eNews July 8

In the News

July 8, 2021

The End of Libor is Near, Creditors Take Note

Annacaroline Caruso, editorial associate

Heated debate surrounding the widespread transition away from Libor (London Interbank Offered Rate) as an interest-rate benchmark has been brewing for years. But several working groups have begun issuing guidance and making serious moves toward Libor’s disappearance as the deadline quickly approaches.

A subcommittee of the Commodity Futures Trading Commission’s (CFTC) Market Risk Advisory Committee (MRAC) recommends replacing Libor with the secured overnight financing rate (SOFR), which is a benchmark interest rate used for dollar-denominated derivatives and loans. The initiative, SOFR First, is a best practice modeled after the U.K.’s SONIAFirst and would replace Libor at the end of July, one of the earliest dates suggested.

“SOFR First’s milestone date of July 26, 2021, is consistent with, and is designed to complement, U.S. banking regulators supervisory guidance that banks should cease entering into new contracts that use USD LIBOR as a reference rate at the end of 2021,” said Rostin Behnam, acting MRAC chairman, in a recent CFTC press release.

The Financial Stability Board also recently published guidance for a smooth transition away from Libor by the end of 2021. The U.K. Financial Conduct Authority announced that the majority of Libor panels will be discontinued at the end of this year.

Libor has been used globally for several decades as the index for interest rates. So why the big push for its disappearance? Libor has been controversial since 2012, when bankers from multiple financial institutions were caught manipulating the rates to their advantage, according to several news reports. The scandal revealed major flaws with Libor and raised questions about its credibility.

As financial institutions begin making this transition, creditors will want to double check that their bank lending agreements have been updated and no longer base interest rates on Libor. “Any contract or agreement we’ve had with the bank for borrowing or our discounting programs for letters of credit and drafts will have to be amended to find a new index,” said Val Venable, CCE, ICCE, FCIB’s International Credit & Risk Management instructor.

Banks will need to replace the traditional interest rate benchmark with alternative index rates. These will be different for each currency that uses its own index. Some examples of Libor replacements include SOFR (USD), SONIA (Sterling), ESTER (Euro), SARON (Swiss Franc) and TONA (Japanese Yen).

Instead of setting interest at a fixed rate, Libor offered protections to lenders by being adjustable, Venable said. Any creditor (or debtor) that has lending or borrowing agreements that use Libor as the index at which to set rates will need to have the agreements amended to reflect the new index.

“It is yet to be seen if the new index, or indexes, that replace what is now Libor will substantially change borrowing rates,” she explained.

