Strategic Global Intelligence Brief for April 19, 2019

Short Items of Interest—U.S. Economy

No Fed Retreat Likely

Trump is not the first president to get irritated with the policies of the Federal Reserve although he has certainly taken his criticism further than any of his predecessors. The fact is politicians will always favor growth and will always be reluctant to endorse anything that slows growth down. The Fed has to worry as much or more about inflation as anything else that points to a recession. The economy was starting to weaken at the start of the year, but that pattern seems to be fading as the year goes on. The latest data suggests there has been a rebound within the world economy and the U.S. economy has expanded as well. This has led the majority of the Fed officials to continue to reiterate their position on interest rates. For now, the policy remains in place—hold rates where they are until and unless there is a return to recession and be prepared to keep pushing them up should the inflation concerns build.

Boeing 737 Max Woes

The issue of the safety of the Boeing 737 Max has now served to further complicate U.S.-Canadian relations. The two countries are already knee deep in tense negotiations over a host of trade issues and where Canada stands as far as USMCA (formerly NAFTA) is concerned. Canadian officials want the Boeing aircraft to be subject to more restrictions and they want all pilots to train for an incident like this through a simulator. This is not something the FAA is requiring at this point. Boeing has reported that sales of the plane have not really slipped, although delivery dates have been extended. It is seen as a problem that can be fixed; the 737 Max is still the efficient workhorse all airlines are seeking these days.

The Next Big Immigration Crisis

There are two immigration crises to deal with these days—one is quite obvious and the other is more subtle. The U.S. is contending with wave after wave of migrants fleeing poverty and violence in Central America. We hear about this problem daily. The other crisis is the U.S. lacks workers. The only place to find the people needed would be in varying countries. The skilled labor shortage will not be solved through a higher birth rate—it can only be addressed in the short term via new arrivals, but the mood in the U.S. is profoundly antagonistic towards that population right now.

Short Items of Interest—Global Economy

Libya Becomes Major Flash Point

The government in Libya is on its last legs unless there is focused and concentrated support from the U.S. and Europe. The warlord who had taken the eastern regions of the country is very close to taking control of the national capitol as well as the majority of the oil-producing region. The potential for more development of oil has stimulated a great deal of intervention of late and weapons are pouring into Libya for the warlords as well as the government. A civil war has begun and stands to get much worse.

Notre Dame Fight Begins

Just as the massive cathedral has been a symbol at the heart of Paris for centuries, it is about to take on even more symbolism as the process of rebuilding gets underway. The plan as proposed by President Emmanuel Macron calls for the integration of modern elements of design and the use of modern materials, but this has outraged the traditionalists who want the building returned to what it once was. In its several centuries, this would not be the first time that tradition has been at war with new ideas and concepts.

Germans Discover the Stock Market

The German consumer has rarely been an enthusiastic investor. The vast majority of people have simply stashed their money in banks. That is now starting to lose its appeal as returns have been so low. The average German is now as active in the markets as they have ever been. That may have contributed to the expansion in consumer activity of late.

Global Growth Prospects Improve

The International Monetary Fund (IMF) has not yet indicated a change of heart. Neither have any of the other analytical groups at this point, but there are some encouraging signs that might affect their assessments in the future. Earlier this year, there had been a bit of optimism stemming from some of the data that described 2018, but it was determined the progress from last year had started to fade. By the end of the first quarter, it appeared the headwinds that had been feared were manifesting even faster than had been expected. The IMF, World Bank, Organization for Economic Cooperation and Development (OECD) and others all downgraded their evaluations of the global economy by between 0.2% and 0.5%. Not a catastrophic decline, but certainly not the expansion some expected to continue from 2018. With the latest data, there is some sense that growth decline may hold off a little longer.

Analysis: The first encouraging piece of data was the improved trade picture for the U.S. The trade deficit narrowed by 3.4%, a far better performance than had been expected. The even better part of this improved data is that the gains came as a result of more exports as opposed to fewer imports. There was a decline in the level of imports as well, but the drop was not all that dramatic and seemed to have more to do with seasonal factors than anything else. The U.S. bought less from China, but this is generally not the time of year that imports of consumer goods come flooding in from China and other nations. The really good news was exports were up across a number of categories. The farm exports expanded, but so did exports of manufactured goods and machines. The U.S. relies on exports for 15% of its GDP (a larger percentage of GDP than in Japan). The bulk of that export sector continues to be manufactured goods. The U.S. also saw an expansion of service exports. That has become a bigger and bigger part of the U.S. export total. In fact, the U.S. maintains a surplus with most nations when it comes to services, which is certainly the case as far as China trade is concerned.

