eNews August 20

In the News

August 20, 2020

The Risky Business of Material Suppliers

—Andrew Michaels, editorial associate

If there’s one piece of advice credit professionals in commercial construction should follow, it’s knowing who you’re getting into business with from the start. Material suppliers must not only assess any and all potential risks of conducting business with a subcontractor (sub) but also understand the consequences of little to no due diligence. Fortunately, there are some telltale signs material suppliers can use that shine the spotlight on risky business.

A recent article in Construction Dive highlighted five red flags for contractors to consider during their risk assessment process prior to accepting a job: Bad owner reputation, unorganized project, uncertain financing, unfavorable contract provisions, and taking over for another contractor. Although written from a contractor’s point of view, Chris Ring, of NACM’s Secured Transaction Services, said the reasons listed also apply to material suppliers and showcase why construction credit is “the hardest form of credit.”

Uncertain financing is at the height of any credit professional’s concern as their goal is to get paid. What contractors need to ask themselves is, “Is there money to pay for the project?” Mark Himmelstein, attorney and partner at Newmeyer & Dillion LLP, said in the article. In turn, material suppliers should do the same when working with subs because the latter may not get paid by the general contractor.

“As a general rule, material suppliers selling to subcontractors should secure lien and bond rights on large dollar job accounts because it’s very likely that the subcontractor will not be able to pay the material supplier if the subcontractor is not paid. That’s always a risk,” Ring said.

A job account becomes more complicated when the construction project itself is risky. Ring said sales representatives working for material suppliers must be comfortable asking the tough questions when accepting job accounts from a sub, especially if it’s a new sub. The sales representative can do so by rephrasing Construction Dive’s five red flags into questions such as, “What is the owner’s history with other projects, i.e., reputation?” or “How is the project organized, i.e., project documentation?”

Project documents that contain “too many inconsistencies or omissions” are a sign of a poorly organized project, Attorney Edward Seglias, partner at Cohen Seglias Pallas Greenhall & Furman PC, told Construction Dive. Just as contractors don’t want to show the owner how to do their job, material suppliers don’t want to hound down subs for payment.

Upon reviewing the article’s red flags, Ring noted there is a possibility that a “desperate” sub may accept a project because many, if not all, other subs refused the project because of the associated risk. If a material supplier is selling to that “desperate” sub, then the risk of non-payment is quantifiably greater.

