eNews March 25

In the News

March 25, 2021

Supply Chain Vulnerability on Full Display

Chris Kuehl, Ph.D., NACM economist

Ever have one of those days? You have an urgent meeting to get to—perhaps the first one in over a year. You are scrambling to get everything you need to get out the door and hit the highway only to discover that everybody else seems to have the same goal. To top it off, there is a major fender bender ahead that just turned the highway into a parking lot.

There you have it: the latest supply chain crisis. A a massive container ship managed to get itself beached sideways in the middle of the Suez Canal. Nothing can get past the ship because it is the size of the Empire State building, or 1,250 feet. Apparently an unexpected and very strong gust of wind blew the ship sideways and off course and caused it to run aground. There have already been two failed attempts to get it floating again. Meanwhile, hundreds of ships are stuck on both sides of the ship and the Suez Canal is not functioning.

This has not been a good year for the global supply chain. The ship will be moved in a few days; and a resumption of normal activity will return, but once again there will be delays. Shipments from Asia will have been bottled up. Container shortages will worsen because the empties are not making it back to the Asian ports.

The pandemic crushed the supply chains globally as ships were placed in quarantine and ports were likewise shut down. Today the issue is vaccination. Of the approximately 1.4 million seafarers working these cargo ships more than 900,000 are from nations that do not have the ability to vaccinate their populations. That means that the pandemic can affect these crews; it also means that nations will refuse them entry into their ports.

The global supply chain has been flexible enough to handle the usual run of emergencies such as storms, accidents and the like. The situation in the Suez Canal will be resolved soon, but the pandemic is another story. This has created a demand for alternatives as far as supply chains are concerned. Given that the threats have been global, the alternatives have been local. Business is actively seeking shorter supply chains and less vulnerable ones. The impetus for moving overseas and sourcing globally was to take advantage of lower production costs; but as transportation costs get higher and reliability worsens, there is a reason to rethink.

Roughly a third of those that are importing from China have indicated they are seeking alternatives—either importing from other nations or bringing production and sourcing back to the home market. The challenge in finding an alternate to China sourcing is that very few nations can match the infrastructure that China offers.

Their ports are not as good, their internal transportation networks are not as reliable, and overall efficiency is lower. To bring back work to the U.S. and Europe presents challenges as well. Labor costs are higher and so are the costs of regulation and taxation. On the positive side, greater supply chain reliability exists and an opportunity to be far more responsive to the consumer. Transportation delays do not vanish just because the focus is domestic, however. Remember the mess created by the “big freeze” in February?

Upcoming Nacha Rule Differentiates Among

Unauthorized Returns for Debits

Andrew Michaels, editorial associate

The next National Automated Clearinghouse Association (Nacha) rule change takes effect April 1. The change will attempt to better distinguish among reasons that customers declare debits as unauthorized.

Buyers claim ACH debits as unauthorized for a variety of reasons, including transaction dates or payment amounts, Nacha said. A buyer also might not recognize the party withdrawing money from its account or state it never authorized a withdrawal.

Under the new Nacha rule, the originating depository financial institution (ODFI) and the originator of the transaction will receive “clearer and better information when a customer claims that an error occurred with an authorized payment, as opposed to when a customer claims there was no authorization for a payment,” Nacha states. The parties involved would then “be able to react different to claims errors, and potentially could avoid taking more significant action with respect to such claims.”

According to the Nacha website:

The rule re-purposes an existing, little-used return reason code (R11) that will be used when a receiving customer claims that there was an error with an otherwise authorized payment. Previously, return reason code R10 was used a catch-all for various types of underlying unauthorized return reasons, including some for which a valid authorization exists, such as a debit on the wrong date or for the wrong amount. In these types of cases, a return of the debit still should be made, but the originator and its customer (the receiver) might both benefit from a correction of the error rather than the termination of the origination authorization. The use of a distinct return reason code (R11) enables a return that conveys this new meaning of ‘error’ rather than ‘no authorization.’

