Strategic Global Intelligence Brief for April 24, 2019

Short Items of Interest—U.S. Economy

Not All Housing Data is Bleak

Earlier in the week, the data on existing home sales was not all that encouraging and it was asserted that all those housing headwinds were taking their toll. Now comes the data on new home sales and it tells a far different story, with a gain of 4.5% as compared to the expected decline of 2.6%. The big miss as far as forecasts seems attributable to a couple of factors. The supply of new homes expanded in almost all the markets (except the Northeast). In the south, the expansion was the most significant in over a decade. The added supply has dropped prices in most regions and has triggered sales. The majority of new homes have been at the upper end of pricing, which means starter homes are still very slow.

Cain Withdraws Nomination

In the weeks since President Donald Trump tried to place Herman Cain on the Fed's Board of Governors, the opposition had been building among the GOP Senators that would ultimately have to pass judgement on the nomination. It became clear Cain would not survive the process. At the start of the Trump term, he nominated people to the Fed who had been vetted and selected by staff in Washington, especially those at the Treasury Department. Lately, he has been at odds with the Fed and declared that he wants "his own people." This has not gone over well with most in the Senate and it is thought that Stephen Moore's nomination is in some jeopardy. The two who Trump nominated last year remain willing to be re-nominated: Marvin Goodfriend, an economist at Carnegie Mellon, and Nellie Liang, a former Fed economist.

End of the "Special Relationship"?

It has been an article of faith for nearly 100 years. The U.S. and the U.K. had a special relationship built on a common culture, history and language. In many situations, the U.S. had the backing of the U.K. even as other allies hesitated and the U.K. enjoyed that status with the U.S. It now appears that this relationship is in tatters as the British have become utterly preoccupied with the Brexit process at the same time Trump has taken a very hostile position towards the current U.K. leadership. In the coming week, Trump will be paying a state visit to the Queen and will meet with Prime Minister Theresa May. The expectation is that he will meet a very frosty welcome and will encounter massive protests from the British.

Short Items of Interest—Global Economy

Trade War with Europe Will Damage U.S. Economy

According to a new study from the ECB, the U.S. will be the net loser should the trade war between the U.S. and Europe escalate. The prediction is that this conflict will peel at least two points off the U.S. GDP. The impact will be far more damaging than the trade war with China. The major problem is that U.S. exports are directed toward Europe and these are markets that can't be easily replaced. The connection to China is based on imports. The U.S. has options as far as where imports come from. Finding new export destinations can be a lot more challenging.

German Confidence Wanes

Just a month or so ago, the surveys were trending in a very optimistic direction for Germany, as there was more confidence showing up within the ranks of consumers, investors and the business community. Now, there has been a sharp and sudden reversal as the Ifo Institute has released a new survey that takes business confidence down to levels not seen for the last four years. Issues like Brexit and the rise of populism rank at the top of concerns.

Transition in Sudan—the military council that took power with the departure of Omar al-Bashir—has promised to relinquish power when a civilian government forms, but there is doubt this will really happen. Negotiations between the junta and the opposition have stalled and there is very little trust between the two groups.

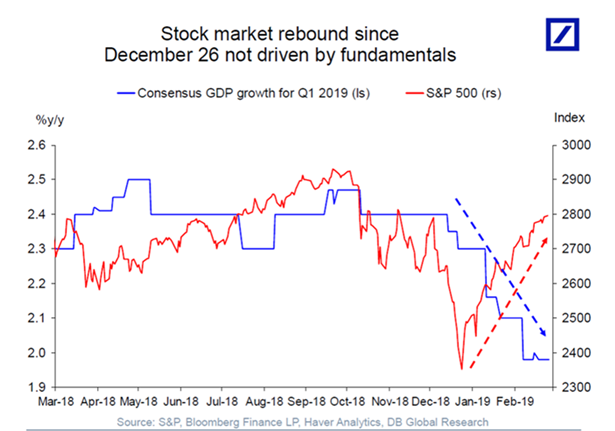

Markets are Buoyant

As if to illustrate the point made above, there has been the performance of the stock market thus far this year. The S&P 500 is up 17% and Nasdaq is up even more to 22%. This has taken place despite a whole host of politically motivated actions that were expected to stall the economy. There was the longest government shutdown in U.S. history that pulled over $7 billion out of the economy. Trade wars and tariff wars have caused major price hikes in several sectors. The border crisis has worsened the labor shortage in many industries and so on.

