August 4, 2022

New Bill Would Protect Small Contractors on Federal Projects

Annacaroline Caruso, editorial associate

The House of Representatives’ Committee on Small Business is considering a bill that would require the federal government to pay at least half of the costs associated with change orders on federal projects. HR8273, the Small Business Payment for Performance Act of 2022, would allow small businesses to request an equitable adjustment if the contracting officer places a change order without the agreement of the small business.

“Right now, the government does not have to award a [Request for Equitable Adjustment]; but under the criteria of this new legislation, the government would have to provide a partial payment for the change in scope of a project,” said Dan Kurkoski, finance manager with Kleinfelder (San Diego, CA). “Those payments ultimately improve cashflow for the general contractor, and in turn, any first tier subcontractors who sell the services and products benefiting the project.”

Change orders are inevitable in construction; but when the scope of work during a federal project is expanded, it tends to be more expensive, said Chris Ring, of NACM’s Secured Transaction Services. “It is really unfair to the subcontractor to add more work suddenly because the subcontractor is dealing with costs that fall below them—like asphalt and concrete,” he explained. “Now the subcontractor has to go out and buy more from their suppliers, which can be a burden.”

This legislation would be a step in protecting subcontractors that are blindsided by change orders that were negotiated without their knowledge, Ring added. “A lot can happen in these construction projects that can force the government to make a change. The general contractor is involved in the negotiation of that change but the subcontractor is not. The general contractor can choose not to consult the subcontractor and may catch it off guard. But this legislation is saying that if the federal government is the one forcing the change order, it needs to help with those extra payments.” How and when those funds would flow down to the subcontractor is not yet clear.

The measure has been referred for consideration to the U.S. House Small Business Committee where members will hear expert testimony before it can be sent to the House floor. “It is very late in the term for anything newly introduced to have a hearing or move through congress,” said Ash Arnett, NACM Lobbyist with PACE Government Affairs. “It is unlikely for a bill this late to be passed into law.”

“The Small Business Payment for Performance Act will hold the federal government accountable for any changes in contracts won by small businesses to make sure small contractors don’t have any unexpected financial burdens while completing contracts,” said U.S. Rep. Pete Stauber (R-MN), sponsor of the bill. “This will result in more small businesses competing for federal contracts, and more economic prosperity for our communities.”

Circuit Court Strengthens ‘New Value’ Defense Against Avoidable Preference Lawsuits

Diana Mota, editor in chief

The U.S. Court of Appeals for the Eleventh Circuit “held that, for purposes of Section 547(c)(4)(B), ‘otherwise unavoidable transfers’ made after the debtor has filed for bankruptcy do not affect a creditor’s new value defense,” according to the Justia website.

Background from Court Documents

Beaulieu Group, LLC (“Beaulieu”), was one of the largest carpet manufacturers in North America and “engaged in the distribution of carpet and hard surface flooring products in both residential and commercial markets in the United States and many foreign countries.”

Beaulieu had eight manufacturing facilities in Georgia and one in Alabama, and had three distribution facilities in Georgia, California and Illinois. Over the course of 10 years, Beaulieu’s annual revenue declined from $1 billion in 2007 to less than $600 million in 2016, while its market share fell from 7.7% to 4.4%.

In 2016, Beaulieu added new members to its board of directors and brought in new senior management to develop a business turnaround and transformation plan. But Beaulieu had insufficient borrowing power and liquidity to complete its turnaround efforts. On July 16, 2017, Beaulieu and its affiliates each filed a voluntary petition for relief under Chapter 11 of the Bankruptcy Code.

The bankruptcy court subsequently approved a plan of liquidation that involved transferring all of Beaulieu’s assets to a liquidating trust. PMCM 2, LLC (Trustee), is the liquidating trustee for the Beaulieu Liquidating Trust. The creditor here is Auriga Polymers Inc. (Auriga), which sold Beaulieu polyester resins and specialty polymers used in a range of products, including textiles, before the bankruptcy.

In total, Auriga delivered to Beaulieu over $4.2 million in goods before Beaulieu filed for bankruptcy, for which Auriga had not been paid. Beaulieu filed for bankruptcy on July 16, 2017 (Petition Date). During the 90 days before the Petition Date (i.e., the preference period), Beaulieu transferred to Auriga more than $2.2 million (Pre-Petition Transfers). During that same period, Auriga delivered to Beaulieu over $3.523 million of goods (Goods). At least $694,502 of those Goods were delivered within 20 days of the Petition Date. The Goods were sold on credit and were not secured by an otherwise unavoidable security interest. After Beaulieu filed for bankruptcy, Auriga filed two claims against the estate.

The bankruptcy court approved a plan of liquidation that transferred Beaulieu’s assets, including “claw back” claims for avoidable preferential payments, to a liquidating trust. The trustee of the trust then filed a lawsuit against Auriga, seeking to recover $2.2 million in payments made to Auriga during the 90 days before the bankruptcy filing.

