Strategic Global Intelligence Brief for April 10, 2019

Short Items of Interest—U.S. Economy

Fed Battle to Be Waged in Senate

For the last year or so, the Trump approach to the Federal Reserve has been increasingly hostile. The initial appointments made to the Fed were pretty traditional and did not run into much opposition in the Senate. These included Jerome Powell as chair, Richard Clarida as vice chair, Randy Quarles, Michelle Bowman and two that had not been acted upon by the time the Senate adjourned last year (Marvin Goodfriend and Nellie Liang). Now, Trump has put forward two names that are highly politicized and generally lack the qualifications for Fed engagement: Herman Cain and Stephen Moore. The choices indicate Trump wants to push his agenda through at the Fed and more or less end the independence of the central bank. There is already push-back by GOP members of the Senate as well as Democrats. It is shaping up to be a very nasty battle.

Meanwhile at the Fed

The attacks from Trump are not the first a Federal Reserve has had to deal with when it comes to presidents. The tension is always there as the goals of the Fed are not always in sync with the interests of politicians. The majority of elected leaders want growth at all costs. Therefore, they want the central bank to keep rates very low and engage in other types of stimulative activity—even at the risk of inflation. The Fed is now taking a hard look at its stance on issues like inflation as it tries to determine if holding the core rate at 2% is really the appropriate policy. It is thought that conditions have changed enough so some periods of slightly higher inflation can be tolerated. That would impact future rate policy.

More Tariff Threats Aimed at Europe

At this juncture, nobody is quite sure where the tariffs on European vehicles might stand as Trump has been vague regarding timing and intent. Meanwhile, another set of threats has emerged as the U.S. takes aim at the subsidies EU nations have been providing to Airbus for years. This has been a bone of contention between the U.S. and EU for decades as Airbus is essentially owned by the EU. Work on these planes is spread all over the region and almost every government has contributed to some form of subsidy. This has become an even more sensitive issue given the recent issues with Boeing. The EU has always argued that Boeing gets as many subsidies from the U.S. as Airbus gets from Europe, but they are of a different kind.

Short Items of Interest—Global Economy

ECB to Hold Rates Low

As expected, the European Central Bank (ECB) has indicated it has no plans to alter the interest rates this year. The performance of the eurozone has been weak by any measure one chooses to use and certainly means the central bank will avoid putting any more stress on the system. It is not yet clear whether the ECB will elect to engage in any direct stimulation such as buying up more assets or lowering rates from their already low levels. The betting is the ECB will just keep things as they are for the next few months and see what the economy looks like at the end of the year.

Immigration Crackdown Worries Mexico and Central America

At this point, nobody quite knows what the purge of the immigration authorities in the U.S. will really mean. The new people mentioned are seen as hard liners, but it is difficult to tell how policies can get any harder. The fear in Mexico is that it will be pressured to crack down on Central American migrants, which might lead to violence and demands on the Mexican budget that will be impossible to accommodate.

Merkel Backs Calls for Brexit Delay

One of the most ardent European voices on Brexit has been German Chancellor Angela Merkel as she has demanded that very little in the way of concessions be provided to the U.K. She is now calling for the EU to give Britain more time to work something out; a big step for the Europeans.

Global Growth Expected to Slip

The International Monetary Fund (IMF) is certainly not notorious for its upbeat forecasts. The institution began life after the Second World War as the lender of last resort—created primarily to give the shattered European nations an opportunity to rebuild their economies with borrowed money. It worked like a charm as these were mostly modern industrial states with the know-how and ability to compete once they had an opportunity to rebuild their shattered infrastructure. As that mission was completed, the IMF turned its attention to the developing world with the same basic plan—cheap loans to build infrastructure. The outcome was not quite so positive, however, as these states often lacked the background and skills to take advantage of this kind of support. Pretty soon, the IMF was the institution that set about correcting these bad habits through direct intervention—teams of IMF economists virtually seized control of entire economies. This essentially set the IMF as the arbiter of good and bad economic policy. Its periodic reports on the state of the world are generally seen as very accurate, but they do tend to lean in a more negative direction.

