eNews January 14

In the News

January 14, 2021

How to Identify Financial Statement Fraud

—Michael Miller, NACM managing editor

Financial statement fraud only accounts for 10% of fraud cases, but it is one of the most expensive types. It has a median loss of $945,000, said Chris Doxey, CAPP, CCSA, CICA, CPC, president and owner of Doxey, Inc., during the NACM and FCIB webinar, “Financial Statement Fraud Concerns: Critical Considerations for Detecting Risk.”

Financial statement fraud occurs when corporates manipulate earnings, intentionally misstate asset values or mischaracterize expenses. In comparison, asset misappropriation is the most common type of occupational fraud, yet it results in a median loss of only $100,000. Asset misappropriation occurs with fraudulent disbursements and theft of inventory or intellectual property.

Doxey pointed out five basic forms of financial statement fraud:

- Fictitious sales

- Improper expense recognition

- Incorrect asset valuation

- Hidden liabilities

- Unsuitable disclosures.

Some of the more common approaches to financial statement fraud are to overstate revenue by recording future expected sales, inflating asset net worth and hiding obligations off the balance sheet.

Doxey shared more than a dozen red flags to watch out for when trying to detect financial statement fraud. Among them were to search for accounting anomalies and sales growth consistency.

Growth in revenues should correspond with growth in cash flow. These should “move more or less in tandem over time,” Doxey said. However, be careful when looking at consistent sales growth because this could be due to efficient business operations instead of financial statement fraud, she cautioned.

A surge in performance in the final reporting period of the fiscal year is another potential warning as well as companies that maintain consistent gross profit margins, while their industry faces pricing pressure. The latter can potentially indicate failure to recognize expenses or aggressive revenue recognition. The art of credit also comes into play. If something feels off about the business model or operations, use your gut instinct, Doxey said.

Unfortunately, detecting red flags “can be extremely challenging as firms that are engaged in fraudulent activities will attempt to portray the image of financial stability and normal business operations,” she said.

One way to help detect financial statement fraud is with ratio analysis. Doxey spoke about the M-score: A mathematical model that uses eight financial ratios to identify whether a company has manipulated its earnings. “The variables are constructed from the company’s financial statements and create a score to describe the degree to which the earnings have been manipulated,” she said. Among the ratios used in the M-score are:

- Days’ sales in receivables index

- Gross margin index

- Asset quality index

- Sales growth index

Just more than two-thirds of respondents to the Association of Certified Fraud Examiners’ third (December 2020) Fraud in the Wake of COVID-19 Benchmarking Report expect an increase in financial statement fraud over the next 12 months. Slightly less than half saw financial statement fraud increase as of November 2020, up from 30% in May and 41% in August. More than three-fourths of respondents said preventing fraud is more challenging due to COVID-19, and about 70% said it was more challenging to detect fraud.

Register for the on-demand version of “Financial Statement Fraud Concerns: Critical Considerations for Detecting Risk” to learn about each of the red flags and how to prevent losses as well as how companies “cook the books.” The next webinar in the series of webinars being presented by Chris Doxey is “Key Performance Indicators and Metrics for Your Financial Close” on Tuesday, Jan. 26, at 11 a.m. EST.

Consolidated Appropriations Act Provides Relief for Small Business Via Chapter 11

—Brendan G. Best, Esq.

With the passage of the new Consolidated Appropriations Act of 2021 (the "Act"), many struggling but viable small businesses temporarily unable to pay rent can now file a Chapter 11 bankruptcy case, get four months of rent relief, and confirm a reorganization plan that allows payment of the arrearage over three to five years.

Here are the bankruptcy highlights from the Act:

- Landlords and creditors are protected from being sued to pay back payment made on account of pre-petition forbearance or other debt accommodation agreements. These payments could otherwise be deemed to have been made "outside of the ordinary course of business" and therefore recoverable by the estate.