Findings of the Appeals Court

- The Eleventh Circuit held that a creditor may file a post-petition claim for the unpaid value of goods delivered to the debtor immediately before bankruptcy without impairing the creditor’s defense against disgorgement of pre-petition payments.

- Specifically, the court determined that a creditor’s “new value” defense (a creditor receiving a preferential payment from a debtor gave “new value” in the form of goods or services to the debtor after receiving the payment) against avoidance of pre-petition transfers under 11 U.S.C. § 547(c)(4) is not offset by the debtor’s post-petition transfer made in response to the same creditor’s claim under 11 U.S.C. § 503(b)(9).

- The court concluded that the context of § 547(c)(4) provides that the statute’s reference to “otherwise unavoidable transfers” is limited to pre-petition transfers (Auriga Polymers Inc. v. PMCM2, LLC).

For an in-depth look at the case, watch for Lowenstein Sandler’s analysis in the September/October issue of Business Credit magazine.

What the CHIPS Act Means for US Manufacturers

Annacaroline Caruso, editorial associate

President Joe Biden signed the CHIPS Act into law earlier this week, a $52 billion package and 25% tax credit aimed at boosting U.S. semiconductor chip production and research. The goal of the bill is to bring computer chip manufacturing back to U.S. soil and reduce reliance on Asia-based manufacturers.

“Supporters, including companies such as Intel and Global Foundries, argued that the bill was necessary since other countries subsidize their semiconductor industry, making it hard for U.S. companies to compete without help,” reads an article from CNBC.

More than 90% of semiconductors come from Taiwan, according to PBS, and U.S. semiconductor production dropped from 37% to 12% over the last 30 years. “Should Taiwan be invaded or shipping channels closed, much of the world would face a cascading economic crisis and become unable to maintain chips-dependent weapons systems,” the article reads.

Manufacturers have felt the impacts of the global computer chip shortage for the last several years, as companies have been forced to halt manufacturing while they wait for the small but vital component to finish building products such as vehicles, solar panels and smartphones.

“As the CEO of a 5G chipmaker, I know firsthand how critically important it is to have stable, reliable manufacturing partners and a resilient supply chain,” Maryam Rofougaran, CEO of 5G startup Movandi, told CNBC. “Making chips in the U.S. will help the companies get them consistently and it will create good-paying jobs which is good for the economy.”

While the CHIPS Act is a step in the right direction, it is no quick fix. “Building a chip plant is a long process, and attracting the talent needed to staff a new facility is not done overnight,” the CNBC article notes. “Regulations, labor costs and other roadblocks common in U.S. manufacturing are likely to further slow the process and the timetable for when U.S. companies can obtain these home-grown chips.”

Intel announced earlier this year a plan to build a $20 billion semiconductor “mega site” near Columbus, Ohio. But the company does not expect to see cash from the CHIPS Act any time soon. “Our expectation is there’ll be a process and that process will take us into 2023 before we start receiving money from CHIPS,” the company's chief financial officer, David Zinsner, told analysts in a conference, per The Columbus Dispatch.

The money is set to be allocated over the next five years. “I think it’s a little early to determine exactly how all that is administered and makes its way into our [financial statements],” Zinsner continued. “We’ll table that until that becomes clearer to us exactly how things shake out.”

How Will a Slowing Economy Impact Credit Defaults?

Martin Zorn, managing director, Kamakura Corporation a SAS company

The Federal Reserve increased interest rates last week by 75 basis points for the second time in two months. Members voted unanimously in favor of the aggressive move to try to control inflation. It should be noted that in the last 11 tightening cycles, the Fed has only avoided a recession three times.

During each of these cycles, inflation was lower than it is today. However, it also should be pointed out that both current employment conditions and the lingering effects of the supply chain disruption does mean that “this time is different.” Europe, in addition to battling inflation, is dealing with a precarious energy situation, and the value of the Euro is declining.