Organizations and agencies could better manage their ACH payments and collections—particularly exceptions and disputed payments, Nacha notes. For example, a payment disputed as never authorized requires a course of action to determine whether the payment was legitimate and what the originating company’s rights are to attempt collection of the debt. Meanwhile, a dispute regarding a payment amount would lead to a simpler corrective action.

Senior Credit Manager Ed Bell, Ph.D., CBA, ICCE, said he and other credit professionals within his company believe the impending rule will have minimal impact to the company’s ACH process because most of their interactions are for smaller payments with an average invoice below $500.

“The vast majority of our ACH payments are initiated by the customer and not by us,” Bell said. “I believe we do have a few customers set up for ACH debits, but I have not seen any impact—positive or negative.”

Earlier this month, Nacha’s first two new rule changes of the year took effect. The first rule established a third same-day ACH processing and settlement window by extending the banking day by two hours to 4:45 p.m. ET, giving financial institutions more time to submit files. The second rule addressed ACH originators of web debits and their required use of “a commercially reasonable fraudulent transaction detection system” to screen for fraud. As of March 19, Nacha updated that requirement by making it explicit that “account validation” is a part of the system.

Stayed turned with NACM’s eNews as more changes to Nacha rules and regulations are expected in June and September. To learn more about Nacha’s rule changes effective earlier this month, click here.

