Strategic Global Intelligence Brief for April 5, 2019

Short Items of Interest—U.S. Economy

Job Gains Back to Near Predicted Levels

The economy added another 196,000 jobs in March—a slightly higher number than had been predicted, but close— and a far cry from the anemic total that set off rounds of worry and concern in February. The unemployment rate remained at 3.8%. That is on par with the lowest rate seen in over 49 years. There remains a strong labor market despite the development of some headwinds. The single-most-interesting factor in all this has been the deep reluctance on the part of business to lay people off. In past years, the rate of joblessness would worsen not only because there were fewer hires, but because business was almost casually firing people assuming they could always hire them or somebody else later. Today, there is a real fear of not being able to find qualified people when they might be needed. Business is retaining their workforce more aggressively. This is good for the job numbers, but it has started to cut into profits for companies that have been struggling.

Jobless Claims Down

To further illustrate the point, the number of people filing for first-time jobless claims last month was the lowest level set in over 50 years. The business community is simply not letting people go. Under similar circumstances in the past, they would have been. There are several sectors of the economy where layoffs have been common and an expected part of the business routine. At the top of that list is construction as there are months during the year where little work can be done. This year, the winter was long and bitter, and gripped much of the country. It would have been expected that many workers would be dismissed and maybe brought back once the building season started again. However, many of those workers were kept on for fear the company would not be able to find adequate replacements once the construction period started.

Fed Members Still Insisting Another Rate Hike Is Possible

Trump continues to fulminate and demand that the Fed cut rates and buy assets as it did in the height of the recession. He has selected two people to serve on the Fed's Board of Governors that would back his plan to the hilt—assuming they are confirmed by the Senate. This has not stopped the more hawkish members of the Fed to assert another rate hike this year remains a possibility. Patrick Harker from the Philadelphia Fed and Loretta Mester from the Cleveland Fed are only the latest to issue that warning. Neither Harker nor Mester are currently serving on the Open Market Committee, but both will be voting members next year.

Short Items of Interest—Global Economy

North African Crisis Number One

One of the warlords who has been attempting to take over bigger swaths of Libyan territory has started another move to consolidate power. Khalifa Haftar is marching on Tripoli with an army fully large enough to destroy what is left of the national army and could easily stage a coup at this point. The action has further destabilized a country that is on the brink of a civil war.

North African Crisis Number Two

Over the last year, the majority of those who have been trying to flee to Europe have been coming from Libya. There are many Libyans in the exodus, but the majority of those making the attempt are from all over the region. They chose Libya due to its proximity to Italy and Malta. As the EU has worked to interrupt this migration, the people trying to flee have become caught in the Libyan civil war and have been forced to flee south into the impoverished state of Niger—which has been utterly overwhelmed by the numbers of desperate people.

North African Crisis Number Three

The decision by President Abdelaziz Bouteflika of Algeria to resign caught the nation unprepared and a succession war has broken out already. The contenders include rival elements of the military, members of his old regime and some of those in the opposition who had been calling for Bouteflika's ouster.

Trade Deal Close?

For the last few weeks, there has been a steady stream of contradictory commentary regarding the potential for a comprehensive deal between the U.S. and China. One minute it looks like the deal is imminent and the next minute it appears to be as distant as ever. The latest word is that it will be concluded in about four weeks and most of the deal has been struck. On the other hand, there have also been comments that indicate the toughest part of the negotiation has yet to be worked out.

Analysis: It appears the toughest part is enforcement, which is far from unusual. The Chinese have agreed many times in the past to fix certain issues. They have pledged to crack down on those who would steal technology and counterfeit U.S. products. They have promised to cease demanding technology transfers and they have pledged to buy more from the U.S. Every time these promises have been made the Chinese have ended up reneging. They always have such great excuses. The U.S. wants enforcement this time and wants the ability to unilaterally impose tariffs and other restrictions. China is against this unilateral approach. That has been a deal breaker to this point.

The Uncertainty Factor

Uncertainty is a given, but that doesn't mean the business community is particularly fond of the challenges presented. As a matter of fact, the goal of most companies is to reduce levels of uncertainty in any way possible. There are several categories of uncertainty businesses will be expected to cope with and most are not that controllable. There are natural disasters that radically change the operating environment—such as the floods that devastated large parts of the agricultural community this year. There is the uncertainty that stems from the decisions and actions taken by competitors. Usually these can be anticipated to some degree, but when these are combined with major technological changes, an entire industry can be utterly altered—think of what Amazon has done to the retail community or ride sharing apps to the taxi industry. One of the most vexing of uncertainties are those that stem from political and governmental decisions or the lack thereof.