How to Maximize Your Benefits

Through Joint Check Agreements

Bryan Mason, editorial associate

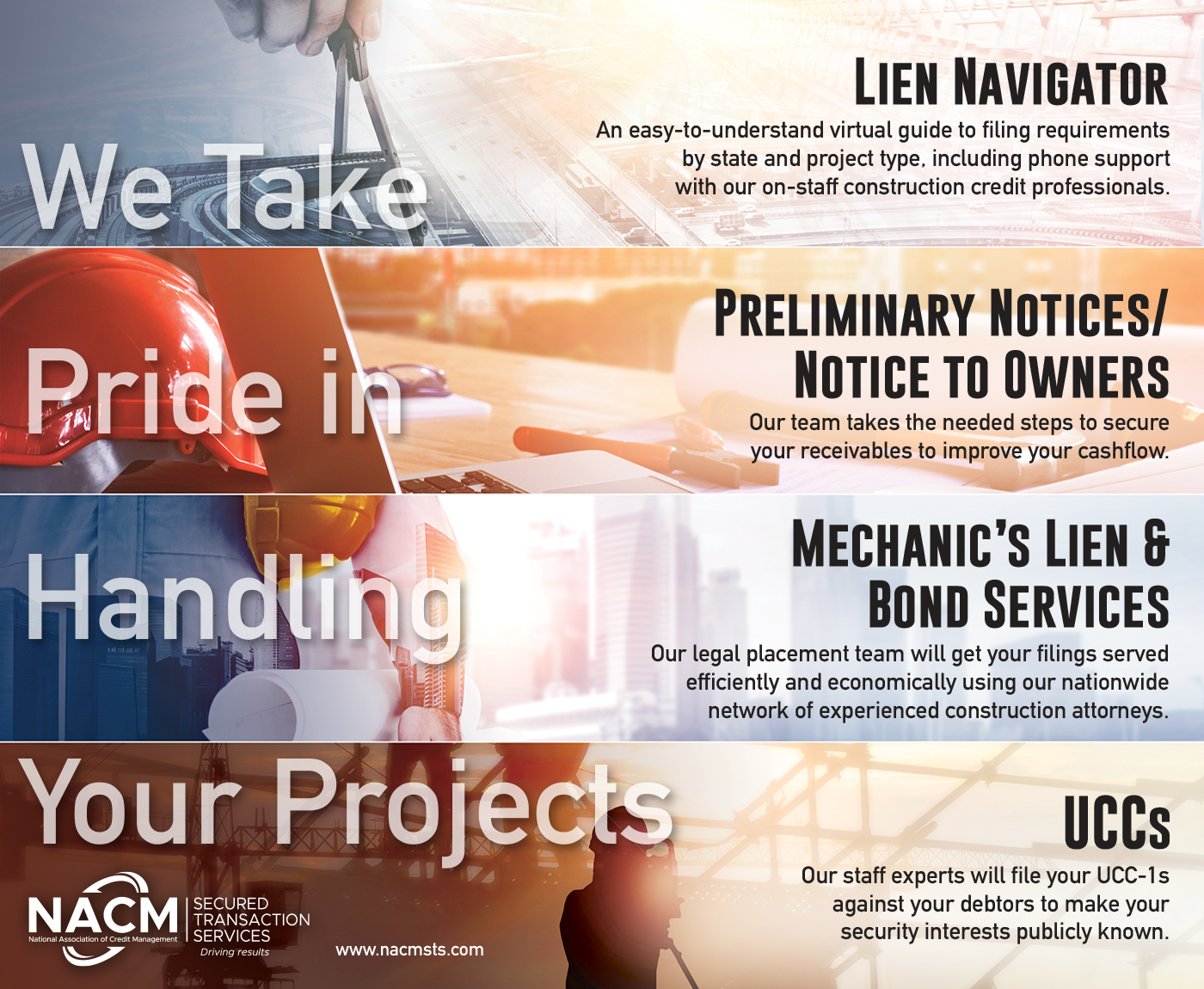

Agreeing to payment terms and then achieving those terms can be a challenge—particularly in the construction industry, where there are tiers of buyers and sellers. Sometimes general contractors will use joint check agreements to issue payments simultaneously to a subcontractor and its supplier. These agreements clarify the rights of each party regarding the endorsement, issuance and effect of the joint check payments.

Contractual agreements such as these are agreed upon by all parties and state that payment made by the general contractor to the subcontractor for the cost of the materials supplied will be sent to the supplier.

The topic of joint check agreements surfaced during a recent discussion among members of NACM’s thought leadership construction group. The discussion emphasized the importance of scrutinizing the language within the agreement before signing on the dotted line.

“A joint check protects the supplier from the risk of the subcontractor getting paid from the general contractor and then using those funds for something other than paying the supplier its portion,” said Sam Smith, regional finance manager of Crescent Electric Supply Company (East Dubuque, IL).

Joint checks can be useful in any industry or market—regardless of a customer’s financial standing—but they are more commonly used in the construction industry. These agreements can protect suppliers, and they can also “protect general contractors from having a mechanic’s lien or bond claim filed due to nonpayment,” Smith said.

Chris Ring, of NACM Secured Transaction Services, cautions, however, that joint check agreements do not guarantee that someone will actually write the check. “Therefore, you should never accept a joint check agreement in lieu of maintaining and enforcing your lien rights.”

