eNews February 11

In the News

February 11, 2021

Inflation Back on the Worry Agenda

Chris Kuehl, Ph.D.

There is little immediate concern regarding inflation threats. The Fed is not discussing hiking rates and other central banks have not reacted either and neither have data. Regardless, that has not eased the concern.

Many people do not have any real memory of a serious hike in the rate of inflation. It has been nearly 20 years since the overall rate was above 2.0% for more than a month or so. Inflation is in many ways more economically destructive than high levels of unemployment because it affects everything and everyone.

Recessions tend to be brutal for some while others escape the impact and can even prosper during these periods. As prices rise, there is stress everywhere and it tends to feed on itself. Those with the inability to hike their own prices or wages are slammed quickly.

The Fed has weapons to deploy against inflation, but it takes months for these tools to have a real effect. In the meantime, higher prices are chasing higher prices. Given the lack of inflation over the last 20 years, what is convincing some individuals that an inflation threat is now emerging?

Many aspects of this potential inflation threat are highly conditional. It would take the right combination of trends to create a real threat. The factors that have kept inflation at bay are still front and center. The three drivers of inflation are generally wages, commodity costs and money supply. Two of these factors have not moved much in the last few years and the third one should be affecting the economy but simply hasn’t—at least not yet.

The wage connection has been upset by the large number of unemployed due to the lockdowns. There are still tens of millions of people out of work and that holds wage inflation down, but it goes beyond the recent issue of excess labor. The whole process of globalization has affected wage inflation simply because businesses can employ people for lower wages by moving overseas or sourcing overseas. Obviously, millions of jobs can’t be shifted out of the U.S., but there is enough labor flexibility to affect wages.

The commodity impact on inflation is always volatile because it depends on supply and demand. In past years, there have been inflation surges as the price of oil fluctuates. That factor has faded as the U.S. has gained more control over its own oil needs. Attempts by the oil states to drive prices up with restricted production have failed several times in the last few years. There have been spikes in the price of metals and lumber and other commodities, but thus far these have been short lived.

The most consistent harbinger of future inflation is excess money supply, too much money chasing too little supply. If there is insufficient production and lots of money in the economy at the same time, a very real potential for shortages exists. These shortages then create a situation where producers can keep hiking prices because demand has the fuel to keep surging.

The reason the Fed can control inflation to some degree is that it can reduce money supply with higher interest rates and other tools, but this only works once the original oversupply is dealt with. It is the money supply issue that has started to worry people. The focus of the policymakers is currently on rescuing a wounded economy; that has involved spending close to $6 trillion (everything from direct efforts to tax breaks and the proposed increase under consideration now). It can be argued that this injection is what is needed to keep the recession from extending, but it can also be argued that this money will prove inflationary.

The concern grows from one key assumption: The recession is still basically artificial. The lockdown is what created the recession, the loss of jobs and the closure of business. When and if that lockdown is lifted, the recession is likely to lift with it. Jobs will be regained and businesses will reopen as consumers resume the patterns of pre-pandemic life. A lot of people will begin demanding a lot of things and services that will be in short supply. Many people will have the money to pay the higher prices that producers will be able to charge as they work to meet that demand.

An inflation surge is far from guaranteed, but it is enough of a possibility that business, consumers and policymakers have to consider what steps they need to take now to blunt its development. That could mean a rate hike sooner than predicted, and it could mean that some spending is done sooner than would be expected as a way to avoid those hikes. Unfortunately, that is exactly what can trigger more inflation.

New Rules Coming to Nacha’s ACH Network in March

Andrew Michaels, editorial associate

The Automated Clearing House, better known as ACH, has become a go-to network for electronic payments in the business-to-business credit industry. In fourth-quarter 2020, B2B payments via ACH increased nearly 15% to 1.2 billion.

