By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy:

Is Inflation Finally Starting to Ramp Up?—

Certainly nobody is talking about runaway prices, but for two months in a row, there has been an increase of 0.3% in the readings for the Consumer Price Index. The hikes have been broad-based as well and have occurred even as some of the more volatile categories have been down. The price of gas at the pump has either been steady or falling, but the price of energy through the local utility has been rising along with food, clothing, entertainment and others. This is not convincing people that an inflation crisis is brewing, but it will demonstrate the economy remains healthy enough for producers to hike their prices a bit. The impact of tariffs has been minor so far. Now that they have been delayed again, the impact will likely not affect the holiday season.

Tariffs? Not Yet—Again

The majority of the tariffs President Trump asserted would be imposed in a few weeks have been delayed once more and now might appear in December. Who knows? There was no rationale provided for the imposition of this latest round and no rationale provided for delaying them. China had been negotiating and nobody saw much difference between their position last month and their position now. The Chinese tariffs on the U.S. have been imposed and have not been altered. This has affected the farm sector in the U.S. as the Chinese are not buying U.S. output at all. The trade deficit between the U.S. and China has worsened this year as China has purchased very little from the U.S., while the U.S. continues to buy heavily from China. If there is a strategy behind the current tariff plan, it is very murky at this stage.

Loud Warnings from the Inverted Yield Curve

The yield curve situation is as stark as it has been since 2008, which is creating a lot of angst among investors. The process is a pretty simple one. It is based on expectations among investors. They are expecting interest rates to be lower in the future than they are now. That generally means more growth and a greater threat of inflation. This makes acquiring bonds much more attractive, which in turn, drives yields down. The inversion is a signal that a downturn of some kind is more likely. It doesn't cause the recession—it is a reaction by investors to the possibility of one. It seems they now think a recession is much more likely.

Short Items of Interest—Global Economy:

German Growth Falters

The latest numbers indicate the German economy is growing at the slowest pace in the last six years. The decline in the last quarter was 0.1%. That translates into annual growth of just 0.4%. It is now considered likely Germany will enter actual recession territory. The main reason for the decline has been the global slowdown in trade. The U.S. relies on exports for about 15% of its GDP, Japan relies on exports for around 14%, while Germany relies on exports for 53% of its GDP. Losing markets in China and the U.K. have hurt.

Hong Kong Crisis

The situation just got more serious. Until the last few days, the demands from the protestors were somewhat manageable and it seemed China had an exit strategy. They wanted the resignation of Carrie Lam and the end of the extradition plan. Now, the protests are demanding full democracy. That is something the Chinese simply will not agree to. The clash is now destined to come to a violent end, and fairly soon.

Kashmir Crisis Is Not Well Understood

The status of the Kashmir has been a flashpoint in South Asia for years. There have been three all-out wars between India and Pakistan over the region. Since Prime Minister Narendra Modi ended its semi-autonomous status, the possibility of a fourth conflict has risen dramatically and now these two nations have nuclear weapons. This is a situation that should never have been allowed to get this far, but powers that might have interfered are preoccupied, namely Russia, U.S. and China.

Report from the Manufacturing Front

Each month we review a series of indices that matter quite a bit to the manufacturing community for two organizations—the Chemical Coaters Association International and the Industrial Heating Equipment Association. Both are in the business of treating and heating metal. What follows is the executive summary and some select breakdowns of the subsections.

Analysis: There has been a metaphor making the rounds and it seems pretty descriptive. Remember the old Road Runner cartoons? The part where Wile E. Coyote goes running off a cliff and doesn't realize that he has run out of ground? When it dawns on him, he plummets to the bottom of the canyon. There are analysts who assert this is what is happening with the current U.S. economy. There is no real emergency showing up in the data, although there are certainly signals that all is not as it should be. The bigger issue is that global economic concerns are becoming very real and putting pressure on the U.S. One of the most telling examples is the behavior of the world's purchasing managers' indices which is detailed in the section on the PMI new orders. There are certainly some aspects of the current economy that are encouraging, but some of the signals are not as positive.

Of the 12 indices, five are trending positive and seven are trending down. The bigger concern is that the ones trending in a more negative direction are the more predictive indicators. They include the sales of new cars and light trucks. There has not been a significant reduction in activity, which is a good sign. For the last year, the sales of vehicles have been steady regardless of the travails that have affected the consumer. On the other hand, the data on new home starts has been concerning. Not that the numbers are all that bad as they have still not fallen to the lows seen just a few months ago. The problem is that many of the once hot markets have cooled off and the lively ones are now in much smaller cities. This doesn't generate the demand that growth in the bigger communities does.

