October 28, 2021

In the News

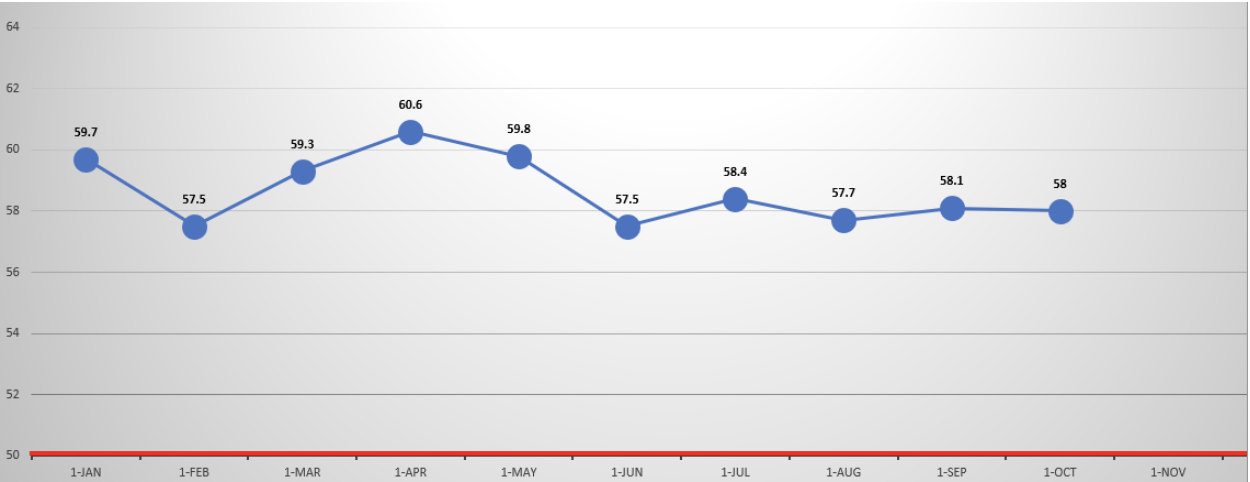

October CMI Remains Mostly Unchanged

Annacaroline Caruso, editorial associate

NACM’s Credit Managers’ Index (CMI) for October signals continued stability with its 0.1-point drop from last month.“The fact that the CMI this month is nearly identical to the CMI last month is welcome,” said NACM Economist Chris Kuehl, Ph.D. “Given the fact that credit managers tend to think more about the future than what is happening right now this outbreak of stability may be pointing to a more predictable end of the year.”

The combined index of favorable factors improved with a 1.7-point gain to 67.7 this month. Both sales numbers and dollar collection improved by 2.3 points. Of the four categories comprising the index, amount of credit extended improved the most with a 2.5-point jump to 70.0 — the first time this category has reached the 70’s.

“Many companies are buying more heavily and aggressively than they usually do as they are trying to beat inflation and they are concerned about the supply chain,” Kuehl noted.

However, the combined unfavorable score dropped to 51.5 — its lowest reading in the last year. Rejections of credit applications remained unchanged at 52.1 while the disputes category dropped 2.8 points (48.5) into the contraction zone. The dollar amount of customer deductions fell into contraction territory (49.5) also slipping by 2.8 points.

For a complete breakdown of the manufacturing and service sector data and graphics, view the September 2021 report at https://nacm.org/download-cmi.html. CMI archives may also be viewed on NACM’s website at https://nacm.org/cmi/cmi-archive.

How to Make the Most of Your Insurance Coverage During Construction Projects

Bryan Mason, editorial associate

Insurance coverage on supplied materials and equipment can be an effective tool to protect yourself from potential loss during a construction project. During NACM’s most recent construction think tank session, Jim Untiedt, partner and construction practice leader at Acrisure Construction, LLC, describes what types of insurance policies are out there and how credit professionals may utilize them to ensure their work is covered.