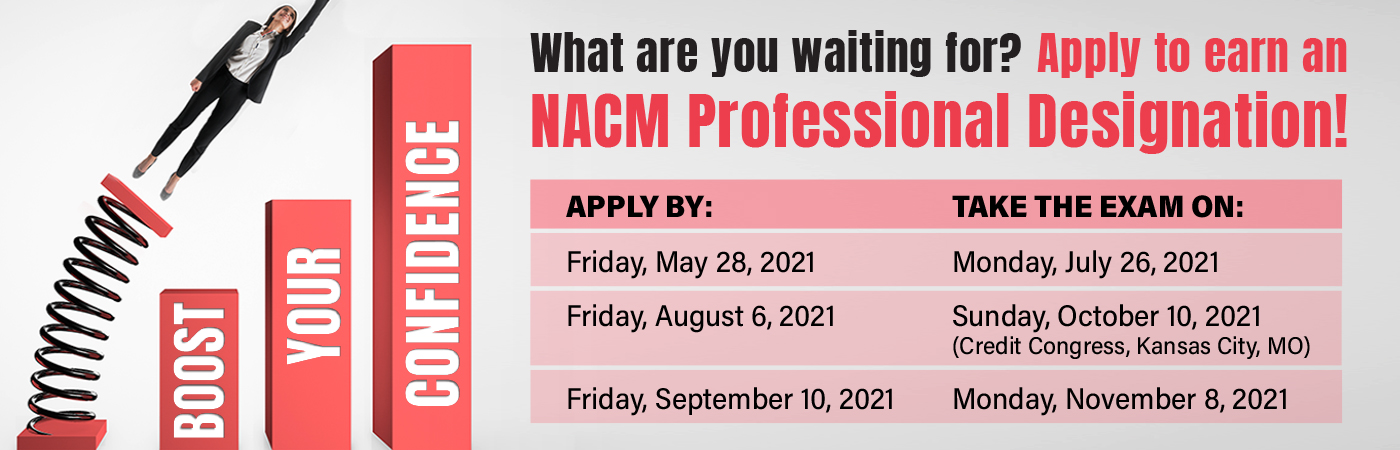

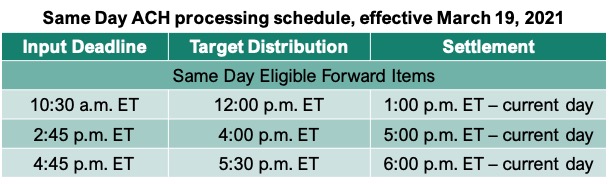

The governing body behind ACH, the National Automated Clearinghouse Association (Nacha), is implementing new rules and regulations in 2021, two of which take effect March 19.

One of these changes establishes a third same day ACH processing and settlement window. The change extends the banking day by two hours to 4:45 p.m. ET, giving financial institutions more time to submit files. This change will especially benefit West Coast financial institutions, which must currently submit these transactions to an ACH operator by 2:45 p.m. ET (11:45 a.m. PT). Interbank settlement for these entries would occur 6 p.m. ET.

With regard to the new same day ACH processing and settlement window, Nacha states:

- A receiving depository financial institution (RDFI) must make funds available for same day ACH credits no later than the end of its processing day. However, an RDFI could decide to make funds available sooner than the deadline.

- Same day ACH transactions will be identified the same way as existing windows.

- Originating depository financial institutions (ODFIs) and originators may use “SD1800” in the Company Descriptive Date field for transactions.

- All credits, debits and returns can be processed, except international ACH transactions (IATs) and forward transactions over the per-transaction dollar limit.

- All returns and notifications of change will be eligible for processing.

- It will absorb the existing “returns-only” window provided by the ACH operators to enable RDFIs to send returns up to 4:45 p.m. ET. It will also enable RDFIs to make use of same day ACH processing for returns, which would get settled 14.5 hours earlier than next-day returns.

The other rule change that takes effect March 19 targets web debits, which cover a variety of ACH-funded internet payments. Presently, ACH originators of web debits must use “a commercially reasonable fraudulent transaction detection system” to screen for fraud. The change adds to that requirement by making it explicit that “account validation” is a part of the system.

“It applies to the first use of an account number, or changes to the account number,” Nacha states. The organization does not specify methods or technologies for validating account information.

The Nacha website states that:

- The originator does not have to validate the owner of the account, just that the account is open and accepts ACH entries.

- Each originator in consultation with its advisors must determine for itself whether verifying that an account is open is sufficient. Depending on the organization, a more rigorous assessment that also verifies account ownership might be appropriate to meet the standard.

- The validation of an account can be completed by using one of the following:

- Prenotification entry;

- ACH micro-transaction verification;

- Commercially available validation service provided by either an ODFI or a third-party; or

- Account validation capabilities or services enabled by APIs.