Analysis: The investors are shrugging off these issues and responding to the fact the Fed has elected to leave interest rates where they are for the foreseeable future. The majority of the major companies are reporting healthier than expected earnings. The trade war with China no longer seems so imminent, but most importantly, the consumer is spending. The latest retail numbers showed greater activity in everything from clothing to furniture to luxury goods. There was a jump in what consumers have been paying at the gas station as well. Until and unless the consumer starts a retreat, the news will be pretty good.

Why Does an Economy Grow?

There are lots of moving parts and it is quite hard to look at all the factors involved to determine which of them matter the most. The biggest challenge is that no two industry sectors are alike. What is good for one sector could be very bad for another. Despite all this complexity, there are some fundamental motivations that drive economic growth. The most important is consumer demand. It really does all come down to the willingness of the consumer to spend their money. This also means that consumers have to have money to spend, which means they have the ability to work and earn. The core motivation for business is profits; there is no point to engaging in the challenges of running a business unless there is some kind of reward. Obviously, the whole structure swiftly gets more complex when considering the wants and needs of the investor, the community and everyone else affected by any given business decision.

Analysis: It is important to remember that it all comes down to consumer demand and the desire for profits. It tends to put other motivations in some kind of perspective. For a variety of reasons, there is a lot of blame and credit assigned to the political side of things and that can be distorting. For the most part, the role of government is limited to shaping the environment that business and the consumer operate within. The rules and regulations imposed on business are ostensibly designed to protect consumers from shoddy products, to promote competition, to ensure that employees are treated fairly, to protect the community and the environment. Some of these regulations work better than others, but the idea is to create a framework for the operation of business. The consumer's behavior is shaped by the amount of tax they pay, the availability of goods, the labor environment as far as job availability and the like. The majority of these rules and regulations have been in place for many years, but there are always new ones being developed to react to the changing business environment.

Can a given president or Congress really take responsibility for economic growth? Can a given president or Congress be assigned blame if the economy doesn't grow? The truth is that there is limited influence as far as politicians. This is not to say that decisions on taxation and regulation don't play a major role. It is simply these decisions are not usually direct stimulators in the way that other decisions and developments can be. Take employment as an example. Nothing motivates the consumer quite so dramatically as job status. If one feels their job is secure and that they can look forward to pay hikes, they will be far more inclined to spend their cash and even go into debt. The government can play an indirect role as far as job development, but the decision on whether to hire someone lies with the business. What that person will be paid is a negotiation between the business and the employee. Right now, there are all manner of assertions from various politicians regarding job creation and growth, but these decisions to hire are only remotely connected to these political decisions.

Consumption is even further from direct government control. What people spend on is highly variable. Fads come and go and that affects spending. People change their minds regarding priorities—go on vacation or replace the furnace? Spending alters according to what generation one is talking about. Boomers bought things, delighted in accumulating and bought big houses to keep all that stuff in. Millennials eschew buying things and concentrate on buying experiences. They accumulate less and want smaller homes. The other side of consumption is compensation—people can only consume if they have an income that will support what they desire buying and, thus, is created the symbiotic relationship between business and the consumer. Business has to pay people enough for their employees to be consumers and consumers need to buy enough from business to stay in business.

As we prepare for the onslaught of the political year, we will hear a great deal about who is and who is not responsible for economic growth over the last few years. There will be those who credit the Trump effect and others who will point out that growth started under Obama. Some will credit Trump and the GOP and others will assert that we would be growing faster were it not for their bad economic decisions. The point to remember is that political influence is indirect and remote in most cases. It is akin to asserting that it was the weather that caused a football team to win or lose. It was certainly a factor, but the collective efforts of the players were what won or lost that game.

EU and U.K. Seem to be Missing the Point

The fight that has dominated European news for the last few years has been that of Brexit. The latest maneuver was a classic case of "kicking the can down the road." The U.K. will not be forced into a hard exit at the end of this month or even the end of May. They now have until the end of October to have this battle all over again and unless positions change radically in the next several months, there will have been no real progress or change by the time of that next deadline. The issues that have been blocking progress are real enough, but they are perhaps not the most important for the future of the U.K. or the EU economy. Both sides have been locked in a fight that is fundamentally regional: what to do about trade between the U.K. and EU, what to do about the border between Ireland and Northern Ireland, how to handle the position that expatriates will now find themselves in. In one very important area, the EU and U.K. are both forgetting that they are in a global market and one where the world's other competitors are more than ready to pounce.

