Short Items of Interest—U.S. Economy

Jobs Data Still Holding Up

The estimate was there would be an additional 148,000 jobs added this month. The numbers were slightly better than expected with an addition of 164,000 jobs, while the overall unemployment rate held steady. Employers in the service sector are still hiring at a pretty good pace, but there has been a decline in the number of new manufacturing jobs. The pace of hiring has been off from what it was last year, but has been respectable with an average of 165,000 added per month as compared to 223,000 last year. The service sector has dominated, although most of these have been in relatively low-paid positions, holding down the overall gains in wages. There is still no sign of an outbreak of wage inflation.

New Budget Passed

For those who have been waiting for the moment the U.S. Congress elects to try to address debt and deficit, the wait is going to be much longer. The budget that has made it through Congress raises the debt ceiling for the next two years and contains $2.7 trillion in discretionary spending over the next two years. This is spending unrelated to the entitlement programs such as Medicare, Medicaid and Social Security. The additional spending over supposed limits set in 2011 will be $320 billion. Much of this will go to the military, but many social programs also saw funding preserved. The debt and deficit will both continue to grow, and at a more rapid pace.

Consumer Debt Continues to Rise

The level of consumer debt has hit yet another high point. The consumer in the U.S. now owes over $4 trillion. This debt does not include mortgage debt and is focused primarily on student loan debt ($1.5 trillion), car loans (up 40% in the last decade to $1.3 trillion) and credit card debt. There has not been a great deal of inflation, but there has been some. This has been taking place at the same time wages have been stagnant. The costs of education and health care have been rising and there have been substantial hikes in many of the services that consumers buy.

Short Items of Interest—Global Economy

Consensus Failed and Now There Is a Vote

After weeks of negotiations, there has not been a consensus candidate emerging as the new head of the International Monetary Fund (IMF). There will now be a vote of all the European finance ministers. If one of the those on the short list of four emerges with over 50% support, they will be the new IMF head, but it is more likely there will be a runoff between the top two finishers. The hope is that one of the four gathers some momentum so they have a chance to start strong with the organization, but after all the wrangling, it is likely there will still be objections.

U.S. Pulls Out of Arms Treaty

Several years ago, the Putin regime in Russia developed a short-range missile called the SSC-8. It is a cruise missile that has a range that would include all of Europe. It caused major concern within the ranks of NATO. The U.S. has been trying to get Russia to destroy the weapon as it is considered a violation of the treaty, but Russia has refused and has started to deploy the weapon in western Russia. The U.S. has been threatening to pull out of the treaty. Now, the withdrawal is formal. This allows the U.S. to deploy missiles and countermeasures of its own. It essentially means an arms race is back on.

Indian Markets Fall

The Modi bump was short lived. The stock market in India has just suffered its worst July in decades and seems to be heading down further in August. Investors were originally excited about Modi's win, but now they are worried about whether he will have the support needed to carry out any further reforms. They are of the opinion that nationalist politics have come to dominate the agenda and economic reform is taking a back seat.

Markets Spooked by Latest Trump Move on China

So much for those renewed trade talks. The U.S. delegation returned from China with nothing much to show for their efforts. The immediate reaction on Trump's part was to ratchet up the tension and impose more tariffs on goods that had not been subject to restrictions before. The market reaction was immediate and negative as stocks fell dramatically and government bonds gained in value as investors sought financial havens. There is an emerging assessment that is creating a great deal of worry. This latest round of tariffs may be the straw that breaks the camel's back given all the worrying data that has been issued regarding the global economy. Strategically, there seems very little to be gained by this latest escalation; however, the Trump reaction seems more petulant and personal and unrelated to any kind of trade goal.

Analysis: As a tactic designed to alter China's trade behavior, the imposition of tariffs and other restrictions had already made their point—without having a major impact on the U.S. economy and U.S. consumer. Intensifying the attack risks doing real damage to the U.S. economy without adding appreciable pressure on China. The trade wars have already been a major factor in the overall decline of the Chinese economy as it has seen its GDP growth fall to levels not seen in 20 years. The U.S. tariffs have been targeted to a degree and have affected the Chinese more than the U.S. The Chinese retaliations have stung the U.S., but there has been some wiggle room of late as U.S. farmers have been able to sell more soybeans and other goods to the Chinese. That resumption of agricultural import is now coming to a screeching halt. The most significant impact from the trade dispute thus far has been the marked slowdown in the overall global economy and global trade. The latest manufacturing data coming from the Asian states shows a universal slowdown as these countries lose their market in China. The Chinese economy has slowed dramatically, but when the second-largest economy in the world falters, it is going to take a lot of other nations with it.

The assumption had been that Trump was going to let talks and negotiations drag on for months so as not to compromise the 2020 reelection effort. There are those who still believe he will present a solution to the trade war later this year or early next as a means by which to boost the U.S. economy. Others are asserting that too much damage will have been done by the end of the year and a solution might not be enough to reverse the trend. All eyes will be on the data that gets released in the next several weeks. Three factors will be watched carefully; it is assumed they will be the most sensitive.