Analysis: Thus far, the Trump administration has been responsible for a great deal of uncertainty as policies have been highly fluid and unpredictable. The latest example is the threat to close the U.S. border with Mexico. This decision took the business community by surprise and reactions were swift as thousands of businesses tried to insulate themselves from this move by accumulating as much inventory as possible before the border closure. In cases where this accumulation was not possible, there were immediate reactions in terms of pricing and supply. The price of food from Mexico skyrocketed as shortages were expected to appear immediately. Transportation companies started to deploy their assets away from the border as they anticipated a lack of access. People who traveled across the border every day for work or as consumers suddenly had to find other alternatives. It has been estimated that the border closure would take as much as 0.5% off the U.S. GDP and perhaps 1.8% of Mexico's—a loss of billions of dollars. Suddenly, the threat ended. Trump dropped the threat to close the border and instead issued an ultimatum to Mexico that states it has a year to do something about their border security. Those that do business across the border heaved a sigh of relief, but there is also deep frustration as they have taken actions that now create new problems—namely excess inventory that may or may not be disposable in the next few months. What is worse is nobody knows if this current plan will remain intact as there have been no specific requests made of Mexico at this stage, so it will be hard to know if they are in compliance.

This is not the first time a major policy reversal has been made by Trump, nor is it the first time a reversal has been subsequently reversed. The original plan as far as tariffs on imported steel and aluminum was to place tariffs on all imports, but then there were exemptions issued for most of the nations that supply the U.S. (including the five largest importers to the U.S.—Canada, South Korea, Brazil, Mexico and Russia). Then, the plan changed again and exemptions were dropped for Canada, Mexico and Russia while Brazil and South Korea were still allowed to sell to the U.S. With the development of the USMCA, it is assumed that both Canada and Mexico will eventually get their exemptions back. Meanwhile, steel producers are not confident enough in this regime to start investing heavily in new capacity, while steel users are facing price hikes of 40%—not the 25% that had been assumed.

It is not that Trump is the only president who has abruptly changed policy direction over the years. These threats to trade patterns are common tactics as far as trying to get progress on political issues. What does Trump expect from Mexico in terms of border security? How does the U.S. business community know that Mexico is in compliance and the border closure threat is over? What does Trump want from steel exporters in Canada and Mexico? Trump has threatened dozens of nations with trade barriers and tariffs but to what end? Is this an actual policy designed to evoke a reaction or is a knee-jerk response that is designed to curry favor with some part of the Trump base? The business community has no way of knowing at this point. That makes any sort of planning very difficult.

What to Expect in Labor Report

Last month there was a major collapse as far as job creation is concerned and most assumed this was an anomaly. The bounce back in job gains this month proves that assumption to be correct.

Analysis: At this stage the more interesting aspect of the report is that which deals with wage increases. The bulk of job creation for the past year has been in the lower-paid service sector. That has meant wage gains overall have been rather anemic. If there is a gain this month, it will signal that at least some of the new jobs are better paid. It also may signal that companies are paying their existing staff more so that they will not be poached by other companies.

It has been noted that far more people are being hired without the necessary skills and education. Companies have little choice but to hire to train. That means they have made investments in a workforce that will not be all that productive for anywhere from a few months to a few years. This will show up in productivity numbers and may show up in future wage rates as these employees complete their training and either get raises or move to another employer willing to pay them more.

Challenging Fed Independence

Central banks were not always independent. For many years, these banks were essentially tools of whatever political party was in power at any given time. If the powers that be wanted to push economic growth at all costs, the central banks were essentially ordered to pour money into the economy. Today that still happens with the central banks in some of the undeveloped nations. In the 1920s and 1930s, it was determined that central banks had to be immune from the whims of the political world if there was to be any kind of monetary stability. The bottom line is that politicians are never good at dealing with inflation. Cutting off an inflationary spiral means deliberately slowing the economy through higher interest rates, higher reserve ratios, higher interest rates for banks that hold money with the central bank and so on. This clamps down on the money available to expand and grow, but that also means less inflationary pressure. The process of thwarting inflation is controversial among politicians as it means slowing the economy and with it, job growth. If the central bank is not able to operate independently, the likelihood of runaway inflation is much more pronounced.