- A fraudulent transaction detection system without an account validation component is not sufficient.

- The rule is not retroactive and only applies to new account numbers on a going-forward bases.

Nacha developed this rule to “help prevent fraud on the ACH Network” and “protect quality transactions.” As a result, ACH originators may need to re-tool their fraud detection systems, particularly for those parties that do not currently have a system in place.

Extending the banking day will factor into the credit process, allowing for faster processing times, said Bectran representative, Dominic Biegel. However, the validation process is going to be more significant for credit professionals, he noted. This new ACH regulation will help eliminate errors when credit professionals are working with customers.

Incorrect information “requires credit professionals to go back to the customer to validate the account by getting the correct account number and routing number,” Biegel said. “The new validation rule is definitely beneficial. It is going to save a lot of time and energy on the backend.”

If credit departments use a third party, they can submit ACH payments into the credit platform of the company’s chosen system and the customer can see if they have been validated. The user may also have to enter in specific information, such as a valid routing number, preventing someone from hacking the process.

Biegel said he believes Nacha will continue to expand and update rules, especially as more organizations push people to use ACH via incentives to avoid the nuances and difficulties of cash and check payments.

“To have everyone using ACH, it’s going to increase the number of people paying,” he said.

Stay tuned with NACM’s eNews for more information on Nacha’s ACH Network changes this year.

Delaware Bankruptcy Court Teaches Important Lesson

on Timely Lien Perfection

Daniel A. Lowenthal and Maxwell K. Weiss, Patterson Belknap Webb & Tyler LLP

Perfect your liens on time or you may lose them. That’s the painful lesson U.S. Bankruptcy Judge Karen B. Owens taught Halliburton Energy Services, Inc., in her recent decision.

Ruling on plaintiff-debtor Southland Royalty Company LLC’s motion for partial summary judgment, Judge Owens found that Halliburton did not obtain a lien on Southland’s production of oil, natural gas, or their proceeds. In re Southland Royalty Co., LLC, 20-10158 (KBO) at 1 (Jan. 21, 2021, Bankr. D. Del.) (the “Opinion”).

Southland focuses on the acquisition, development, and exploitation of oil and gas reserves. It owns leasehold and mineral interests in southwestern Wyoming. Halliburton is one of the world’s largest oil field service providers. Among other services, Halliburton opened two sets of newly constructed wells (the “Wells”) for Southland. Halliburton began and completed its work in August 2019, and the Wells started producing later that month. Opinion at 2.

Southland filed for chapter 11 bankruptcy on January 27, 2020 (the “Petition Date”). On February 11, Halliburton asserted several mechanic’s and materialmen’s liens under Wyoming law, including over the Wells (the “M&M Lien”), which Halliburton caused to be recorded. The next day, Halliburton sent a letter to Wamsutter LP, a purchaser of Southland’s oil and gas. The letter notified Wamsutter that Halliburton held a lien claim against Southland’s property and proceeds. Importantly, Halliburton did not obtain relief from the automatic stay triggered by Southland’s bankruptcy petition, see 11 U.S.C. § 362, before filing its M&M Lien or delivering the notice. Opinion at 2.

On April 16, 2020, Halliburton filed a notice of perfection, continuation, or maintenance of lien with the bankruptcy court, purporting to perfect the liens under Bankruptcy Code sections 362(b)(3) and 546(b)(1)(A). Together, those provisions permit “the postpetition continuation, maintenance, or perfection of an interest in a debtor’s property if applicable state law creates such interest prior to a bankruptcy filing and the interest’s postpetition perfection relates back to the date of its creation (the ‘Relation Back Exception’).” Opinion at 2-3.

The Wyoming Lien Act grants lien rights to those who perform work to improve real property or mineral interests. The liens cover: “(i) [a]ll the production of oil, gas and ore and minerals in solid form attributable to the interest subject to the lien; (ii) [t]he proceeds of production attaching to the working interest as the working interest existed on the date labor was first performed; (iii) any well... and (ix)... the land or leasehold... where work was performed.” Wyo. Stat. § 29-3-105(a). Generally, such liens relate back to “the commencement of any construction work or repair of the premises or property.” However, Wyoming law treats production and proceeds liens differently than liens on wells and land. Opinion at 5. Pursuant to the Wyoming Lien Act, a lien “covering oil, gas... or the proceeds of their sale is not effective against any purchaser of the oil [or] gas... until written notice of the claim is delivered.” Wyo. Stat. § 29-3-105(b). Further, “[t]he production of any mineral interest or working interest otherwise subject to a lien... is not to be encumbered until notice of the lien is delivered.” Id. § 29-3-105(c).

