eNews July 29, 2021

In the News

CMI Rebounds After a Two Month Drop

Annacaroline Caruso, editorial associate

NACM’s Credit Managers’ Index (CMI) increased by nearly one point in July after two consecutive months of decline. The combined score for the manufacturing and services sectors totaled 58.4, still below the 2021 readings recorded in March, April and May. Favorable factors rose 2.2 points to 67, month on month, while unfavorable factors remained stable at 52.7.

"This has been one crazy and unpredictable year, and it has come on top of an even crazier and unpredictable 2020,” said NACM Economist Chris Kuehl, Ph.D.

Sales jumped 5.6 points as new credit applications soared nearly seven points to 69.8—a new high for the CMI. “The amount of credit new applications signals a lot of planned credit activity as the recovery continues,” Kuehl said.

However, the amount of credit extended score dropped roughly six points compared with June, suggesting that credit managers are being a bit more cautious. “Businesses tend to fail more during recovery than during a recession itself, which can make credit managers nervous,” Kuehl noted.

Rejections of credit applications remained fairly stable, which is a positive sign given the jump in volume of credit applications, he added. Accounts placed for collection slipped by about one point, but this category continues to remain somewhat stable with only minor fluctuations. Disputes fell into the contraction zone with a reading of 49.4, while dollar amount beyond terms data climbed out of the contraction zone to 52.4.

For a complete breakdown of the manufacturing and service sector data and graphics, view the July 2021 report at http://web.nacm.org/CMI/PDF/CMIcurrent.pdf. CMI archives may also be viewed on NACM’s website at http://www.nacm.org/cmi/cmi-archive.

Get Paid Through Construction Trust Fund Statutes

Bryan Mason, editorial associate

Contingent payment clauses like “pay-if-paid” can provide those higher up on a construction project chain with an unfavorable advantage over material suppliers when attempting to collect funds. Fortunately, construction trust fund statutes can help suppliers retain leverage despite these clauses and increase their chances of getting paid in full.

A construction trust fund statute follows a general rule, which states that payments made to anyone in the contractual chain are held “in trust” for contractors and suppliers down the line. Failure to do so will result in a “breach of trust” along with a “breach in fiduciary duty.” Fiduciary duties exist in law when a person or entity makes a commitment to act in the best interest of another person and their assets.

Not every state has a construction trust fund statute. To date, 15 states do: AR, CO, DE, FL, GA, IL, MD, MI, MN, NY, OK, SD, TX, WA and WI. The statutes vary by state. During a recent NACM Construction Thought Leadership Discussion Group session, Katy Baird, attorney at Andrews Myers PC (Houston, TX), explained that trust statutes include three important factors:

- A trustee—the party that receives the money (owners, general contractors, directors, officers, etc.).

- A trust property—the money paid for work performed, materials furnished or both for the project.

- Trust beneficiaries—subcontractors or suppliers that did the work or furnished the materials.

Suppliers can file claims against the trustee under the construction trust fund statute, depending on the state, if they have reason to believe that payment for materials furnished or work performed under a construction contract were misappropriated.

According to Baird, filing these claims also provides suppliers with the opportunity to hold individual owners or managers personally accountable by including their names in the initial demand letter—notifying individual C-suite members of the potential suit that may be coming their way. This may prompt more urgency from upper-level management.

“Hopefully, the threat of using these trust funds at the onset of your demand process will be enough to force payment,” Baird said.

Additionally, some states may enforce a trust fund statute on funds acquired through a loan that is secured by a lien on the property prompting payment from the lender. For example, in Texas, both lenders and individual owners can be held liable under the state’s Construction Trust Fund Act.

“In general, the key takeaway from the Construction Trust Fund Act is that you get to force individual liability and bring the true stakeholders of the company to the table and to the dispute,” Baird said.