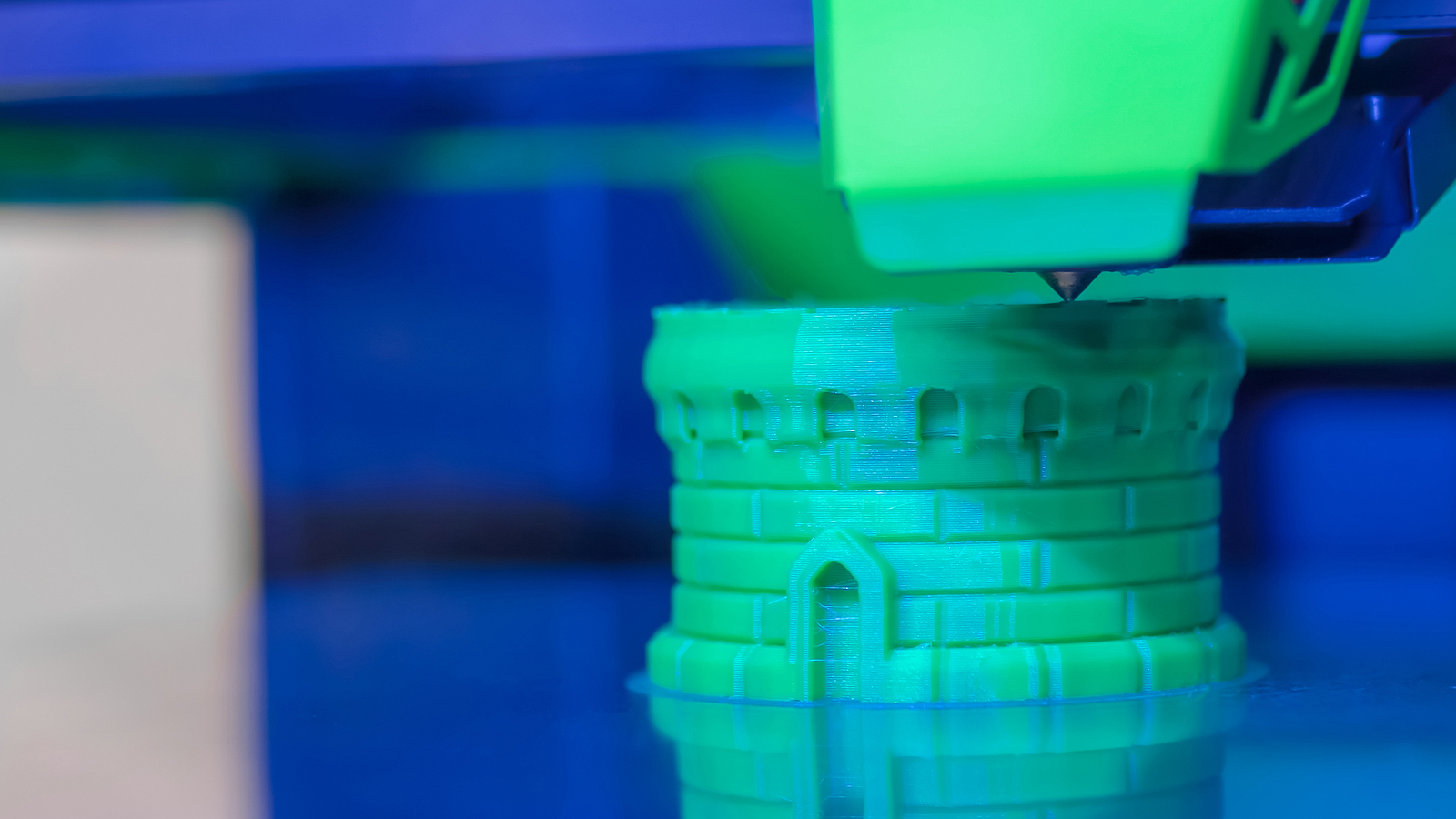

3D Technology Could Overhaul Construction Industry

Bryan Mason, editorial associate

When you think of commercial construction materials, supplies of concrete, brick, steel and wood stored in warehouses and shipped on demand would likely come to mind. Today, you can add a mix of materials generated on demand and on-site from 3D printing.

“Three-dimensional (3D) printing is an additive manufacturing process that creates a physical object from a digital design. The process works by laying down thin layers of material in the form of liquid or powdered plastic, metal or cement, and then fusing the layers together,” as defined by Investopedia.

Although homes constructed from 3D printing materials have received media attention in the residential housing industry, the technology has yet to break into commercial projects. However, that is beginning to change. Branch Technology, a prefabrication and technology company that specializes in large-scale 3D printing, has just made commercial 3D printing a reality.

In Chattanooga, TN, contractors are getting set to build Tennessee Valley Credit Union’s newest branch with what is claimed to be the first 3D printed exterior using cellular fabrication (C-Fab).

According to Branch Technology, the 3D printed structure combines materials and industry-standard hardware to create composite wall systems with “incredible” strength to weight ratios. This results in a code-compliant facade that balances the demand for well-designed building within the project budget and timeline.

Branch Technology claims the system uses a unique printing method that allows material to solidify in open space, creating a matrix of polymer in virtually any shape. While this new design is both innovative and fundamentally different than other 3D printing techniques, it reportedly uses 20 times less material.

“This project is a staple of design freedom offering a one-of-a-kind product outside the literal box of repetitive, conventional construction and facade manufacturing,” said John McCabe, Branch Technology’s advanced concepts team and director of communications.

So, what does this mean for the future? According to Smart Architect, there have been mixed responses to the enactment of this new technology because it is still in its early stages. The main concerns include how 3D printing may affect the average construction worker on-site, how disruptive it might be within the housing market and if 3D printed homes are actually safe for habitants.

However, per Smart Architect, structures built from 3D printing come with many upsides, which include:

- Reduced construction times—3D fabricated structures can significantly decrease the amount of time spent on projects. For example, Apis Cor built a 400-square-foot home within 24 hours, according to Engadget.

- Reduced material costs—no wastage or mistakes and the same material can be reused.

- Improvement in global housing crisis--3D printing can accelerate production at reduced prices.

- Reduced cost of transport—once the printer is installed, everything is done on-site.

If 3D printing takes root, it has the possibility of disrupting existing business models and supply chains.

Reveel, a provider of shipping intel, thinks that “3D printing could upend this traditional economy. Manufacturers are already using 3D modeling and additive manufacturing to design prototypes. If those systems can scale, manufacturers will be able to make a huge variety of products for themselves, giving them a competitive advantage.”