Judge Owens ruled that “based on the plain and unambiguous language of the statute, [production and proceeds liens] arise if and only when proper notice is given to the holder of the mineral interest or working interest and the purchaser.” Thus, while “Halliburton may have been entitled to assert a lien on Production... , the Production is not encumbered until notice is provided to Southland and Wamsutter.” Halliburton failed to deliver notice until after the Petition Date and the automatic stay took effect. Thus, “[b]ecause a lien on Production does not relate back to a time prior to the Petition Date, Halliburton’s postpetition actions do not fall within the scope and safeguards of the Relation Back Exception... Accordingly, any postpetition attempts of Halliburton to obtain a lien on Production are void ab initio.” Opinion at 5-6 (discussing Wyo. Stat. § 29-3-105(b)-(c)).

Potential lienholders, especially over the production and proceeds of mineral assets, should learn an important lesson from Judge Owens’s opinion. In the face of a potential bankruptcy, ensure that you perfect your liens pre-petition. As Halliburton learned, relying on the Relation Back Exception can be risky. Even where state laws like Wyoming’s create lien rights that can trigger the exception, there may be additional requirements to effectuate such liens (e.g., notice). Failure to satisfy them can prevent the operation of the Relation Back Exception. Opinion at 6 (finding liens on production “void ab initio”). And depending on which state’s law applies, the Relation Back Exception may not apply at all. See In re Linear Elec. Co., Inc., 852 F.3d 313, 322 (3d Cir. 2017) (“Pennsylvania [mechanic’s] liens relate back, and New Jersey liens do not.”).

|

This webinar will provide a roadmap for the implementation of key metrics and reporting that can be used for the P2P process. Join Chris Doxey as she provides practical guidance for developing metrics that are reportable, actionable and stand the test of time. Learn how to actually use metrics and trends to develop areas for business process improvement. Chris will define and explain four foundational groups of metrics for P2P process and how to implement a meaningful reporting process. Objectives include:

|

How Liquidity Becomes the Kryptonite of Capital Structure

David Bagley, Principal, Carrac Capital Partners, LLC

A company’s “capital structure” is the array of its liabilities and equity. It is often described by the debt to equity ratio, which is the amount of total debt divided by total equity. Capital structure commonly consists of three main components: working capital (also known as operating debt), financing debt, and equity.

- Working capital, or operating debt, includes accounts payable, accrued expenses, and other current liabilities usually due within one year.

- Financing debt includes senior bank financing, leases, and financing mechanisms like mezzanine or second-lien debts that are amortized over varying lengths of time.

- Equity can be constructed of one or more categories of ownership interest, including common stock, convertible shares, and preferred stock (among others).

Does capital structure indicate a company’s value? Economists Franco Modigliani and Merton H. Miller famously (to MBA students) said, “No.” In 1958, they published an article in the American Economic Review with the grandiose title of “The Cost of Capital, Corporation Finance, and the Theory of Investment,” which remains a seminal work on corporate finance. Modigliani and Miller argued that in an efficient market, the value of a firm is not dependent upon its capital structure. Their view is often known as the “capital structure irrelevance principle.”

For distressed businesses, however, capital structure can be highly relevant, not only to company value but also to its ability to continue as a going concern. The key component is liquidity. In a distressed situation, insufficient liquidity is kryptonite to an otherwise suitable capital structure.

Below we discuss how the lack of liquidity reflects and worsens two common capital structure issues—maturity matching and lease debt—and how a restructuring through a bankruptcy can help stabilize the liquidity-stressed company.

Maturity Matching

A long-standing conservative tenet in corporate finance is to match the maturity of debt to the life expectancy of the corresponding asset. To illustrate: consumers finance a home, a long-term asset, with long-term debt (a 30-year mortgage loan), and use the credit card (30-day debt) to pay for consumable purchases. At least we hope they do. Businesses would do well to adhere to similar practices.

