Strategic Global Intelligence Brief for August 16, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy:

Delayed but Not Forgotten—

The threat to impose a raft of new tariffs on goods from China was delayed until December, but not all of the affected goods have been given that reprieve. There will be tariffs imposed on a wide range of consumer goods—everything from apparel to sporting goods and many electronics. The delay will affect many more electronics, phones and the like. These will be tariffs that hit the consumer directly—provided the Chinese manufacturers pass these tariffs on in the form of higher prices. Some will and some will not. If there is real inflation showing up for the consumer during the coming holiday season, there could finally be the consumer reaction that has been anticipated.

Industrial Production Slows in July

There had been an expectation of some minor growth as far as industrial production numbers were concerned, but that is not how things turned out as there was a 0.4% decline. The assumption was that manufacturing would slow and it did. The expectation was there would be sufficient growth in utilities output and oil and gas production to offset the dip in manufacturing. In the end, the utilities held their own as this is peak power demand time. However, oil and gas sagged a little and the decline in manufacturing was worse than expected. The slump in the global economy and the high value of the dollar has seriously eroded the U.S. export sector. That dramatically affects the state of manufacturing.

Housing Starts Down Again

For the third straight month, the number of housing starts has dipped. It has become a major concern as far as overall economic growth. The new home market is a fraction of the size of the existing home market. However, it drives a great many corollary sectors from appliances to building materials and it is crucial to the whole support system of lenders, sellers and processors. Despite this setback in the data, there is not much panic as permits were far higher than expected—a gain of 8.4% over June. For the year, housing starts have been up by 0.6% and permits are up by 1.5%.

Short Items of Interest—Global Economy:

Reactions in Argentina

It is not certain that President Mauricio Macri will lose to the resurgent Peronists in October, but the primary vote makes his defense of his presidency very challenging. The markets are already assuming the worse. The peso is crashing at an epic pace, while the consumer in Argentina is being hammered by high inflation—a situation that will only get much worse. The assumption on the part of the global financial community is the failed policies of the past will be resurrected and Argentina will once again default on its obligations, while running up government spending to epic levels. The prognosis is grim indeed with many suggesting Argentina is on its way to becoming g a failed state on par with Venezuela.

Is Greenland for Sale?

The emphatic answer from Denmark is "NO." The 56,000 inhabitants of Greenland are in a self-governing status, but are part of Denmark. The Danes provide the bulk of the region's budget and handle their foreign policy. The sudden offer by Trump to buy Greenland evoked everything from hysterical laughter to derision and outrage in Copenhagen. Nobody even knows if this is a joke or serious proposal. The supposed motivation for the U.S. would be to be better placed to exploit the Arctic, but the Danish government has rejected the notion emphatically.

German Social Democrats Try to Rebound

The center-left Social Democrats have been without a national leader since April when Andrea Nahles stepped aside in response to the crushing defeat at the polls. Nobody of note had come forward until now, but Finance Minister Olaf Scholz has now indicated an interest and may be able to bring the party back to significance. The SPD has been hampered by its decision to work with the center right in a "grand coalition" and lost ground to the Greens. They will try to regain relevance as the center right moves on from Chancellor Angela Merkel.

End Game in Hong Kong

The situation in Hong Kong gets more complex and threatening every day. There is very little that can be done by any other nation. Should Beijing decide to crack down hard with the military, there will be condemnations and howls of outrage, but nothing more. There is absolutely no chance of an intervention of any kind. Even sanctions will be anemic and symbolic at best. The U.S. already has trade restrictions in place and there is little room to add more. Other nations will be loath to do anything substantial as they need China's market. This will be an internal issue—just as Tiananmen Square was. Two developments recently make the confrontation more likely and have amplified what is at stake.

Analysis: The first is that demands from the demonstrators have changed and become more threatening to the Chinese leaders. In the beginning, the protests were highly focused and seemed to give the Chinese government some wiggle room. The demonstrators wanted two things—the removal of Carrie Lam as the leader of the Hong Kong government and the complete abandonment of the plan to extradite people to China for breaking laws in China even if they were not breaking Hong Kong law. The protests taking place are perfectly legal in Hong Kong, but not in China. That would mean China would be able to arrest and punish anyone engaged in this opposition. It would not have been simple for the Chinese to give in, but there might have been some face-saving options.

That opportunity has vanished as the protests have grown and as the Chinese government has hesitated to act. Now the demand is for the city to be granted full democracy—the opportunity to elect their own leader without Chinese interference. This is not something Beijing can tolerate and that sets up a confrontation that will rival the crackdown at Tiananmen Square. The second development is related to this escalation. At the start of the confrontation, the troops and police tasked with controlling the demonstrations were local and had some modicum of sympathy for those involved in the protests. The Chinese government has been replacing the local authorities with troops from the western sections of the country. This was the same tactic used when the Tiananmen Square protests were broken up. The western troops have no sympathy towards those in the eastern regions and have no qualms regarding a hard crackdown.