Analysis: The financial services sector is not one that attracts a lot of sympathy from the politicians in either the U.K. or EU. The fate of bankers evokes little concern, but the reality is that lack of access to the global financial markets will cripple the U.K. and EU equally. Both sides appear to think they can make minor adjustments and that will be enough to protect their position. The U.K. promises looser regulation and that is a strategy that has very little political support. The EU is devoted to recreating what London once had in the EU but without changing any of the situations that have made it hard for the EU to compete in the past.

Right now, companies in the U.K. only get about a quarter of their funding needs from capital markets as compared to three quarters of the companies in the U.S. and over half in Hong Kong and China as a whole. In order for either the U.K. or EU to really compete with the dominant markets in New York and Hong Kong, there would have to be significant structural changes and reforms. To begin with, the current pension systems in the U.K. and EU are "pay as you go" and third party privately funded pension systems are rare and even prohibited in some nations. This robs the region of billions of investor dollars that generally flow to the private funding groups in the U.S. and Asia.

An even bigger issue is that there are 27 separate and distinct capital markets in the EU and they all have their own rules and regulations. What is permissible in one country is not in another. The welter of different rules and situations makes for an immense paperwork jam and keeps many investors out of select countries altogether. Despite the fact that almost everybody in the EU decries this state of affairs, there has been no unity in terms of how to alter as they all want their own national systems to become the EU norm so that they do not have to make changes.

Another huge issue is that EU rules demand that EU entities only trade with other EU entities and that prohibits the involvement of larger international entities such as major global banks. New York and Hong Kong not only allow this engagement, but they also actively encourage this engagement and that expands the capital pool significantly. The bottom line is that there is little incentive for larger players to engage in either an isolated U.K. or the EU as they continue to pursue a highly protective strategy.

Shifting Terror Strategy

The details that have been emerging as regards the vicious attacks in Sri Lanka are making an already tragic situation the more frightening. There is strong evidence that this was an attack that was based on retaliation for the attack on the mosques in New Zealand. The terrorist in social media repeatedly assert that the real "Holy War" has finally started and the new strategy is to go after places of religious significance and areas where Westerners will be found. They fully expect that Islamic sites will be attacked in kind and that will justify even more assaults. The attackers in Sri Lanka were local, but they received significant logistical support from ISIS.

Analysis: As the U.S. and other nations declared "victory" in Syria and elsewhere in the Middle East, it was reported that thousands of ISIS fighters from all over the world were streaming back to the nations they came from. The territory taken by ISIS was indeed recovered, but the size of the terrorist armies was not significantly affected and these fighters have a new mandate: take the war to the rest of the world. Analysts have noted that attacks have been launched in many locales (DRC, Sri Lanka, Algeria, Libya) and that it is only a matter of time before a major target in Europe, the U.S., China or elsewhere is hit. We are back to the 9/11 style of attack with no other goal but hurting the enemy.

The Millennial Challenge

I rarely get asked to wander too far from my comfort zone when it comes to making presentations. I stick to economic topics and leave other topics to those with a better grasp. But on occasion, I agree to wander a little and yesterday was such a day. I did about an hour on the topic of the millennial from an economist's perspective. It was more than a little weird for a 65-year-old guy to be holding forth on this topic, kind of like talking to people about getting the most from their smart phone.

I really did not get into the particulars as far as managing this cohort—what the heck would I know about that? I looked at the economic implications of millennial behavior and attitude. For example, the millennial is likely to change jobs every three or four years and that costs business in the neighborhood of $30 billion annually in additional training costs and lost productivity. It is also distressing that 55% describe themselves as "not engaged" in the goals of the company they work for and almost half think their employers are unethical. The dependence on technology means that millennials rarely ask their experienced colleagues for help and get all their information from Google searches. Seventy percent really hate talking on the phone, even if they are sales people.

There was a gap between the Boomer and Gen-X, but it was not all that wide on core issues. The gap between Boomer and Millennial is very wide and only slightly narrower with the Gen-Xer. After a session like this, all I can say is that I am sort of glad that I am old.