One of the most important will be the job market. This trade move is too recent to have an impact on the jobs data released this week, but there will be attention paid to hiring decisions going forward. There is already an expectation that job growth will be more anemic this month than it has been—maybe around 145,000 jobs. There are many reasons for slower job creation, but the sector most affected has been manufacturing. Companies have already been citing a reduction in export activity as a major reason for their reluctance to hire. Some are even starting to reduce the size of their workforce.

The second factor that will grab attention will be the reaction of investors and that has obviously been the first indicator of concern. There was already a great deal of nervousness in the markets as investors contemplated the meaning of the inverted yield curve, the timing of the current economic cycle and the decision by central banks to cut rates in anticipation of a slowdown. The rush to bonds and the stumble in equity markets suggests investors expect more of this defensive behavior, and that ensures the slowdown.

The third area to be watched is manufacturing in general. There has already been cause for worry as many of the indicators have been trending lower. The Purchasing Managers' Index (PMI) has been down to levels close to contraction. In many countries, the PMI has already fallen below 50. Capacity utilization shows slack in the economy and durable goods orders have been down. The U.S. manufacturing sector depends heavily on exports and the trade wars are affecting companies throughout the U.S. It is not that the U.S. sells a lot to China, but the U.S. sells a lot to those nations that sell to China. These trade partners now have less money to spend on U.S. goods.

Oil Prices Likely Headed Down

The contest between the U.S. and China is also affecting the price per barrel of oil. Analysts think it may fall as low as $50 a barrel this week. The thinking is that demand for oil will be reduced by the trade war and its impact on global manufacturing. One of the largest consumers of oil is ocean cargo. A single, large container ship uses as much fuel as 50 million cars. The shipment of oil accounts for over a third of maritime activity. If there is a drop in the demand for imports and exports, there are fewer cargo ships in use and overall freight activity declines. The transportation of freight accounts for around 30% of all fuel use in the world.

Analysis: There has already been evidence of global slowdown. That has affected the demand for oil and thus the price. The U.S. is currently sitting on a large surplus which has offset the potential loss of production in the Middle East, North Africa and Latin America. Generally speaking, the U.S. has benefited from lower oil prices, but today the U.S. is the world's largest oil producer. These low per barrel prices are not as welcome as they once were. The oil operations in the U.S. vary between offshore activity to traditional development in Texas to the newer fracking operations in the Dakotas, Texas and elsewhere in the western states. To be profitable, these operations need prices close to $80 a barrel—not $50 to $60. Another reaction to the U.S. trade attack on China is likely to be additional purchases of Iranian oil by China in defiance of the U.S. sanctions.

Structural Slowdown in China

The conversation regarding China has been roughly the same for the last 20 to 30 years. It has been the story of rapid development and the transformation of a very undeveloped nation into the second-largest economy. In 1990, China ranked No. 11 in the world from a GDP perspective despite a population well over one billion. It was behind the U.S., Japan, Germany, France, Italy, Great Britain, Canada, Spain, Russia and Brazil. None of these states have changed their rankings much, but China most definitely has. There has always been discussion over whether this transformation has been a good thing or bad, but there was no arguing that it wasn't a major factor in terms of global growth.

Analysis: China's rapid development was fueled by an almost constant investment in massive infrastructure improvements. It was all this development of new roads, seaports, airports, utilities, dams and other business infrastructure that allowed China to supplant the dozens of countries that once exported to the U.S. and Europe. The trade deficit with China developed because the U.S. and Europe concentrated imports from China and stopped trading with the likes of Sri Lanka, Romania and Botswana. The rest of the world focused on China as either a source of those consumer products manufactured cheaply in China, or they were a destination for the commodities and intermediate goods that China needed. It rapidly became a rival to the U.S. and Europe as a driver of global growth and has held that position for some three decades. This position is now threatened and China is losing its ability to power the global economy to a significant degree. This has serious implications for the Chinese and the rest of the world as well.

China is growing as slowly as it has since the early 1990s. This has been attributed in part to the trade and tariff wars with the U.S., but it goes beyond this. The breakneck pace of infrastructure development has slowed as there has been less foreign investment to work with and the Chinese government has backed off from some of these projects as a reaction to inflation. China has far more competition as the "world's manufacturer" as other nations have emulated the Chinese approach with low production costs. The effort to build a domestic consumer base in China has come at the expense of China's ability to protect the low-cost production reputation it once had. Wages have been going up in China for several years now. They are clearly no longer the cheapest place in the world to do business.

The global slowdown has been manifesting primarily in the manufacturing sector. The primary reason for that reduction in activity has been the faltering global growth engines. China is the latest to experience that slowdown, but they are most definitely not the only one as there has been profound slowdown in Germany and Japan. Even the U.S. has now started to lose momentum. That leaves no global engine functioning.

