Strategic Global Intelligence Brief for April 17, 2019

Short Items of Interest—U.S. Economy

Are Malls Dead?

Of all the economic shifts taking place over the last few years, none seem to have such far-reaching implications as the death of the shopping mall. These shopping centers have been at the heart of economic development for years—essentially replacing the traditional main street. Now, they seem to be next. The pull of the mall was convenience and variety—a single place where one would be able to find most everything one needed or desired. The first blow to the mall was the development of the super store—the Wal-Marts and others. They offered that same variety in a more compact form along with low prices. Now the threat is online shopping as that has challenged every other kind of retailer. The real crisis is that these malls were the tax base for many communities. Now, that revenue vanishing fast.

Widening Pay Gap

One of the provisions of the Dodd Frank law to address the banking crisis which led to the "great recession" was a requirement that corporations reveal what their senior leaders are paid. The gap between those at the top and those at the bottom has widened since the days of the recession—the ratio now is 254-1. It was at 235-1 just a couple of years ago. Not only is the gap widening in the U.S., it has become far wider than in any other developed nation. U.S. executives make 1.7 times their German counterparts and Germany is in second place as far as compensation. It has also been noted that compensation has very little to do with company performance as some of the highest-paid executives have presided over some of the biggest failures and financial collapses.

Compensation Complexity

The data on wage gaps is accurate enough as far as it goes, but the real challenge is determining how people are actually compensated. The majority of the executive level leadership only receives a small amount of compensation through wages and salaries. Most of the income is tied to the value of the stock and to various bonus plans that reward specific behavior. It has been compared to an athlete who gets a base salary and then a whole series of bonus payments according to how well they play. These tend to be very hard to compare from one year to the next.

Short Items of Interest—Global Economy

Chinese GDP Climbs Back to Respectability

For the last several months, the Chinese have been consistently downgrading their growth potential and had assumed they would be lucky to stay at 6% for the year. Suddenly, the GDP numbers are improving and China is growing at a 6.4% pace again. The major impetus for this growth has been an aggressive set of stimulus efforts and a perception that the U.S. trade war is fading. A settlement to the trade dispute now seems imminent; it is not as detrimental to the Chinese economy as it was assumed to be.

U.S.-Japan Trade Talks

These talks have been stalled for the better part of the last two years, but there now seems to be some life in them. The fact that something may be worked out with China has put Japan on the front burner. These conversations may get serious in the next few months. The stalled Japanese economy really needs to expand its interaction with the U.S., but the U.S. has concerns about the way Japan protects its domestic industries and favors exporters.

Germans Still Worried About Trade

Even as the data seems to be trending positive in Germany and the ZEW index has improved, the government has downgraded growth numbers due to concerns over trade. The country remains highly dependent on trade. Most of the markets Germany relies on have been faltering to one degree or another. The U.K. has all but collapsed and the eurozone is not all that healthy. Chinese demand has been down and the U.S. has not seen a significant level of growth.

The Rebuilding of Notre Dame

The fire that devastated the Notre Dame cathedral in France was as emotionally wrenching as anything that has happened in the last few years. Not that this tragedy compares with the massive loss of life that has accompanied terrorism and war, but this fire hit people in profoundly emotional ways—both those who are part of the Catholic tradition and those who are not. The pledges to rebuild are now pouring in from all over the world. President Macron has called for the rebuilding to be complete in five years. At the same time people are trying to get over the shock of the fire, there are any number of awkward questions bubbling to the surface.

Analysis: At the top of the list is the question of why Notre Dame was in such bad shape to begin with. It had been estimated that some $40 million worth of basic repairs needed to be carried out with some urgency, but the annual budget for these repairs was only around $3 million. The building had been affected by crumbling stone, water damage, insect damage and collapsed access corridors, while the threat of fire was ever present. Had the spending been done in previous years would Notre Dame have been so vulnerable? What is the status of the hundreds of other historical sites? Are they in similar condition—disasters just waiting to happen?

A second concern is the restoration process itself. It has been noted that many of these disasters have taken place during restoration efforts as this is an immensely risky and complex process. Ancient timbers, ancient stone, erosion, weather damage and ravages of time are all concerns. It is often more dangerous to try to repair something than to try to replace it. At what point does it make sense to recreate rather than repair. Much of Europe was destroyed in WWII and rebuilt to be as close to what it once was as possible. Does this make it less valuable to the population?

Then, there is the whole issue of priority. France has bigger issues than this albeit none so emotional. If the restoration costs upwards of a billion dollars (as some estimates have asserted), can it be justified. A billion dollars would address many other issues—everything from homelessness to ethnic tension to climate change or a thousand other pressing issues. Nobody will ever be satisfied with how funds are spent. The argument can easily be made, however, that Notre Dame is a symbol for all of France and worthy of the effort.

German Economic Recovery on Horizon?

