a genuine desire to change how business is to be conducted. However, the decision by the Business Roundtable to move away from the assertion that a corporation's only mandate is to return shareholder value has stirred up lots of controversy. Should corporations be required to address the needs of the community, worker, supplier, consumer and the world in general along with shareholder?

Analysis: It sounds like a noble aspiration, but there is one significant point to consider. Should decisions about the welfare of consumers, workers, suppliers, the community and world as a whole be left in the hands of business executives? Not that they are incapable of making good decisions or that they will not try. The point is the task of considering the welfare of the greater community has already been assigned. This is the task government was created to handle. That these elected leaders have failed to do this job should not provoke the abandoning of the system itself, but should prompt the replacement of those who hold these offices. The corporate community should not be asked to solve all the world's ills. Ford should focus on making vehicles and Yum should focus on the food it sells. It is the government that should set the rules to ensure the cars are safe or efficient and the food is not going to make you sick. Milton Friedman is still correct—the sole function of a corporation is to return shareholder value.

Report from the Front

This week featured an opportunity to speak to over 1,000 men and women who work in the steel industry. The Steel Summit is a group that both Keith, the co-founder of Armada, and I have had an opportunity to address over the last few years. it provides some great insights into the economy and all the factors that affect it. Last year, the mood was one of crisis as the imposition of tariffs on imported steel had just been announced by the Trump administration. The expectation was that steel prices would surge and manufacturing would be crushed. One year later, the focus was on the fall in steel prices and the reality of a tariff system that really didn't address the issues affecting the steel industry. The future of steelmaking in the U.S. remains a very hot topic and a controversial one—a situation that has existed for a long time.

The fundamental question is an emotional one. Does it matter where the steel comes from? Given that the U.S. can import steel from as many as 30 nations, there is no realistic scenario in which the U.S. would be denied the steel needed for any purpose. If the steel obtained from other nations is cheaper than that which is made here isn't that a benefit for all the companies that use steel in their products and doesn't that ultimately benefit the consumer? Is the issue one of employment or national pride? Is it politics? The issue would be easier to address were it not for all the market manipulation in the sector. China heavily underwrites and subsidizes their steel industry, but frankly so does everybody else to a degree. Steel gets caught up in discussions of national security and has for years.

What was most interesting is that despite all the attention focused on tariffs, subsidies and trade, the most salient threat has been the development of alternative materials—aluminum trucks, high impact plastics, ceramics, reinforced wood, new cement and concrete formulas. The two biggest markets for steel remain construction and vehicles. These are the sectors drawing the attention of alternatives.

Durable Goods Orders Chart

The durable goods numbers are always of interest; the data has been all over the place for the last year. The most recent trend has been positive, but there are always caveats when looking at these numbers. Durable goods are those designed to last more than three years. As a result, the bulk of these items are industrial machines rather than consumer goods. The improvement in orders means that business has been investing in new machines. The data can be thrown off by what happens in the aerospace sector as it doesn't take many aircraft sales to boost the numbers. That is why there is always a version of this data that excludes airplane sales.