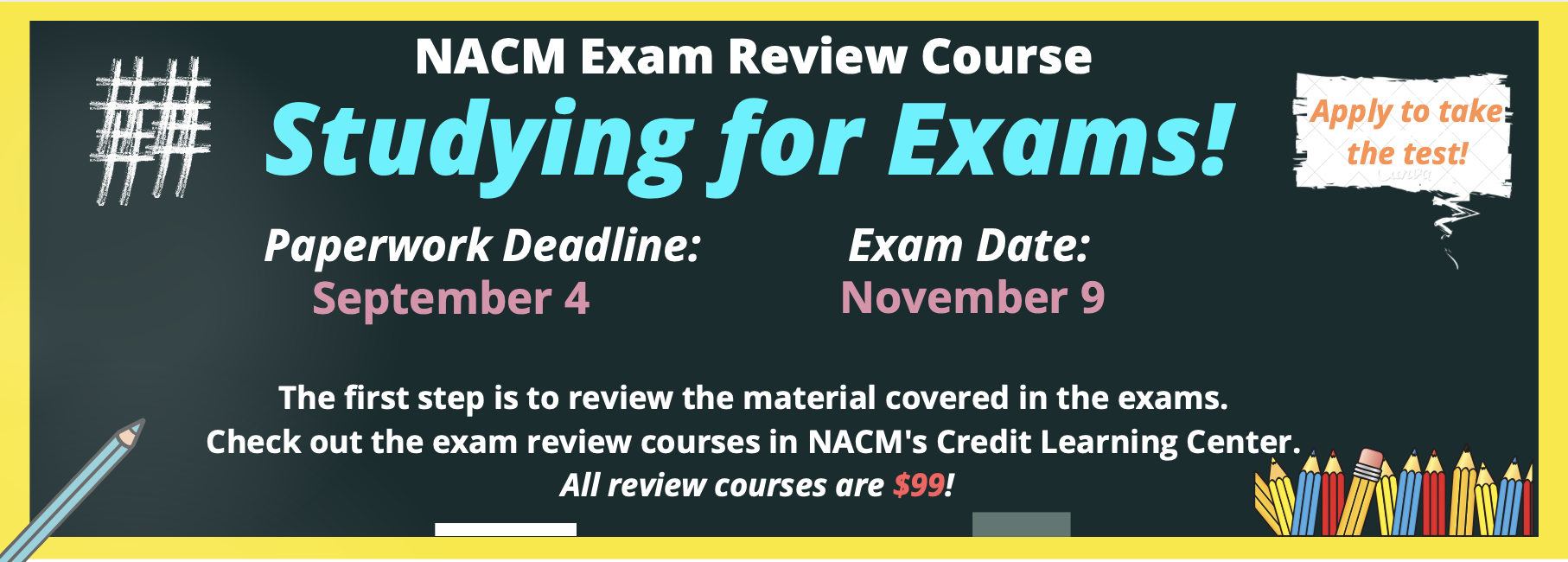

12 Different Online Courses Support Your Need to Excel:

1. Advanced Credit Policy

2. Basic Financial Accounting

3. Bankruptcy Bootcamp

4. Business Credit Principles

5. Business Law

6. Commercial Bankruptcy Credit Specialist

7. Commercial Collections Specialist

8. Commercial Construction Credit Specialist

9. Credit Law

10. Financial Statement Analysis 1

11. International Credit & Risk Management Online CourseSM

12. Soft-Skills, Ways to Conduct Effective Conversations

NACM offers a wide variety of online courses that cover everything from basic to advanced business credit concepts and topics. Experts in the field record and lead some courses; and for others, expert practitioner instructors monitor online progress. While most of the courses are on demand and can be completed at your convenience, the Basic Financial Accounting and International Credit & Risk Management courses begin and end on specific dates, three times each year.

Your Virtual Report Delivery is Your Final Product

—Stephanie Scotti

Congratulations! You and your team just finished compiling a lengthy report about the impact of a months-long project. Now you are charged with delivering your findings to a virtual audience of C suite executives, senior-level managers and directors.

How can you translate that deliverable into a clear and compelling online business presentation? Where do you even start?

These are important questions. Delivering quantitative and qualitative data to different stakeholders is a challenge. The key to success is adopting a mindset that focuses on what your audience needs to know versus what you feel compelled to tell them.

While you may want to share absolutely everything you uncovered—walking them through page by page, chart by chart—don’t. Discerning and speaking to your audience’s needs is especially important in our Zoom-fatigued era.

To understand how to do this, let’s return to some data presentation fundamentals.

Deliverable vs. delivery

There’s a crucial distinction between submitting a physical report and orally presenting the findings from that report. Once the deliverable (i.e., the document) is complete, it’s time to focus on your delivery (i.e., translating those findings into an oral presentation). These are two very different tasks.

The deliverable may include executive summaries, benchmarking reports, compilations, research and technical findings. An impressive report is comprehensive and provides what is needed to thoroughly address the questions asked or issues presented.

By contrast, to deliver a high-impact presentation, your job is to synthesize and translate the findings into terms your audience can easily understand and act on.

Having discussed the fundamental difference between creating the deliverable and delivering your findings, let’s consider how to present the findings.

5 tips for delivering the deliverable

Warning: If you go into the delivery with the mindset that you “just need to get through this,” you risk all of your efforts being wasted.

1. Develop a curious mindset

Because you are starting with a huge storehouse of data, the first hurdle is distilling and sorting the information according to what your audience absolutely needs to know. That’s no easy task.

There is a great Southern expression, “You can’t read the label when you are sitting inside the jar.” In other words, you need to step back and take on an outsider's point of view. Be curious and ask, “What are the stakeholder’s biggest questions and concerns?” Not sure what those concerns are? Ask the stakeholders and be open to understanding their perspective.

2. Make the information easily shareable

Then develop a presentation using everyday language so the information you share speaks to their needs, is actionable and is easily shared on the digital platform you will be using. Think about it this way: Your report includes recommendations that are critical to decision making.

The easier it is for listeners to comprehend and share findings and recommendations, the easier it will be for them to move forward. Make it your goal to give your client a context for the data in plain English. Make it easy to discuss key findings and you will become the go-to expert in their eyes.

3. Remember glance and grab

Many times, the written deliverable is a PowerPoint document—a series of slides used to graphically display the findings. For a written report or as a resource document, this strategy is valuable. However, repurposing these slides for your oral presentation will get you in trouble.

These charts and graphs contain too much information, making the presentation hard to follow, causing information overload or inviting listeners to ask questions about data not being addressed in your presentation. Keeping visuals relevant and succinct allows listeners to glance, grab the needed information and return to listening to what you have to say.

In addition, when presenting online, remember that stakeholders will view your presentation on a variety of devices, including a smartphone. Ask yourself: Is every slide glance and grab, even on a small screen?