The levels of steel consumption are off as well—partly in reaction to what is happening in automotive, but mostly due to slower construction activity and a sluggish pace in terms of new energy development. At the same time steel consumption has been down, there has been a general decline in metal prices despite the fact that several of them are being whipped around by the investors. Gold has been soaring as one would expect, but even aluminum and copper have been getting some speculative attention. With all that volatility and the fact that production has been down, the prices have not escalated as anticipated. The levels of capacity utilization have also trended down, but the movement has been slight. There has been some additional purchasing of machinery and there may not have been enough time to integrate these new purchases. If this is a timing issue, the capacity numbers should start to improve in the next month or two. Another problem sign has been the readings coming from the Credit Managers' Index. The manufacturing sector as well as the service sector have been showing strain. The most activity has been in the favorable factors such as sales and dollar collections. There has not been much change as far the less favorable numbers are concerned, but most of these have been in contraction territory already.

The positive indicators are certainly encouraging, but they tend to indicate where the economy is at this very moment. The level of capital investment has been improving slightly, but this seems more reactive than a sign of better news ahead. The companies struggling to find the workers they need are essentially giving up and buying machines and technology instead. There has been a strong recovery as far as productivity is concerned, but this has been related to the technology more than additional hiring. The durable goods orders have been stronger than expected as there continues to be an issue with the airplane maker Boeing. When all that is resolved, there is liable to be a boom in aircraft sales, but not right now.

The factory goods orders have also done well as the U.S. consumer has been staying engaged—enough that it has compensated for the reduction in export activity. The all-important holiday spending season has begun with relatively strong back-to-school numbers, which should help maintain the factory levels. The appliance sector still has that gap between unfilled orders and total inventory—a position the reverse of what it was just a few months ago. Transportation has slipped a bit, but has stayed in expansion territory—if only by a narrow margin. Most of the angst has been in the trucking sector, while ocean cargo has been negatively affected by the trade disputes and tariff threats. Perhaps the most interesting piece of positive data is the small increase in the new orders index from the Purchasing Managers' Index (PMI). The U.S. sports one of the very few positive PMI readings in the world. It is encouraging to see the new orders numbers hanging in there.

New Automobile and Light Truck Sales

The sales of new vehicles have continued to surprise. It is not that there has been a surge in activity (in fact, this month the trend was a little down), but there has been consistency; not what analysts had expected to see at this point. The headwinds were supposed to kick in by now, but they haven't. Consumers are still in a good mood, unemployment numbers are still low, car loans are still cheap and getting cheaper as interest rates fall. The lenders are still willing to finance and consumers are still willing to be financed even as the average length of a car loan is now five years, and six is not unusual. The buyers are continuing to favor the larger SUV and truck. The sedan continues to struggle with interest in the fuel sipper falling like a rock. The electric car is gaining a little, but remains a very minor player. The assessment now is that sales will hold steady for a while longer.

Industrial Capacity Utilization

The changes in terms of capacity utilization have been minor, but it is still a concern that the numbers are trending in the wrong direction. There is more slack in the system than would be preferred. This means there will be less incentive to acquire new machines and less incentive to hire additional people. The ideal level of capacity usage is between 80% and 85% as that signals there is limited slack but no shortage either. The numbers have been hovering in the upper 70s for close to two years. While this is not bad, it is frustrating. Movement up has been expected for a long time, but demand has not justified further activity at this point.

New Home Starts

The latest data on housing starts is a little down, but this may be a short-lived phenomenon. The last week or so has been eventful in the bond market to say the least. The mortgage rates are closely tied to long-term bonds and the yields on these bonds have rarely been lower. This has meant a steep drop in mortgage rates. That is likely to boost home buying—it has certainly stimulated a great deal of refinancing activity. There are other factors involved in home sales, of course, and these have not been quite so encouraging. The price of new homes has remained high and the lenders have continued to be cautious with new prospective homeowners. The demand for significant down payments has continued. This has continued to skew the market toward the higher-end homes. The mortgage rate is important to that buyer, but the performance of the stock market matters more as these buyers have been using the money they made with their investments. The equity markets have been in turmoil for the last few weeks and this is likely to continue. The bottom line is that starts will probably accelerate in response to these lower mortgage rates in the next few months.

Steel Consumption

The level of steel consumption has trailed off in the last few months, a trend that will likely continue. The sectors which consume the majority of steel in the U.S. are construction, automotive and machinery in general. All three sectors are showing signs of weakness. The construction season is starting to wind down—at least as far as the public sector activity is concerned. The commercial activity has been slowing for a while now and uneasiness about the global and national economy will keep it subdued. The automotive sector is holding its own, but isn't growing fast enough to boost demand. The area that has declined the most has been export-oriented machinery. That is the bulk of the U.S. export activity (outside of farm exports). The tariffs that were supposed to assist the U.S. steel sector have had limited impact as the major exporters to the U.S. have all been granted exemptions of one kind or another. The top four exporters to the U.S. have been Canada, Brazil, South Korea and Mexico. All have escaped the brunt of the tariff restriction.