Analysis: The latest edition of the World Economic Report is characteristically blunt as it outlines the factors that have been dragging the global economy to the slowest period of growth seen in the last several years—nearly as slow as seen during the recession that gripped the U.S., Europe and the world in general. The report cites an "environment of increased trade tensions and tariff hikes between the United States and China, a decline in business confidence, a tightening of financial conditions and higher policy uncertainty across many economies." More than in past years, these are all man-made issues made more serious by political positions and the growth of populism as a political/economic motivator.

The growth expectation for trade now is for a rate of 3.4% in 2019. That is down from a previous estimate of 3.8% and way down from the nearly 5% notched in 2018. The growth spurt that was led by the U.S. in 2018 faded quickly and the corresponding surge in Europe was even more short-lived. The tax cuts in the U.S. coupled with additional European stimulus provided an unsustainable boom, but from the start, that surge was undermined by other policy decisions. For every step forward, there was a step or two back and the global economy ultimately started to falter. Growth estimates for the world economy are down; almost every nation is looking at dramatic reductions in their GDP. Germany is expected to be down by 0.5%, Italy is also expected to be down by 0.6% and the U.K. will fall by another 0.3%. Mexico is down by 0.6% and all of Latin America is looking at around 0.7% with big drops in Brazil and Argentina. The Middle East will see a decline of 0.9%. Even the once-high-flying U.S. economy will be coming back to earth with growth at perhaps 2.3% as compared to the 3.2% noted at the start of 2018.

Of the issues cited by the IMF, the ones that seem to be causing the most concern revolve around uncertainty. This confusion is firmly rooted in politics. The erratic nature of U.S. trade policy has been attributed to the fact that there is no real policy in place. Tariffs are imposed and then lifted. Threats are made and then are not followed up with action, but then the threat reappears at the time most assumed the issues had been resolved. The policy is directed entirely by presidential whim and the perception of how such a deal will play with the base. The agony of the Brexit process has taken everybody by surprise and has all but destroyed the British reputation in the world. It was assumed that cooler heads would prevail and an orderly and mutually acceptable deal would be thrashed out. Now the betting is the U.K. will crash out of the EU in a chaotic mess that will set their economy back by years, taking a big chunk of Europe with it. At the same time that British isolationism and populism heads the U.K. towards this train wreck, there are similar elements in Europe with Italy at the forefront of the populist crisis. The economy of Italy is in shambles; all the leadership can focus on is immigration.

The IMF is not very enthusiastic about the situation in Asia either. China has shown some signs of life of late as the manufacturing data has improved, but there are still major headwinds due to the trade fight with the U.S. and the slowing economic growth in Europe, a market that is more important to them than even the U.S. Japan remains mired in slow growth patterns and India has not been in a position to exploit the market opportunity provided by China's struggles. Latin America is at near panic levels over the mess in Venezuela and the bombastic leadership in Brazil. The hope for Argentina has faded as old problems have come back to haunt.

No End in Sight for Venezuelan Crisis

The nightmare scenario for the Latin American states that border Venezuela is not a military conflict between Maduro and some combination of states that seek to oust him. As chaotic and threatening as a civil war would be, the alternative is worse as far as many of these nations are concerned. The country is emptying out at an astonishing rate. It has been estimated that three million people have fled Venezuela in the last three years. If the current pace continues, the number will be close to six million by the end of this year and eight million by the end of 2020. Two years ago, the majority of the migrants were young men seeking some kind of work or just trying to escape the military. Today, the exodus includes whole families, the elderly, those who have been seriously ill and children. There is quite literally no place for these people to go. The neighboring states such as Columbia have been as welcoming and generous as they can be, but they have been running out of even the most basic of resources. The refugee camps are short of shelter, food, water and medical care and have become exceedingly dangerous. The Colombian authorities have caught provocateurs sent by Maduro to stir the camps up with violence—trying to paint these places as extremely dangerous.

Analysis: Realistic options are rapidly dwindling. Any potential solution begins with the removal of Nicholas Maduro and the whole corrupt government that he leads. It had been hoped he would succumb to the pressure of the world and flee. His challenger—Juan Guaido—seemed to have the support required to execute a bloodless coup of some kind, but that hope has faded. Maduro has been slowly squeezing Guaido into a box, while the expected revolt by elements of the military has not yet taken place. The Maduro regime still commands the majority of the troops, and for the most basic of reasons. The officers worry they will be held accountable for their actions if Maduro is overthrown despite the assurances of Guaido. They fear he will not be able to control those who will come back from exile and frankly, they are probably right. The soldiers know they are able to stay out of poverty because they are still part of the military and worry that when it all collapses, they will be in the same boat as everybody else in the country.