The other piece of encouraging global economic news is China seems to have shaken off some of its own doldrums. The Chinese have been engaged in some aggressive stimulation. It has been successful as there has been growth in domestic demand at the same time that export numbers have been recovering. The latest data from the official Purchasing Managers' Index has been far more positive than has been the case, while the other industrial data has followed the same pattern. The government had been predicting growth of perhaps 6%, but that has now been upgraded to perhaps 6.5%.

One of the complicating factors has been the on-going trade war with China and the threats of more tariffs and other restrictions. It has created a whole series of reactions that have tended to throw off the month-to-month data. Companies have been buying more than they ordinarily would in order to avoid shortages or higher prices later. Then, the threat eases and the buying tapers off. Companies are now stuck with excess inventory and are not sure what they will have to do to get rid of it. If the shortages manifest and the tariffs stay in place, they will be able to exploit that capacity shortage. However, if the supply chain resumes, they will be left with more material than they can manage.

Ukraine Set to Elect Zelensky

Volodymyr Zelensky has been described by many as "Ukraine's Trump," but not really, due to the policies he has espoused. To be honest, there remains a lot of mystery as to what these policies will be. His campaign has been that of an insurgent and outsider, which has led to the comparison with Trump. He has been a comedian who played the role of president on TV—a bumbling and corrupt one at that. His appeal is largely that he is not part of the old establishment. The voters in Ukraine have definitely tired of the same old faces. The irony is that the current president came to power as an outsider as well. Now, he struggles to separate himself from the older generation of politicians. In the first round of voting, Zelensky made political gains when current President Petro Poroshenko won a lukewarm endorsement from Yulia Timoshenko. She has been around since the founding of the new Ukraine and is a highly polarizing figure.

Analysis: It is widely assumed that Zelensky is essentially a tool for some of the more powerful oligarchs in the economy. There are few who have very high hopes for his administration. The biggest issue remains Russia and what to do about the fact they have all but seized control of eastern Ukraine. The economy of the country is in a shambles and corruption is rampant. The Poroshenko regime asserted it was pro-western and reform-oriented, but that rarely seemed to manifest. The country has steadily grown poorer despite having oil and gas as well as lots of agricultural output.

Consumers to the Rescue?

For the last few months, the assessment of the U.S. consumer was somewhere between bleak and depressed. There had been an assumption that the economic headwinds would start to weigh on the consumer at some point—even though the unemployment rate was continuing to hang at record lows. The assumption had always been that low levels of joblessness would trigger enthusiastic consumer behavior. It would be logical to assume that more jobs would mean higher pay as the business community would be required to pay more to recruit people and even higher wages to keep the people they have. This was the foundation of the Phillips Curve. It had been an accurate measure since the 1950s. That connection seemed to have been broken this time, however. The rate of joblessness has been down, but wages have mostly remained stagnant. In just the last couple of months, there has been some sign of additional wage hikes, but not really enough to trigger either wage inflation or significant consumer spending.

There is another traditional consumer boost, but that has not been the factor it has been in the past. In previous years, there were a large number of people receiving significant tax refunds, but the tax law changes took many by surprise. They paid less tax through the year, but many failed to understand they would not be able to count on deductions this time. There have been millions who suddenly owed money and millions who were expecting refunds they did not get. That should have cut into consumer activity (and it probably has), but something else seems to have triggered better than expected consumer activity.

Analysis: There has been a roller coaster of retail activity since the end of last year. The sales in December of 2018 were a major disappointment given the way that the retail season had started. It was assumed that those headwinds were finally building to the point of impact. January sported a little gain, however, and some of those assumptions faded. Unfortunately, the decline resumed in February and numbers ended up lower than they had been in December. The expectation for March was that there might be a slight improvement—perhaps 1%. Instead, the increase was by 1.6%. That marked the largest recovery in monthly totals since September of 2017.

The jump in consumer activity was attributed to several factors—some signaling better news than others. There was a big jump in the spending at gas stations. That indicates higher gas prices have been chewing up more of the consumer's income. At the same time, there was more spending on restaurant meals and entertainment. There was also more spending on things like car parts and repair items in hardware stores. This signals that people are unwilling to buy new cars and are focused on repairing what they have. The same issue is affecting housing where it appears people are putting off moving in favor of fixing up the place where they are now.