Depending on the severity of the trustee’s misappropriation of funds, trust beneficiaries can file either a civil or criminal lawsuit against the trustee. If the trustee is found guilty, Baird describes some remedies the courts in Texas may impose on the perpetrator:

Civil Remedies

- Veil piercing—individual liability for the trustee

- Exemplary damages—for holding funds too long

- Non-dischargeable bankruptcy—removing the trustee’s ability to eliminate debt through bankruptcy

Criminal Remedies

- Class A misdemeanor:

- The misapplication of $500 or more

- Failure to maintain a construction account

- Failure to maintain account records

- Third-degree felony for the misapplication of $500 or more with the intent to defraud

Baird states that proving intent to defraud can be difficult. However, she did provide an example of a situation that may help beef up your case if you suspect that is the trustee’s intention.

“If an owner knows they’re supposed to pay you, it may not rise to the level of fraud,” she said. “But if they are intentionally holding those funds to prompt you to take a discount on your project and they’ve sent you emails where they’re saying, “Hey, if you cut us a break, we’ll pay you $50,000 out of the $75,000 that you’re owed,” that is a misapplication of trust funds.”

If your state has enacted a construction trust fund statute that can help you prove an unlawful act by your customer’s upper-level management, check out NACM’s exclusive Lien Navigator for details (subscription required).

Furthermore, contact NACM Education Director Tracey Lerminiaux at This email address is being protected from spambots. You need JavaScript enabled to view it. if you would like to be a part of NACM’s Construction Thought Leadership Discussion Group. The group meets monthly via Zoom to share ideas, network and learn from each other and other experts in the credit industry.

Political Risks Heightened as World Emerges from Lockdown

Annacaroline Caruso, editorial associate

As vaccine distributions increase and countries ease lockdown restrictions, some issues created by the pandemic are lingering.

“We saw the largest quarterly drop in history in the second quarter of last year, much greater than the Great Depression,” said Carolyne Spackman, vice president and chief economist of country risk at American International Group, Inc (AIG), during last week’s members-only FCIB Global Expert Briefing.

Sovereign debt levels have skyrocketed in almost every country, monetary policy has been slack, supply chains are lagging, and inflation continues to wreak havoc.

“In order to combat the problems of shutting the economy down, [governments] had to provide some stimulus packages to help cushion the blow,” Spackman explained.

It also is unclear as to whether inflation is here to stay or if it will subside once supply chains pick up and demand normalizes. “Because it was this sudden cessation of activity, there is the possibility … we could see a stronger recovery,” she said.

However, even with some level of recovery, there remains a risk to global commodity prices, which can in turn increase political risk. For example, variability in agriculture prices can lead to protests if there’s food insecurity, Spackman said.

These combined factors create a perfect atmosphere for heightened political tension, she added, of which creditors need to be aware.

Eastern Europe

Turkey is experiencing rising authoritarianism, political interference and a change in central bank leaders. It’s not likely to improve any time soon, Spackman said. “This country is one we are still expecting to see more problems with down the road.”

Armenia was in an active conflict with Azerbaijan last year, and even with a peace plan in place, it is unclear if the situation will improve. Croatia and Montenegro rely heavily on tourism, which was shuttered because of the pandemic. These countries were partially reopened this summer for tourism so there is “still a lot of room for recovery” in these areas.

Asia

According to Spackman, this region performed best last year, particularly China. The country still saw a drop in growth, but it did not experience a recession like most of the others. China returned to work earlier than a lot of other countries, which helped boost commodity prices and trade.

However, notable geopolitical risks remain; for example, the Hong Kong protests and increased tension toward Taiwan. “Half of the semiconductor chips that are exported to a lot of Western companies are from a Taiwan semiconductor company,” she said. “So that’s a global spillover risk.”

India has struggled to contain the pandemic and has been forced back into lockdown several times. As a result, it has had a deep contraction in GDP. The country is expected to rebound, but it will depend largely on the pace of its pandemic recovery.