The only remaining peaceful option is if Maduro flees to exile in some nation such as Cuba. For this to happen, the governments of China and Russia will have to stop supporting him and demand he take that option. Thus far, neither of these states has shown any desire to do so. This leaves only violent alternatives. There could be an internal coup carried out by elements of the military or even the ruling party, but for this to work, they will need immediate assurance of massive support. They will need the backing of states like Colombia and the U.S.—especially when it comes to money. It is hard to see the U.S. and other states putting in large sums when elements of the old regime remain in control.

There could be a coup from the outside led by exiles living in Colombia and elsewhere. These are not unified groups in any sense of the word and have only opposition to Maduro in common. They will differ on almost everything, which will compromise their effectiveness if Maduro and his supporters fight back. Russian troops are now in Venezuela and so are Cuban troops. Any attack on Maduro risks killing Russians and Cubans. That complicates things greatly for the U.S. as well as Colombia and others. It is hard to see an outside coup succeeding without help from the U.S., but it is unlikely the U.S. will want to get that involved. Even the needed monetary aid is unlikely to be provided.

This leaves internal disintegration—a country that simply starts to utterly fall apart with nobody in a position to restore order. It could accelerate the mass migration and lead to the loss of almost a quarter of the nation's population. The countries on the border can't begin to absorb this flood and nobody seems is stepping up to help with the burden.

Netanyahu Pulls it Off

For months, the polls in Israel showed that Prime Minister Benjamin Netanyahu was unpopular. Even those who supported his Likud Coalition expressed dislike for a man they saw as corrupt and extreme. The early polls suggested he might finally go down to defeat, but in the end, he was able to gather enough control to ensure a fifth term. His reluctant supporters distrust his opponents more.

Analysis: His awkward coalition is now made up of aggressive free market advocates, ultraorthodox Jews, virulently anti-Arab racists and other fringe groups that have nothing in common other than dislike for the other side.

Moderate Rise in Consumer Prices

The Consumer Price Index (CPI) rose a bit last month, but there have yet to been any real alarm bells. The majority of the increase was due to a sharp hike in the price of gasoline at the pump, but this has not been a pattern that seems to be extending. The per barrel price for oil was headed up due to the decisions by OPEC and Russia to limit production, but that threat has started to fade somewhat as other producers are picking up the slack.

Analysis: The other elements of the CPI did not move all that much, which has kept inflation at bay for another month. The expectation was prices would start to react sooner than this, but the consumer has remained fairly consistent and the usual motivators for higher prices have not been in evidence. The latest labor report showed that wages are still not growing as they had been expected to and there is little on the horizon that suggests they will move much in the near future. The reduced threat of inflation has been a prime reason for the Fed to keep interest rates where they are for the time being. Should there be a sudden hike in either consumer or producer prices, the Fed could be back in the game with another interest rate hike or two.

Random Acts of Annoyance

We all know about those random acts of kindness we are supposed to be engaging in these days. It is a small way to try to make the world a better place, but we also know how futile this exercise seems at times. It appears we are far more likely to experience random acts of annoyance. I don't think most of us are walking around with enmity towards our fellow man—most of what we do is probably best described as thoughtless. We just don't seem to notice what we are doing that affects others. Nowhere is this more apparent than when traveling. (You knew there was a travel rant coming—didn't you?)

The fact is few of these behaviors rise to the level of true irritation—it is just that they can be avoided with a tiny bit of thought. There are the drink jugglers trying to make it down the aisle without spilling; they are not always successful. Almost as bad is the "blunderer" with bags everywhere. I have been smacked upside the head by many a backpack over the years. Also, don't forget the "window seat wiggler." This is the person who will have to use the W/C several times, but plants in that window seat anyway. Big fun for those of us in the center and the aisle seats. Last night, I had the "foot-freedom advocate" in the center seat who proceeded to remove shoes and socks to gain comfort, but was oblivious to the aroma. The list goes on—petty, silly stuff that really matters little. All of it imminently survivable, but my point is that it is just inconsiderate. The plane is nobody's idea of a good time—we are squeezed together like sardines. The least we can do is try to behave in a way that doesn't make life worse for our fellow sufferers.

