eNews May 20

|

In the News

May 20, 2021

What Lien Waivers Say Matters

Bryan Mason, editorial associate

Lien waivers are legal documents designed to protect both parties: the payee and the payer. However, addressing unfavorable language and negotiating the conditions of the waiver is essential to ensure your company receives equal protection in the process.

To start, what constitutes conditional and unconditional lien waivers? Conditional waivers become effective upon the receipt of payment. Both parties will then reap the benefit because the payer won’t be faced with double payment and the payee can maintain its lien rights until the check has been received. Look for language that states clearance of funds or add “upon receipt and clearance of funds” with your initials.

Unconditional waivers go into effect immediately after they are signed, regardless of whether payment has been made. During a recent NACM STS webinar, attorney James D. Fullerton, of Fullerton & Knowles, P.C. (Clifton, VA), advised that material suppliers make all waivers conditional. Unconditional waivers should only be signed once payment has been received and cleared the bank.

Marlene Groh, CCE, ICCE, regional credit manager for Carrier Enterprise (Charlotte, NC), states that neither type of waiver is superior, but using the right one in the right situation and being cautious of the language is vital.

“If you have not received the payment, you use conditional and make sure it is worded [so] it is conditional on not only receiving payment but also that the payment clears the bank,” Groh said. “Don’t be scared to cross out wording that makes you uncomfortable or add information to clarify something on the lien waivers.”

When a general contractor requires a lien waiver on a project, Groh verifies the information before signing it. “I review the amount billed on the job at the date referenced on the waiver and the total amount of the job,” she said. “I review all the wording on the documents for accuracy. Sometimes, I think they make some of them long on purpose hoping people will not read them in full.”

It helps to have at least one team member who can understand and amend waivers for specific language, retention, change orders and dates, Fullerton advises. The most common language credit professionals should look out for in waivers include:

- Hereafter Have: You may see this in regards to the statement that voluntarily gives up certain lien rights on a property. When “hereafter have” is implemented, you are giving up your lien rights for the remainder of the project. Fullerton recommends crossing out this phrase to preserve future lien rights and only give up rights to the amount presented in the waiver.

- Through Today: When a waiver uses this language, it lacks sufficient dates that can end up causing disputes for future payments. Fullerton suggests crossing out “through today” and inserting the specific date to avoid potential litigation issues.

- Except for Retention: Unlike the two cases above, this is a condition you should add into your waivers. “Except for retention” is another way of saying “except for money still owed.” By implementing this language, material suppliers can maintain their lien rights for future payments.

Fullerton also suggests adding “except for change orders.” However, he acknowledged “there might be pushback.” General contractors may be reluctant to comply with this revision, so Fullerton mentioned using the language “except change orders actually submitted on this date” to keep both parties satisfied.

“Most of the time customers are not educated in what they are signing,” Groh said. “If you explain the reason why you are not signing or explain which form you are willing to sign, the customer usually understands.”

Occasionally, general contractors may police their subcontractor by making them acquire waivers from all suppliers involved to ensure everyone is getting paid, Fullerton explained. In addition, he said suppliers should make sure general contractors aren’t forcing waivers on current payments so you can be certain your debts, dates, change orders and so on are protected.

Lien Navigator subscribers can view Fullerton’s entire webinar, “Mechanic's Lien & Bond Waivers: Reading and Revising Waivers to Protect Security Rights,” through the NACM STS Construction Credit Academy webpage.

How Many Credit Professionals Does It Take

to Run a Department Efficiently?

Annacaroline Caruso, editorial associate

In order for any department in a business to run smoothly, it’s imperative to have enough team members who can divvy up tasks and get the job done well. Being understaffed can negatively impact productivity and the quality of work.

The credit management or AR department is responsible for many tasks that play into a company’s success, so it’s not the place to cut corners on staffing.

“Most companies largest asset is their accounts receivable portfolio,” one NACM member said. “It also seems, from my perspective, to be the easiest one to forget about because so many folks don’t think about the cash collection piece.”

Customers won’t be upset if you don’t have time to collect on their past dues, so that activity is one of the first to go when a department is understaffed, she added. “As our volume of sales increase … our time is more and more taken up with troubleshooting and doesn’t leave much time for periodic credit reviews, being proactive, and looking at customer credit limits.”

So how can you find the sweet spot for the number of credit managers required to run a department smoothly?

NACM asked a similar question in a recent eNews poll. The majority of people (60.24%) said the number of accounts is how they determine staffing needs. Some participants also answered that head count constraints (53.01%), dollar size of portfolios (38.55%) and the complexity of transactions (31.33%) also factored into the size of their credit departments.

But one NACM member, who is working on building a business case to increase the number of staff in her AR department, said it’s still a bit of a guessing game.