The spending that is not taking place is spending on things like sporting goods and hobbies as well as luxury goods. There continues to be demand for various services, which may accelerate with the arrival of spring and summer. The expenditure on yard work and the like spikes this time of year. The spending on clothes and furniture has hit levels not seen in the last two years. In other words, the consumer is typically diverse and patterns have been hard to discern.

It would be nice to see a real trend emerge in the next couple of months, but that has been illusive for the last few months. The news thus far has been enough to convince more than a few economists to upgrade their assessments for the performance of the second quarter. The consensus view was that growth would be closer to 2% than to 2.5%, but now there are those who assert that a 2.6% to 2.7% rate is not out of the question—assuming the coming driving season is robust and summer travel is about as it has been in prior years.

Dueling Interpretations on USMCA

The ball is now in the Congressional court. At this stage, it is very hard to predict the future of the U.S.-Mexico-Canada Agreement (USMCA). It really doesn't have a champion as both Democrats and Republicans are finding fault with it. The Trump White House has issued a rosy assessment of what it will mean to the U.S. economy, but this analysis has been questioned by the U.S. International Trade Commission (ITC)—which has been charged with making the official assessment. The ITC has concluded there will a gain of about 0.35% in the GDP and maybe a gain of some 176,000 jobs. Trump's assessment is for roughly three times that impact, but with little data to back it up. The ITC has concluded the pact will add considerably to the costs for consumers. That would largely negate whatever gains might come from the pact.

Analysis: The Democrats dislike the pact as they want more environmental protection and more labor protections. The Republicans dislike it as they want less expansion of U.S. manufacturing into Mexico and Canada. The Canadians are upset with the demands being made on their dairy industry and they do not like the dispute-settling mechanisms. Mexico is not all that thrilled with the pact as it exists and making deals with the U.S. is desperately unpopular with the population as they have become very weary of the unrelenting attacks from Trump and the GOP. Those examining the pact are increasingly dubious about its passage. The closer the elections get, the more unlikely the chance of success as people will be unwilling to challenge their constituent base. In the meantime, the uncertainty is affecting manufacturers in all three nations. In particular, there have been real fears within the agricultural community. The latest set of unease was due to the continued threats to completely close the border between the U.S. and Mexico.

Some Folks Need to Just Chill

In all likelihood, we all need to do this, but for some it appears to be more urgent. I have noticed in my travels there seems to be a war between the ride-share people and most airport authorities. I understand that dealing with all these amateur drivers can be a challenge. I also understand there has been a close relationship between the taxi companies and airports in many cases. But the fact is Uber and Lyft are here to stay and the traveler clearly likes the service. The war between the ride-share crowd and the authorities in Chicago seems near the boiling point. One woman in particular was very tightly wound. She was constantly screaming at drivers, confronting them and going so far as pounding on their cars as she berated them for some mysterious infraction. This is not going to guarantee her a long life. Unfortunately, there seem to be many in Chicago and elsewhere that are in a perpetual state of anger and distress.

I get it—I am not without a temper of my own and have to fight it when I get frustrated. I do try to settle down and put it all in perspective, but I have my successful days and those not so successful. The ones that create the deepest concern are those that never seem to calm those inner demons. It is disconcerting to see this level of anger and rage. The looks on the faces of the people waiting for their ride was a mixture of fear and confusion. Why all the energy and venom? I eventually found my ride and was off, but not before my driver was treated to a string of nasty remarks. He just shrugged and said, "she is always like this—today was even calm by her standards."

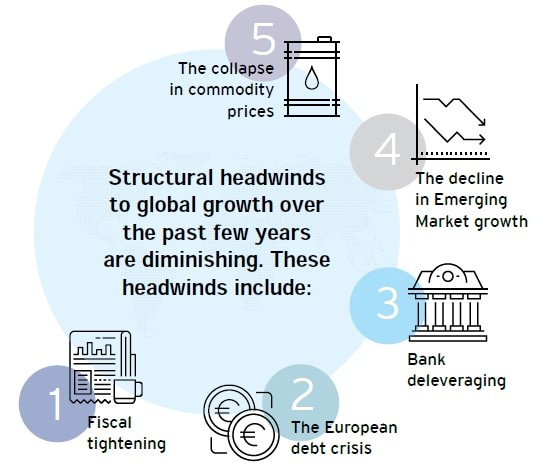

Pace of Global Growth

The pace of global growth has improved of late although there are still plenty of pitfalls that could cause a reversal later in the year. Most analysts assert that the biggest inhibitors to that growth have started to fade a little, which has allowed the economies of the world to gain some traction and overcome some of the challenges that slowed progress in the past.