Manufacturing “powered by 3D printing would be one that requires fewer factories, fewer warehouses, and fewer miles shipped. As each link in the supply chain is consolidated, a trucking route or air shipment is made obsolete,” the firm said.

Software provider, AMFG agrees. “As the manufacturing environment becomes more volatile and uncertain, businesses are looking to reduce the complexity of their supply chains. The opportunity now exists to simplify the supply chain by using 3D printing to manufacture end-use parts in-house.”

|

|

Are you looking for processes to improve supplier and buyer relationships? Learn about the tools and integrated solutions that will reduce friction between suppliers and buyers. This course is recommended for Controllers, Shared Service Management, AP/P2P, and AR/O2C Business Process Owners. Learning Objectives:

|

The economic crisis caused by the COVID-19 pandemic heralded major business failures and insolvencies in France, and across the eurozone as a whole. But, in 2020, and even if the real impact of the COVID-19 crisis remains uncertain, the number of insolvencies actually fell in all major European economies.

According to Coface research, the gap between the expected deterioration of companies’ financial health and the number of insolvencies suggests a high number of “hidden insolvencies” that have been postponed, rather than prevented. Therefore, Coface projects both France and Europe have a high number of unviable companies whose failure is only a matter of time.

Similar Trend in Main Eurozone Countries

In France, the fate of 22,000 companies remains unresolved: These hidden insolvencies are expected to gradually materialize between now and 2022.

Coface estimates the number of hidden insolvencies at:

- 8,600 in the construction sector

- 1,800 in retail

- 1,500 in manufacturing

- 1,200 in business services

- 800 in transport.

Although the economic crisis has affected sectors unevenly, the number of insolvencies has fallen in all sectors, including those that have been at a standstill for several months. Similarly, all French regions recorded a clear fall in the number of insolvencies in 2020, ranging from 34% in Brittany to 49% in Corsica.

In France, without the country’s Solidarity Fund, the operating result of the hospitality and catering sector would have contracted by an estimated 109%, instead of the 17% observed in Coface’s results. The impact of insolvencies on job losses was nevertheless limited at 126,000, the lowest level since 2006.

In Germany, Coface estimates the number of hidden insolvencies at 21% below the 2019 level—at around 3,950 insolvencies. At the start of the pandemic, Coface expected insolvencies to rise by 9% over 2020, but they ended up falling by 15%. This result is partly due to the German government temporarily imposing a moratorium on insolvency proceedings to give stimulus measures time to take effect. However, the German metal and automotive sectors, both of which have been in recession since well before the pandemic, have seen an increase in insolvencies compared to 2019.

In Spain, furloughs have proved effective. For example, in the retail sector, Coface simulations indicate that furlough measures limited the fall in profits to 26% in the second quarter, compared with 67%, had they not been put in place. These measures have nevertheless failed to prevent a meteoric rise in insolvencies in the tourism sector, 90% up year-on-year in the second half of 2020. Globally, Spanish hidden insolvencies are estimated to be around 1,600 (34% of their 2019 level).

In Italy, Coface estimates the size of hidden insolvencies at around 39% of their 2019 level, or 4,100 insolvencies. Based on Coface’s calculations, however, insolvencies should have increased by 7%.

A Worrying Outlook

Not all of the hidden insolvencies are expected to manifest in 2021. The continuity of insolvency moratoriums, aid measures and support from banks will be decisive. The insolvency “catch-up” process from 2021 onward will directly correlate with the rate at which restrictive measures end, which in turn will be determined by the speed at which vaccinations are rolled out. This process will also depend on states’ willingness to continue providing support, especially as the vast majority of companies will only begin to repay state-guaranteed loans from 2022 as is the case in France, for example.

|

Upcoming Webinars |

|

Mar 29 |

The Leadership Toolkit

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey Inc. |

| How to Reduce Supplier and Buyer Friction

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey Inc. |

Mar 31 |