Strategic Global Intelligence Brief for April 15, 2019

Short Items of Interest—U.S. Economy

Industrial Production Expected to Be Lower

The Federal Reserve releases industrial production numbers this week. Most expect them to be a little lower than they have been. Last month marked the second consecutive month of decline. This would mark month No. 3. The decline has been very broad based on slowdowns in almost every sector (energy is expected to be the exception). The biggest declines may be in automotive, as demand has ebbed, and in aerospace, due to the ongoing crisis over the 737 Max. Even some of the more reliable growth areas seem to have slowed a little—medical and high tech included.

Trump Weakens Fed

As the global financial community attends the International Monetary Fund (IMF) meetings, there has been an unexpected topic of conversation. The universal sense is the U.S. Federal Reserve is being weakened by the relentless attacks on its independence. It is certainly not unusual for elected officials around the world to disagree with the conclusions reached by a central bank—there have been plenty of battles involving the European Central Bank (ECB), Bank of Japan, Bank of England and others. What is rare is for a leader to seek to deliberately polarize the institution by putting people in place that are simply partisan representatives. Neither Herman Cain nor Stephen Moore have the necessary qualifications to be on the Fed's Board and would only be there to carry out Trump's orders. This is not how the central bank is supposed to comport itself.

Trade Data Released on Wednesday

Last month, the U.S. trade deficit improved rather dramatically— for both good and not so good reasons. The U.S. has not been importing as much as it had been, but much of this reduction has been due to a slowing retail sector and some consumer caution. On the plus side, the U.S. saw its deficit with China reduced. The important number will be the export data. Last month, the U.S. sold more around the world, but this month there is concern that slowing economies in Europe and China will have affected export demand.

Short Items of Interest—Global Economy

Germany Urged to Pursue Stimulus

At the IMF meetings, the German government has been criticized for now pushing a more aggressive policy of stimulation. The German economy is faltering with growth under 1%—bad news for the rest of Europe. The German attitude has been to focus more on the future threat of inflation. There is little desire to do anything that might compromise the German economy simply to make things easier on the rest of Europe.

ECB Facing Pressure as Well

It is not just the Germans that are feeling the pressure. The assembled finance ministers and others at the IMF meetings are urging the ECB to take measures that would stimulate the eurozone economy. This is the kind of pressure central banks have grown accustomed to over the years—no direct attack on the institution itself or the people on its board, but it is certainly fair game to urge policy measures that fit other agendas. The ECB regularly tries to balance the inflation hawk attitude of the Germans with the more free-wheeling approach of the French.

Finland is Europe

Voters in Finland have handed the leadership a dilemma. It is one that is shared with Europe as a whole. The vote was split almost equally between the Social Democrats of the center left, the populist party (Finns) and the Centre Party of the center right. The big loser was the ruling Centre party, but it still has a third of the votes. There is, however, no coalition that makes a great deal of sense. That means there may be an extreme minority government cobbled together with several very small parties and a marriage of convenience between the center right and center left. Nobody wants to ally with the Finns, but they have the ability to thwart much of what the others try to do.

Global Growth Down—Markets Up

Needless to say, this is not the way things are supposed to work. Aren't the markets supposed to at least pay a modicum of attention to the performance of the world economy? Isn't the success or failure of businesses tied to some degree to the overall performance of the economies of which they are part? It seems these are not the hard and fast rules they once were. The performance of the global economy is not desperately bad at this point—there is no deep recession on the horizon, but the slowdown in Europe has been profound and the IMF has downgraded the rate of growth for the world economy. Even the U.S. economy has been stuttering to some degree—resting back at the growth rates common over the last 20 years (between 2.3% and 2.5%). So, what is the issue? Are investors wrong about their assumptions or has there been some significant change in how the global economy functions?

Analysis: At the end of last year, the global markets were reacting as many had been predicting for months. The declines were profound and steady. It certainly appeared that all those dire warnings about the state of the economy were true. Europe had fallen to less than 1% growth and the U.S. GDP numbers were as bad as they had been all year. China was sinking and downgrading their projections for the coming year. This year, the markets have nearly regained all the ground lost at the end of last year. Which of the market assumptions have been inaccurate? Was it premature to predict the end of global growth last year? Is the problem now one of unjustified enthusiasm?

If one looks at the comments coming from within the investment community, there appear to be three or maybe four motivations for the current mood. At the top of the list has been the signaling coming from the world's central banks. They were all talking about moving interest rates up in anticipation of some future inflation threats, but these voices have been stilled for now. The most aggressive of the rate moves had been coming from the Fed, but now few think rates will alter this year. There are even a few voices that think a rate cut might be in the offing later this year or in 2020. The same message has been sent by the other major central banks, which means easy money is still out there in abundance. That said, there are those who worry about what this means as far as the inverted yield curve—will the Fed start to cut rates and reduce the value of those 10-year bonds?