Firms struggle when their declining cash flows (and expected returns) reduce liquidity and prevent them from amortizing their long-term debt according to the schedule negotiated with the financing source. The original long-term financing (real estate mortgage or corporate bonds) for a new plant may need to be restructured because of the company’s overall falling financial performance. If the company can convince itself that future interest rates will be low for debt carrying shorter-term maturities (such as lines of credit, asset-based facilities or revolving facilities), then the company may choose to refinance longer-term debts with shorter-term, lower-interest rate financing.

If financial performance further deteriorates, or if interest rates start to rise, the revised capital structure will experience worsened cash flow as it faces imminent maturity dates. The company may be forced to refinance or restructure at less favorable interest rates. Turnaround professionals see this story told time and time again in first-day affidavits filed by senior officers in bankruptcy cases (which explain why the company filed for chapter 11 relief).

Bankruptcy law provides ways to correct a debtor’s overleveraged condition. The filing itself automatically stops creditor efforts to collect (the “automatic stay” is imposed by section 362 of the Bankruptcy Code), which affords the company time to develop a plan of reorganization, under which the debtor may pay unsecured vendors over time or rework its financial debt.

Lease Debt

Because the liability associated with a lease is not recorded on a company’s balance sheet, it is often overlooked as part of the capital structure. Yet lease obligations, for expensive capital items like computer hardware or software, equipment used in production, and aircraft and aircraft engines, can weigh heavily upon a company’s liquidity. Retailers and other multi-facility companies have used bankruptcies to eliminate leases on poor or underperforming locations.

If a lease goes into default and an aggressive lessor secures a judgment against the company, the non-balance sheet lease liability is transformed into a current liability. Many lenders, financial institutions, franchisors and vendors look at the ratio of current assets to current liabilities as a measure of solvency and liquidity. If a judgment moves a non-balance sheet liability like a lease obligation into current liabilities, the now more highly-stressed balance sheet can exacerbate the liquidity problem.

Bankruptcy law provides special powers to a debtor to free it quickly and decisively from unfavorable leases, perhaps enhancing the opportunities for the company to reorganize both its operations and its financial obligations. Section 365 of the Bankruptcy Code grants the debtor the right, under many circumstances, to “assume” or “reject” an unexpired lease or an “executory contract.” An unexpired lease is assumed when the debtor pays all amounts past due and owing and agrees to perform the entire lease contract going forward. A debtor may reject an unexpired lease, which constitutes a breach of the lease, and which requires the debtor to turn over possession of the leased personal property or real property. However, rejection greatly limits the lessor’s claim and thus can relieve the debtor of substantial liquidity pressures.

United Artists Theatre Company entered chapter 11 and used lease rejection under section 365 as a core strategy. It confirmed a plan of reorganization that rejected leases for 70 theaters that had been closed but for which the company had been still obligated to make rent payments. The rejections relieved the debtor from continuing lease obligations and limited the claims of lessors. The lease rejections were part of United Artists’ successful conversion of $715 million of debt into $252 million of senior secured debt and equity in the reorganized company.

For a reorganization to succeed, of course, the underlying business must make financial and operational sense. The use of lease rejection in bankruptcy for its 642 store chain could not save Borders Group, Inc. It continued to bleed cash and failed to persuade publishers to ship merchandise to it on normal terms (that allowed the chain to pay bills later, instead of right away).

Liquidity and Appropriate Corporate Structure are Key to Successful Restructuring

Capital structure is one of the reasons that companies seek protection under the Bankruptcy Code. A lack of flexibility in its capital structure can restrict a company’s liquidity, which can come to require recourse to bankruptcy in order to gain access to funds. Liquidity is the key to bridging short-term financial issues. Longer term, the quality of a company’s overall business plan, coupled with an appropriate capital structure, are keys to a successful restructuring and revival.

|

Upcoming Webinars |

|

Feb 16 |

The Power of Procure to Pay (P2P) Metrics and Dashboards

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC |

| Project Management Principles That Drive Continuous Improvement Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC |

Feb 17 |

|

Feb 17 |

North Carolina: Notice to the Lien Agent vs. Notice of Subcontract Speaker: Chris Ring |

| Letters of Credit Series: Letter of Credit Documentation: How to Avoid Discrepancies Speaker: Richard “Chip” Thomas |

Feb 18 |

|

Feb 18 |

Author Chat: Connected Leadership Author Francis Eberle, Ph.D. |