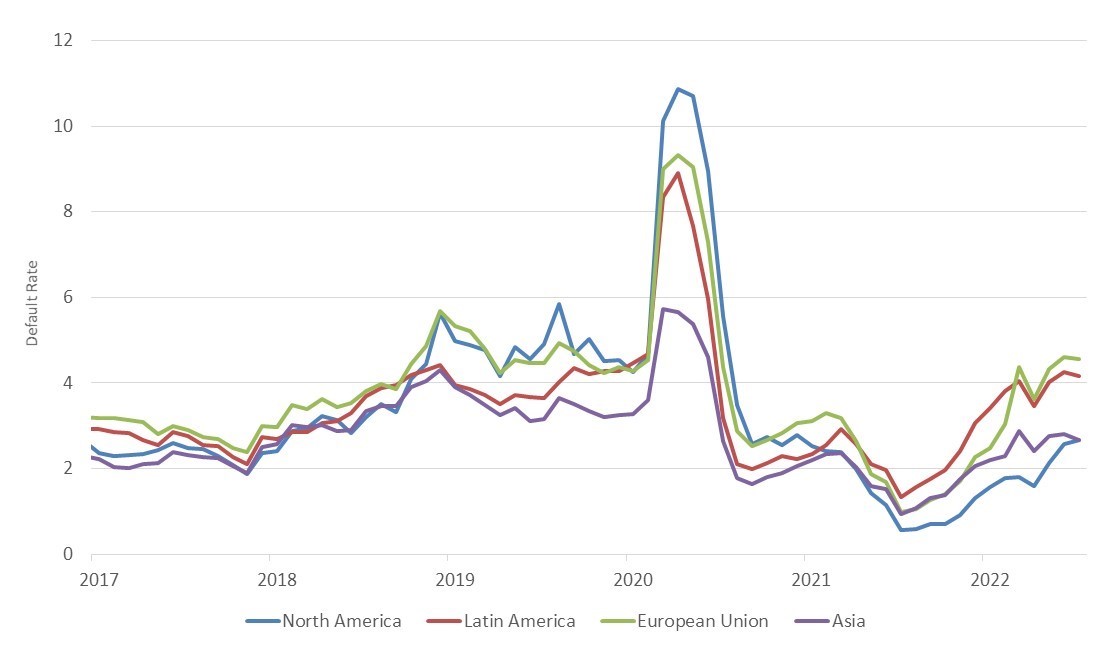

Given the fact that we are in the early stages of the tightening cycle by central banks, it is instructive to examine forward-looking default measures, such as the expected cumulative default rates. We also should spend more time studying the implications of the term structure of defaults. Figure 3 below shows that while expected cumulative defaults are beginning to accelerate across geographies, they also vary significantly by region.

Figure 3: 3-Year Expected Cumulative Default Rate — July 29, 2022

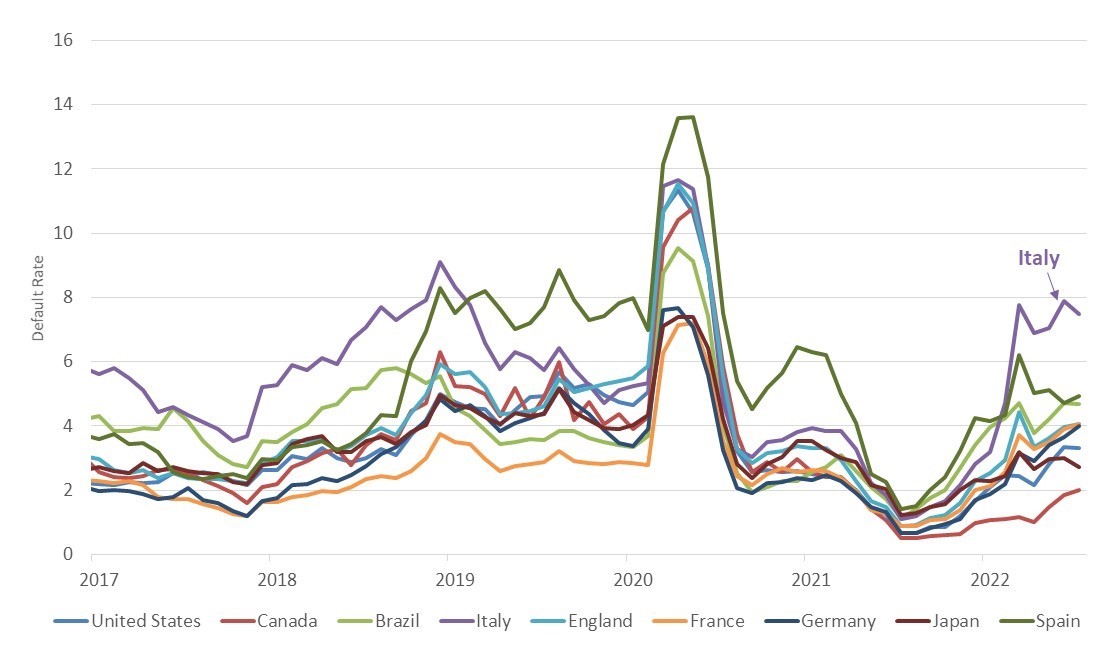

This differentiation becomes more pronounced when we focus on country data, with Italy showing the highest risk and Canada on the low end.

Figure 4: 3-Year Expected Cumulative Default Rate by Country — July 29, 2022

We are now entering a period of business cycle correction and contraction. Rising interest rates and a reduction of liquidity, combined with less accommodative credit policies, will put pressure on households and companies with the most leverage. More critically, many portfolio and credit managers have not experienced an inflationary environment, and many of the tools they use are not calibrated to manage one. For example, most are still using single-factor copula models, which backfired during the credit crisis of the Great Recession and are likely to do so again, rather than adopting more modern simulation models.

During the upcoming month, we plan to analyze the forward-looking data to examine differences in sectors, in addition to the geographic differences noted today. We also will examine the drivers for these differences. These are all critical metrics that will help risk managers determine whether to profit from risk, avoid risk or hedge.

-

APRIL

22

3pm ET -

Do You Know Who You Are Selling to?

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

-

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes -

APRIL

24

11am ET

-

APRIL

29

3pm ET -

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute

-

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes -

MAY

7

11am ET