Johnson Fails First Electoral Challenge

It is inappropriate to put too much emphasis on a single by-election, but it was the first to take place under U.K.'s Prime Minister Boris Johnson and was therefore a test of his electoral strength. The conclusion is that Johnson is on very thin ice. The seat was taken by the Liberal Democrats and was a loss for the Tories. They now have a single-seat majority in Parliament. The success of the Lib Dems was not the issue as they had held the seat for 20 years prior to losing in the last election to the Conservative candidate. The bigger issue is that several of the anti-Brexit parties banded together to take the seat (Lib Dems, Plaid Cymru and Greens). The Conservatives were not able to create their own coalition as the Brexiter party took some 3500 votes. Had these voters backed the Tories, they would have saved this seat.

Analysis: The bottom line is that Johnson has very narrow coat tails, which is going to make it hard to hold off a challenge from the Brexiters. They are advocating a total break from the EU and are not interested in any further negotiation with Europe. If Johnson does try to work out a compromise, he will lose the Brexiters completely and may not gain much from his own critics in the Conservative Party. Meanwhile those who oppose Brexit are putting their rivalries aside and are creating coalitions that can unseat the Tories. The Labor Party is still in disarray, but combinations of the Lib Dems, Greens and the nationalist parties in Wales, Scotland and Northern Ireland constitute a real threat. The Scots, Welsh and Irish all voted heavily to stay in the EU as they have long relied on Brussels to protect their rights from the dominant English. The support for the EU has only grown as the battle over departure has raged. Johnson is dependent on a loyal base, but one that will turn on him if he disregards their positions.

Why Aren't People Nicer to One Another?

Tolerance is a funny concept. To tolerate someone or something implies that one dislikes the person or situation, but not enough to take real action. We may not like those sticky, humid days of August, but we are not prepared to quit our jobs, sell the house and move to San Diego. We are all quite tolerant of friends and relatives, although we may disagree with them politically—have differing social values, different religious preferences, attitudes towards alcohol and so on. We balance that which we dislike with what we do like about them. When it comes to strangers, we no longer attempt to balance—we simply categorize them as bad or good based on some very narrow set of precepts.

Tolerance seems in short supply these days. Anyone who is not in complete sync with us in every way is to be shunned and actively disliked. Conflict is the norm and confrontation has replaced acceptance. A single instance of disagreement condemns a person to personal attack and rejection—negating everything else about that person. Only those who are carbon copies of ourselves are tolerated and all others become the enemy. This creates an extremely narrow world view. Understanding what makes a person different from oneself does not diminish one's beliefs and opinions nor does it mean one can't try to persuade another. It simply means one can offer respect and tolerance so that a more complete picture of that person can develop.

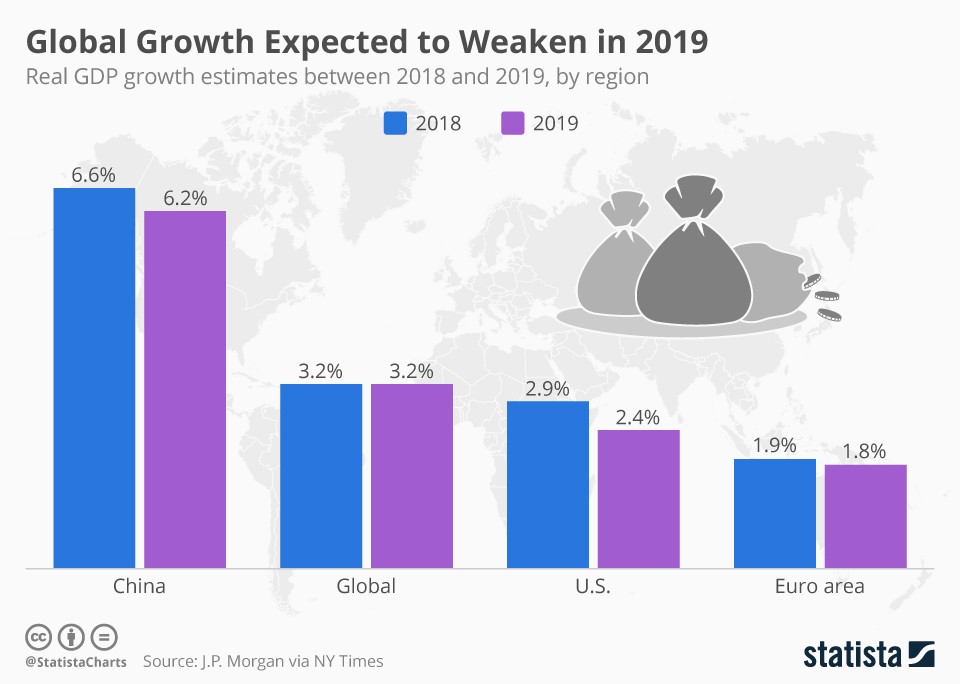

Global Growth Expected to Weaken in 2019

There is a building consensus that growth is slowing throughout the world at a pretty rapid clip. The pattern over the last few years has been far more encouraging. Many seem to have missed the fact that growth in the U.S. economy has been rooted in that global activity. The U.S. is an export-centered nation, and with a pretty limited set of trading partners. The U.S. sells primarily to other developed states—Europe, Japan and a few other Asian economies. These are all struggling with slow growth. That will come back to bite the U.S. sooner than later.