There is little argument among analysts when it comes to assessing the state of the German economy in 2018. As well as the U.S. economy performed, the Germans seemed to face the opposite issues. There was no real stimulus effort made by the inflation-wary Germans and the majority of the economic players seemed to retreat into caution. Consumers were down and so were the majority of business people. The closely watched ZEW index was weak all year. This was bad news for the Germans and for the rest of the EU. Now there appears to be a reversal under way as the ZEW readings are as high as they have been in months. In April, the ZEW index rose to 3.1, the first time it has been in positive territory since March of last year. Last month, it was a negative 3.6 reading, so this marks a six-point reversal. This poll looks at the consumer, manufacturers and the financial community.

Analysis: The issues that dragged the economy down last year have not gone away and the export sector is continuing to stall. The German manufacturing community remains stressed by the Brexit debacle as Germany was the U.K.'s biggest European trade partner. The economic travails in the eastern sectors of Europe affect the Germans most of all as Germany has been the biggest investor in this emerging region. The export sector is over 50% of the total German GDP. That slowdown affected the whole country and by extension all of the eurozone.

The factors that have led to greater levels of confidence have been a combination of a resurgent consumer and government engagement in some crucial areas. The consumer has perked up due to the increase in wages that have taken place in the country as unemployment levels have fallen. In contrast, the U.S. has not seen the expected wage hikes that come with low levels of joblessness, but Germany has. The U.S. has struggled with people being hired for jobs they are not qualified for. That means they are not getting paid as well as might be expected. This has not been an issue in Germany and wage gains have translated into higher levels of consumer spending.

The government has engaged in some stimulus activity, but has not gone overboard. There have been some lowered taxes and efforts to put people to work. The most interesting development has been the concentrated effort to get the migrants and refugees to work. The initial waves of immigrants were entirely dependent on state aid and were a clear drain on the economy. Now, the country has found jobs for them and many have started businesses—making them contributors in terms of spending and taxation.

Manufacturing Slumps a Little—But Not Our Fault

There is a great deal about U.S. manufacturing that somehow remains deeply mysterious to the average person. Polls and surveys taken over the last several years show that few people have a clue when it comes to the nature of manufacturing in the U.S. Over 60% in one poll thought the U.S. no longer produced anything at all in the way of manufactured goods. Most other polls show that people think manufacturing's share of the national GDP is under 1% and the U.S. is entirely a service economy powered by consumers who buy imports. It shocks people to learn that manufacturing accounts for $2.7 trillion worth of the U.S. GDP—a sum larger than the entire GDP of India, Russia or Canada. Even those who have an appreciation of the role of manufacturing in the U.S. have odd notions as far as what is produced, where it is produced and by whom. One aspect of manufacturing that seems to escape notice consistently is the importance of exports. So much attention is focused on the trade deficit the U.S. runs with countries like China and India that many fail to realize that manufactured goods make up the second-largest percentage of U.S. exports—behind only the sale of agricultural output. The U.S. does not sell much in the way of consumer goods internationally. Instead, the U.S. exports sophisticated equipment of all kinds—construction gear, aircraft, technical machinery, health care equipment and so on. These are great markets and can be very lucrative, but they can also be very sensitive to economic trends in other parts of the world.

Analysis: The export sector of the U.S. accounts for around 15% of the total GDP in any given year. That is a higher percentage than in Japan. The manufacturing sector depends on that global demand to continue growing. Of late, it has been the slowdown in the global economy that has accounted for the slowdown noted in U.S. manufacturing. Domestic demand has been relatively solid over the last couple of years, although there has been considerable ebb and flow among sectors. The market for farm machinery has been generally weak for the last few years, but in contrast, the demand for oil field equipment has been growing. Health care-related manufacturing has been strong for years and there have been up and downs when it comes to automotive and aerospace.

The latest industrial data coming from the Federal Reserve shows a continued decline in the industrial sector. After two months of decline, this month's performance was flat. This translates into a first quarter decline of 1.1% and marks the first quarterly decline since a 1.6% decline in 2017. This is not catastrophic news by any stretch, but the reason for the dip is a dramatic slowdown in global demand. That is a significant worry as there is little expectation of a recovery any time soon. In fact, it is likely that global conditions will worsen. The International Monetary Fund (IMF) has once again downgraded the prospects for the world economy—expecting no more than 3.2% growth this year. That is down from their previous estimate of 3.8% and a far cry from the 5% growth that was notched just a few years ago. This has taken a chunk out of the U.S. manufacturing market, and that damages the U.S. economy in a variety of ways.

For the most part, this is a development out of the hands of the U.S. The pace of growth has slowed in the eurozone due to some self-inflicted wounds—namely the bitter negotiations over Brexit. Though it is understandable the EU wants to make the departure unpleasant so other nations are not tempted to go the same route, the tough stance has made it hard for the U.K. to come to an agreement. That has cost the eurozone economy. Not as much as it has cost the U.K., but there has been an impact on those nations that did the most business with the U.K. (France, Italy, Germany and Spain). The slowdown in China is partly the fault of the U.S. since there has been a concentrated effort to restrict trade. This is not the only reason the Chinese economy has been stuttering, but it has been a contributing factor. At first blush, it would not seem to matter much that China is struggling as they do not buy all that much from the U.S. The problem is that many nations in Asia and elsewhere in the world sell a lot to China. When that demand fades, they are unable to buy as much from the U.S. These are the emerging market states that had been buying a great deal of the U.S. manufactured output. The U.S. doesn't make much in the way of consumer goods, but the U.S. makes the machines that other nations use to make those consumer goods.