Creditors also should keep an eye on the countries that carry a high amount of debt with China, especially those countries in emerging markets, Spackman noted. If the private sector does not provide debt relief to countries with high amounts of debt, the most vulnerable could be in a position to default, she added. “This is something that is hanging over the emerging market space for the next year or two.”

Latin America & Africa

Latin America had a very sharp decline in real GDP growth last year. Peru was hit hardest, but it also was able to bounce back because of commodity price rebound. “They have strong foreign exchange reserve buffers, so they're a little less risky,” Spackman explained.

However, Peru is currently having an election dispute, and there are concerns it will not resolve peacefully. Argentina has a track record of poor economic stability, and that risk only heightened throughout the pandemic. The country has had changes in political power, and the government had to default. Columbia and South Africa have seen an alarming increase in protests, which points to political tension.

And, some countries in Africa, such as Zambia and Mozambique, have already defaulted. Nigeria is at high risk of debt distress as well. “There are pockets of vulnerability throughout that continent,” Spackman said.

Middle East

The biggest weak spot in the Middle East is currently Lebanon. “Lebanon has been teetering on default and finally defaulted last year,” she explained. “Even without the pandemic, it probably still would have [defaulted], owing to political problems they’ve been facing.”

Spackman said risk in Lebanon could change as restructuring takes place so it’s a country that should be watched closely.

The next FCIB Global Expert Briefing is on August 20 and will focus on currency risk.

NACM’s Newest Thought Leadership Group

Looks to Develop the Next Generation of Leaders

Bryan Mason, editorial associate

All credit professionals are tasked with mastering the technical skills associated with extending credit and collecting payments. Credit managers, however, have the added responsibility of developing the next generation of credit leaders.

Soft skills—the people skills—are often lacking, said DeAnna Leahy, CCE, corporate credit manager for Sunroc Corporation (Orem, UT). Leahy wants to help her team members grow these skills similar to how they have grown their technical skills through NACM education and certifications. For Leahy, this is one of the primary reasons she joined NACM’s thought leadership group on the topic of leadership—one of several NACM groups charged with strengthening and growing the credit profession’s collective knowledgebase. (To date, the other groups include metrics, construction and technology.)

Leahy identified the following skills as focus points for developing new leaders:

- Managing people

- Communication

- Dealing with conflict internally and externally

Another member of the group, Amy Cook, CCE, credit manager for McNaughton-McKay Electric Company (Madison Heights, MI), shared what has worked for her. “I find that I always must bring new challenges, projects and job responsibilities to maintain full engagement.”

To help acclimate new employees, Cook’s company has used an immersion program, a two-day training program across all positions and areas to expose new employees to the company as a whole and to how their job fits into the big picture. However, continued education also plays an essential role, she added.

By combining education, experience and strong interpersonal skills, new credit professionals can grow into leadership roles in the credit industry. As their new recruits’ technical skills progress, credit managers should identify those interpersonal skills that they would like them to develop further. For Cook, that means:

- Empathy—an understanding and supportive feel for others.

- Accountability—the ability to take on tasks, admit failure and handle those failures accordingly.

- Resilience—the determination to go after their goals and the goals of their organization without being easily influenced by others.

“Leadership starts with job intelligence,” Cook said. “Can the leader do the job and support the team when they need it? But that is just the base; these new leaders need empathy, accountability and resilience.”

If you’re interested in joining one of NACM’s Thought Leadership groups to share experiences, strategies and best practices from your peers, please contact Education Director Tracey Lerminiaux at This email address is being protected from spambots. You need JavaScript enabled to view it..

|

Upcoming Webinars |

|

Customer Contract Management 101 Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey, Inc. |

August 4 |

|

August 9 |

Integrating Fraud Prevention in Credit Checking, Billing and Other Order-to-Cash Areas