4. Shift from a monologue to a dialogue

Keeping visuals simple also allows you to turn what would have been a monologue into a dialogue. Rather than struggling to decipher what is projected on a screen or monitor, displayed on a device, or written in a physical report, you are free to look into the camera! This alone can be a real breakthrough.

When you look at the people you’re talking to, it becomes a conversation, even when they are not actually talking to you. While you may not be able to view your entire audience during a virtual meeting, you can keep an eye on the chat box for clues about when people are confused, engaged, or even disagree with you.

5. Practice out loud

Key to getting the delivery right is practice. You absolutely need to talk through your presentation ahead of time (yes, even if your delivery is a collaborative discussion). Do yourself a favor and find a nonexpert outside of your immediate team and talk through your delivery via Zoom.

Ask for their feedback using the following questions:

- What resonated with you?

- What were your biggest takeaways?

- What would you have liked to know more about?

- What confused you?

The process of talking to someone who is unfamiliar with your findings will help you eliminate jargon and ensure your delivery of the data makes sense to someone who isn’t familiar with the report.

Delivery matters!

I leave you with these basic truths:

- Everyone loses when the audience’s needs are overlooked

- If what you learned is more important to you than what the audience wants to know, your delivery will fall on deaf ears.

- If you don’t keep it simple—translating the data into memorable soundbites—your audience will miss the wisdom of your findings, conclusions and recommendations.

- When you’re so married to your “script” (or slide deck) that you can’t see the audience’s perspective or anticipate their response, your efforts will go down the drain.

Remember, your report was compiled as a deliverable, but your delivery is the final product!

Originally printed in SmartBrief.

Stephanie Scotti is a strategic communication advisor specializing in high-stakes presentations. She has over 30 years’ experience mentoring every level of professional, from newly minted executives up through the C-suite echelons and into the president’s cabinet. Today she is a trusted consultant and speaker coach for companies ranging from early-stage start-up to Fortune 500. She has also developed a strong following at elite institutions such as the Center for Strategic and International Studies, Duke University and the University of North Carolina-Chapel Hill, as well as serving as a TEDx speaker coach.

Her first book, "Talk on Water: Attaining the Mindset for Powerhouse Presentations," was a #1 Hot New Release in Business Communications on Amazon in 2018. She is a regular contributor to SmartBrief, the leading digital publisher of targeted business news. Learn more at www.professionallyspeaking.net and www.professionallyspeakingblog.com.

When is Revenue Recognized?

—Michael Miller, managing editor

“Getting the complete picture of an organization’s revenue has never been easy,” according to a Credit Congress session on revenue recognition presented by former NACM-National Board of Directors member Ed Bell, Ph.D., DBA, CBA, ICCE. “The prior revenue recognition standard was rules based and industry specific,” meaning it was hard to compare across industries. The new standards are principles based across all industries.

There were four basic criteria used to meet revenue recognition under the Generally Accepted Accounting Principles (GAAP): Evidence of an arrangement; delivery or performance; fixed or determinable price; and collectability. “Much was written as to what they were, but different interpretations remained as to practical applications especially as more complex and complicated transactions were introduced.”

Accounting Standards Codification (ASC) 606 was introduced to correct and simplify revenue recognition—an impact to accounting and financial areas but also compliance. “The new guidance establishes the principles to report useful information to users of financial statements about the nature, timing, and uncertainty of revenue from contracts with customers,” states the Financial Accounting Standards Board (FASB). “The new guidance affects any reporting organization that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets unless those contracts are within the scope of other standards.”

The purpose of the update is to eliminate variations in the way businesses across industries handle accounting for similar transactions, noted the Credit Congress session. The lack of standardization in financial reporting made it difficult for investors to compare results across industries and even within the same industries.

What is Revenue Recognition?

The revenue recognition principle is a cornerstone of accrual accounting; this is where most of the transactions in the business-to-business world are, said Bell. The principle determines the accounting period in which revenue and expenses are recognized. Revenue is recognized when they are realized or realizable and earned no matter when the cash is received. However, in cash accounting, revenues are recognized no matter when goods or services are sold. Cash can be received in an earlier or later period than obligations are met, and related revenues are recognized that results in two types of accounts: Accrued revenue, which is when revenue is recognized before cash is received; and deferred revenue, which is when revenue is recognized after cash is received.

According to FASB and GAAP, there are five principles to revenue recognition: Identify the customer contract; identify the obligations in the customer contract; determine the transaction price; allocate the transaction price according to the performance obligations in the contract; and recognize revenue when the performance obligations are met.