Metal Pricing

The metal markets are a bit all over the place these days. Gold has been soaring due to the investment uncertainty that has been driving bond yields ever lower. There has also been some investment activity surrounding metals like aluminum, copper, iron ore, nickel and the like. There is a lot of speculation regarding future demand for the industrial metals. At the same time, there are some investment groups seeking alternatives to the equity and bond markets. For example, there has been a lot of discussion regarding aluminum as there is a sense that at some point Boeing will get clearance to start selling the 737 Max again and airlines will start flying it again. The pent-up demand for airplanes has been acute as there is no real alternative to the 737 for many airlines—they have been forced to simply wait it out. The sense is that when the clearance is given, there will be a stampede to make up lost production time and aluminum will be in high demand—rewarding those that have been buying at the low current price.

PMI New Orders

The PMI numbers globally have been sending some real signals of distress and the U.S. has been right there with them. Of the top 15 trade partners for the U.S., only three have positive PMI numbers right now. Of the three, two are hanging on to expansion territory by the narrowest of margins. The U.S. PMI for manufacturing is close to contraction territory. The service sector reading is down to the mid-50s from the high 50s and 60s that were common just a few months ago. The new orders index has fallen dramatically over the last year as it went from the mid-60s to just 50. This month, there was a very slight improvement, but moving from 50 to 50.8 is hardly cause for jubilation. The fact is business has become cautious in general. This risk averse approach has manifested in a general slowdown for many indicators. It is not certain that trends will turn towards contraction, but a rapid rebound into more positive territory is even less likely.

Capital Expenditure

One of the more interesting developments has been the unexpected rise in capital expenditures (capex). Given the fact that capacity utilization has been falling a little and many of the other measurements have been sounding a note of caution, it would have been expected that capex would be down as well, but the latest numbers are as robust as they have been for the past year. With the exception of that end-of-year spike in December, the last time numbers were in the over 9 billion range was June of last year. Now, we have had two months in a row above that 9 billion mark. The best analysis at this stage is that many companies have been struggling to find workers to fill positions and have decided to simply replace human capital with machinery and technology. Even many white-collar jobs are being replaced by these automated alternatives as there has been a skill gap in the service sector as well.

Appreciation

There are many, many things I am really, really glad I don't have to do. I see people making a living at jobs that would cause me to want to pull the covers over my head or take to drink. I am exceedingly glad these people are out there and willing to do these tasks. I try to express my appreciation when I get the chance. Take for example the guys who pick up the trash every week. On most Mondays, we leave them with multiple bags of yard waste as there is always a lot of weeding and trimming going on at the abode of a master gardener and her faithful master hole digger. We recycle and usually have only one bag of household stuff, but spring and summer can get carried away.

The other day, I watched for the truck and hustled down the drive to give them a dozen bottles of Gatorade and Powerade. It was a miserably hot and humid day and they looked beat. They looked absolutely shocked. "Nobody usually notices us." I assured them I did and was grateful for the willingness to haul that vegetation away. I encounter a lot of people who work at things I would not want to do and I try to remember to let them know I appreciate them. The reaction is always total shock and that somehow bothers me. My call to faithful readers is to thank somebody who is doing that cruddy or difficult job that makes your life a bit better or easier.

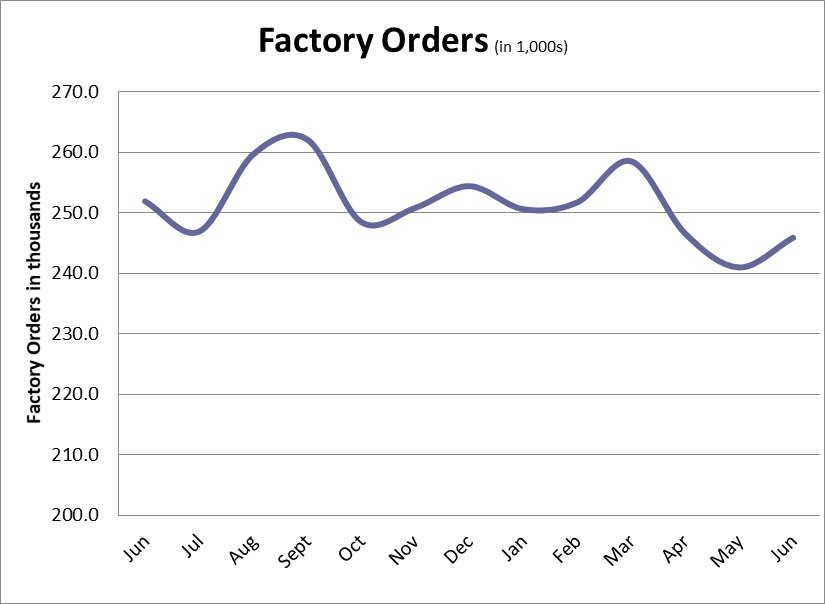

Factory Orders

The recovery in factory orders is not as closely related to the improved capital investment numbers, but rather seems to be connected to the better mood of the consumer. This has been a tricky development to call. On the one hand, there have been consistently high levels of consumer confidence this year, although there has been a slight trend downward of late. The retail numbers have been improving with four months in a row of growth. The fear and dread that was expected due to the trade war has not occurred as there hasn't been the predicted inflation yet. That could change with this next round of tariffs, but for now, the consumer seems to favor spending. That has been good for the factory sector.