In general, the U.S. under Trump has abandoned its role as champion of free trade to become highly protectionist. This is generally a flawed strategy, but it is especially dangerous for a nation that is traditionally engaged in the full global market. The U.S. needs to both buy from and sell to other markets and ought to be pursuing more open trade—not less.

Studying Distribution of Wealth and Income

It would seem logical that governments would know the answer to a pretty basic question, but the fact is that very few have any idea. The U.S. is now going to make an attempt to answer this critical question. How much of the nation's production income goes to what groups in the U.S.? The Bureau of Economic Analysis is setting out to create a distributional study to determine what part of the population benefits from the $20.5 trillion in goods and services produced each year.

Analysis: This will be a large and complex undertaking and will be highly controversial regardless of the conclusion. Right now, there are those who assert that distribution is extremely unequal. Then, there are those who assert it is fundamentally fair. Neither group is likely to be happy with the findings. There will be many attempts to skew the data to fit one or the other political position and it will require a very vigorous study with clear parameters if it is going to be believed. If successful, it will provide some solid facts around which to build policy as opposed to the current system with its use of biased and often anecdotal pieces of evidence.

Preparing for the Inevitable

As we just made it through one of life's inevitable tasks—taxes—I suppose we can have a thought about the other one—death. Revealing my book addiction prompted some intervention on the part of friends of a certain age. They have reached the point where the accumulations of a lifetime need to be dealt with. I have been urged to purge. It certainly makes sense given the hassle that ensued when I had to contend with the stuff that Mom and Dad had collected. Thus far, I am unwilling to make that switch.

One reader opined. He is 94 and started getting advice on what to do with his stuff in 1989 when he was 64. He ignored the advice and still has it all (plus all the other stuff accumulated since). His opinion is this: "I spent a lifetime collecting all this, buying this house, landscaping it. Why would I give it up now when it brings me such joy and fond memories. I know where all that stuff came from, who bought it for me, what grandkid made it, what cute shop I found it in. I remember a life well-lived when I look at it all." That is my position now. I have surrounded myself with things that bring me everything from solace to joy.

Someday, this will be a problem for somebody else. For that, I can only apologize to future generations. It is nothing that a good bonfire can't handle.

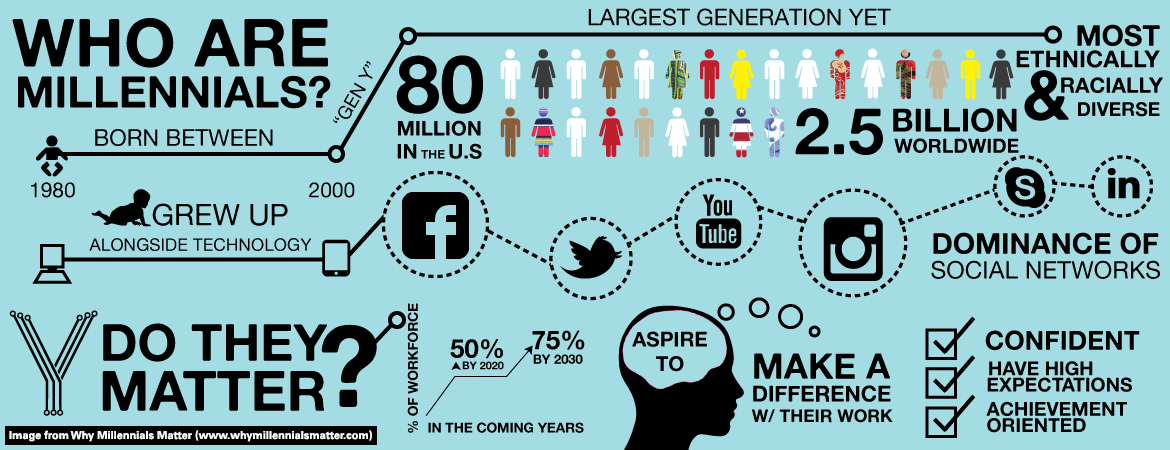

Who Are Millennials?

Next week, I am stepping a bit out of my comfort zone to speak about the economic impact of the Millennial—today and going forward. This graphic is a little bit of an eye chart, but contains some interesting information. Much has been written about what makes them different than the Boomers or Gen-Z as well as what makes them similar. The fact is this is a generation that grew up with different tools and different exposures. They will not react the way previous generations did. Boomers are leaving the workforce at a rate of 10,000 a day and the Gen-Z population is the smallest of the cohorts. Already, it has been noted that 50% of Millennials are in leadership positions. By 2030, they will make up 75% of the workforce.

.