- Subchapter V small business debtors get an additional 60 days (for a total of 120 days) grace period to begin making rent payments. This, combined with the ability to pay post-petition rent arrearage over time in a plan, will give many small businesses temporarily unable to pay rent a safe harbor to reorganize.

- Subchapter V small business debtors may pay post-petition rent arrearage through the life of their plan rather than in a lump sum prior to plan confirmation. This resolves an ambiguity in the Bankruptcy Code and overturns at least one bankruptcy court decision that held that rent arrearage could not be paid in a Subchapter V plan, a death blow to many small businesses that cannot afford to make a lump sum catch up payment.

- Debtors get an additional 90 days (for a total of 210 days, with an additional 90-day extension) to make the election to assume or reject a lease. Many debtors have struggled with the current timing to make decisions regarding assumption or rejection of leases given the current uncertainty.

- While the Act contains several potential amendments that would allow small businesses and family farmers in bankruptcy to obtain PPP loans, those provisions will only go into effect in the sole discretion of the SBA Administrator. Therefore, the current split of authority regarding a debtor's eligibility under PPP was not resolved by the Act.

- The Act also contains numerous other changes related to individual debtors, family farmers, fishermen, landlords and creditors.

Brendan G. Best is partner at Varnum LLP. He focuses his practice on restructuring, workouts and bankruptcies, representing creditors, debtors and other parties in Chapter 11 bankruptcy cases, out-of-court workouts and restructurings, distressed transactions and general insolvencies. Brendan has a national insolvency practice, serving clients in diverse industries including manufacturing, automotive, building supply and service, energy, oil and gas, health care, food service, gaming, hospitality, construction and real estate.

B2B Payments 2021: Assessing The Gaps And Digital Opportunities

—PYMNTS

Most businesses strive to expand, but expansion can come with growing pains. It can be particularly challenging for growing businesses to manage payment flows. Having inefficient payment operations can lead to excessive payment costs, ultimately eating into firms’ bottom lines and reducing their expansion-related gains.

It is not just growing businesses that are feeling financial pressure to streamline their payment operations. The average business already spends almost 3 percent of its annual budget on payment-related expenses—and many spend even more. This would be enough cause for concern even during stable economic times, but maintaining efficient payment operations is all the more critical in the current economic environment. How can businesses enhance the efficiency of their payment operations to meet their unique, strategic goals?

Payments 2021: Assessing The Digital Gaps In Business Payment Flows, a PYMNTS and Flywire collaboration, provides an overview of business leaders’ chief concerns regarding their business-to-business (B2B) payment operations. We surveyed 459 decision-makers at technology firms, education institutions and travel companies across the United States to learn more about the payments frictions they face, the criteria they use to judge the effectiveness of their accounts payable (AP) and accounts receivable (AR) operations and how they plan to use digital innovations to streamline their payment flows.

Our research shows that businesses can use more efficient data management systems to alleviate many of the common payment pain points they face. Such frictions include difficulties when handling customers’ payment-related questions (cited by 28 percent) and challenges with managing multiple supplier relationships (24 percent). Firms also face stress when handling payments that take too long to receive, with 24 percent of businesses citing long payment wait times as payment-related friction. Real-time access to payment data may not make payments move faster, but it can give cash flow managers and other financial professionals more accurate insights into when they can expect their funds.

It follows that many businesses are planning to enhance their payment processes with digital innovations in the near future. Almost half of all businesses are planning to adopt technologies that will grant them real-time access to payments data in the next three years, but just as many are planning to implement billing and subscription management tools that can automate their payment operations and thus reduce their costs.

These are just a few of the ways in which businesses are looking to digital innovations to enhance their payment operations over the next three years. Payments 2021: Assessing The Digital Gaps In Business Payment Flows provides a nuanced account of the strategic visions of technology firms, education institutions and travel companies across the U.S. and how they aim to transform their strategic payment visions into concrete realities.