According to Smith, suppliers can benefit in a number of ways when signing a joint check agreement such as:

- Awareness from all parties that your company is supplying materials to the project, making you more likely to get paid.

- Improvement in DSO, when joint check agreements are properly executed.

- Increased communication with the general contractor.

Unfortunately for suppliers, some subcontractors try to use the funds that are intended for the supplier to make payments elsewhere such as payroll, to other suppliers or for other work-related activities.

“Years ago, a customer of mine admitted to taking funds intended for me and using them for his employee Christmas party,” Smith said.

And, payment funds do not always flow easily. Suppliers can still be affected by any delays that may occur. For example, if there is a dispute between the general contractor and the subcontractor, the general contractor may withhold payment “until the subcontractor resolves the issue, thus preventing the supplier from being paid even though the dispute has nothing to do with them,” Smith said.

Although credit departments can develop their own joint check agreements, Smith cautions that some general contractors may want to use their forms because they were approved by their legal team.

If that is the case, “we have to review the general’s form and determine if we can work with it,” Smith said. “There is no standard joint check agreement, and they all can be very different.”

Suppliers that ask their customers for a joint check agreement might be met with resistance. Some customers could consider the idea of a joint check agreement as an insult, Smith said. Or, “They don’t want the general contractor aware of any potential financial issues they may have and how it could impact their job.

“My experience has been that many generals prefer joint checks so they don’t have to worry about issues of nonpayment and lien or bond claims,” Smith said.

When reviewing a joint check agreement, Smith recommends addressing these key points:

- Watch for “no lien clauses” that state you agree not to file a lien or bond claim on the project under any circumstance.

- Look for any language that could tie you into another contract. Never agree to any contract that you don’t have the opportunity to review before signing.

- Confirm what type of joint check agreement it is: It can be procedural, meaning the general contractor will issue the check jointly to the subcontractor and the supplier. Or, it can be a guarantee, which commits the general contractor to issuing the check jointly to the subcontractor and the supplier, while also guaranteeing the supplier will be paid.

The key is to understand what you’re signing, Smith said.

NACM’s next Construction Think Tank takes place July 20. If you’d like to learn more about this collaborative experience, contact Education Director Tracey Lerminiaux at This email address is being protected from spambots. You need JavaScript enabled to view it.. NACM also has thought leadership groups that meet monthly to discuss topics such as metrics and technology, and the newest one will focus on leadership.

Manufacturers’ Price Index Reaches Levels

Not Seen Since Late 70s

Bryan Mason, editorial associate

The chaos of supply chain meltdowns has continued to be felt week after week. Amidst these complications, manufacturers have to deal with insurmountable demand for materials, which are in short supply. Factor in labor shortages and you have a recipe for supply chain shortages that continuously push up prices for supplies and production down.

Last week, the Institute of Supply Management (ISM) noted that manufacturers reported record price jumps as its manufacturing price index rose to 92.1% in June—a high not seen since 1979 (93.1%).

ISM CEO Thomas W. Derry points out in the ISM white paper, COVID-19 and Supply Chains: Increasing Impacts, Decreasing Revenues: “If there’s one overarching supply management lesson to be learned from the pandemic, it’s that overemphasis on total lowest cost has been revealed to be a myopic objective. In a supply disruption, the business is worried about lost revenue and forgone sales. In other words, supply management needs to redefine itself as the critical enabler of the corporate top line, not merely a contributor to the corporate bottom line.”

Month on month, the ISM June Manufacturing PMI registered 60.6%, down a 0.6 percentage point month on month.

Despite the slight drop, “this figure indicates expansion in the overall economy for the 13th month in a row after contraction in April 2020,” the ISM said.

Timothy Fiore, chair of the ISM’s manufacturing business survey committee, outlined the following contributors to manufacturers’ inability to meet demand:

- Record-long raw-material lead times

- Wide-scale shortages of critical basic materials

- Rising commodity prices

- Difficulties in transporting products

In addition, “worker absenteeism, short-term shutdowns due to parts shortages and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential,” Fiore added.