“The way that other [departments] justify an increase is to look at activity over a period of time, but there are certain things in my department that are difficult to measure,” she said. “We find ourselves having to look at many different drivers of how our time is used in order to justify an increase.”

While there’s no set formula to calculate the staffing needs of a credit department, an NACM member who works for a staffing company said there are some ways to make the need clearer.

“We look at the number of credit applications we get each week,” he said. “That’s a big driver … the big piece is credit applications because that’s what really bogs them down.”

Take a close look at what roles the employees in your department handle. Does your department manually work through credit applications or is the process automated? Does your credit team also handle collections? These are important questions to ask when determining needs, according to some staffing professionals.

“Also, industry trends depending on the economy, that may keep a higher level of staffing for a credit department,” he added.

Another way to look for staffing gaps is by tracking the time employees in your department spend doing different tasks and then using that to create your own statistics.

“If we’re understaffed then we could potentially miss sales or make a bad decision because we’re rushing through things and put the company at risk with some of those clients,” the credit professional said.

Remind senior management of the role the credit department plays in the company’s growth and how increasing staff will ultimately help achieve its goals.

NACM’s Business Credit magazine will take a more in-depth look at how credit staffing needs have evolved in the August issue. Reach out at This email address is being protected from spambots. You need JavaScript enabled to view it. to share your staffing strategies and best practices.

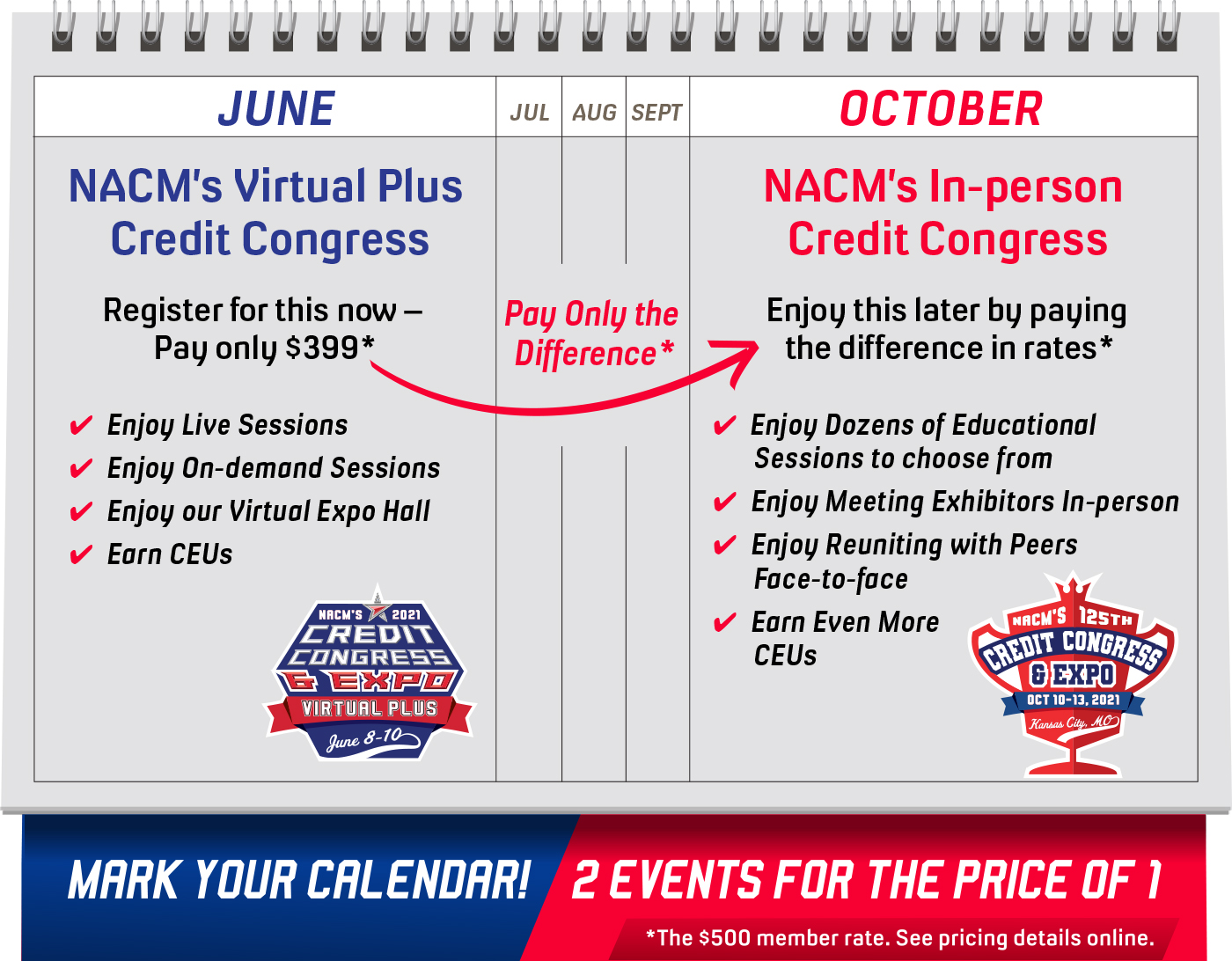

NACM Virtual Plus Credit Congress Approaching,

Register Now!