Untiedt explains there are five areas creditors look at to protect themselves on a construction project: mechanic’s liens, payment bonds, builder’s risk insurance, installation floaters and supplier’s transit insurance. He focused on the three main types of insurance policies listed above, including:

- Builder’s Risk Insurance – typically purchased by the owner or general contractor so they don’t have to pay twice

- Installation Floaters – typically purchased by subcontractors to protect themselves for damages to materials and equipment

- Suppliers Transit Insurance – purchased by suppliers to protect the value of materials being shipped to the jobsite

According to the American Institute of Architects (AIA) 2017 Contract Section A.2.3, owners or general contractors shall purchase builder’s risk insurance for the full value of the project, including change orders. They have to be on a replacement cost basis, and maintain coverage until substantial completion.

“If the owner chooses not to purchase that policy, they're often going to require the general contractor to purchase it,” Untiedt said. “I would say for about 90% of brand-new construction projects, if not a greater percentage, there will be a builder's risk policy in place.”

However, builder’s risk insurance does impact the rest of the contractual chain considering owners or general contractors typically do not share the policy with lower tier subs, Untiedt said. “Contracts are usually worded in a way that subcontractors need to determine if coverage exists [for them]. If not, they need to be responsible for damage to their work, their materials and their equipment.”

Furthermore, the deductibles included in the builder’s risk insurance policy may be passed down to lower-tier subs in the event of materials being stolen or damaged. Untiedt notes that he has yet to see a builder’s risk policy that states subcontractors and suppliers of every tier are covered.

In cases where there's not a builder's risk policy protecting all parties, subcontractors can purchase an installation floater to protect themselves for damage to their work for both labor, and materials supplied by a supplier. This policy covers materials while they’re being transported, stored, on the jobsite, during installation and when installation is complete but not yet accepted by the owner.

This brings us to two “action steps” for suppliers when looking to acquire an insurance policy. The first involves contacting the subcontractor to see if they have purchased installation floater coverage. “That is an option for you, as a supplier, to give you some evidence that there's somebody with the ability to pay if your materials are damaged before you get paid,” Untiedt said.

The second action step offers another option for suppliers looking to pursue coverage on their own, and that involves suppliers transit insurance. Much like installation floaters, this policy protects the value of your materials while its being shipped, Untiedt said.

“Sometimes transit insurance can provide coverage at other locations for a period of time as well,” Untiedt said. “So, you can take some action on your own insurance policies by talking to your own insurance broker and asking “what insurance can I purchase to protect my materials until they're paid for? But the best way [to protect yourself] is to require your subcontractors that you’re working with to show evidence of an installation floater equal to the largest amount of materials at risk before you're being paid.”

Best Debt Collections Strategies in Mexico

Annacaroline Caruso, editorial associate

Debt collection can be one of the most difficult jobs for a creditor. However, collections become even more complicated in different countries if you aren’t prepared for cultural differences.

For U.S. based creditors, understanding the best debt collection strategies for companies in Mexico is a valuable tool to avoiding uncollectables. U.S. goods and services trade with Mexico totaled an estimated $577.3 billion in 2020, and Mexico is currently our second largest goods trading partner, according to government data.

“The way that we're going to accomplish our goal of becoming better collectors, is by learning three things,” said Romelio Hernández, president of HMH Legal (CA), during NACM’s 2021 credit congress session Creative and Sound Techniques for Effective Debt Collection in Mexico.

The first skill for improving collection chances in Mexico is due diligence, Hernández said. You have to do your due diligence on the front end in order to have the tools and knowledge to negotiate a deal. “You have to investigate your data and ask yourself what is the situation,” he explained. “See how many lawsuits [the customer] has.” If your customer has a lot of lawsuits then it's a big risk and you will want to try and negotiate outside of court if possible.

Creditors also want to be sure to have the debtor sign a promissory note ahead of time as added protection against bad debt. “When a debtor signs this, they are a lot more concerned,” Hernández said. “They know that if they don’t pay…they will have a court clerk probably knocking on their door trying to seize assets on your behalf.”

Psychology is the next skill Hernández said is key to debt collection in Mexico because it helps a creditor understand the debtors’ mindset. “There are clever ways to collect even the toughest claims,” he explained. “We can improve our chances by learning a little psychology and applying the arts of persuasion and tactical empathy, under a proven strategy for negotiation.”