The two options are equally bad. The first is that Chinese troops will move quickly and violently to break up the demonstrations. Many thousands will be detained and there will almost certainly be casualties. If the protests end abruptly, at this point the carnage will be limited, but option two is that the protestors try to fight back and resist. That will result in a protracted struggle and many more deaths and injuries. The Chinese government really doesn't want a violent end as there is preparation under way to observe the 70th anniversary of the Communist Party in 2020. This was to be President Xi Jinping's big moment. He would rather not have a crushed Hong Kong as a backdrop. On the other hand, the party leadership can't be forced to make these concessions to the demonstrators.

Global Markets Settle Down for Now

It is the nature of the markets to be volatile. It is all about anticipation as investors try to figure out what is gaining and what is losing. That natural volatility has been amplified by a very erratic set of political actions taken by the Trump administration. It has been nearly impossible to determine what the strategy is with tariff threats as they are imposed and then lifted within weeks or even days. The markets were slamming into the ground just a week or so ago as it looked like Trump was willing to pull the trigger on new tariffs on China that would affect consumers in the U.S. Then the threat was called off and the markets rebounded.

Analysis: Bond yields rose above 2% again and may get stronger over the next few days given the good news that came from the retail community. Gold lost a little value as fewer investors were choosing to retreat to the metal. Meanwhile, the pound gained despite the continued concern about what happens with Brexit in the next couple of months. The price of oil also gained a bit as there is now expectation of better growth. The U.S. economy will hang in there as long as the consumer feels confident enough to keep spending and going into debt. The European economy may be getting a boost from the stimulus planned by the European Central Bank (ECB) and some additional fiscal activity. China has turned in numbers that are nearly as bad as expected yet they seem to have found a way to keep exports up. To be honest, the U.S. has not imposed nearly as many restrictions as have been threatened. The Chinese producers have been reluctant to pass the tariff costs on to their consumers, so most American consumers have not seen the big price hikes expected earlier.

Consumers to the Rescue

I can't be broke; I still have checks. It has long been the mantra of the American consumer and apparently still is judging by the latest retail sales data. The gain in July was more than expected—up 0.7%. That makes the fifth month in a row that retail sales have been improving; the latest reading is the best performance since March. The consumer accounts for roughly two-thirds of the U.S. economy—a much higher percentage than any other developed economy. There are several reasons the consumer remains strong right now. For the time being, their activity is offsetting the declines and challenges elsewhere. Industrial production is down as manufacturing struggles to gain against the backdrop of trade wars and tariffs. The investors are still spooked and driving bond yields down, fretting over what is happening with the global economy and how the Fed might react in the months to come. But for now, the consumer is fired up and looks ready to drive a solid holiday spending season.

Analysis: There is considerable speculation regarding the behavior of consumers and why they seem to be ignoring all those headwinds that were supposed to have slowed them down by now. The first is that confidence remains high because the unemployment rate remains low. More than anything else the consumer reacts to the job market. When the rates of joblessness remain low, the average person feels secure in their job and believes they can go out and find another one easily if they should want to. The quit rate as measured by the JOLTS report has not been this robust since before the recession. That signals confidence in job mobility. People are willing to spend beyond their means if they are safely employed.

This brings us to the second rationale—debt. Confident consumers are ones willing to use a credit card and they have been. The total of consumer debt is at $13.5 trillion and rising fast. Credit card debt is now at $4.1 trillion and mortgage debt is at $9.4 trillion. These are all record levels and far greater than was the case prior to the last recession. That little burst of frugality that occurred after 2009 has long faded and people are back to their old habits. This is not good for the financial health of the individuals as they are now more vulnerable to a next downturn than they were in 2008, but it has been great news for the economy as a whole as it means that people are spending aggressively.

The third factor to consider is the fact U.S. consumers spend far more on services than on things. This is simultaneously a consumer and service economy. That translates into lots of spending on a wide variety of services—a list that grows every year. Millions of dollars are spent on having someone mow your lawn, babysit your dog, clean your house, cook your food, entertain your kids and help you with problems ranging from too much flab to angst. This focus on services is one reason the tariffs on imported goods have not had as big an impact as was expected. The first issue is most of the tariffs imposed thus far have affected industrial goods and that impacts the consumer indirectly. The other issue is services are not imported and are thus unaffected by tariffs and trade restrictions. It is assumed the next round of tariffs will hit consumer goods harder. This will finally deliver the inflation that has been anticipated for months, but given the recent decision by Trump to delay their imposition, it is likely this inflation will not appear until sometime in 2020.

Now for the standard dismal scientist's disclaimer. The consumer is nothing if not fickle and it has always been dangerous to assume consistent behavior. In 2016, there was another period where most of the economic indicators were down but the consumer carried the day and helped the system power ahead. This looks like another year of the same, but there have been many years where the consumer was shaken by something and withdrew. The most likely triggers for a consumer retreat would be a sharp hike in the rate of unemployment or a sharp hike in prices that are hard to escape. In the past, this has often meant gas prices. A jump in the pump price depresses the consumer right away as they can't escape the news of the hike and it is a purchase that provides no satisfaction at all. It evokes the same reaction as a tax. That is the other factor that can depress the consumer—a tax hike that seems to come out of nowhere.