Payment terms fall under the first step. “This is where credit really comes into play—getting payment in exchange for goods or services, and price is part of this,” according to the session. Credit also needs to be involved in negotiating the contract. If the sales team draws up a contract and doesn’t consult the credit department, and it’s later determined there was no way the customer could pay; if revenue is recognized but it was known that it couldn’t be collected, then compliance issues pop up or a possible violation.

Under step five, consignment is new for private entities under ASC 606. This is important because if contracts have consignment language in them, the control of that consignment inventory can come into question. If the seller maintains control of the consignment inventory, revenue can’t be recognized

The crucial component to the order to revenue process is automation. “The key to do this effectively is automate as much as possible,” according to the session. Auditors will look at this as well; it’s a way to continue being in compliance.

The implementation of Current Expected Credit Loss (CECL) under FASB has also impacted revenue recognition. When selling a product, CECL is the difference between what you charge and what you expect to collect on it. The new model requires an estimate of loss over the entire contractual term while the old model did not. When creating a new contract or new customer, credit departments have to estimate what the collection efficiency will be with that customer. CECL now allows to predict losses on historical loss, current economic conditions and future conditions, within reason, whereas the old principle only allowed for historical loss and conditions.

Revenue Recognition along with dozens of other educational sessions are still available for viewing through the end of August on the Credit Congress & Expo Online Showcase website.

Quicker delivery speeds do not mean giving up on fresh investigations. Each next-business-day credit report from FCIB is freshly investigated at the time that you order it.

Get the key corporate facts you need to set credit limits quickly, including:

- A robust predictive credit risk rating

- Legal filings, bankruptcies, judgments, and liens

- The latest financial and shareholder information

FCIB Reports meet the due diligence requirements of trade credit insurers and government-backed funding programs. To learn more, please contact David Anderson at +410-423-1840 or This email address is being protected from spambots. You need JavaScript enabled to view it., or click here for sample reports, pricing and ordering.

Georgia Senate Bill 315 [“SB 315”] amends the lien waiver statute codified under OCGA §44-14-366. It has passed both houses and has been signed into law by the governor with an effective date of Jan. 1, 2021. The reason the law was amended was a recent decision by the Georgia Court of Appeals that held a lien waiver was not limited to lien/bond claims, but waived all claims. This meant that, where a lien waiver was filed and there was no Affidavit of Non-Payment, the supplier waived all right to collect on the account in question. The revision of the statute was made to remove that language and replace it with language limiting the effect of lien waivers and streamlining the process.

The changes under the new statute are as follows: “(a) Waivers and releases provided for under this Code section shall be limited to waivers and releases of lien and labor or material bond rights and shall not be deemed to affect any other rights or remedies of the claimant.” This limitation language negated the holding by the Georgia Court of Appeals and limited lien waivers to liens and bonds only, as was meant when the statute was originally enacted.

The forms now have new titles:

“INTERIM WAIVER AND RELEASE OF LIEN AND PAYMENT BOND RIGHTS UPON INTERIM PAYMENT” and “WAIVER AND RELEASE OF LIEN AND PAYMENT BOND RIGHTS UPON FINAL PAYMENT”

SB 315 extends the time to file an Affidavit of Non-Payment. Under the present law, Affidavits of Non-Payment have to be filed in the records of the Superior Court of the County where the property was located within 60 days of the execution of the lien waiver. The new deadline is 90 days.

SB 315 negates the option to file a materialman’s lien instead of an Affidavit of Non-Payment. Under present law, a materialman’s lien had the same effect an Affidavit of Non-Payment. Under SB 315, there are two deadlines after a lien waiver has been filed. First, if a materialman’s lien is to be filed, it must be filed within 90 days of the last date of work or delivery of materials. Second, where a lien waiver was filed the Affidavit of Non-Payment must also filed within 90 days of the date of the lien waiver.

Emory Potter, partner with Hays, Potter & Martin, LLP, is a construction, commercial and civil litigation attorney with extensive trial experience. His specialties include material man’s lien practice, bond work related to construction, creditors’ rights, and commercial collections.

|

Date & Time Title Speakers

Romelio Hernandez, Esq.

HMH Legal S.C.

Chula Vista, CA

Tawnya Marsh, CCE

Pendleton Woolen Mills

Portland, OR

Brett Hanft, CBA

American International Forest Products

Portland, OR

Jason Robinson, Esq.

Babcock Scott & Babcock, P.C.

Salt Lake City, UT

Samantha Goddard STG Legal Pty Ltd Joyner, Australia

Lee Crosthwaite

Worrells Solvency & Forensic Accountants

Brisbane, Australia

Kevin Seltzer, Esq. Seltzer & Seltzer, LC St. Louis, MS

|