You want to remind the debtor of how much time they have invested in the business relationship and growing their reputation within the market. Chances are the debtor will become concerned that if they don’t pay, they won’t be able to do business with others, Hernández said. “If you can convince someone that what they stand to lose by not paying is more important than what they have to gain, you’re going to be more persuasive in your argument,” he added.

The last skill is having a solid collection strategy in place. “If you really want to solve problem accounts, you have to sit with your debtor,” Hernández said. “There is no other way.” Once you are able to do that, the next part of your strategy should be about building rapport with the debtor. The best way to do this is by being aware of culture and egos. “There are always clever ways to collect even the most challenging of claims.”

Boost Your State of Mind by Adopting These Healthy Practices

Bryan Mason, editorial associate

Continuing to improve yourself professionally can bring limitless value to your career, but improving yourself mentally can benefit you both professionally and personally. This was the theme for David George Brooke, speaker, coach and best-selling author, during his session Maximizing Your Gratitude Attitude at NACM’s recent Credit Congress & Expo.

Brooke spoke to credit professionals explaining the importance of realigning priorities to focus on what you have in life versus what you don’t have. “It starts with how you look at things,” he said. “Gratitude turns what you have into enough.”

Before discussing the science that supports the benefits people can experience from being more grateful, he provided multiple steps anyone can take to help them get there. These steps involve:

- Limiting your association with negative people

- Actively changing your behavior to promote a positive attitude

- Not giving up in the face of discouragement

- Identifying what makes you happy and what drains your energy

- Listening to others more intently

- Approaching life with a “glass half full” type of mindset

To begin, Brooke recommended three exercises for attendees to engage in on a daily or weekly basis: an association exercise, a gratitude journal and making it a point to change your own behavior. The association exercise Brooke uses involves listing three people you spend time with who either make you feel better after seeing them, neutral, or worse.

“You might want to consider being a little picky about who you associate yourself with, both personally and professionally,” Brooke said. By identifying those who bring negative energy to your day, you give yourself the opportunity to disassociate yourself with them to focus on the more positive influences in your life.

Brooke takes this idea a step further by employing the use of a gratitude journal. To do so, he recommends writing down a short list of things you’re grateful for every morning. Brooke continues by stating if you actively take note of what you’re grateful for, both your mental and physical well-being will improve.

“Appreciating what we have measurably improves our relationships, life satisfaction, health, sleep, and our physical health leading to fewer aches, pains, lowered blood pressure and less depression,” Brooke said. “Grateful people are more likely to take care of their health, exercise more often and schedule regular checkups.”

In addition to the benefits listed above, Brooke also states gratitude can reduce toxic emotions like envy, resentment, frustration, anger and aggression while enhancing positive emotions like empathy, care and sympathy. “Happiness is rarely constant, so although happiness is a fantastic goal, gratitude is a more important tool to help get you there,” he said.

Gratitude doesn’t only relate to how you treat yourself, but with how you treat others as well, Brooke said. “You can walk out today and change your behavior.”

Brooke provides an example of a time where a colleague expressed to him that he had a bad reputation among his coworkers. Brooke took note, and changed by making it a point to greet his coworkers every time he saw them and asked questions about how they were doing. “I quickly became one of the most popular people in the building.

“Try to remember names. Use it as soon as they introduce themselves to you and associate it with something in your mind to help you remember. Be a good listener, especially in your job, and ask people to tell you more about themselves.” Additionally, if you’re in a position of power and need assistance from your team, Brooke advises credit professionals to be careful with their wording when asking for help.

“It’s important to think about how you ask somebody to do something,” he said. “Start sentences with: Can you do me a favor? When you get a moment. If you have a second, I’d really appreciate it. Don’t say: You should. You need to. You have to. You got to. Instead, use the word ‘consider.’”

-

APRIL

22

3pm ET -

Do You Know Who You Are Selling to?

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

-

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes -

APRIL

24

11am ET

-

APRIL

29

3pm ET -

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute

-

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes -

MAY

7

11am ET