Venezuelan Crisis

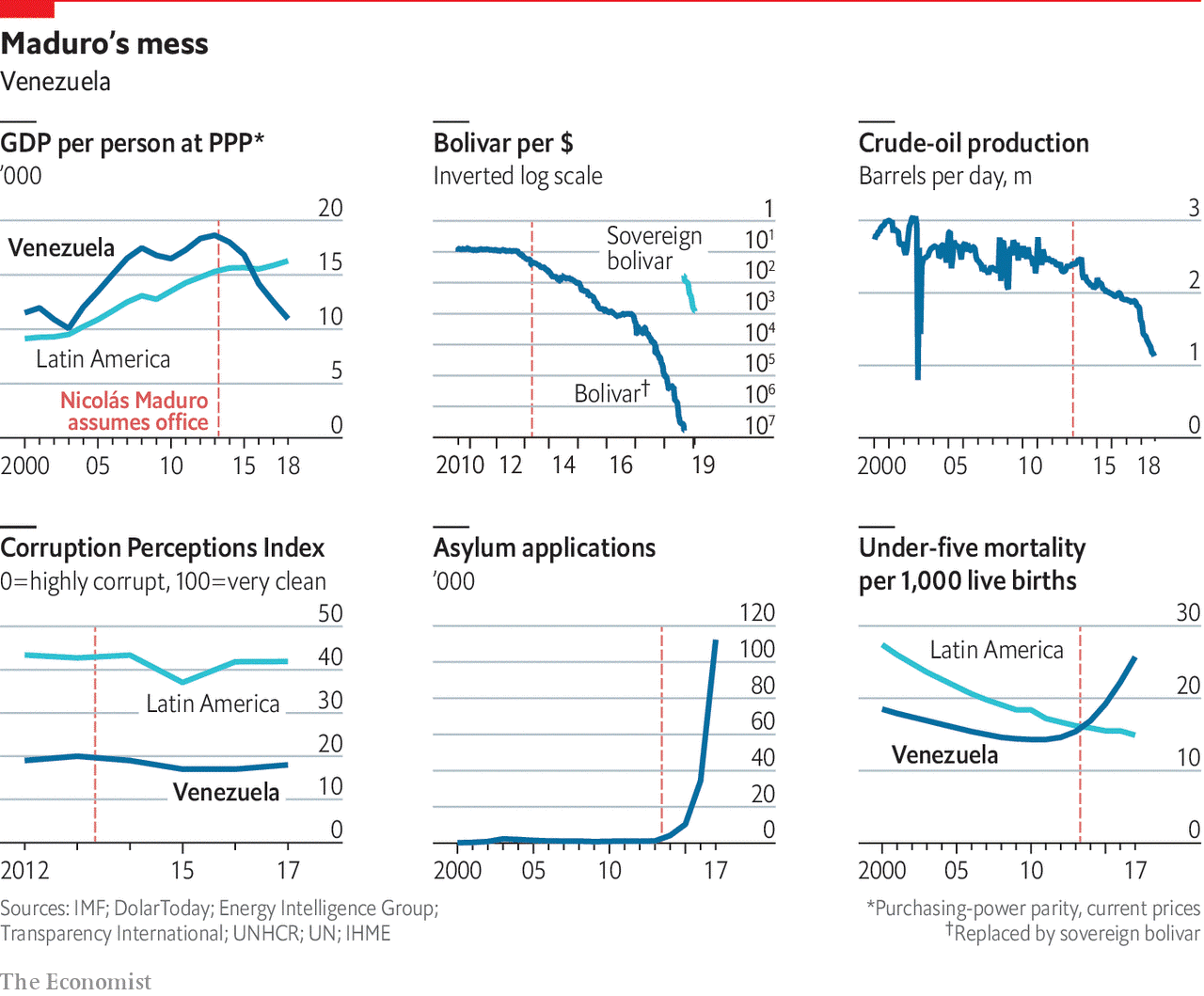

This set of graphs is a bit of an eye chart, but captures the crisis that has gripped Venezuela and illustrates why recovering is going to be a very long and drawn-out process. There is simply no future for this nation unless it is essentially adopted by the global community and rebuilt. It is not clear that any nation wants anything to do with such an undertaking.