According to comments he made in the white paper dated April 2020, Fiore expected supply chain recovery to take up to two years. “It will be the primary focus of risk reduction planning in the near and moderate term,” he said.

| An Economic Perspective on Country Risk in the Middle East |

An Economic Perspective on Country Risk in Latin America |

Leverage O2C Internal Controls and Due Diligence

to Support Compliance Efforts

Diana Mota, editor in chief

Knowing who your customers are and that they are not on any government watchlists is a key component of mitigating risks for your company.

“We want to make sure we're not doing business with terrorists or enemies of the United States,” said Chris Doxey, CAPP, CCSA, CICA, CPC, president and owner of Doxey, Inc., during today’s FCIB webinar, Advanced Regulatory Compliance: Leveraging Internal Controls and Due Diligence for the Order to Cash Process.

To make the process more challenging, there is not one source for getting compliance information and the information is continuously updated.

“So, you could do a compliance check on a new customer today, and guess what? They could show up on a watchlist tomorrow,” Doxey said. “With a manual process, you do not have the luxury of checking everything on a daily basis.”

On top of that, “There's often quite a few false positives and checking all of those false positives becomes a very lengthy due diligence process,” she added.

For example, government databases look at the principal names of a company. If a name is even close to someone on a watch list, it's going to show up as a potential issue and is going to need some action to make sure that it's not a problem that needs to be addressed.

In addition to mandatory government compliance requirements, companies are also busy managing their own internal controls and risk management efforts.

For Doxey, it only makes sense to integrate the compliance programs. “My philosophy over the years has been, let's not reinvent the wheel; let's not create silos; let's figure out a way to combine some of these internal controls and compliance efforts.”

The integration process starts with developing a compliance and internal controls universe. Doxey mapped out her vision of what that looks like. It starts with the tone at the top driven by the CFO and CEO and it ends with assertion and attestation. The peripheral components include key requirements of internal control such as a company’s code of conduct, policy and vendor risk analysis.

“Having all of these things combined and addressed under one universe is really a best practice,” Doxey said.

She also presented one of the more traditional frameworks developed by the Council of Supporting Organizations of the Treadway Commission, known as the COSO framework. It starts with an environment similar to the one she has embedded in her universe model such as assessing the risk, control activities, information and communication, and monitoring activities.

“And that's going to cut across not only operations, reporting and compliance, but also entity, divisions, operating units and function.”

These types of frameworks support compliance, fraud prevention and organizational-internal controls, Doxey said. “These components are really just telling you how you would implement such an internal controls model with defining the scope and ending with testing and evaluating controls, as well as the assertion and attestation components.”

Doxey also outlined 20 top internal controls, shined a light on OFAC and FCPA compliance programs and ended her webinar with a discussion on implementing a controls self-assessment program. The replay of the webinar will be available online. Next week, Chris Doxey will present SOX and Internal Controls for the Order to Cash Process 11 a.m., July 14, and Cash Management: Inputs and Outputs 11 a.m., July 20.

Doxey is currently working with the American Productivity & Quality Center to further the research on internal controls development. If you would like to participate in the survey, you will receive the full report. The survey closes July 16.

| An Economic Perspective on Country Risk in the Middle East

Speaker: Niels de Hoog, Atradius Credit Insurance |

July 12 |

|

July 12 |

Protecting Liens & Bond Collateral in Wisconsin

Speaker: Jim Sander, Esq., Larkin Hoffman's Real Estate Litigation Group |

| An Economic Perspective on Country Risk in Latin America Speaker: Greetje Frankena, Atradius Credit Insurance |

July 13 |

|

July 13 |

Financial Statements and Red Flags in Credit Risk Management Speaker: Craig Simpkins, CCE, CICP, Johnson Controls |

| SOX and Internal Controls for the Order to Cash Process

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey Inc. |

July 14 |

|

July 19 |

(FREE) Merchant Services 101 Speaker: Lisa Killingsworth-Cohen, Fiserv |