The second point of encouragement is related to the lowering of rates. It means there is still plenty of money around to finance mergers and acquisitions. The investment community is thoroughly convinced that organic growth is far too slow. The only way for a company to grow is to acquire. It will either seek to buy up competitors or seek some kind of vertical integration. These moves are motivated by a desire to buy up market share, to acquire people or to acquire technology. As long as there are companies that see their future in M&A activity, the lower rates will be a major encouragement to go into debt to do just that kind of expansion. This activity is exactly what has worried the inflation hawks at the Fed. These mergers and acquisitions often fail to yield what the company expected. That leaves it saddled with debt, and more importantly, it leaves the banks that backed these deals vulnerable as well.

The third motivation for the global investor is there doesn't yet appear to be a panicked rush to get into the market for fear of missing a good deal. The enthusiasm has been more measured than in the past. Most of the big investors have some sort of exit plan to keep from being badly stung if there is a market reversal. It seems to be a matter of investors remaining cautious but taking advantage of the opportunities that have been presenting themselves in the meantime.

The fourth motivator could easily become a very negative factor if the assumptions are wrong. The prevailing view is that a trade war with China will be largely averted and a deal will be struck. It is also assumed that the U.S. will work a deal with Europe and will create a new version of NAFTA. The line of thinking is that Trump is simply in deal-making mode and will test the waters as much as possible before settling on something. The skeptics assert Trump has been too mercurial to count on. He may very well decide that a full-on confrontation with China is better for him politically and will ignore the economic implications. That would send the markets reeling. Many have been trying to make that point with Trump of late.

Major Breakthrough in U.S.-China Trade Deal?

This has been a rather drawn out and highly politicized process, but that was always to be expected. Nothing about the relationship between the U.S. and China will ever be easy. These are nations with vastly different goals and aspirations that compete with one another in almost every sense of the word. The political systems are polar opposites. Virtually everything China wants, the U.S. seeks to block and vice versa. China backs Venezuela, Cuba, North Korea, Iran and every other regime the U.S. opposes. China wants to dominate the South China Sea and essentially the Pacific. The U.S. wants to thwart that. The U.S. supports Taiwan, while China wants to invade it and bring it back to the mainland fold by force. China persecutes people for their religious beliefs as well as their ethnicity, and the list goes on and on.

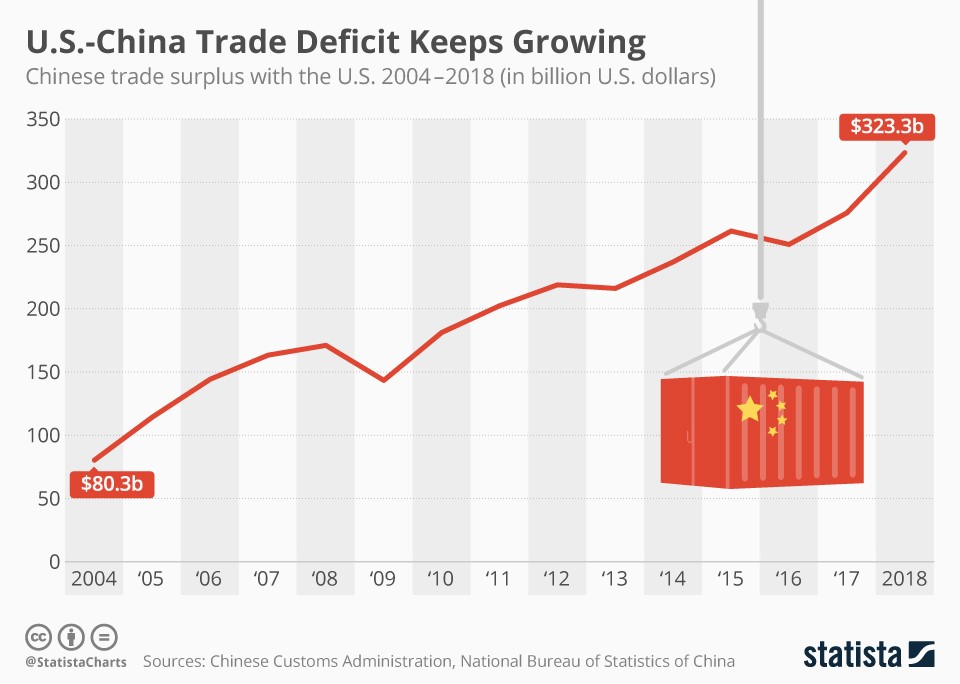

At the same time, the U.S. imports over $500 billion a year on average (and this number has been going up). It also exports some $135 billion to China annually. Obviously, the U.S. buys a lot more from China than it sells. That has been the crux of the problem for years. To put some of this in perspective the U.S. imports more from China than the total GDP of Austria or Norway. The trade war that has been sputtering away for the better part of the last few years is predicated on the notion that something can be done by government edict to change the situation—essentially using tools like tariffs and other trade barriers to convince U.S. buyers to choose somewhere else to do business. For this kind of strategy to work, there are some important prerequisites.

Analysis: The first is there has to be an alternative to the product China is selling to the U.S. The U.S. buyer has to be able to turn to some other source. That is not always possible as there are things that are only made in China. Over time, it is assumed other nations will take advantage of the trade restrictions placed on China and will start producing that alternative. This is the first assumption. If India, Brazil or Sri Lanka decides to offer that alternative, they will have to rely on the U.S. to leave that trade barrier or tariff in place. If the restrictions on China vanish, it will no longer be profitable for these alternative suppliers. Frankly, these nations do not trust the U.S. to keep these policies in place.