Annacaroline Caruso, editorial associate

NACM’s annual Credit Congress is kicking off virtually on June 8. The first three days of the online conference provides members with the opportunity to interact with presenters.

Participants can ask questions in real time during any of the six live seminars offered June 8-10. Most of these sessions will be recorded and available for three additional weeks along with 10 other pre-recorded forums.

New this year are live exhibitor Meet and Greets where participants will get time to chat with service providers. “It gives the opportunity for members to connect with our exhibitors,” said Jill Leimbach, director of meetings for NACM.

At the Credit Congress Virtual Plus, there’s an education opportunity for every credit manager from nearly every industry. Everything from financial analysis to technology, construction and more.

“It’s a well-rounded program with a balance of different types of sessions,” Leimbach added.

The virtual sessions will help update members on the latest market trends, said Fred Dons, of Deutsche Bank (Amsterdam), who will present live on credit risk analysis with Martin Zorn, of Kamakura Corporation (Honolulu) and Jay Tenney, of Trade Risk Group (Houston).

“We will discuss the risks which we see in the market right now,” he said. “We don’t know what the effect will be on the economy. There might be a bigger crisis post-covid. We want to make the audience aware that there are a number of risks in the market already, and we don’t know how they will develop and you should prepare.”

The live aspect of the virtual conference opens the lines of discussion, Dons added. “We used to have small talk and now we are missing the discussion parts, so you hear less and less about what’s happening in the market,” he explained. “It’s important to have these seminars just to engage again. There’s a real need to participate in these things to find out what happening out there.”

Online seminars are also a way to reach the upcoming generation of credit professionals, explained Darrell Horton, ICCE, director of credit at Litigation Services (Las Vegas, NV), who will be hosting a live session discussing interaction with the C-Suite.

There is a variety of registration options for Credit Congress 2021. Anyone who is signed up for the Virtual Plus event can upgrade at a later date to the in-person conference, which takes place in October. If you’re already sure you want to attend the in-person conference, you’ll receive access to the Virtual Plus complimentary.

Delegates can earn continuing education units (CEUs) toward CCE recertification points and participation points on the NACM Career Roadmap or the Recertification Report.

NACM Southwest members recently took a stand against Texas House Bill 2237 during a public hearing last month. Thanks to their efforts, they were able to persuade the Texas House of Representatives' Business & Industry Committee to amend unfavorable language within the bill that they said hurt suppliers.

“I am pleased to report that the efforts of the NACM Southwest were successful in obtaining a compromised revision to House Bill 2237,” said Randall Lindley, partner at Bell Nunnally & Martin LLP (Dallas). “The testimony of 11 NACM Southwest members and two supporting lawyers, combined with the efforts of our lobbyist, persuaded Committee members and the bill’s author to include a new provision in the bill that allows subcontractors to send a notice of nonpayment to the general contractor.”

The original bill had removed the second-month notice used by suppliers to perfect their liens. Southwest members argued that suppliers would lose a valuable collection tool and would likely run into more payment issues.

Following the public hearing and numerous testimonies from NACM Southwest members, the bill was sent back into pending status. After substitutes were considered in committee, the bill was eventually amended on May 7, before being passed by the House the next day.

“While this bill continues to ‘remove’ the ‘second-month notice,’ the added provision accomplishes our goal of keeping a ‘collection tool’ in place for use by our members,” Lindley said. “The added benefit of the revised language is that the notice is not required to be sent in order to perfect the lien claim, therefore, the ‘gotcha’ that was associated with failing to send the second-month notice has been removed.”

The bill was reviewed by the Senate’s Business & Commerce Committee in a public hearing on May 18. Perrin Fourmy, senior associate for Bell Nunnally, stated that while there was a Senate committee substitute offered, “the changes did not affect the language that we requested be inserted to address NACM members’ concerns.” At press time, the bill was still pending in committee.

|

Upcoming Webinars |

|

May 25 |

The Softer Side of Credit Management: The Importance of Soft Skills in An Analytical-Driven World Speaker: Craig Simpkins, CCE, CICP, Johnson Controls |

| Alternatives to Bankruptcy: What Trade Creditors Need to Know Speakers: Bruce Nathan, Esq. and Michael Papandrea, Esq., Lowenstein Sandler LLP |

May 26 |

|

June 3 |

Challenges Remain as Global Economy Recovery Emerges in 2021 Speakers: Aaron Rutstein, Atradius |