Some Unusual Impacts from Changing Climate

The changes that have already occurred have spawned a lot of investigation as to what this all means and what impact it will have on the lives of people. Much of the attention has focused on issues such as rising sea levels and storm intensity, but there have been more subtle alterations as well.

Analysis: Two that will be affecting much of the Midwest involve mosquitoes and kidney stones. It seems the patterns setting up for the future will make the Midwest considerably wetter than in past years. This summer will be considered the norm. That means there will be more floods and more mosquitoes—translating to more mosquito-borne illness such as West Nile virus. Standing puddles of water in July and August used to be rare—not anymore.

The kidney stone issue is related to higher temperatures and the reactions of the public unaccustomed to that heat. If people are not vigilant about consuming water in times of high heat, they will become dehydrated and kidneys will not function as designed. That means that the "kidney stone zone" is creeping northward.

Not that these changes can't be coped with. Drink more water and make sure you are replacing what you sweat. Dump out the puddles of water and use mosquito repellant (or install a bat house). The point is changes have occurred and this demands adjustment, and quickly.

Decency

This is a surprisingly hard concept to pin down. It is defined as "behavior that conforms to accepted standards of morality or respectability." That is a wide-open interpretation given the fact that accepted standards can and do change constantly. There is nothing that has changed so much as concepts of decency when it comes to things like what people wear in public, the use of profanity, what can be advertised on TV and so on. Those who object to the barrage of ads focused on bathroom habits are labeled prudes and those who bristle at the dress considered acceptable on airplanes are just dismissed as cranky. A bigger issue is what we expect from those who seek to lead us—politicians, business leaders, teachers and the like.

It has been challenging to find common decency these days. It doesn't seem all that long ago that people in politics were able to differ with one another without resorting to name calling, lies and insults. The public has been just as bad with every opinion evoking a nasty and very personal assault. There are certainly exceptions to the norm, but they seem few and far between. I was recently reminded of a truth that really should guide all of our interactions with one another. "Everyone is dealing with demons that nobody else can see." We just do not know what is happening in anybody else's life nor do we know what they have experienced. We need to assume that everyone deserves respect and understanding—even as we disagree with their actions and beliefs. We most certainly need to demand that showing of respect from the people who set themselves up as our leaders—political, cultural, business and anything else.

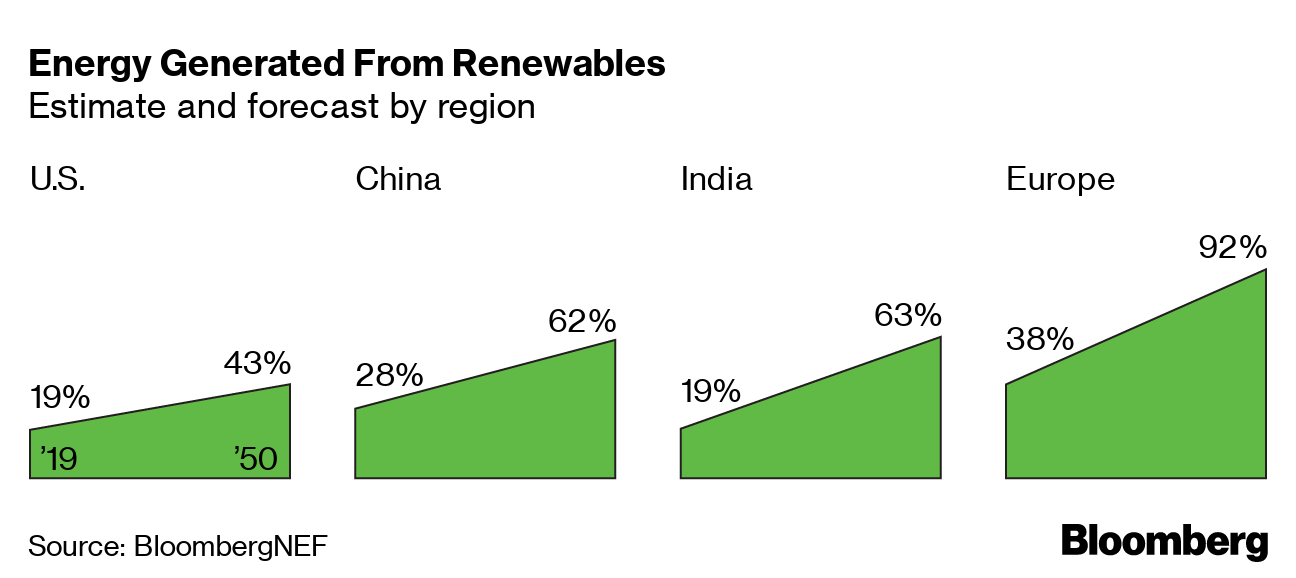

Energy Generated from Renewables

The U.S. is woefully behind in terms of adopting renewable sources of energy. This is not a position the U.S. has been accustomed to as it has long had a reputation as an innovative nation. The reluctance to move faster on alternatives such as solar, wind, geothermal and others has been related more towards politics than towards business opportunity or the economy. There is plenty of room for profit in developing these alternatives, but barriers have been persistent in the U.S.