Speaker: Bob Karau, Merchant & Gould PC |

| Credit and Collection as an Influencer: An Interactive Roadmap

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey, Inc. |

August 17 |

|

August 18 |

Knowing the Lender in Washington Is a Huge Benefit Speaker: Chris Ring, NACM STS |

|

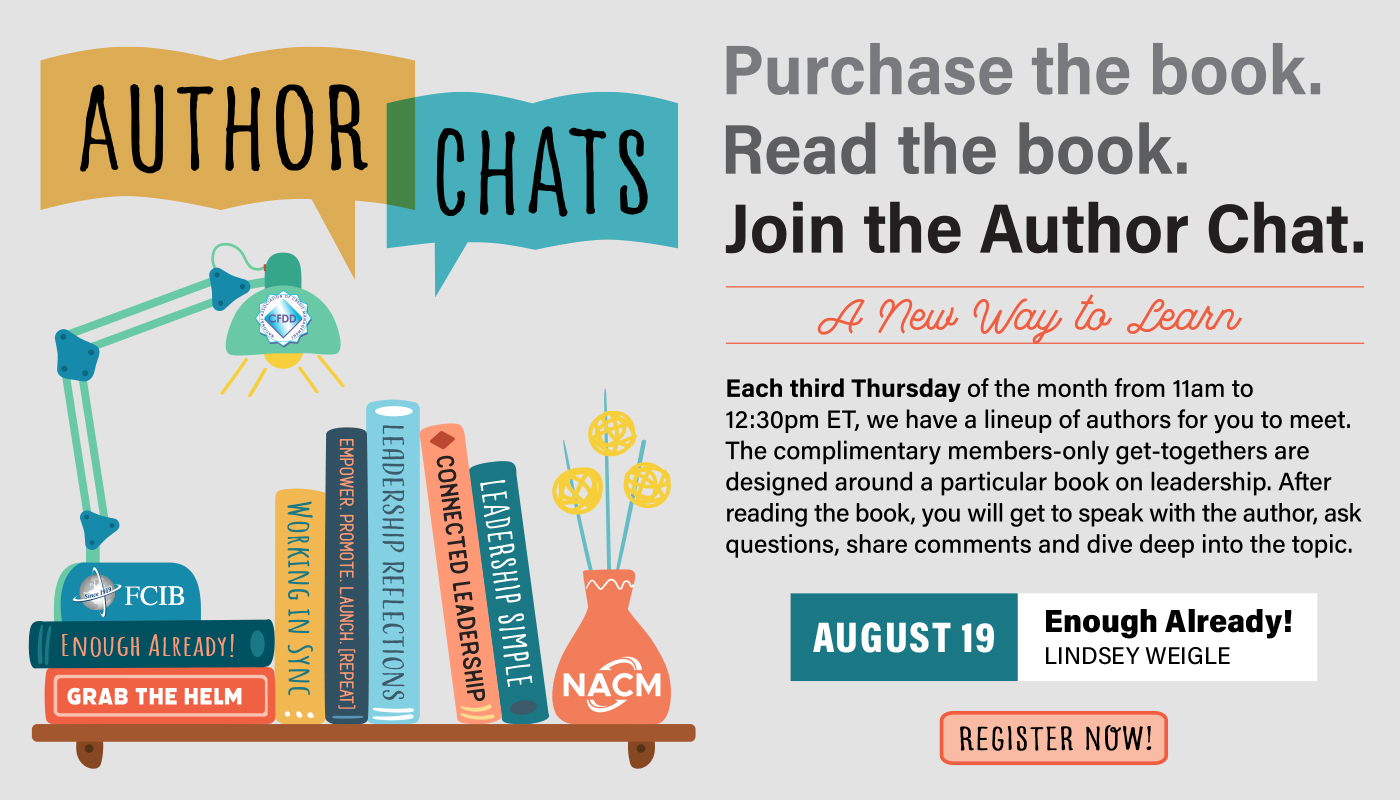

NACM and FCIB Present Author Chat: Speaker: Lindsey Weigle, Bluewater |

August 19 |