Analysis: The Federal Reserve is the central bank for the U.S. It is not uncommon for this institution to draw the ire of the political leadership at any given time. To the elected officials, all that matters is growth and jobs. Anything that promises expansion is good news and anything that slows it down is to be avoided. This is what makes it nearly impossible for elected officials to stop running up huge debts and deficits. The only way to limit the growth of debt is to spend less money or raise more revenue. Neither of these options are very popular.

Trump has been attacking the Fed for the past year. He has asserted it has not supported the growth of the economy because it has not taken an aggressive stance as far as stimulation. Trump and some of his advisors have wanted the Fed to keep interest rates at absolute rock bottom and have been calling for the Fed to lower them now. There have been those within the Fed who are in favor of halting the planned set of increases, but few have gone so far as to suggest that rates be lowered. The concern on the part of the hawks that still advocate a hike in rates is that inflation remains a threat. It is one that can manifest very quickly. If there is an inflation surge at this point, the Fed would be compelled to jam interest rates up and risk the possibility of a real recession. The thinking is that gradual and predictable rate hikes will fend off inflation without risking a real downturn.

This is not the policy that Trump wants the Fed to pursue and he has taken steps to place people on the Fed's Board of Governors that would support his goal of very low interest rates and a highly stimulative position. The nominees Trump has selected have been essentially mainstream. He has won plaudits from the economic community for his choice of people like Jerome Powell as chair, Richard Clarida as vice chair and for Randy Quarles and Michelle Bowman. Last year, he nominated Marvin Goodfriend and Nellie Liang. Both earned praise but the Senate never got around to confirming them. Now Trump has two new nominees. Both are intensely controversial. Herman Cain is the former CEO of Godfather's Pizza and a perennial presidential candidate that has become an ardent supporter of Trump. Stephen Moore is an author of a book that praises Trump's economic policy. Neither man has commanded much respect from the economic or financial community. There is deep concern that both will merely become shills for Trump and will work to undermine the independence of the Fed.

Understanding Weakness

I have decided people can be divided into two categories based on how they react to the weakness in others. There are those who react to weakness with hostility and those who react with compassion. I ran across the account of a legislator in a southern state who said that people who are sick don't deserve health insurance and should be expected to pay far more for anything they get. The "good" people take care of themselves and don't get sick. I am not sure this rocket scientist quite understands how maladies like cancer and genetic disease work, but even if one's lifestyle choices were not the best, it doesn't seem charitable to consign them to death or poverty. I see this dichotomy all the time. There are those who assert that anyone who has engaged in something that could be categorized as a weakness or bad judgment should be made to suffer the full consequences of that choice.

I do not subscribe to the notion that people should never have to confront their choices and their issues, but I do subscribe to the notion that we should offer them compassion as opposed to condemnation. We now know that addiction is not a choice—some people will succumb to alcoholism and drug addiction far easier than others. We know that even the healthiest person can and does get cancer or heart disease. It is a fine line to walk—I understand that. The person who has become an opioid addict or an alcoholic or who has any other sort of malady needs to confront what brought them to this point, but they also need the help and support of us all if they are ever expected to get control of their lives and their health.

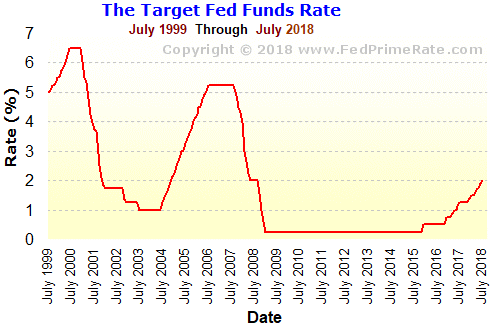

The Target Fed Funds Rate

There has always been a certain amount of fluctuation when it comes to the Federal Funds rate—the current numbers are historically low. The last time they even approached this level was in the early 2000s. That was when the economy was starting to get hyped up by what Alan Greenspan termed "irrational exuberance." This is what prompted the hikes in the 2004-2008 period. The purpose of these hikes was an attempt to cool things off before the issue of inflation became too dominant. As is often the case, the hike pushed the economy down and a recession followed. Interest rates were cut quickly, but it took several years before these low rates kicked in.