To learn more about the digital payments innovations that businesses are planning to implement to ease their payments woes, download the report.

Reprinted with permission.

Social media has increasingly become a part of our everyday lives. Currently, Facebook has 2.7 billion active users monthly and Twitter, 330 million, according to Statista. In addition, many more people use other forms of social media such as review, image sharing and video hosting sites and blogs.

Using these websites and applications brings about a lot of exposure and responsibility. One comment, tweet or post can tarnish not only an individual’s reputation, but their employability too.

“Getting overly political, profane and hateful on social media is a recipe for alienating at least half of your potential clients and customers, not to mention your boss,” said Joanne Funch, owner of Marketing Dish. “If you don’t like the president [or someone else], it’s probably best to bite your tongue, digitally speaking.”

The recent attack on the U.S. Capitol is one of the latest examples of how what appears on social media can affect you. Rioters, as well as journalists, photographed and recorded the breach on the Capitol sharing the images on social media. Police are using these posts to identify and arrest rioters, many of whom have lost their jobs due to their participation.

In the Manifest 2020 Recruitment Survey, 90% of employers said social media is important when they are evaluating a job candidate. Nearly 80% of HR professionals said they have denied a job candidate due to inappropriate content on their social media accounts.

Manifest listed the following as content that has gotten candidates rejected:

- Hate speech

- Images of heavy partying or drug use

- Illegal or illicit content

- Poor grammar

- Confidential or sensitive content about a former employer

Manifest cautions that employers will look at social media accounts, not just what someone links to their resume.

Whether it is someone’s first job or a stepping stone in their career, anything someone posts on their personal social media sites “can come back and haunt them,” Funch noted. Social media gives hiring managers the ability to search and review prospective employee’s social media sites to learn more about their character. “So, be sure what you post publicly will not embarrass you professionally.”

Anyone—employed or seeking employment—must understand the difference between freedom of speech and commonsense, Funch said. It is not prudent for an employee to post private or confidential information about their company online.

“It is leadership's role to communicate what is defined as private or confidential and ensure each member of a department or team understand what the best practices are,” Funch said. “It is important to create some basic concepts and practices, which will govern the handling of confidential information.”

Employees should familiarize themselves with their company’s social media policy often found in an employee handbook.

Funch also commented on social media sites used for professional means such as LinkedIn.

“When using LinkedIn—which is the No. 1 social media site for professionals—be sure everything in your profile is up to date,” she said. “Include more than your job title. Write out in detail what you do, what makes you credible and your accomplishments. Your LinkedIn profile is more than a resume; it is a 24/7 personal brand bio, so be sure you are representing you and your company in a professional way.”

For more information on today’s business etiquette, attend Joanne Funch’s, “Think Before You Hit Send—Professional Etiquette for a Digital Age,” session #30032, at NACM’s 2021 Credit Congress & Expo.

|

Upcoming Webinars |

|

Jan 19 |

Forfaiting: Increase Your Competitiveness & Improve Cash Flow

Speaker: Greg Bernardi, London Forfaiting Americas Inc., New York, NY |

| Not so Peachy in Georgia: Mismanaging the Lien & Bond Process Speaker: Chris Ring, NACM’s Secured Transaction Services |