Another assumption is that Chinese suppliers will not adjust their prices to retain market share. If the tariff is 25%, the Chinese company might cut their price by 25%. Given the fact that most of the competitors to China will seize the opportunity to hike their prices as the tariffs kick in, it is likely Chinese producers will only have to absorb a small price cut. The pattern that has emerged time after time is that producers hit with a tariff or fee of 25% or 20%, or whatever, will see their competition hike their prices by 15% or 20%, so that they earn higher profits but still gain market share. It is really a recipe for a kind of price war.

The U.S. and China have supposedly been on the edge of an agreement for weeks. Some of the major issues have been essentially settled with China agreeing to buy more from the U.S. and protecting the intellectual property rights of U.S. companies. There have been moves to open up the Chinese market to more U.S. firms, but the real sticking point has been enforcement. In past years, the Chinese have agreed to a lot of these same provisions but have not followed through. The U.S. had been demanding the ability to unilaterally declare that China was in violation. This would automatically trigger the trade barriers and tariffs. It seems this unilateral demand has been dropped and now the Chinese can also declare the U.S. in violation and can impose restrictions of their own. It is also likely that any imposed sanctions or tariffs will have to be discussed between the two states, but it is not clear who would arbitrate the disputes.

U.S. Is Not Alone

There are times it seems that the U.S. is all alone in its attacks on the Chinese and other nations deemed trade miscreants, but that would not be an accurate assessment. As the U.S. starts to come closer to some kind of deal with China, the Japanese have also made their objections to Chinese practice known. Traditionally, the Japanese have tended to be more circumspect about their position and have relied on quieter diplomacy, but there is concern that a deal might be developed between the U.S. and China without taking Japan into consideration.

Analysis: The Japanese are objecting to the same behaviors the U.S. has been calling out. This has included theft of intellectual property, forced technology transfer and the mammoth subsidies that have been provided to Chinese tech competitors. It is somewhat harder for Japan to make these accusations given the fact it has been engaged in many of the same practices over the years—especially when it comes to subsidy and their efforts to block imports from the U.S. and Europe.

Consumer Confidence Ebbs

The consumer has started to lose confidence—at least according to the polls taken by the University of Michigan and the Conference Board. The sense is most of the enthusiasm built up last year by the tax cuts has now faded and consumers are much more concerned about the future. They are still not worried about jobs as for the most part they expect to keep seeing wage hikes—albeit small ones. The bottom line is many expected more from those tax changes this year and got less. Deductions were way down for many and returns were generally less for the middle-class taxpayer.

Analysis: The expectation was for a reading around 98. Instead, the numbers fell to 96.9 from 98.4 the month before. The major concern seems to be the potential slowing of the economy although few could put their finger on just what it would be that slows the economy enough to affect their job security. It is interesting that more concern was seen in the ranks of professionals in fields such as accounting and finance than in blue collar jobs. Traditionally, it is the blue-collar job that sees the downturn first, but with growth in manufacturing and construction and the ongoing labor crisis, there is a sense these jobs are more secure than they used to be.

Addictions Are Hard to Explain

I have one and I struggle with how to justify it. Do not be alarmed—it is not one of the trendy ones involving Starbucks and is certainly not one of the tragic ones such as opioids. My name is Chris—I am a bibliophile (Hello Chris!). I am not aware of a Booklovers Anonymous, but I wouldn't attend meetings unless there was a book sale involved. A few years ago, I actually counted the number of books I have in the house. It was over 7,000. There are now probably 8,000 or more. Bookshelves in almost every room.

There is absolutely no way I will ever read all of these. Once upon a time, my father (and fellow bibliophile) and I would scurry to the stacks to look up answers to various queries, but now we have Google. I still use my own book collection though. Why do I have all of these? Why can I not pass a bookstore without going in and buying? Why is Milwaukee my favorite airport simply because it has the Renaissance Book Store in it?

I can't give you a rational reason. When I look at the books in my office (floor to ceiling bookcases with 14-foot ceilings that require the use of a library ladder), I am somehow comforted. I look at the titles and imagine what is inside—knowing that all I have to do is take it from the shelf and open it. I just thumb through them some days—reading a line or two. I am surrounded by intellect, passion and knowledge. Somehow that compensates for some of the chaos everywhere else.

I know that someday some relative will have to figure out what to do with these things. I can only apologize in advance. Like all good obsessions, I really can't stop.

U.S.-China Trade Deficit

It is pretty obvious the U.S. buys a whole lot more from China than it sells. That number is going to be hard to reverse—even if the Chinese keep to their promises. Right now, the expectation is there will be more food sold to the Chinese, but the fact is China is getting better at growing its own. The U.S. mostly exports sophisticated machinery around the world. That would likely be what China wants from the U.S. It is not going to happen if the U.S. companies are afraid their technology is going to be stolen. The trade talks will not necessarily end this kind of tension, but it might be a start.