Jan 20 |

|

Jan 21 |

Metrics: Managing & Monitoring AR Health

Speaker: John Salek, Revenue Management Associates, LLC, Fairfield, CT |

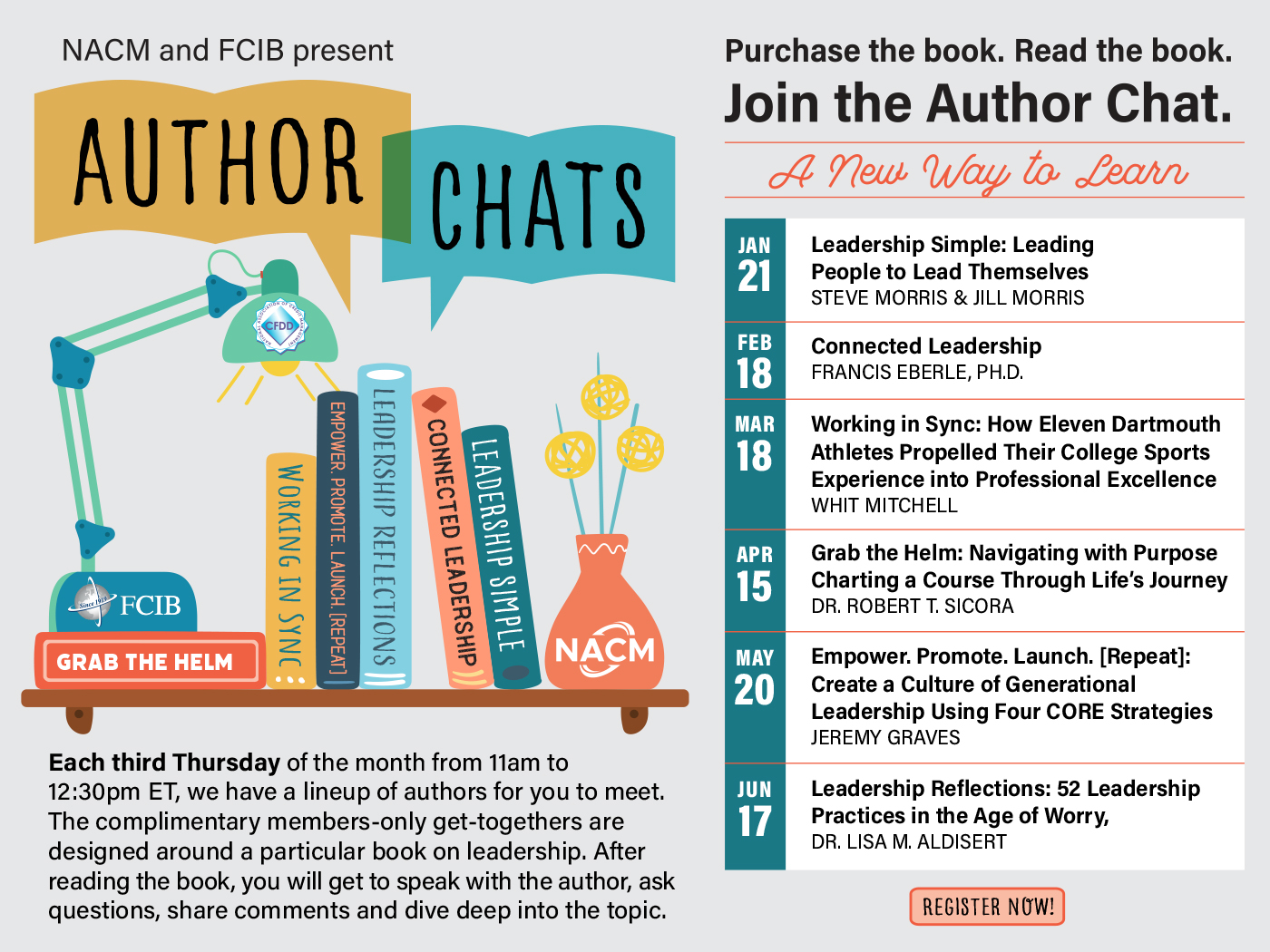

| Author Chat Leadership Simple: Leading People to Lead Themselves Authors Steve Morris & Jill Morris |

Jan 21 |

|

Jan 26 |

Key Performance Indicators (KPIs) and Metrics for Your Financial Close Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey Inc., Paeonian Springs, VA |

| Risk Mitigation in Mexico in a Nutshell: Due Diligence & Secured Transactions Speaker: Romelio Hernandez, HMH Legal S.C., Tijuana-Baja California, Mexico |

Jan 28 |